Doc's Daily Commentary

Mind Of Mav

2022 Macro Market Outlook: What Does The Data Tell Us?

The New Year hasn’t started off well for the crypto markets.

Despite this, there are some key narratives to consider for 2022 if we aim to be prudent and prepared investors.

Key takeaways:

* Illiquid supply in Bitcoin Ethereum.

* DXY and the S&P, how this has an effect on the crypto space.

* Macro market, how US policy might affect outcomes. Money printing, Covid, War and regulation.

* Media coverage preparing retail to reenter. (Retail has essentially been sidelined since May 2021)

* DeFi and stablecoins. Regulation means you should move into decentralised stables. i.e UST, Frax, MIM.

* Bull market, blow off top, bear market. What will happen and how to prepare.

Some notes: These are observations connecting the unfolding of recent and future events and how to best prepare for the next year . . . not financial advice.

Even though I am long term very bullish for the Crypto & Web3 space as a whole, it is important to remember that all markets enter cycles — especially young markets. For those reasons, I believe there may be more volatility this year (yes, more volatile than normal for crypto).

Up until now, we have had relatively clear market cycles. With the introduction of ‘big money’ / institutional whales with institutional whale money, these patterns are changing. This means there are more things to watch out for moving forward. Let’s dive into them.

Illiquid supply in Bitcoin and some On-chain Analysis.

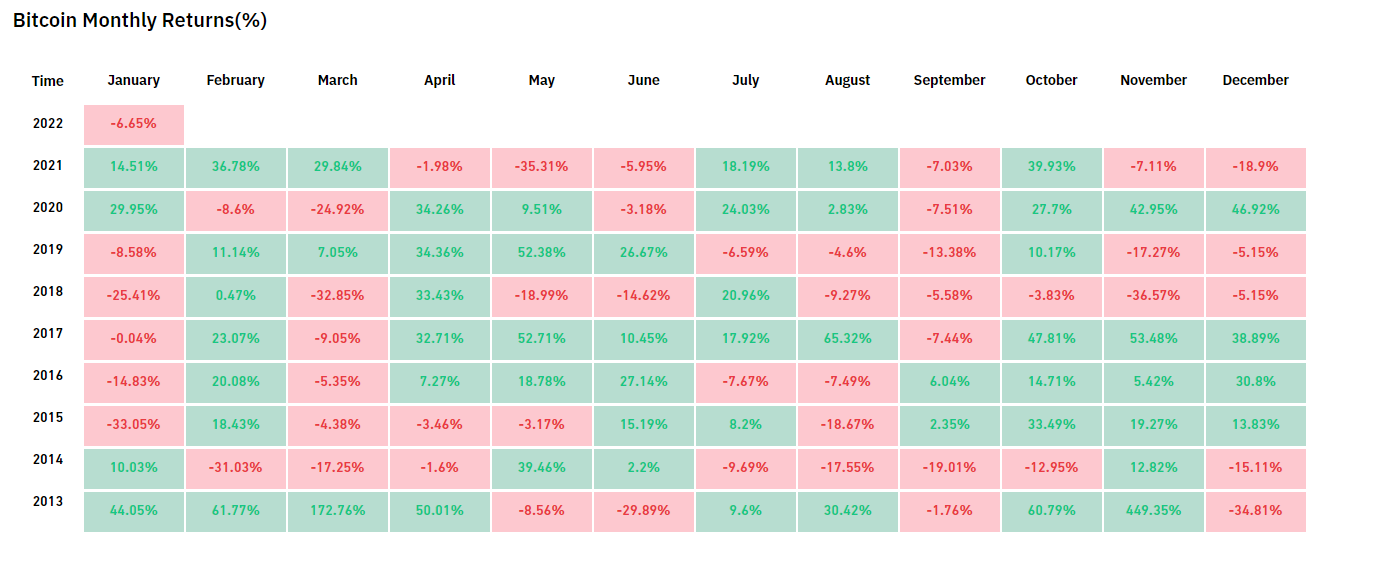

Many people have called this past year a bull market. This is certainly correct, even with 5/12 months being negative for BTC, as we have seen some intense growth in many crypto assets. However, the On-chain data shows a different story — a story of accumulation and price consolidation. Let’s look at the illiquid supply chart and see how this chart has been on a pretty aggressive downtrend. It’s getting to the point where close to 78% of Bitcoin is currently out of circulation, leaving less Bitcoin to be traded. This lack of liquidity can make for volatile movements as only close to 22% of the supply is actually being traded. This means it takes less money to move the price in either direction.

