Doc's Daily Commentary

Mind Of Mav

What Is EIP1559 London Upgrade & Why It Is Special For ETH?

The most awaited ETH 2.0 London upgrade has been rolled out on

Aug-05-2021 12:11:34 PM +UTC

At the,

? Block number: 12,965,000

Now all eyes are on how it will change the game for Ethereum price and transaction fee going forward. Well, this is what we will decode in this brief snapshot about this once-in-a-lifetime event.

What Is London Hard Fork Upgrade After All?

The London upgrade introduced EIP-1559, which is a set of Ethereum improvement protocols that will reform the transaction fee market, along with changes to how gas refunds are handled.

This Ethereum EIP 1559 improvement proposal’s main objective is to make the fee market in its network more efficient and reliable. To achieve this it has proposed the following amendments

As per Ethereum EIP upgrade FAQ:

The Gas limit will be replaced by two values: — Long term average target & hard per-block cap which will be capped to twice of current gas limit

It will also set a BASE FEE(which will be burned to make Ethereum deflationary ) against every user transaction, This base fee will be adjusted on a block-by-block basis, to ensure the average gas fee is controlled to remain very close to the current gas limit value

Every time there is an increase in network congestion leading to excessive target per-block gas usage, the base fee increases accordingly and when the block capacity is below the set target limit, the base decreases. The change in the base fee will be working within the set range so it will be easy to predict the Gas fee and will make the market fee more transparent and reliable

Apart from EIP 1559, there are many other improvements that have also been rolled out with this London hard fork upgrade

EIP-3198: It returns the BASEFEE from a block

EIP-3529: It reduces gas refunds for EVM operations

EIP-3541: It prevents deploying contracts starting with 0xEF

EIP-3554: It delays the Ice Age until December 2021

What Changes For Ethereum Miners With This London Hard Fork Upgrade?

Miners will now be incentivized via priority fee which will be set aside in the user wallet, and the base fee will be eventually burned down by the Ethereum protocol. Which many miners are finding distasteful as their reward is being curtailed, compared to the risk they are taking to be a miner.

Even though it may look like miners are being robbed of those extra earning due to base fee burning, it will eventually be more beneficial. Why so? Well because with Less ETH in circulation the value of the ETH they will hold will be more, due to supply shock.

What Is Ethereum’s Idea behind Burning The Base Fee?

Ethereum network with ETH 2.0 and EIP 1559 upgrade wants to make Ehereum deflationary to some extent if not completely, and enhance its economic value within the blockchain ecosystem. This will also create the necessary balance where miners will not become powerful enough to challenge the very fabric of blockchain decentralization.

With BASEFEE burning, the Ethereum network is trying to ensure that miners don’t end up manipulating the block to juice out extra fees, as now any fee other than the priority(Tip) fee will eventually vanish.

What Will Happen To ETH Price With This EIP 1550 BASEFEE burn strategy?

Well, it is being speculated that with the London hard fork going live, the transactions fee that was previously paid to miners will now be burned and removed from circulation, which can leave some kind of Ethereum supply shock, also with lower transactions, the platforms like DEFI, NFT which leverages Ethereum network, will see higher adoption and will eventually create more demand for the cryptocurrency, so its price is expected to rise.

