Crypto Market Commentary

16 December 2019

Doc's Daily Commentary

The 12/11 ReadySetLive session with Doc is listed below.

Checkmate's Corner

Horizon (ZEN) Spotlight & Review (Part 2)

The Secure and Super nodes

The Horizen protocol has three types of nodes:

Full nodes – No stake requirement and just run a copy of the fully validated blockchain (like in a wallet)

Secure Nodes – Require a non-locked stake of 42 ZEN and an always on server. Node services exist for around $2/$5 a month to host these. Secure nodes act to relay data from various side-chains and applications within the ZEN ecosystem.

Super Nodes – Require a non-locked stake of 500 ZEN and an always on server with higher specs than a secure node. Hosting is around $10/month. Super nodes host the various applications and data structures that enable sidechains and applications.

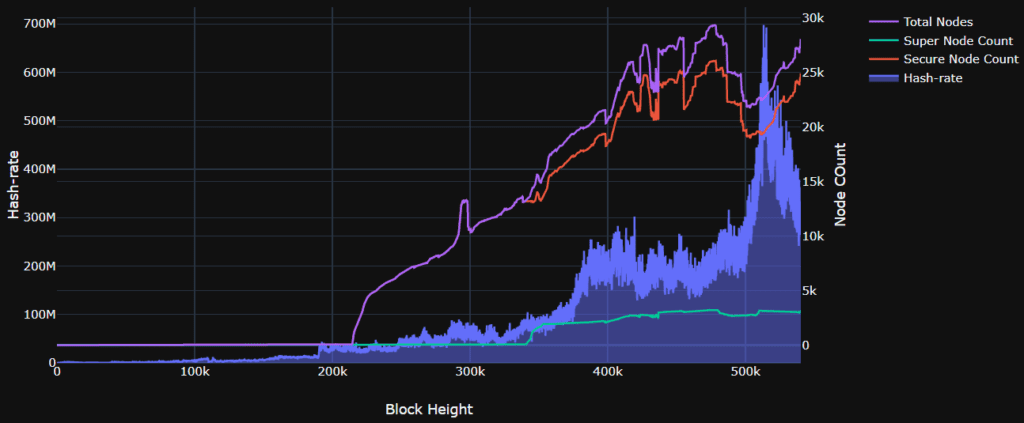

Figure 2 Growth of secure and super nodes along with hash-rate

What Horizen has done is incentivized node decentralisation and in all honesty, appears to have done a good job with it. They currently have over 28,000 total nodes live with a significant number of them coming on line from the start of 2019. What is notable is that staking nodes in particular are growing in number accounting for approximately 40% of circulating ZEN. This is important for creating the vision of a private and global ecosystem of immutable services.

At the moment, secure nodes payout approximately 0.02 to 0.03 ZEN per day, roughly $0.15 per day for a 42 ZEN lockup ($220 at $5.23 USD per ZEN). This equates to around a 25% ROI per year assuming price doesn’t crater. Its actually a viable investment at this stage (a price around $3.50/ZEN seems like a solid entry too).

Critiques: It is an interesting solution and I would like to see the team implement a forced lock-up of capital to secure a node. There is some soft lock-up with hosting providers as if you have pre-paid for a month of hosting, you sacrifice that value if you move the coins. However, If Horizen implemented a system like Decred where the nodes also validate PoW mining, the security would be greatly increased with the additional skin-in-the-game factor.

Market Opportunities

Horizen’s primary goal is to implement a privacy preserving infrastructure layer for the internet. Everything from money, communications, governance and publication. Now does all this data belong on a blockchain?

Actually, maybe the answer is yes. Privacy is interlinked with immutability and censorship resistance. Journalists publishing immutable news and having secure communication channels may actually be a viable application for a blockchain. What Horizen is really trying to differentiate on is the application of privacy to real world use cases. This is a valuable proposition and given the protocol is targeting that explicitly, it may be an edge.