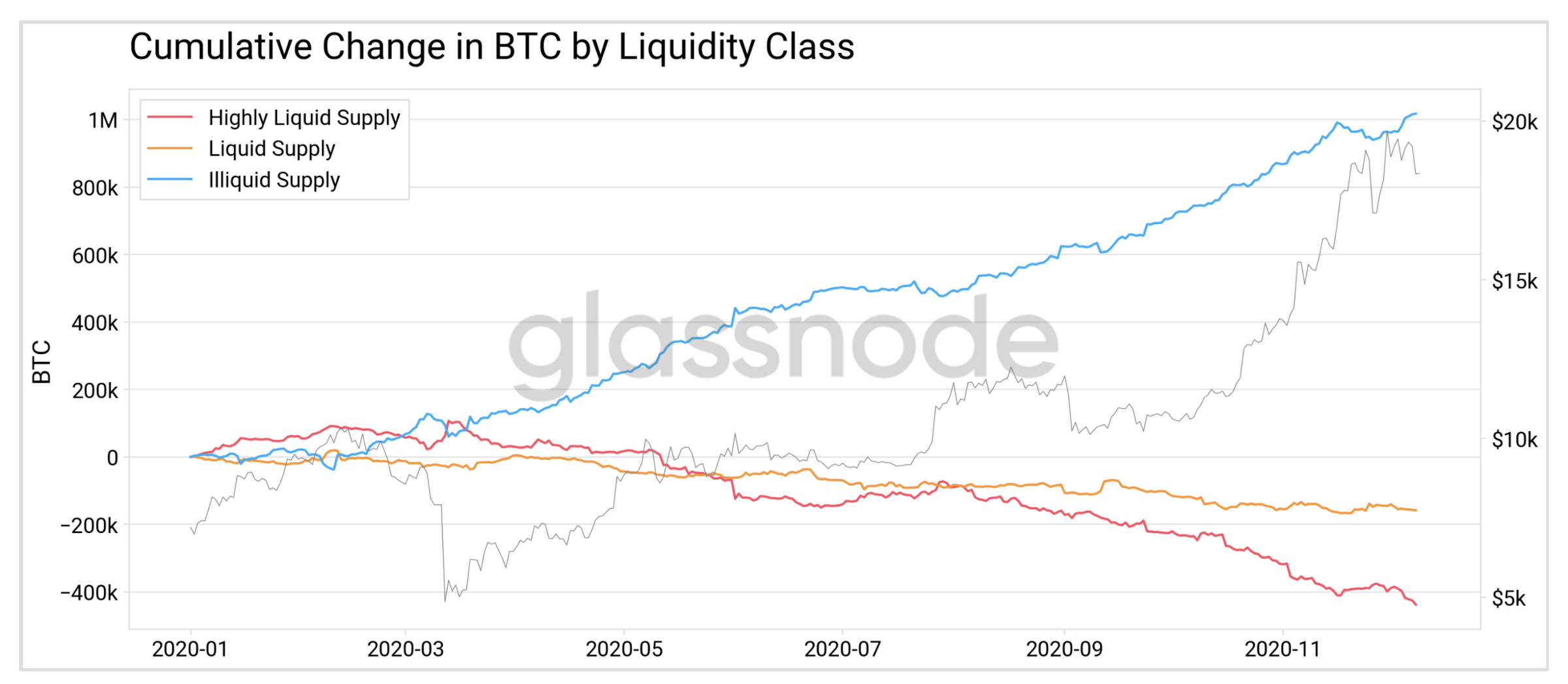

Here we can see how illiquid supply has grown for the past 2 years, even with the price action we’ve had:

There is a direct relation with how illiquid supply tends to be a precursor to some form of bullish rally. You can find more information on why Illiquid supply matters by visiting Glassnode here.

Here we can see how illiquid supply has grown for the past 2 years, again, even with the price action we’ve had:

Moving on, let’s quickly see who has been selling recently and if the market will continue downward.

