Crypto Market Commentary

14 August 2019

Doc's Daily Commentary

Look for the new “Options for Income Masterclass” which is now live!

The 8/14 ReadySetLive session with Doc and Mav is listed below.

Mind Of Mav

The Yield Curve Just Inverted – What Does That Mean?

Holy Satoshi, the yield curve just inverted.

So, what’s going on?

What’s the yield curve?

The yield curve is a line plotting out yields across maturities. Typically, it slopes upward, with investors demanding more compensation to hold a note or bond for a longer period given the risk of inflation and other uncertainties.

An inverted curve can be a source of concern for a variety of reasons: short-term rates could be running high because overly tight monetary policy is slowing the economy, or it could be that investor worries about future economic growth are stoking demand for safe, long-term Treasurys, pushing down long-term rates, note economists at the San Francisco Fed, who have led research into the relationship between the curve and the economy.

Why does it matter?

The 2-year/10-year version of the yield curve has preceded each of the past seven recessions, including the most recent slowdown between 2007 and 2009.

Other yield curve measures have already inverted, including the widely-watched 3-month/10-year spread used by the Federal Reserve to gauge recession probabilities.

Is recession imminent?

A recession isn’t a certainty. Some economists have argued that the aftermath of quantitative easing measures that saw global central banks snap up government bonds and drive down longer term yields may have robbed inversions of their reliability as a predictor. According to this school of thought, negative bond yields in Europe and Japan have forced yield-starved investors to the U.S., artificially depressing long-term Treasury yields.

Suffice to say, although a yield inversion usually precedes a recession, it’s not a very good indicator for actually timing a recession.

For example, when the yield curve inverted in 2006, it was two years until the 2008 financial crisis.

To me, a better indicator is the trend worldwide towards negative interest rates.

The largest anticipated benefit from negative yields is to drive investors out of perceived safe sovereign bonds and into riskier assets. By forcing this move it is believed financial conditions will ease and economic growth will be promoted. In essence central banks are trying to crowd investors out of risk free assets and into riskier assets such as corporate loans or personal loans thereby trying to jumpstart the economy. In fact, former Fed Chair Ben Bernanke wrote an Op Ed in the Washington Post in early November 2010 entitled “What The Fed Did and Why: Supporting The Recovery and Sustaining Price Stability” whereby he addresses what central banks are trying to achieve with actions such as these. Another related and potential benefit to negative yields is to increase inflation in an environment of stubbornly low inflation.

Other potential side effects to negative interest rates include weakening your currency relative to your trading partners, all else equal. Negative rates can also help limit the downside to commodity prices. On the supply side, low rates decrease the opportunity cost of holding commodity reserves in the ground thereby limiting supply. On the demand side, low or negative risk-free rates push down expected returns across most assets thereby increasing the attractiveness of buying commodities all else equal.

Negative interest rates don’t come without a cost. Potential negative side effects include lower bank profitability, impaired functioning of the money markets, reduced liquidity for negative yielding debt, a limited central bank toolset to address a future recession, excessive borrowing and excessive leverage (by individuals, corporations and sovereign countries) and future financial bubbles.

Let’s check in on how that’s going. Right. Italy generated weeks of headlines as they negotiated their budget deficit down from 2.4% of GDP (violating EU rules against deficits in excess of 2% of GDP) to -2.04% (which is apparently within the rules, which allow for rounding. Given the EU’s love of policies that fall within the letter but not the spirit of procedural norms, I propose that during the next crisis they announce that the 2% rule stays, but they now round to the nearest 100% of GDP.) The Euro area overall ran a deficit of about 0.7% of GDP last year. The IMF says that’s a little high, but in the ballpark. Meanwhile, try as they might, they can’t get their inflation rate to 2%. Maybe another year of tiny deficits and an aging populace will do the trick.

This brings up Bitcoin as a hedge and how it will transition into prominence. Daniel Krawisz’s piece on Hyperbitcoinization from 2014 is a great primer on this:

“Demonetization refers to a process by which people cease to use a good as a currency, and hyperinflation is a kind of demonetization when the government inflates the currency at an accelerating pace. Hyperbitcoinization is a different kind, though it will appear (superficially) similar. In both kinds events, prices in the doomed currency will skyrocket until it is no longer a currency at all.

There are two essential differences between hyperinflation and hyperbitcoinization. The first is that a currency hyperinflates with restricted competition from other currencies, whereas hyperbitcoinization happens because of competition with Bitcoin. This is because capital controls are much more effective on other fiat currencies than on Bitcoin, so it is easy for Bitcoin to cross borders and compete with anything.

The second is that in a hyperinflation, the government expands the money supply to outpace people’s inflation expectations. Demonetization occurs as a result of their destructive interaction. Whereas a hyperbitcoinization event need not be accompanied by any change in the supply of either currency.

As the government forms a habit of inflating the money supply, its people form a habit of anticipating rising prices. This prevents the government from gaining as much each time it inflates. Thus, to get the same kick, the government must inflate more. The money loses value once people anticipate such heavy inflation that they can’t spend it fast enough and it no longer functions as a currency.