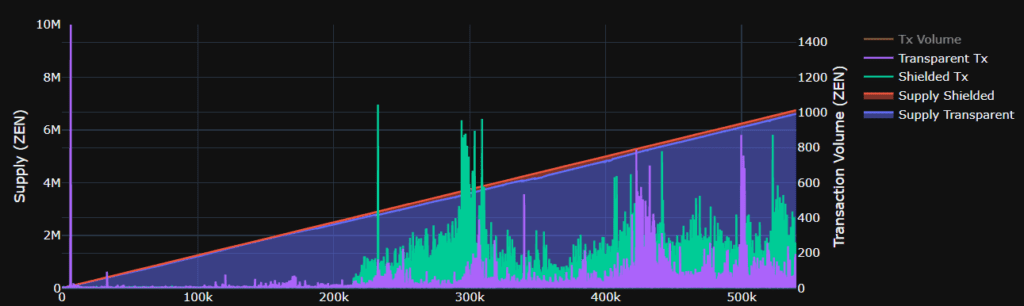

The chart below shows the amount and transaction volume of ZEN in transparent addresses (blue and green) and in shielded addresses (red and purple). We can actually see that the shielded transaction volume is a significant portion of the actual use on the platform. As we saw with ZEC however, it remains to be seen if these volumes are legitimate uses or attributed to the team and R&D running tests. That said, the volume in privacy is significant and actually shows some kind of utilisation.

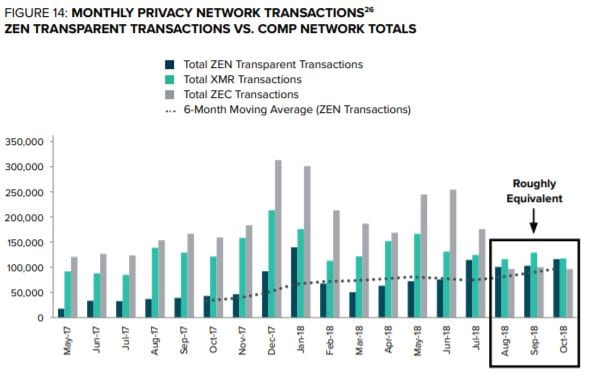

This is a similar outcome to the study by Grayscale in their Horizen investment thesis comparing to ZEC and XMR, Horizens biggest competition in the privacy space. They show that ZEN (back in Oct 2018) was actually competitive. I have not updated the comparative analysis for the present day however hash-rate and nodes both look to be increasing so I suspect it is still somewhat valid.

Grayscale ZEN investment Thesis is here for those interested:

Now the hard question, is Horizen the best platform for these privacy features? Right now it’s a hard No. Network effects on other chains just decimates the value proposition at this point in time. But the opportunity exists in the ‘what if’ scenario. If Zen captured even a fraction of that market share, there is a high risk high reward play.

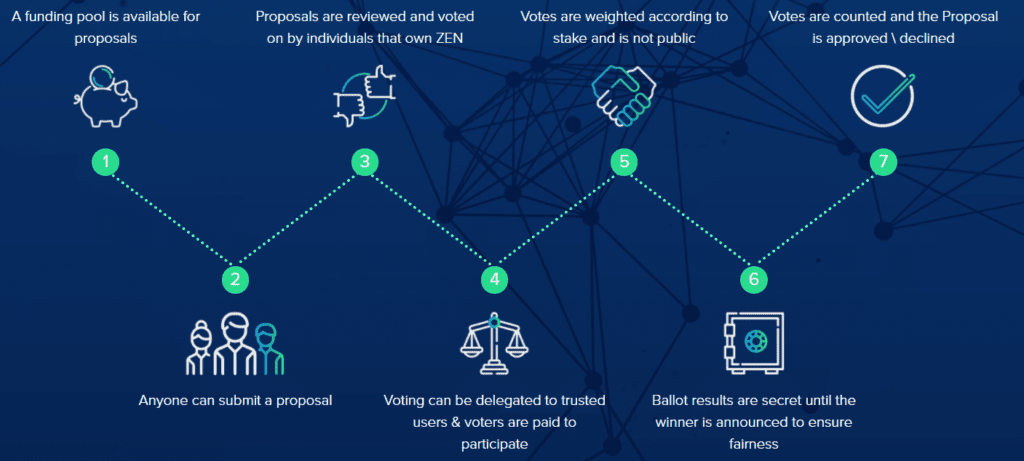

governance

Horizen is currently in a partnership with IOHK (the team behind Cardano for whatever that is worth) to develop a governance mechanism for the treasury funds. Again, we are tending towards a Decred like implementation and to be honest, they should just fork Politeia and run with that rather than pulling in a bunch of scientists and hoping they get it right.

