Premium Daily Crypto Newsletter

February 6, 2018

Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

Down then up

A sign of hope?

What a day for history.

Today we watched as a Tesla car was blasted into space, and we also saw the Commodity Futures Trading Commision (CFTC) and US Securities and Exchange Commission (SEC) chairs testify before the Committee on Banking, Housing, and Urban Affairs in an open session that lasted about 2 hours. The session was held to discuss the SEC and CFTC roles in Blockchain, virtual currencies, and ICOs.

Of particular note were the comments of the CFTC chairman, Christopher Giancarlo, who stated:

“This simple approach is well-recognized as the enlightened regulatory underpinning of the Internet that brought about such profound changes to human society. During the almost 20 years of “do no harm” regulation, a massive amount of investment was made in the Internet’s infrastructure. It yielded a rapid expansion in access that supported swift deployment and mass adoption of Internet-based technologies. Internet-based innovations have revolutionized nearly every aspect of American life, from telecommunications to commerce, transportation and research and development. [“Do] no harm” was unquestionably the right approach to development of the Internet. Similarly, I believe that “do no harm” is the right overarching approach for distributed ledger technology. “

He continued, “With the proper balance of sound policy, regulatory oversight and private sector innovation, new technologies will allow American markets to evolve in responsible ways and continue to grow our economy and increase prosperity.”

In response to a question regarding the value of Bitcoin, Giancarlo responded,

“It’s important to remember that if there were no bitcoin, there would be no distributed ledger technology.”

It’s important to stress this does not mean cryptocurrencies are out of the woods.

Jay Clayton, the chairman of the SEC who we discussed yesterday, weighed in his concerns:

“At the same time, regardless of the promise of this technology, those who invest their hard-earned money in opportunities that fall within the scope of the federal securities laws deserve the full protections afforded under those laws. This ever-present need comes into focus when enthusiasm for obtaining a profitable piece of a new technology “before it’s too late” is strong and broad. Fraudsters and other bad actors prey on this enthusiasm.”

That being said, he also stated,

“To be clear, I am very optimistic that developments in financial technology will help facilitate capital formation, providing promising investment opportunities for institutional and Main Street investors alike. From a financial regulatory perspective, these developments may enable us to better monitor transactions, holdings and obligations (including credit exposures) and other activities and characteristics of our markets, thereby facilitating our regulatory mission, including, importantly, investor protection.”

It was Giancarlo’s conclusion that shone a positive light on the sentiments of the two agencies the most:

“As we saw with the development of the Internet, we cannot put the technology genie back in the bottle. Virtual currencies mark a paradigm shift in how we think about payments, traditional financial processes, and engaging in economic activity. Ignoring these developments will not make them go away, nor is it a responsible regulatory response.”

So what does this all mean? What are the implications here? Let’s break it down.

- It’s clear to us the CFTC and SEC are working together toward a similar end — allow innovation, stop imposition. The new Cyber unit in the Division of Enforcement will be more assertive toward this end, and increasingly so in the future: “I have asked the SEC’s Division of Enforcement to continue to police these markets vigorously and recommend enforcement actions against those who conduct ICOs or engage in other actions relating to cryptocurrencies in violation of the federal securities laws.”

- The main focus for their crosshairs is not DLT (distributed ledger technology, i.e., blockchain) and cryptocurrencies, it’s ICOs that scam and defraud investors.

- As they made quite clear, the majority of ICOs that are utility tokens are securities. “Merely calling a token a ‘utility’ token or structuring it to provide some utility does not prevent the token from being a security.”

- In a similar way, cryptocurrencies, such as Bitcoin and Ethereum are not unquestionably currencies. “Simply calling something a currency or a currency-based product does not mean it is not a security.”

- As we discussed yesterday, the ire of these organizations will be focused on ICOs and exchanges who go against the established regulations. “Many trading platforms are even referred to as ‘exchanges.’ I am concerned that this appearance is deceiving. In reality, investors transacting on these trading platforms do not receive many of the market protections that they would when transacting through broker-dealers on registered exchanges or alternative trading systems.”

- For ICOs, AML (Anti-Money Laundering) and KYC (Know Your Customer) checks must be in place. “Market participants should treat payments and other transactions made in cryptocurrency as if cash were being handed from one party to the other.”

- The market itself is at the mercy of many different manipulating factors. “Experience shows that excessive touting in thinly traded and volatile markets can be an indicator of scalping, pump and dump, and other manipulations and frauds.”

All in all, it’s clear to us the SEC and CFTC have the intention to protect legitimate investors while punishing those who defy securities laws. How they are actually going to go about that remains yet to be seen, but we believe this is a step in the right direction. Crypto needs to work with governments and not against them if there is to be a long term horizon for this space. Quite simply, ICOs are illegal if they don’t register with the SEC, which was made clear by the chairman stating that he does not oppose entities using ICOs to raise money, but they must do so legally.

This may have the consequence of seeing a wave of established companies raising capital through legal channels such as SEC approved ICOs.