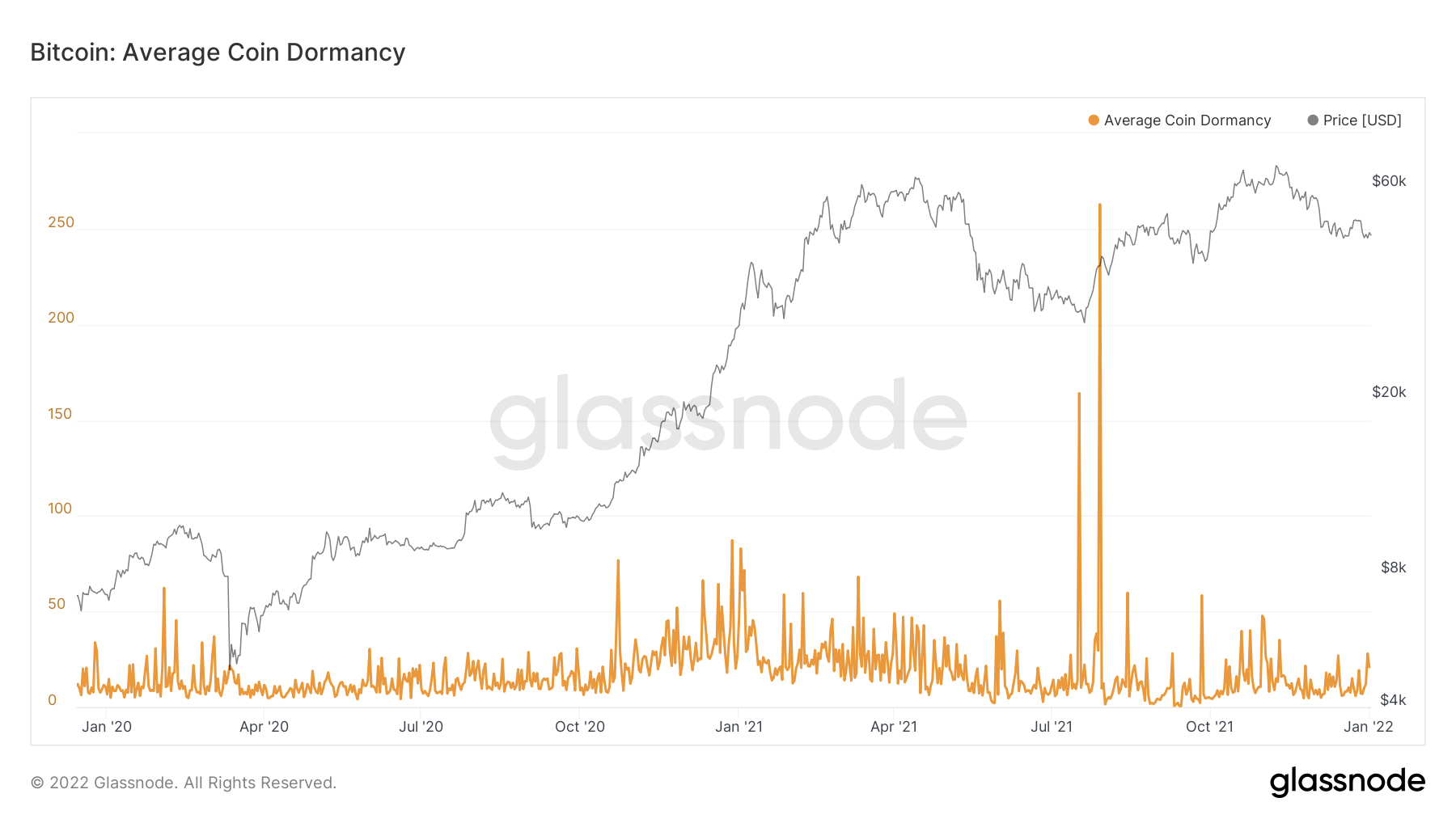

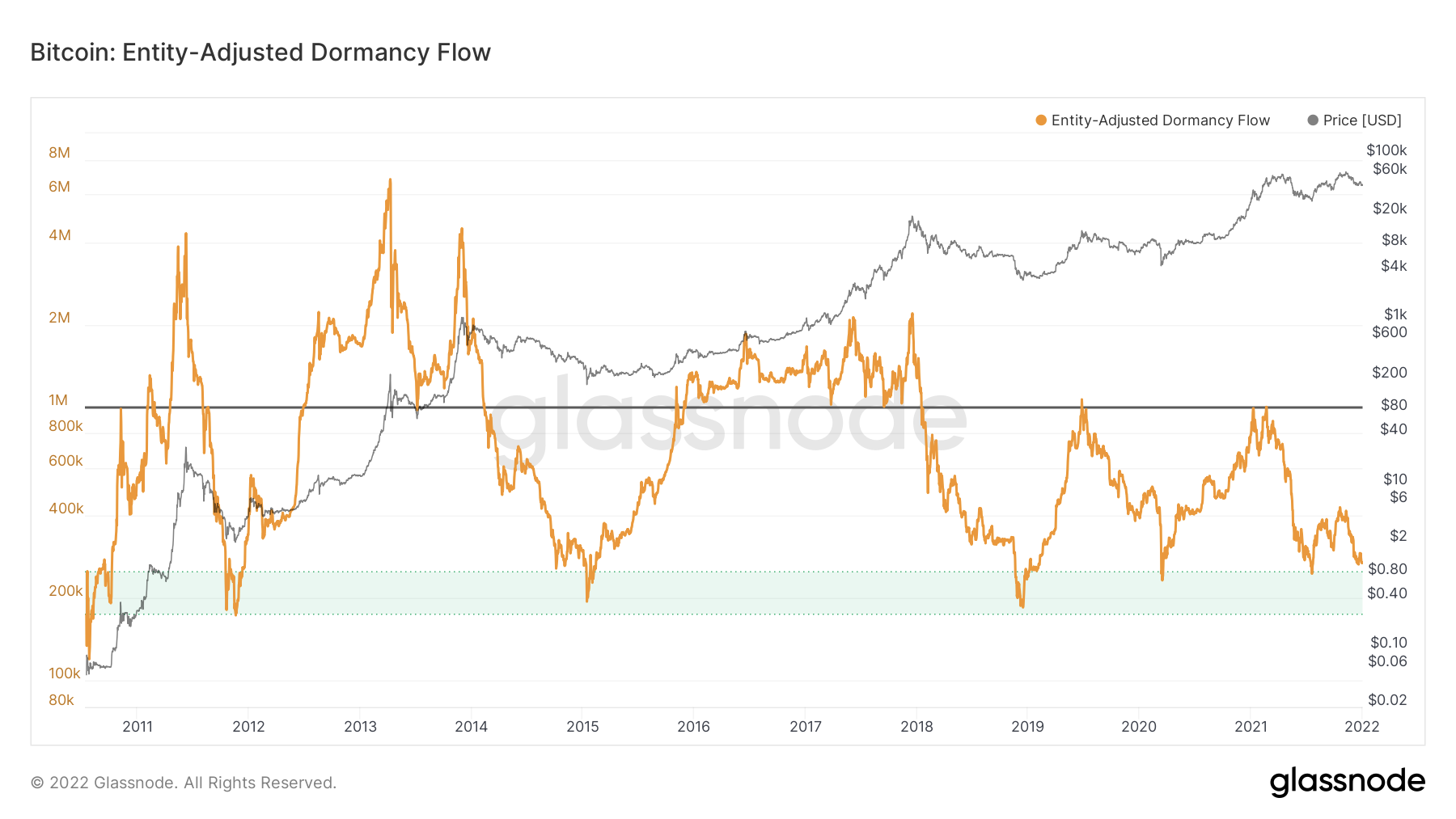

Looking at ‘dormancy’, we can see the average age of the coins that are being spent. In this recent downtrend, most of the coins spent have been young coins. Usually this means whales and ‘smart money’ aren’t spending, rather, recent local top sellers are capitulating:

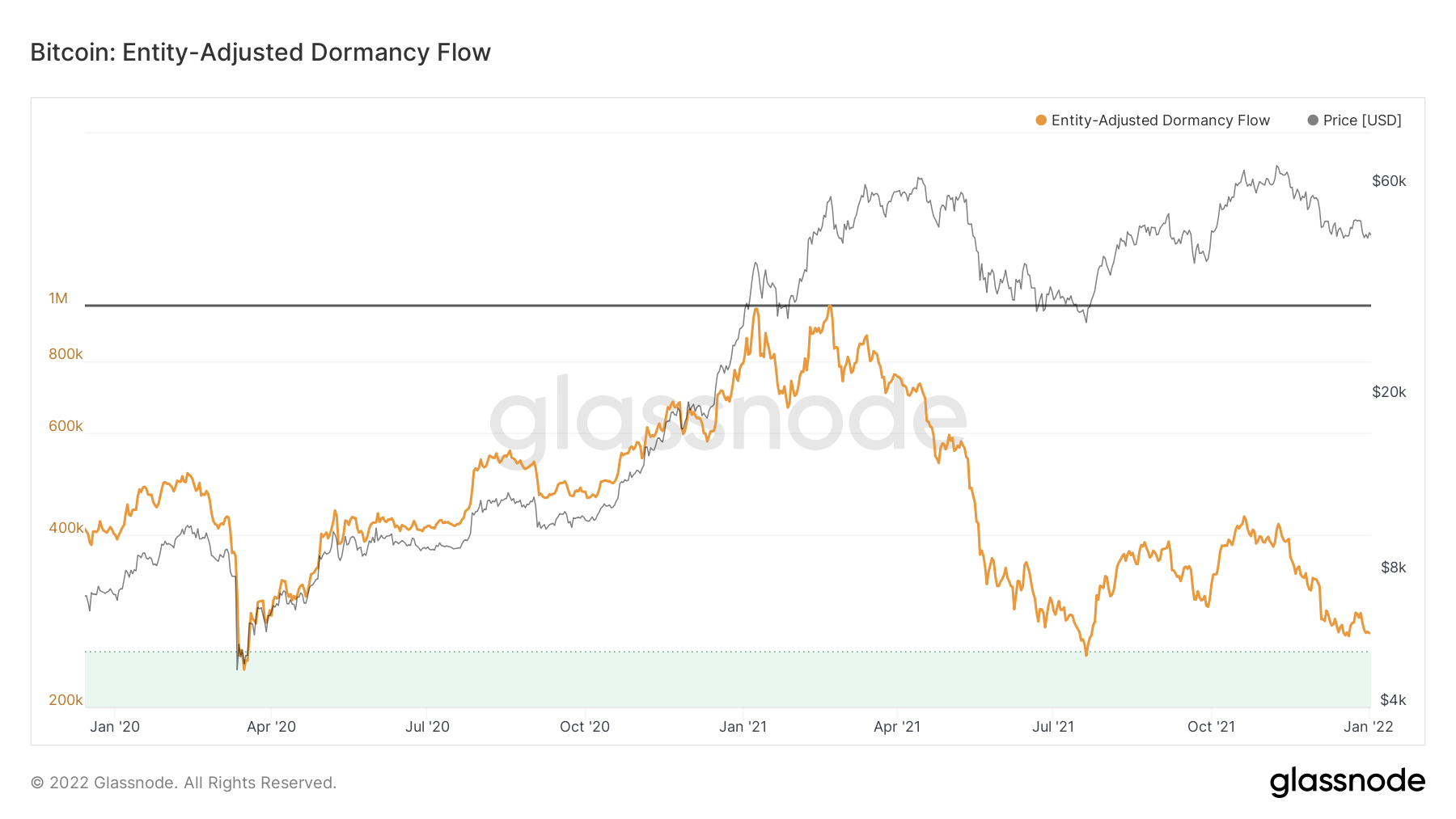

Furthermore, looking at the Entity-adjusted Dormancy Flow, we can see that we have almost reset to the summer lows and are essentially forming another bottom:

Entity-adjusted Dormancy Flow is the ratio of the current market capitalisation and the annualised dormancy value (measured in USD).

Entity-adjusted Dormancy Flow can be used to time market lows and assess whether the bull market remains in relatively normal conditions.

So, if we have a look at the full Bitcoin history for the Entity-adjusted Dormancy Flow, we can see that we have only touched this zone in market bottoms.