Until that is delivered, the protocol is essentially centralised when it comes to governance.

Concluding thoughts

The project has had teething issues. It has a strong team, is forked from a strong code-base in ZCash and its vision is filling a much needed gap of privacy on the internet. Is the scope of works massive, absolutely. Will it take years to get there, definitely. However is the market opportunity for privacy related infrastructure immense…yes.

Over time, they are clearly narrowing down on a very Decred-esque type solution in terms of block rewards governance and hybrid security model…it is just way less elegant. It is focused on privacy however is this enough of a differentiator to compete with Bitcoin, Decred, ZCash and non-blockchain type systems? A rational position to take is to say No. However the opportunity both for privacy preserving technology and even unseating incumbents makes ZEN a small allocation high risk type opportunity.

They have just released their first Sidechain implementation which I understand was a success and likely the reason behind recent price action. The halving will be this time next year (late Nov 2020) so there may be a 12 months accumulation strategy that bears fruit.

Horizen is a potential fundamental play that MUST be caveated as an investment assumed to go to zero. For a conservative investor, stick with BTC, ETH and DCR.

Monetary Policy – Not convinced it will attract a monetary premium over BTC, DCR, ZEC or XMR.

Security – Remains at risk as it is exposed to massively dominant ZCash miners

Decentralisation – Node spread is quite good but protocol is definitely centralised

Users and Adoption – Stake and shielded transaction participation is solid for a small project

Investment opportunity – Amidst all the above drawbacks, the project has fundamentals that make it worth keeping an eye on. Secure Nodes are still profitable with a $2 hosting cost so there is a potential opportunity. No lockup means you are able to quickly exit if price craters. The halving MIGHT have some impact 12 months from now if the project has traction. I wouldn’t bet the farm on it but worth keeping track on developments up to that point.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

