Crypto Market Commentary

15 December 2019

Doc's Daily Commentary

The 12/11 ReadySetLive with Doc is listed below.

Checkmate's Corner

Horizon (ZEN) Spotlight & Review (Part 1)

A small cap project which falls under my category of ‘interesting and legitimate’ is Horizen (previously ZenCash with ticker ZEN). This deep dive aims to review the project off the back of what appears to be some moderately positive price action of late.

I will start by saying that given the size of the project and the potential that money is the only use for a blockchain, I would consider immediately that it is a pure speculative bet founded on the project vision and developer team. It is very centralised as far as access to changing the code-base and monetary policy however does boast a widely distributed node network. Assume it goes to zero is our base case. With that groundwork, let’s get into a deep dive on the merits and risks of this project.

Horizen Vision

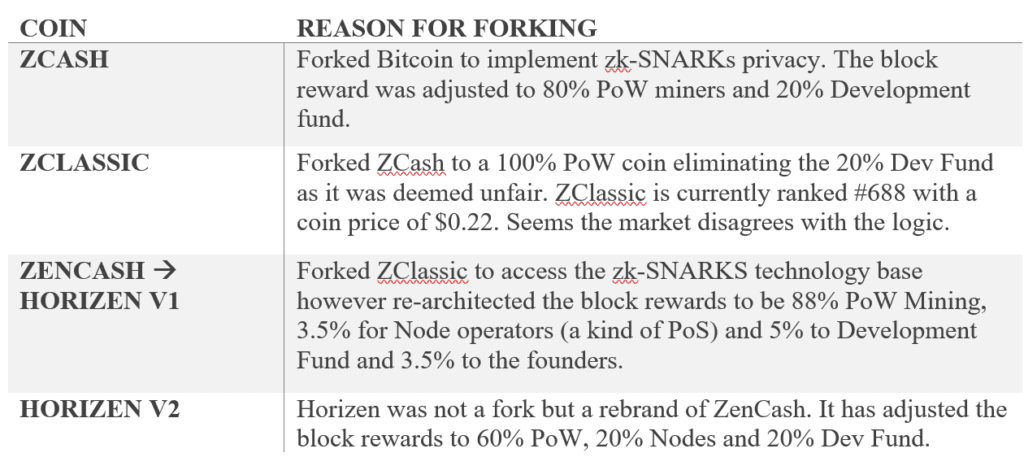

Horizen started life as ZenCash however rebranded min 2018 and pivoted its vision away from being privacy focused cash to being a privacy preserving blockchain currency with additional focus on Layer 2 and sidechain implementations. ZEN was originally a fork of ZClassic which itself was a fork of ZCash which is a fork of Bitcoin. The motivation behind each for is summarised below:

You can see that the project has had a few stages in its evolution but it seems to have reached a relatively stable position and interesting the block reward structure now looks remarkably similar to Decred’s.

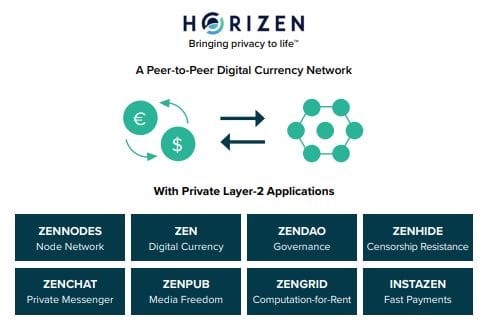

The Horizen project is attempting to be an all-encompassing, privacy preserving platform. In addition to the fungible money use case, the team is attempting to leverage zk-SNARKS to create private communications, document immutability, computation and content hosting amongst others.

It is a large scope of works but is fundamentally rooted in the position that privacy is a human right and one which is being routinely stripped away by institutions and governments.

Critiques: The scope of works is large and will take many years to implement even half of it. There is a risk that if the token does not accrue value, insufficient security and developer funds will be available to execute it all. Massive competition from better funded and greater reputation projects and second layer applications.

Monetary Policy

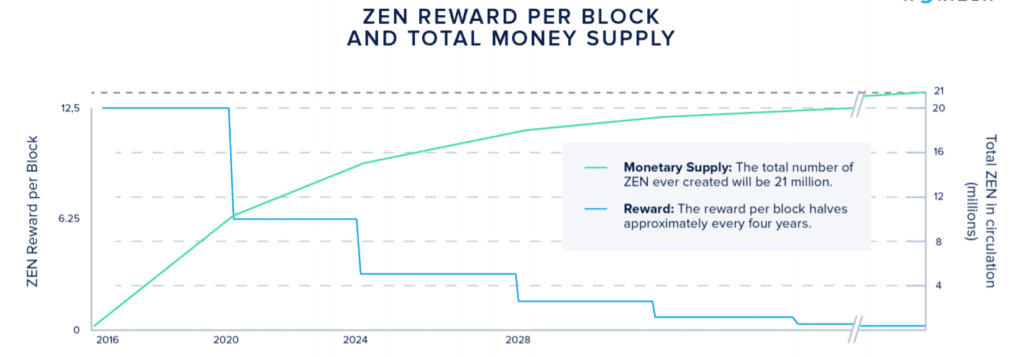

Horizen maintains the 21Million fixed supply cap from it’s fork history as well as halving events every 4 years. The block time is equivalent to ZCash of 2.5mins with the current reward of 12.5ZEN (equivalent to Bitcoin’s first epoch of 50BTC per 10mins).