Hyperinflation is an entrepreneurial act on the part of government, in the sense that it involves a continually changing intervention that prevents an equilibrium from forming. The government must continually alter its own behavior to stay ahead of its people’s. The moment they begin to anticipate its future policy, the government must change the policy by increasing the rate of inflation.

Hyperbitcoinization is a voluntary transition from an inferior currency to a superior one, and its adoption is a series of individual acts of entrepreneurship rather than a single monopolist that games the system.”

So, the board is set:

“For the past several years, the world has enjoyed relative stability with moderate growth and the longest U.S. economic expansion in history. Thus, most recently, Bitcoin and other cryptoassets have grown without the supportive macroeconomic environment in which they were born in.

Recent developments present a radical shift in the macroeconomic and geopolitical environment. Faced with some softness in the latest macroeconomic indicators, widespread inversion of most developed world economy yield curves, negative nominal interest rates, a persistent inability to achieve central bank inflation targets, falling inflation expectations by market participants, and the possibility of a full-blown U.S.-China trade war, the Fed is once again leading the way in easing monetary policy.

In the recent meetings of the Federal Open Market Committee, it is clear that the Fed is growing increasingly concerned about the potential impact of a negative shock to the economy and are willing to consider “insurance-type” interest rate cuts to sustain the current economic expansion.” (https://coinmetrics.substack.com/)

The pieces are moving:

“Following the collapse of the Bretton Woods Agreement in 1971, the freedom granted to central banks to print money is the framework for current monetary policies. As well as funding government deficits, monetary expansion has been used to protect the financial and commercial establishment at everyone else’s expense. We are told moderate price inflation is good for us when it obviously impoverishes society’s disadvantaged. The true purpose is to permit monetary and credit expansion. Furthermore, price inflation is always quantified by governments keen to suppress unfavorable evidence. The combination of monetary inflation and the suppression of evidence of the effect on prices is now the backbone of monetary policy.” (“Deeply negative nominal rates are on their way”)

We come to it at last . . .

Bitcoin has not been immune from the impact of this dramatic pivot – it too has risen in concert with the decline in global yields and rise in gold. Bitcoin’s intrinsic qualities indicate that it could effectively serve as a safe haven asset – particularly its decentralized nature making it immune to the control of and the policy errors of any centralized institution, as well as its high stock-to-flow ratio. Such qualities are important for something to serve as hard money. Analyzed under this lens, it shares many qualities with gold, and it is theoretically sound and logical to make the comparison between Bitcoin and gold.

This theory, combined with a look at the year-to-date price action, has breathed new life in the Bitcoin as a safe haven narrative. Indeed, the decline in real interest rates and increased concerns of geopolitical instability have driven gold to six-year highs and, as the narrative goes, has also driven Bitcoin to steeply recover from its lows. (https://coinmetrics.substack.com/)

The great battle of our time.

Nothing operates in isolation. The crypto market is no different. The search for yield will likely push investors further and

further out the risk curve, which could be a strong catalyst for BTC’s next bull run. The opportunity cost of holding bitcoin

grows by the day, especially as the long-term outlook for conventional asset classes looks more bleak.

(https://www.delphidigital.io)

We are about to see Bitcoin and the rest of the crypto space handle a pre-recession environment.

This is both exciting but also nerve-wracking, to be sure.

What Bitcoin will do and how it is treated as a safe haven remains to be seen.

But as Sir John Templeton said, the four most expensive words in the English language are “This time it’s different”.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