This is a brave new world for crypto that is unfolding. On one hand, cryptocurrencies must go a step further to tell their story and be able to explain rationally how their product works.

Like many things, this process of change will be difficult and uncomfortable for an ecosystem used to operating like the Wild West. But look at what we stand to gain. Escaping the labels of “scam” and “fraud” and becoming a more legitimate space will open the doors to the skeptics and the institutions. Yes, there will be some desertion of established ways, but that’s how change occurs. The stakes are too high, the path of crypto is one of freedom and regulation, and it will be a very interesting new world we will build together.

As always, Don’t Panic.

Video Player

If you missed our class “Introduction to Cryptocurrency Trading” that we held on last weekend, it’s available now in our Premium Member’s Home as an archived class for those that purchase it. You can view more about it and watch the class today by visiting this link here.

Watching on Mobile? Click this link to watch in HD

.Click here for audio link of today’s video

Offense – Adding Trades

Offensive Actions for the next trading day:

- No specific actions.

Defense – Managing Risk

Defensive Actions for the next trading day:

- No specific actions.

Current Portfolio

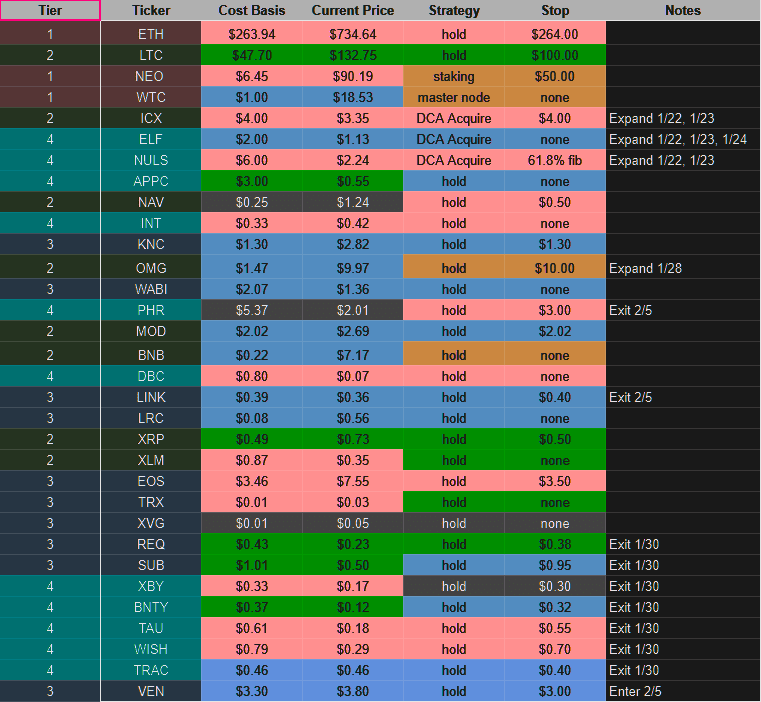

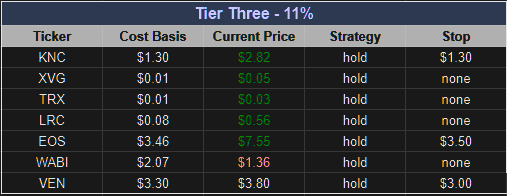

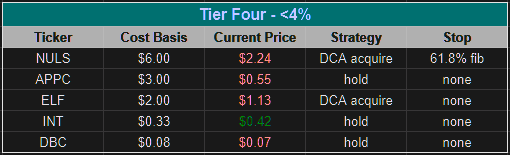

How to read this portfolio: Ticker: Contains the ticker code for the coin. You can search this ticker in Coinmarketcap to learn more about the coin. The color denotes the risk tier by our evaluation. Dark Red = T1, Dark Green = T2, Dark Blue = T3, Light Blue = T4 (Colors in the Ticker column do not interact with the colors in the other columns) Cost Basis = Our average purchase price for this coin. Current price = The average price of the coin based on the exchanges it is listed on. Strategy = What we plan to do with this coin. Staking is receiving dividends for that coin. Master node is also staking, but with a higher return rate for having a (large) number of that coin. Stop = Our exit point, if it exists What do the colors mean? The colors in the ticker column represent the risk profile of that coin. The colors in the other columns reflect what sector(s) that coin belongs to. Some coins belong to multiple sectors, which is indicated by multiple colors. The colors correspond to our 7 categories in the graphic below.

Tier 3

Vechain

VeChain is a global leading blockchain platform for products and information.

VeChain is the world’s leading Enterprise-focused dApp/ICO platform for products and information. It aims to connect blockchain technology to the real world by providing robust infrastructure as well as IOT integration, with scalability up to 10,000 tx/s and pioneering in building real world applications. This is being achieved through partnerships and collaborations with innovative brands and industries.

As of today, VeChain has established partnerships with PricewaterhouseCoopers, DNV GL, Renault Group, KUEHNE+NAGEL, D.I.G., China Unicom, etc., and accumulated extensive experience in an ever expanding list of industries including pharmaceuticals, liquor, auto, luxury goods, retail, logistics, supply chain,food and cold storage and more.