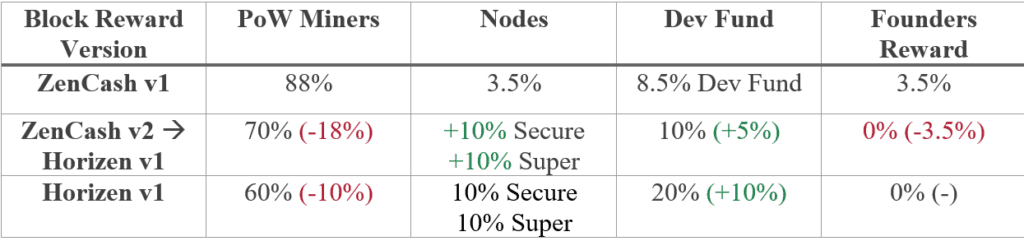

One thing that needs to be brought to light is the centralised nature of the monetary policy. To my knowledge, the block reward structure has been changed three times.

Now the reality of the situation is that the community was on board and well informed for these changes and the project remains very small. Whilst highlighting the inherent centralisation of the protocol level decisions, projects in this industry are attempting to build brand new technology and economic systems. There will be teething problems and in general the changes are in the right direction.

To summarise the current Horizen monetary policy:

* 60% allocation to PoW miners provides the base level of security.

* 20% to nodes incentivises a form of PoS and decentralisation of nodes. It is the only project I have reviewed that uses this system however I do critique that funds are not locked dup, merely symbolically in a single address. In this regard, Decred’s ticket system is much more elegant.

* 20% Dev fund allocation. This was intended to be 10% however the bear market really hurt the Horizen team. They had to reduce team size and double the treasury allocation from 10% at the end of 2018. I think the intention is to reduce this back to 10% when the project can support it but to be honest, I would be inclined for the team to keep it as is given the scope of works.

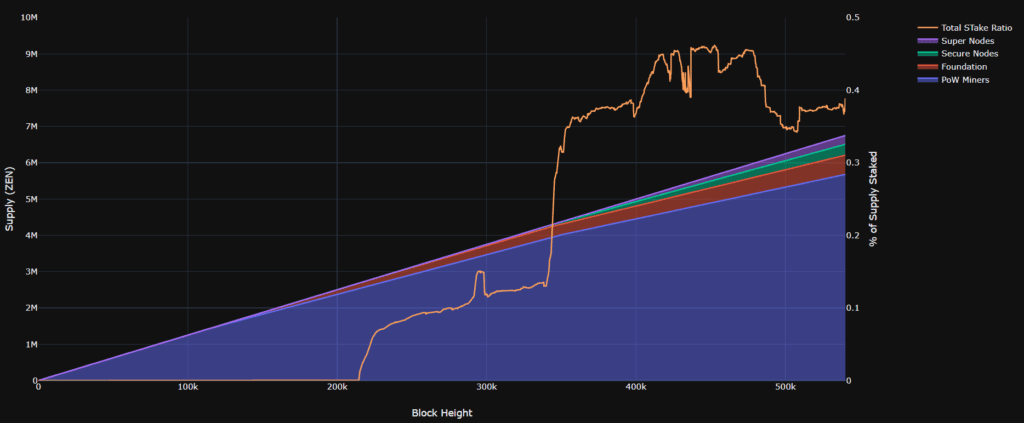

Figure 1: Actual block reward in ZEN paid to each group and total stake in nodes

Critiques: Small project, teething problems and clearly centralised protocol level decisions. Will it compete as cash with BTC, DCR and XMR or even ZEC…probably not. The stake participation in nodes is near 40% which is promising.

Security

The Security mechanism comprises two components, the PoW miners and a penalty system which was implemented following a 51% attack that was carried out on the chain. In June 2018, an attacker was able to re-organise 38 blocks using rented hash-power from NiceHash and were able to steal $700,000 via a double spend on an exchange. Technically, nothing was stolen on chain, it was the exchange that wore the loss.