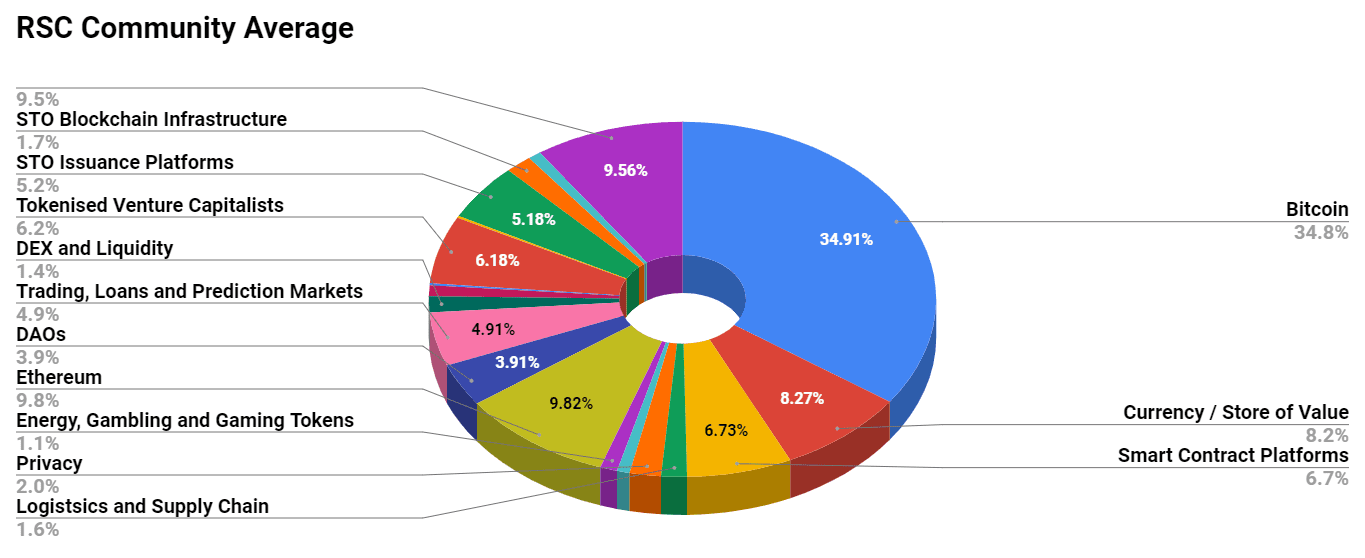

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

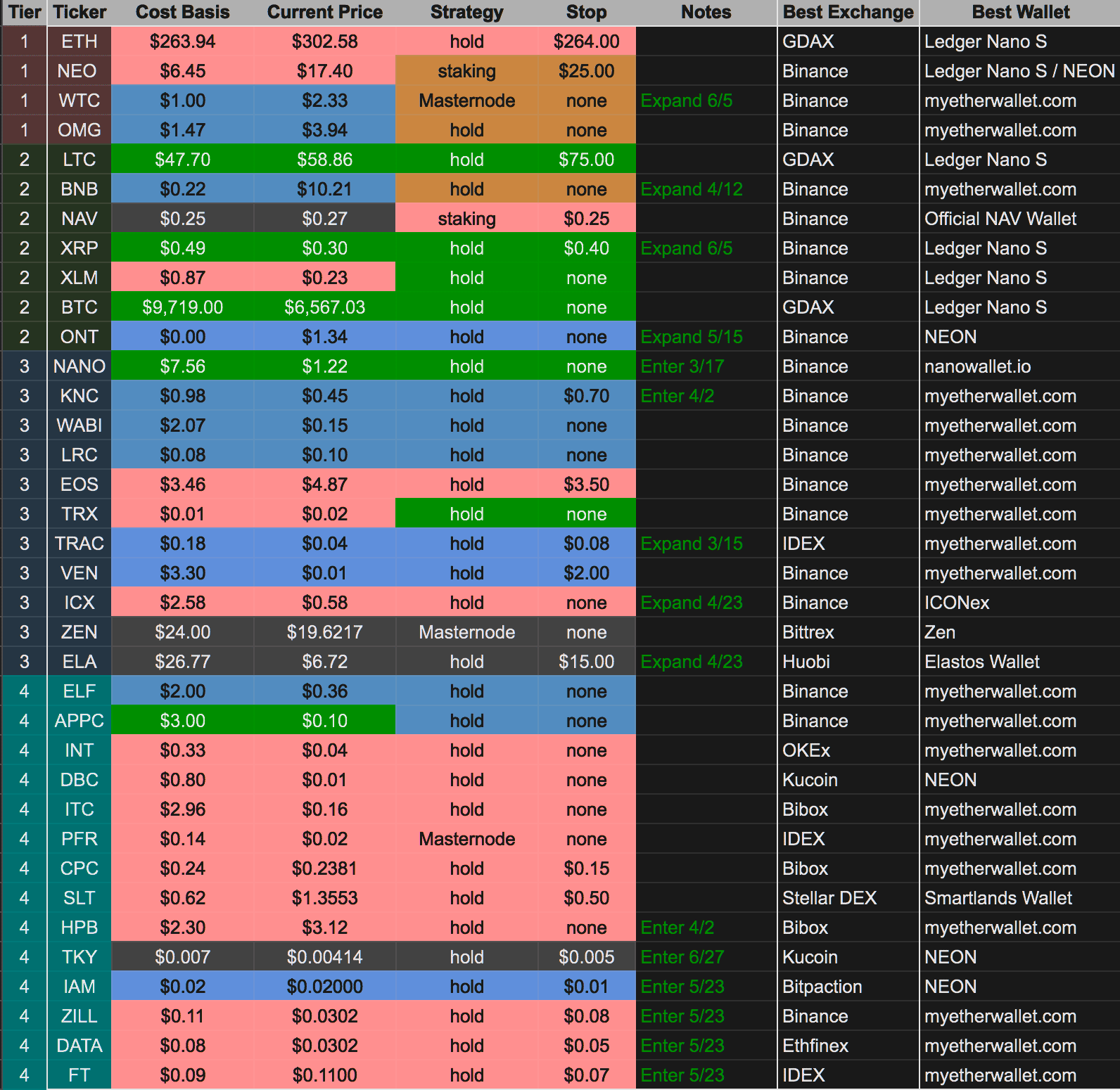

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)