Doc's Daily Commentary

Mind Of Mav

Is The Chaos Economy The New Status Quo?

As we move further into our COVID-induced quantum leap, chaos increasingly dominates our economic outlook. While the immediate impact of COVID on fintech and e-payments was obvious, the follow-on supply chain bottlenecks in both labor and materials were less clear. We were ever careful to avoid the trap of making tacit assumptions of any given function returning to “normal” after a big system hit like COVID; but we still missed that one. Normal is what you see before you today, not what you remember from 2019. COVID is now endemic; there is no “post-COVID normal” to return to. We just don’t have sufficient vaccines for that. As we enter our third year of mask wearing and shut-downs, no one knows when it will end. Our task as investors now is to adapt.

But COVID is not the only chaotic economic disruptor. As anyone who tried to fly over the holidays knows, the climate is increasingly problematic. While we can predict near-term climactic disruptors, the outlier storms, floods, and fires that do the most damage occur with too little warning to effectively ameliorate. As our CO2 levels continue to build unabated, climate based disruption will become another new normal. To return to the world we remember, we need to not only stop adding CO2, we need to remove it. Not happening. Our collective task becomes to adapt to climate change too.

The Predictable 20th Century: The Past

What 2021 showed us is the new importance of turning on a dime. The post-WWII hierarchical organization that dominated the last century and supported US hegemony benefited from honing and automating set procedures. The magic of productivity itself came from repeating the same procedure over and over, learning all the while how to do it better. The zenith of this was the highly productive just-in-time inventory management systems that defined global trade. Success in this environment was predicated on highly repeatable actions made in a largely static environment. These systems became enshrined in the fixed and siloed IT solutions. With COVID, the instability of that environment has become the largest issue. Again, think of holiday travel this year as an example of larger challenges in moving shipping containers. The longer term planning that makes just in time efforts actually work break down in a chaotic environment.

The Chaotic 21st Century: The Present

We are no longer in that predictable era. Operations now require constantly and instantly managing around spot disruptions, including those in: demand, materials, labor, and now weather. Importantly, adjusting to constant and meaningful supply disruptions will only be half the battle. The other half will be meeting real demand; what will a company offer given their constantly shifting kaleidoscope of inputs? What will consumers want given their own unstable life factors? How do you match one of these moving targets to the other without generating waste?

Importantly, this new level of dynamism will have to be reflected somehow in marketing and communications. How do you make an ad campaign for something that may not materialize as planned? How do you generate demand without such a campaign? How do you maintain your audience through their own life changes? Dancing through these raindrops will become how business is just done, further separating the newly automated from the legacy.

Technology Tracks Reality

Importantly, the initial cloud computing adoption cycle starting just after Y2k has been but a prelude to what we need today. While those solutions set the stage for truly agile products, by moving from on-premise servers tightly coupled to local PCs via rigid logic, to the more loosely coupled PC-cloud and then mobile-cloud architectures, by adapting more highly abstracted languages for logic and UIs, they still reflect an earlier era of stability. They still don’t “just work” out of the box. They still enshrine workflows a specialist will need to alter. They still limit options in favor of immediate efficiency.

This is now a relic of the past. A product that can be updated three times a year was once considered cool. Now, one that can push changes overnight would be ideal (if not necessary). On the other hand, one that needs to wait for an (..sigh..) operating system update simply will no longer work. Rather, the more data inputs an IT system can accept, and the faster it can implement options, the more valuable it can be. For instance, a supply chain management system with a complete view of delivery options (more data inputs) and a real-time delivery optimization engine (fast option implementation) could come in very handy right now.

New Inputs, New Systems

Observers of change tend to underestimate the pervasiveness of system adjustment to novel inputs. Any system reflects the sum of all its input variables. Any time a significant new variable gets added, the entire system adapts, not just localized parts. People often use what we call the ice cream cone concept of change, where a new input is just another scoop added to an existing structure. Reality is more of a milkshake, where everything gets blended together. The iPhone is not just about a scoop called unit sales. Apple could never sell enough hardware scoops to be worth $3TRN. Rather, that valuation comes from the milkshake of how deeply that communication system has bent society in its image with Apple near the center.

Similarly, COVID and now climate change, reflect how our baseline reality has changed for good. COVID is more than a disease and climate change is more than a few heat waves or storms. These are extremely powerful new chaotic system inputs that destabilize the underlying dynamics of our economic system in profound and unpredictable ways. In short, we are moving from a stable to a more random era. We will just have to dance faster and faster to keep up. This requires the latest in information processing as well as new ways of organizing both work and finance.