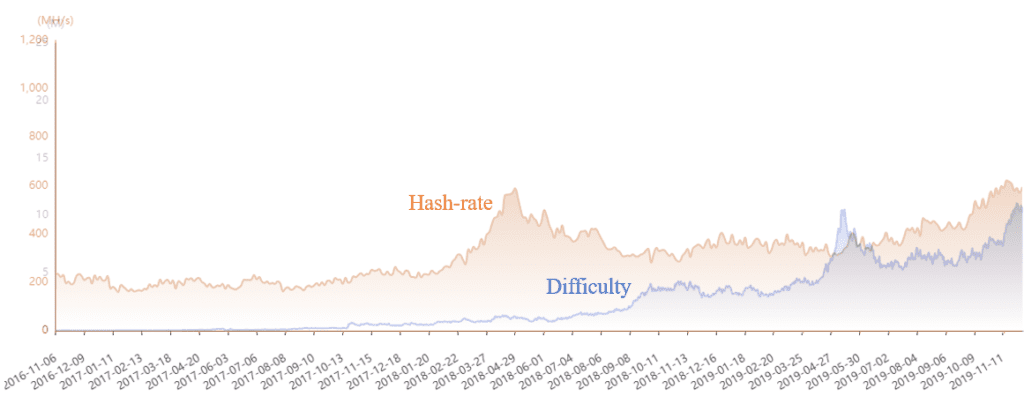

Horizen originally aimed to be ASIC resistant via the Equihash algorithm (same as ZCash) however have now discovered that continually changing hashing algorithms is a futile experience and simply leads to a never ending battle between developers and ASIC manufactures.

As of today, Horizen has ASICs mining it however it must be noted that ZCash hosts more hash-power than ZEN. This does mean that ZEN could in theory be attacked by ZEC miners, just the same way that BCH could be attacked by BTC miners. Zcash (4,370MH/s) actually boasts 7350x the hash-power compared to ZEN (594MH/s) right now.

In response to the 51% attack and being the minority chain in the Equihash class, Horizen has implemented an upgrade to traditional Nakamoto consensus. Essentially, if a miner attempts a 51% attack, they will start by mining their own secret blocks to re-organise the spends, then they will reveal the chain to the honest network. With the Delayed Consensus feature, the deeper the reorganisation, the longer the miner will need to continually mine the chain before it is accepted by the honest network.

As an example (without real numbers), if a re-org of 2-3 blocks is revealed, the attacker will need to continue to mine both chains for a period of say 25 blocks after it is revealed. If the miner wants to re-org 20 blocks however, that time increases exponentially as the penalty delay is the sum of all penalties up to the length of the competing chain and could be hundreds of blocks before the honest chain recognises it as legitimate.

Critiques: We can see that hash-rate is growing on the chain and acceptance of ASICs as reality is a good move. The chain was 51% attacked and as of right now, that risk is not much lower given ZCash has 8x the hash-rate at the time of the attack. If ZEN can grow to be competitive with the ZEC hash market, perhaps it will have a stronger hand. It is unlikely honest ZEC miners would attack ZEN (like BCH and BSV) however it cannot be classed as secure against double spends until it is the apex predator of its algorithm.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