You can watch the burn rate here: https://etherchain.org/burn

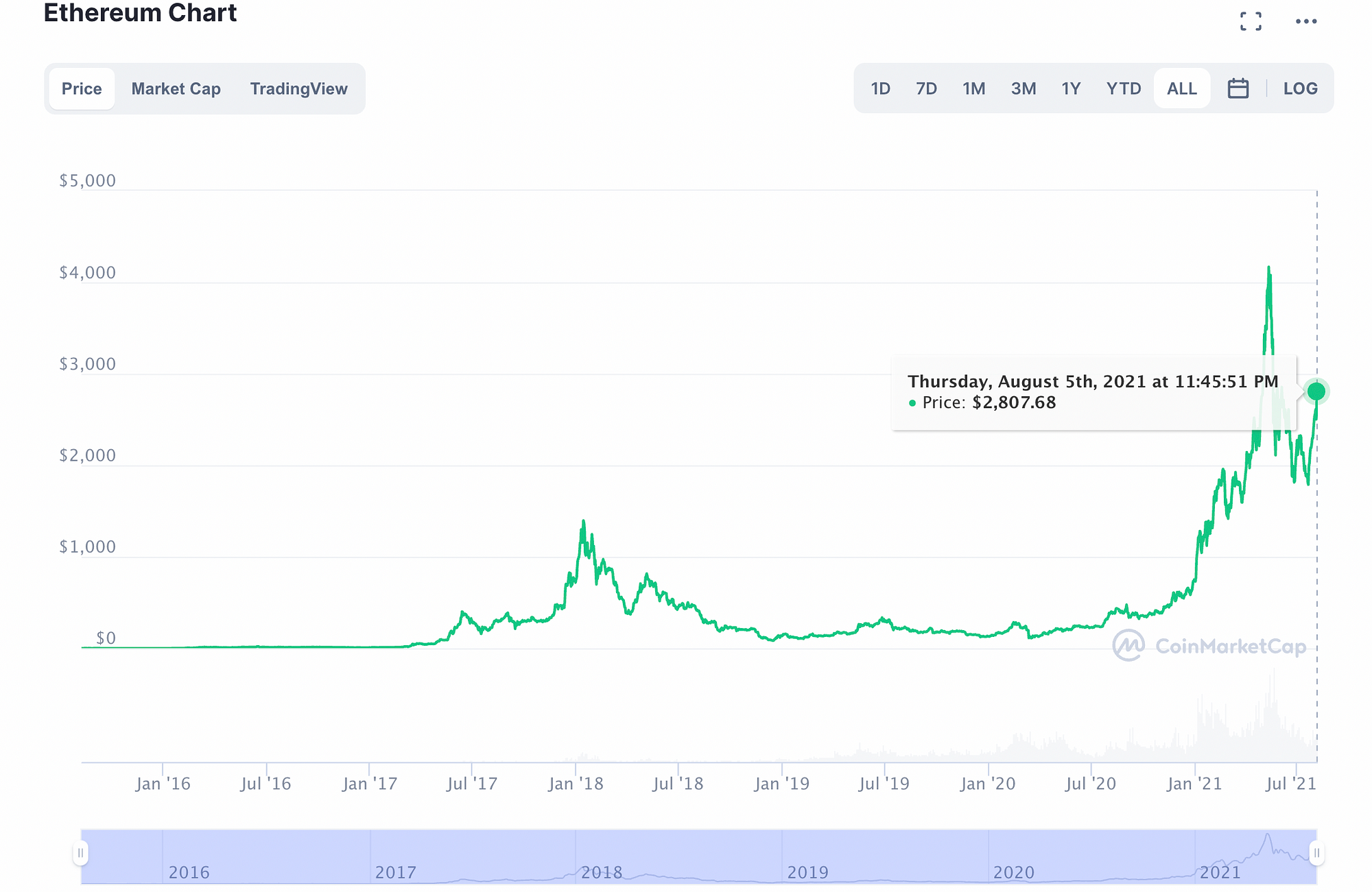

What Has Been The Response Of Ethereum Price After London Upgrade?

ETH soared to over $ 2,700 before and after the EIP-1559 upgrade.

as shown below:

Summary:

With EIP 1559 going live will ETH become deflationary or not let us leave it to the time to tell. But Ethereum on their official blog has clearly mentioned that

By burning the base fee, we can no longer guarantee a fixed Ether supply. This could result in economic instability as the long-term supply of ETH will no longer be constant over time. While a valid concern, it is difficult to quantify how much of an impact this will have.

They have further quoted that :

If more is burned on base fee than is generated in mining rewards then ETH will be deflationary and if more is generated in mining rewards than is burned then ETH will be inflationary. Since we cannot control user demand for block space, we cannot assert at the moment whether ETH will end up inflationary or deflationary, so this change causes the core developers to lose some control over Ether’s long-term quantity.

My Thoughts Summarized :

“This upgrade will definitely see some positive impact on the network reliability and adaptability. With lower GAS fees and more price predictability, the Ethereum blockchain network will see increased adoption among blockchain developers and DEFI innovators. Miners will be forced to behave more responsibly and will not be able to dominate the network thereby straightening the core ethos of Decentralization”

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.