Looking Forward: From Efficient to Antifragile

The chaos of both COVID and climate change, along with the inevitable entropy gains delivered by the continued heating and aging of our environment, imply the current economic system breakdowns we are experiencing will not be fixed by historic methods. Borrowing from Nassim Taleb, those systems are “fragile”. Like a Jenga tower, they may be impressive, but pull out the wrong block and the whole thing catastrophically fails. In contrast, antifragile systems are more loosely coupled affairs that can not only adjust to shocks, but are actually strengthened by them.

This larger trend could explain the current interest in both DeFi and FinTech largely as ways to supplant the aging financial infrastructure that almost collapsed in 2008 and may not withstand unknown shocks coming down the pike. It also would explain the sharp turns in employment we are seeing, where job openings remain unanswered while workers seek more independent livelihoods, along with the tools needed to support that change. With both of these financial and employment trends, we will need the new autonomous and bottom-up automation tools. This future is not “out there”, rather, it is now and I’m definitely ready to see it through while capitalizing upon it.

Guidance for FinTech investing in an era of chaos

The upcoming era of chaos requires us to dive deeper into how the enterprise and the workforce both adapt in order for us to continue finding alpha.

In reading some recent pieces, such as this recent one from a16z, (See a16z “The big ideas that will drive FinTech in 2022” here), it is abundantly clear that they are stuck at a different abstraction layer somewhere around Efficiency but no where near Antifragility, pointing out mostly obvious observations like: “Every healthcare company is a FinTech company” or “Emerging markets will see more FinTech”.

They simply don’t get it. Everything has changed because of the poetic justice of cause and effect.

In a chaotic world where agility wins and all else loses, one needs to consider what are the forces driving this change and what would be the antidote an enterprise could be prescribed with in order to counteract those (once) endogenic forces boiling rapidly above earth’s surface.

There are four foundational pillars of change I can observe:

1. The Workforce Has Changed

2. The New Consumer Demands End-to-End Automation

3. The Economy is Running at a 0 Growth Rate

4. The Supply Chain Has Broken, Permanently

Let’s start by taking the changing workforce and the new consumer as quick examples in outlining some of the remarkable investment opportunities this era presents.

In reading the various 2021 World Economic Forum, International Monetary Fund, and The Organisation for Economic Co-operation and Development reports around the future of jobs, it is clear that the enterprise will need to deal with a few trends stemming from the change in the workforce. Namely, managing a globally dispersed workforce, catering the growing needs of its employees in an era where employee retention is constantly challenged and where the mere definition of “work” is being re-examined. Furthermore, the enterprise will need to use technologies that its (part humanoid part cyborg) workforce would want to adopt. In tandem, as a growing portion of the workforce increasingly become gig-oriented free agents, they too will need to buy software tools that assume many of the support functions historically offered by their employer, such as tools for managing their day-to-day business and finances.

The adoption of agility-increasing technologies by the enterprise is not independent of the workforce, rather it is done in collaboration with the workforce and largely with their consent and buy-in as it ultimately enables them as the direct beneficiary, (See TripActions Liquid, Sorbet, Insurights as examples of such investment opportunities). Or they will be adopted by the operator where the direct beneficiary is the Enterprise itself (See Papaya Global, Tipalti as examples of such investment opportunities etc.)

It is easy to just look inward when considering the enterprise, and there is surely a massive opportunity there as outlined above but let us also not forget the end-consumer.

This end-consumer can be another organization benefiting from the services rendered by the enterprise (B2B) or it can be a direct consumer (B2C). Whomever it may be, the importance of speed, accessibility, meritocracy and democracy has further amplified during COVID to the extent it is now the standard. This move from a top-down to a bottoms-up focus is in keeping with the larger move to antifragility.

When considering the importance of speed, take as an example Sunbit, a company helping brick and mortar merchants approve more customers in a matter of seconds at the POS. When considering Accessibility, think about Next Insurance, a company enabling SMBs with tailored insurance products obtained almost instantaneously from their mobile phones. When considering Meritocracy, think about Venn, a company that utilizes real estate and rental data to give the property owners actionable insights, but also increases engagement and the sense of community of the end-consumer (the tenant). Lastly when considering democracy, think about SMBX, Deshe Analytics, or Equitybee granting access to investment products and wealth creation that only high-net-worth people could once utilize.