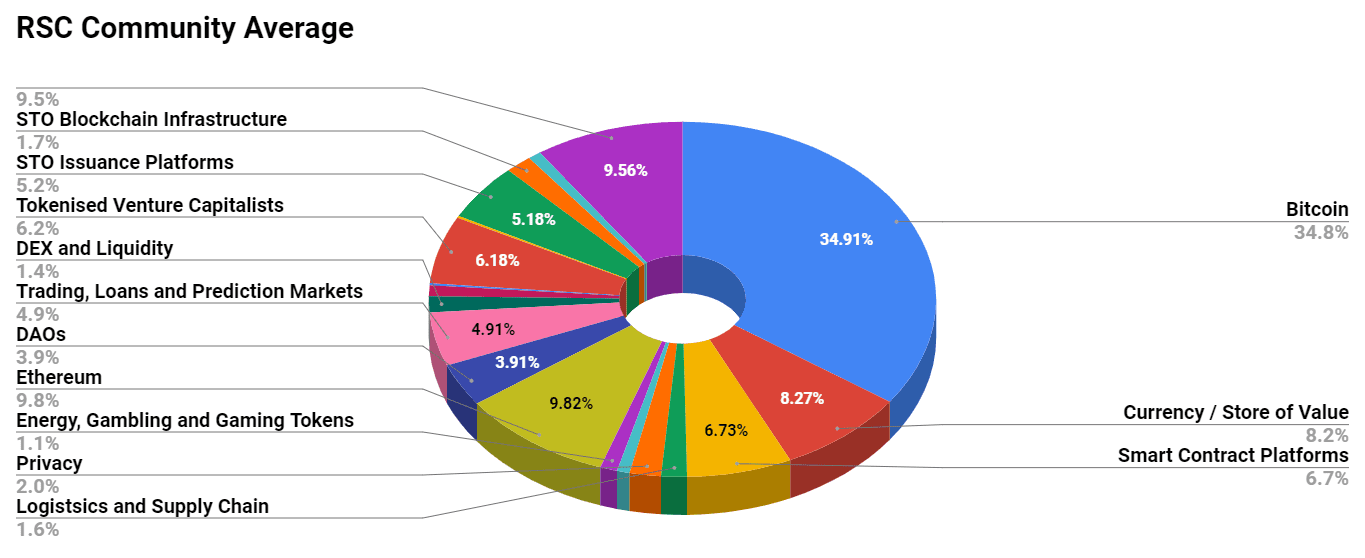

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

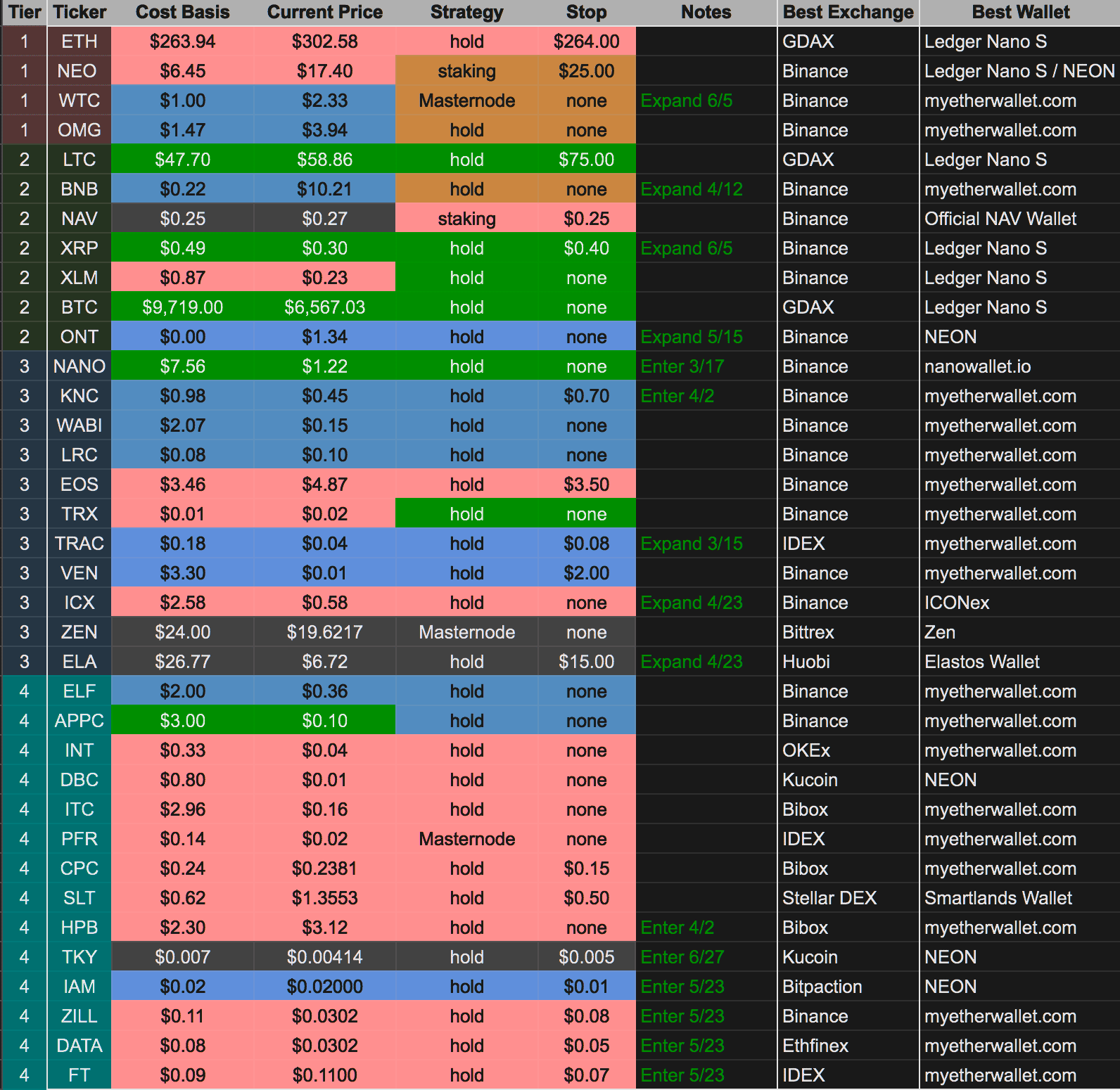

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)