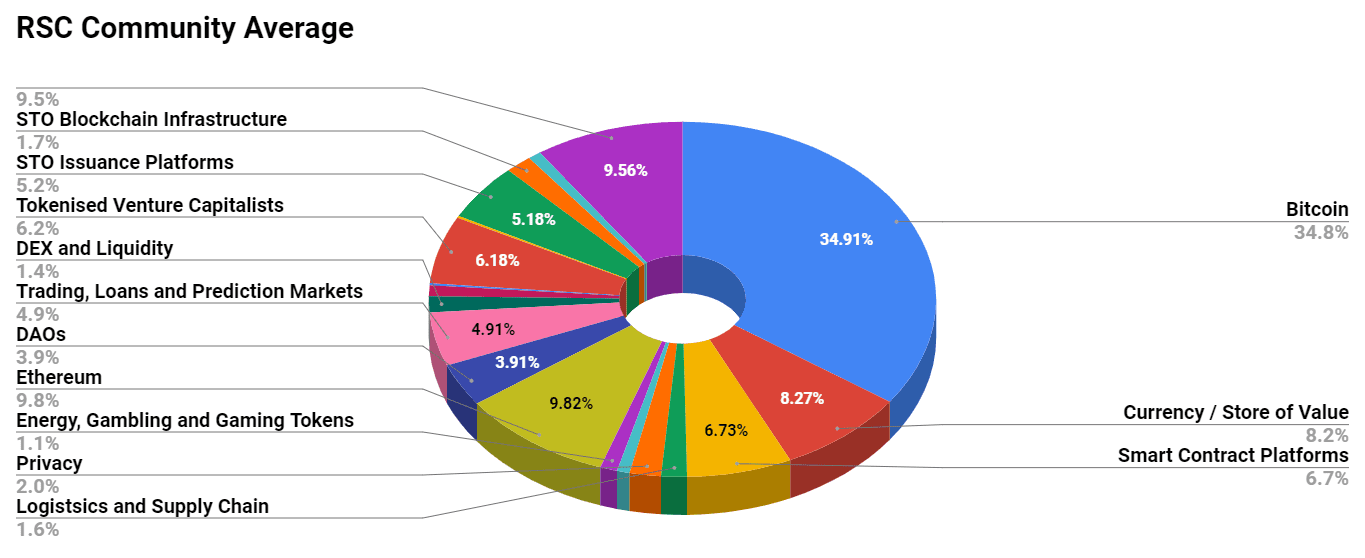

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

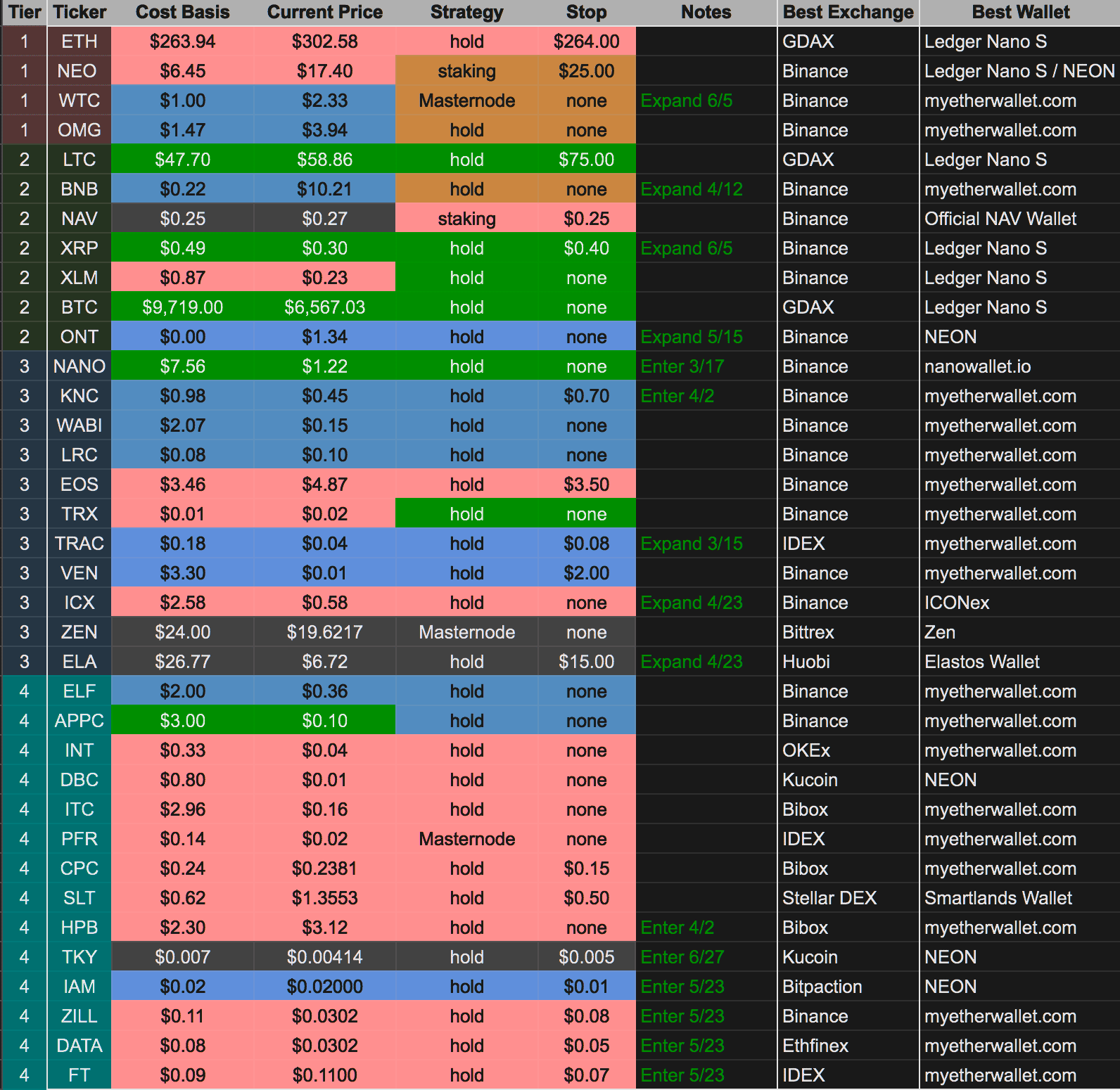

Here’s our past portfolios for reference:

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)