I can keep going deeper in discussion of each of these four foundational pillars of change but a core trend to keep in mind, however, is how we replace long-term AI supported planning with real-time data-infused agility.

Summary: New Solutions for a Chaotic Environment

Like it or not, evidence points to our entering a more random and chaotic environment that is already starting to impact the economic discussion. It is time to adjust. We need to leave the world we know, of post WWII hierarchical systems, behind.

Their very strength has been their repetitive rigidity, which becomes fragility in an unpredictable environment. Rather than try to boil the ocean by preserving a friendly environment for old institutions, it is time to adapt quickly and incrementally to sudden change.

The concept of anti-fragility will compete with efficiency in importance. The winners of the 2020s will be the first ones to adjust to this new reality and to solve the problems presented by both COVID and early climate disruption. The trick is to stop waiting for a return to the pre-2020 “normal” and move first.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

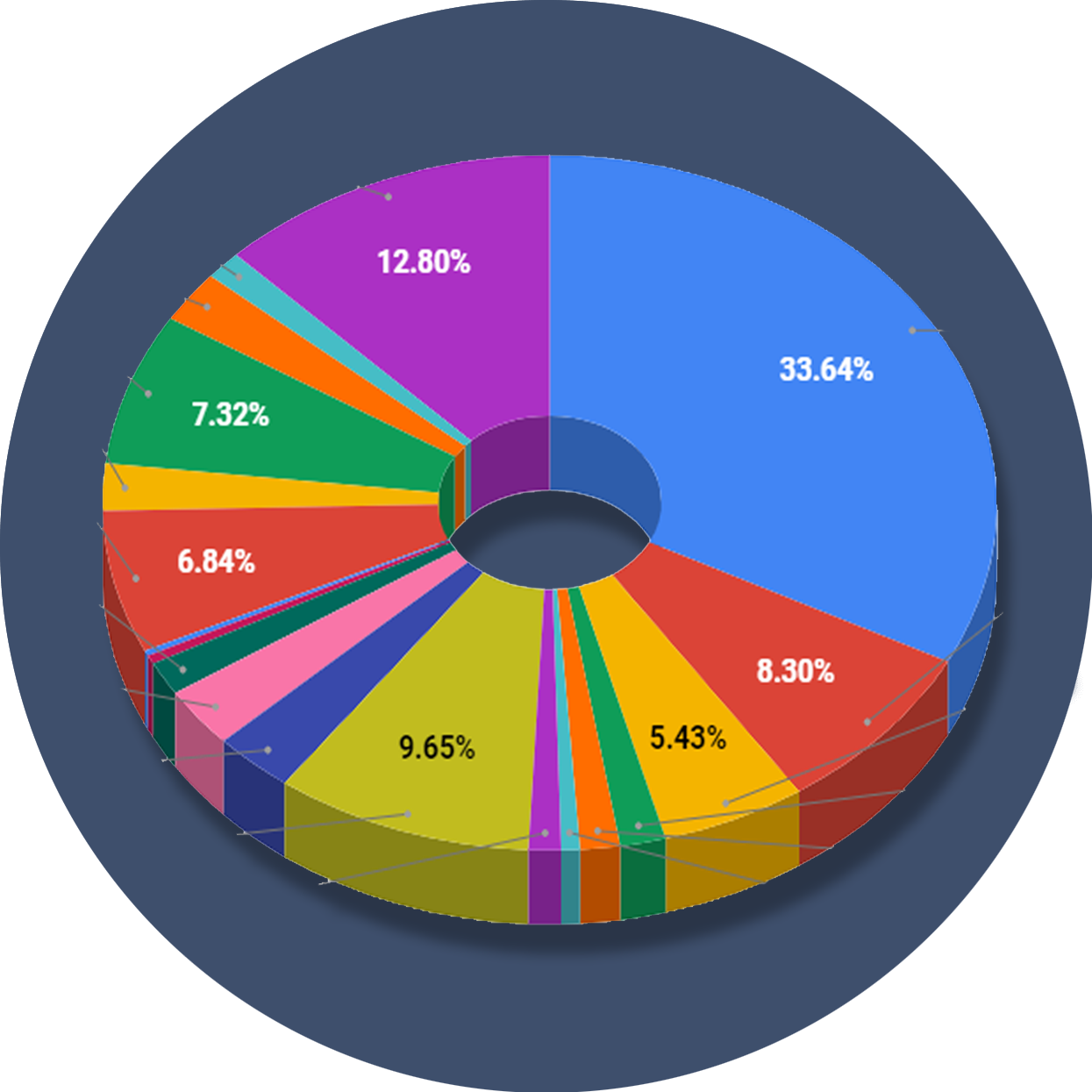

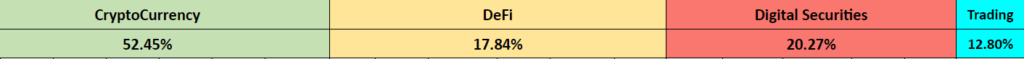

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

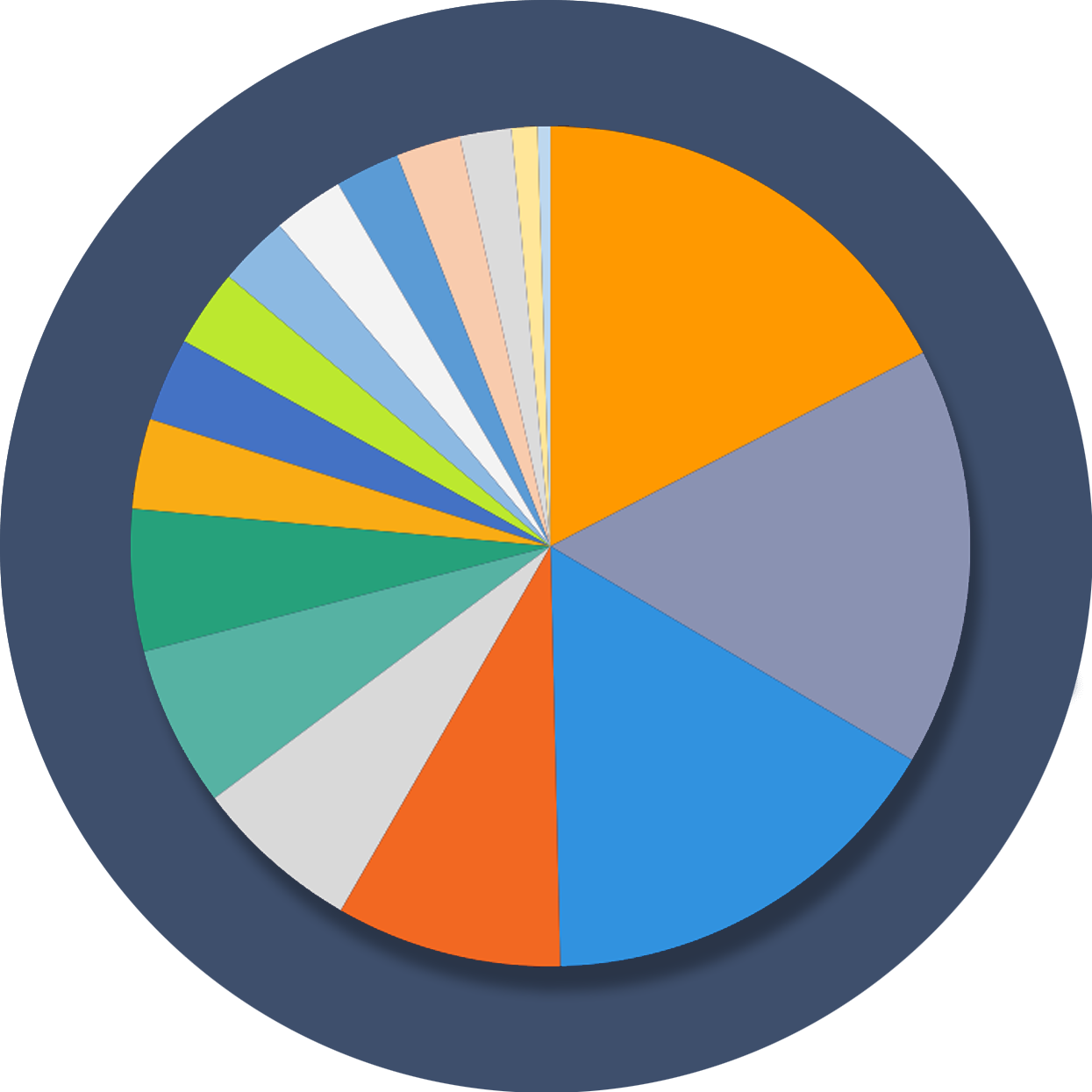

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.