None for today.

Tier 3

REQ

SUB

LINK

Tier 4

XBY

BNTY

TAU

WISH

TRAC

PHR

ReadySetCrypto’s 7 Categories Of CryptoCurrency

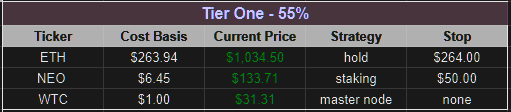

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

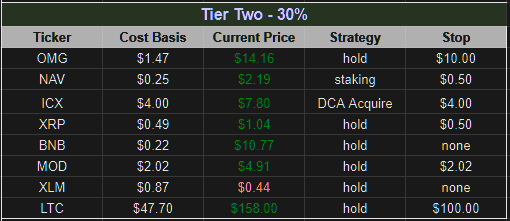

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

Fundamental Currency Research

As always, we we see bounces, look for the coins that perform the strongest and most consistent. Those are coins that will make great candidates for T1 coins.

The rhetoric of this week is certainly centered around government regulation. With the positive news coming out of today’s hearing, a nice rebound was in effect, but it will not be enough to clear the fog.

What is reassuring to me is the discussions being had right now. While it’s clear the implementations are imperfect and incomplete, the underlying technology is unique and matters. The actions of South Korea and China and every other country looking to implement their own support or restrictions of crypto indicate that this is a pervasive technology that will continue to have a role in shaping the future of commerce and finance.

We are confident that we’ve made solid portfolio picks as our largest holdings have weathered the storm as good as we could have hoped. We look forward to the eventual reversal and seeing how the chairs are rearranged.

In this section we’ll feature a daily ICO or new coin we think you should check out. Based on your country, you may not be able to participate in the ICO, but you will be able to trade the coin once it is listed on an exchange following its ICO (usually only a couple of weeks). ICOs are where a lot of money in crypto is made. Here’s proof. That said, we should warn you: ICOs are highly risky endeavours and you need to mitigate any potential losses. Treat it as money you’ve lost the moment you contribute to the ICO. We are not responsible for the ICO’s performance. Today’s featured ICO / New Coin is:

Acorn Collective

For flipping Good.

For long-term holding Neutral. Their platform isn’t ready yet and they need to prove their model works.

What is it?

Acorn is promoting social enterprise by providing free crowdfunding for any legal project in any country. It’s a huge and growing market in the West and a completely untapped market in developing countries.

Crowdfunding, the concept of raising many small contributions through an online funding platform, first appeared in the early 2000s, but it was only after the launch of Indiegogo in 2008 and Kickstarter in 2009 that crowdfunding gained considerable traction (Freedman & Nutting, 2015). Since its founding till August 2017, Kickstarter has channeled over USD 3.2B from more than 13 million backers to fund almost 130,000 projects. Moreover, Indiegogo has raised more than USD 1B in funding. In terms of ICOs, over USD 3B was raised in 2017 alone (as of November). This is not merely a passing fad; business experts agree that crowdfunding is here to stay (Assenova et al., 2016). The impact of crowdfunding on global finance and entrepreneurship is undeniable. In 2015, the total global crowdfunding volume was estimated to be USD 34B (Massolution, 2015). A 2013 World Bank paper titled “Crowdfunding’s Potential for the Developing

World” predicts crowdfunding to reach USD 90-96B per year by 2025. A 2017 report by MyPrivateBanking claims total crowdfunding could reach a staggering USD 1 trillion per year.

What is our verdict?

What we like: Crowdfunding can have a huge following. The team seem passionate. Interesting idea, even if the market is somewhat saturated.

What we don’t like: Whitepaper is vague at times. Crowdfunding isn’t as hot as it used to be. Marketing needs work.

Website: https://aco.ai/

Whitepaper: https://drive.google.com/open?id=0B1PbmmXatTeAODdsWUl4bmRJOW8

Technical Analysis Research

A single green candle is enough to get folks excited about a potential rebound, however the recovery won’t happen until everyone gives up trying to buy the dip with a weak hand. I hate to keep saying the same thing in this space but honestly a rising tide floats all boats, and few coins are able to escape the gravity of BTC and ETH right now.

If you didn’t get a chance to join us in last night’s “Bear Market Survival Webinar,” it’s posted in the Premium Home area, under “Live Classes.” It’s free with your subscription, hope you find it useful.

We had an excellent class last weekend, Introduction to CryptoCurrency Trading. (Click here for more information and to sign up) This class is really targeted at the Crypto investor who wants to get moving but is somewhat uncertain about what they should do, and how to go about it. Another great candidate would be the recent investor who bought in at the top and is unsure of their actions. While you can’t attend the live class and the Q&A any more, the content is all there and we give you the slide download as well.

I am going to stick with the current list of holds and will not go into “swing” mode until we get a release off the bottom. If we see any coin showing particular strength I’ll detail a short-term swing. I can definitely see adding to my WTC position which is somewhat underweight as compared to Mav.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.