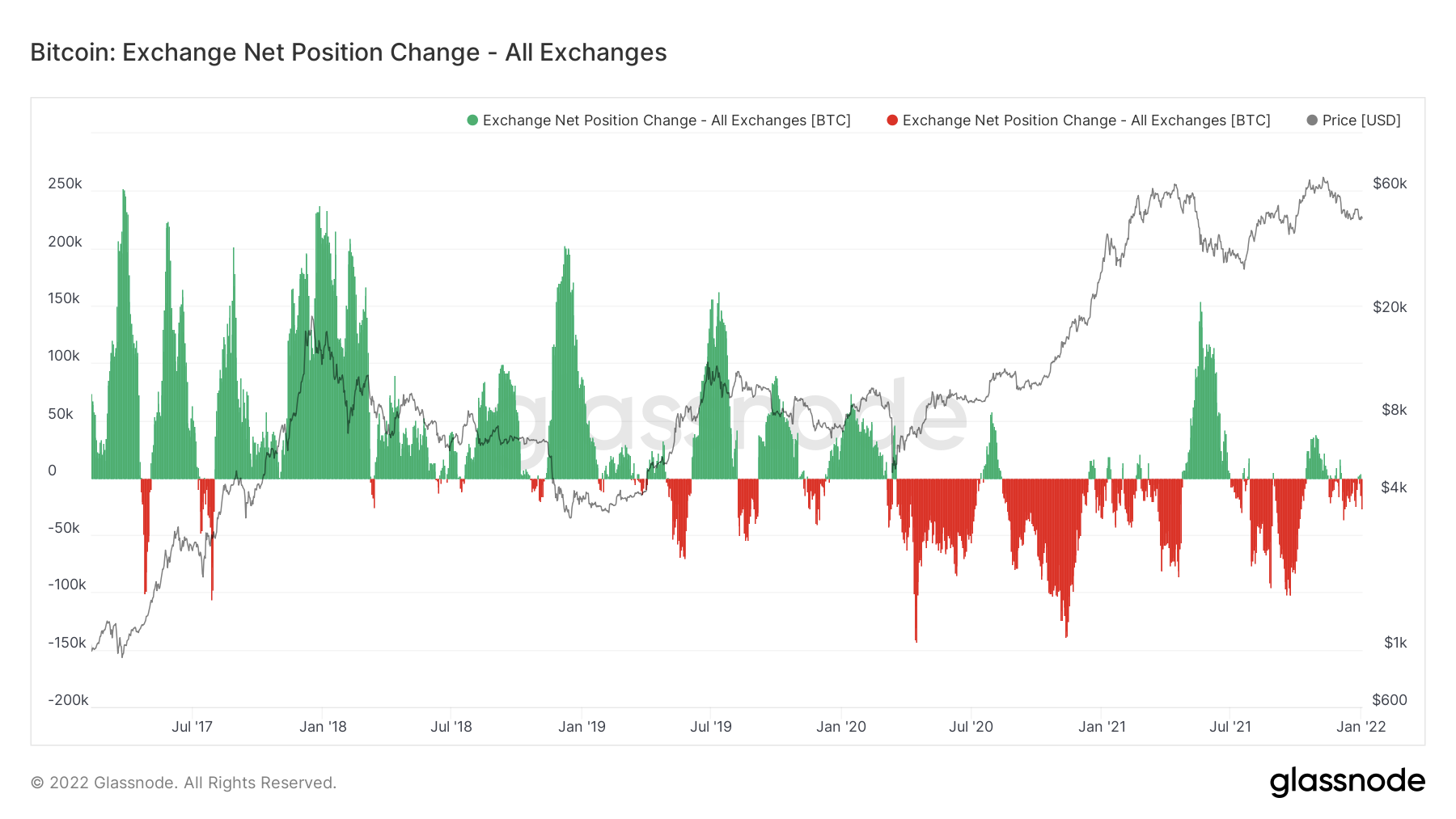

Furthermore, Supply on Exchanges has been moving off into storage that historically is less willing to sell.

This would indicate aggressive accumulation, especially since March 2020.

Even though we have seen some moments of profit raking, the overall actions have been of accumulation and supply leaving exchanges:

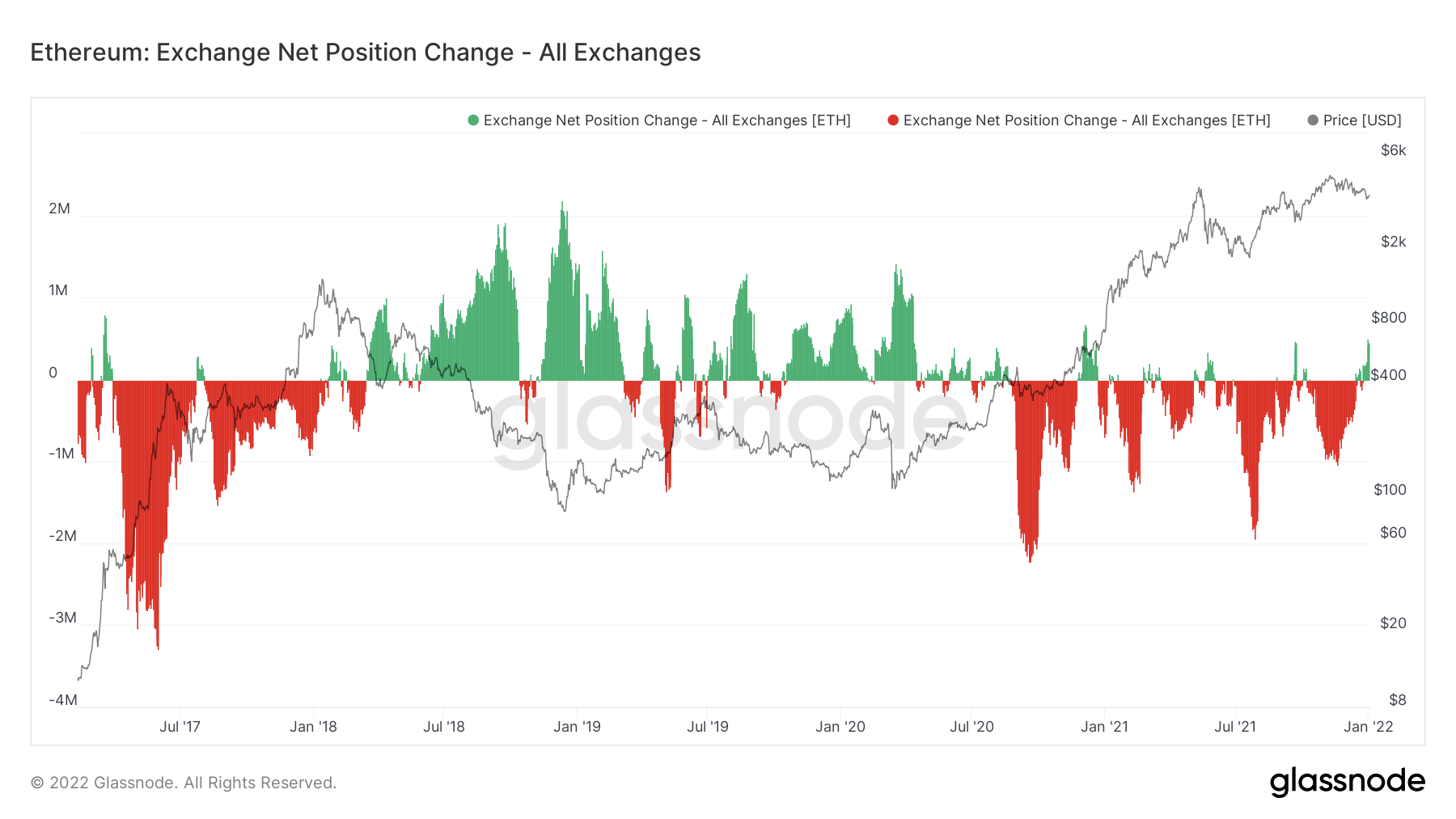

Ethereum tells a similar story. It has actually had more aggressive withdrawals in the past two years and recently has started to see inflows on exchanges.

Typically this would mean intense selling, but given that only about 12% of Ethereum was actually on exchanges, it looks more like the start of a run for it:

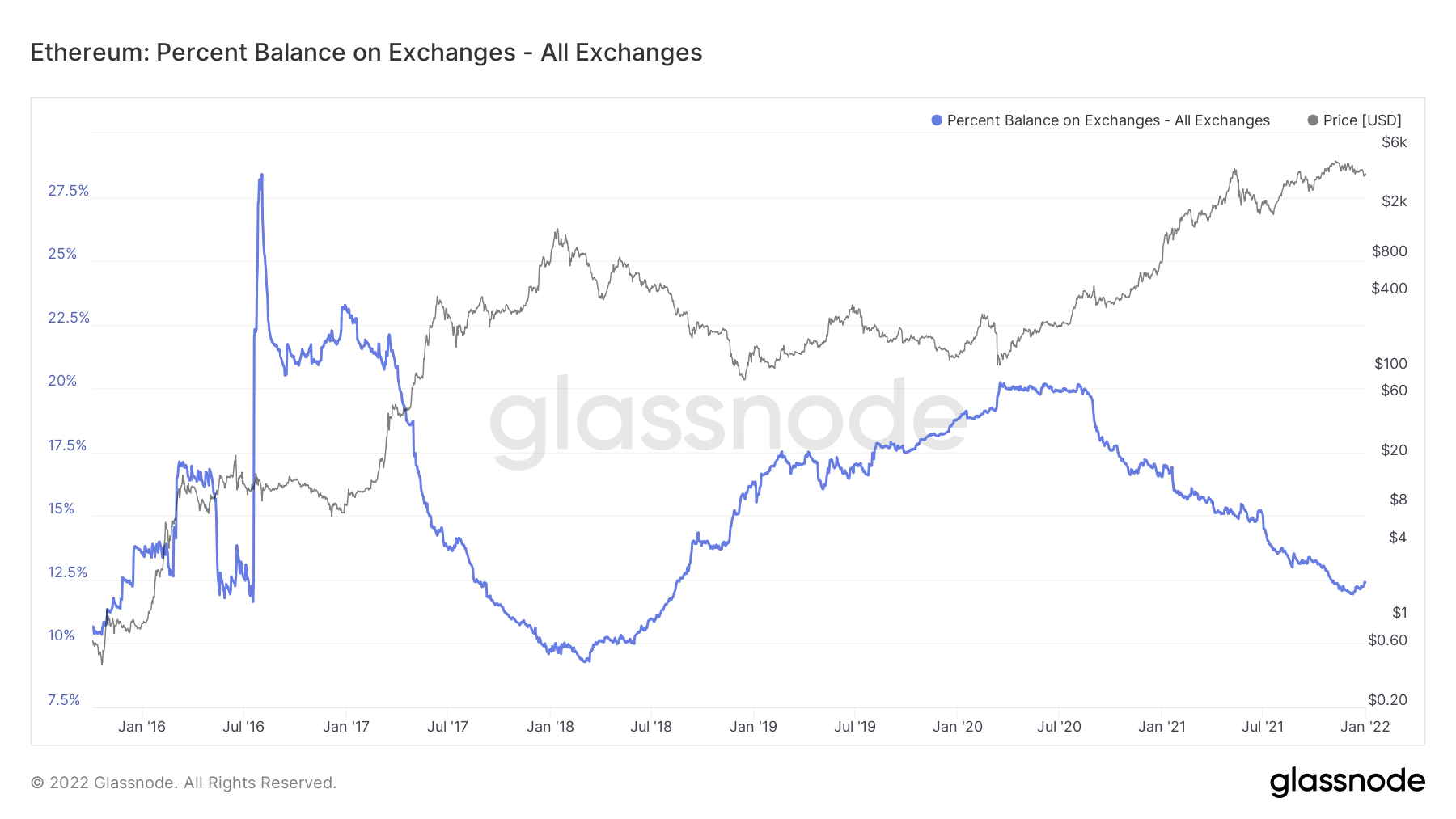

We can see that since the March crash, Ethereum has been leaving exchanges — reaching a low of 11.2%.

As money flows back, it will historically move into the hands of new adopters who do not understand the value of owning your own keys (not your keys, not your crypto / not you keys, not your cheese) and will typically leave their new bought Eth (or any crypto asset) on the exchange:

Now that we’ve discussed the endogenous crypto story, let’s talk about the exogenous one.

DXY and the S&P: How this has an effect on the crypto space

Historically, when the dollar has struggled, but the stock market has rallied, it has created a perfect combination for Bitcoin to flourish.

If the dollar starts to show weakness here, we could see a short but sweet rally of the investment assets as people look for ways to conserve their wealth and purchasing power.

In particular and worth noting, inflation recently reached its highest point in 40 years and shows now signs of slowing, despite what the Fed thinks they can do to shrink the balance sheet or implement contractionary monetary policy . . .

. . . that is, unless they continue to raise interest rates and find a reason to justify printing money, war… more on that later…

With the S&P marching on and the Dollar not looking pretty, money will flow into assets that have proven to protect purchasing power. Sorry for the bugs out there, but gold has not kept up with inflation in the past 10 years….

Macro market, how US policy might affect outcomes.

Money printing, Covid, War and regulation.

“The United States printed more money in June than in the first two centuries after its founding. Last month the U.S. budget deficit — $864 billion — was larger than the total debt incurred from 1776 through the end of 1979.”- Pantera Capital

This is only recently catching up to the US as inflation intensifies and the people in charge scapegoat with supply shortage excuses. Or even worse — boogymen greedy corporate owners hiking up prices out of hate of the general public… Oh Elly…

All of this while still being in the middle of an ongoing pandemic. Yes, the one we have been in for two years now, and for some reason, the COVID case count is at ATH now. I won’t get into that but let’s just say lots of things don’t add up. I’ll mention some of these things: lack of prevention care, excessive use of vaccines (4 doses seems like something didn’t work the first time), arbitrary numbers/counting, oh and the 38 billion in profits from big pharma (a successful new product launch is 1 billion in a year). I won’t add wood to the fire, but more COVID cases tends to mean more justification for government spending.

Pair this with a country that is showing intense divide with each side becoming more extremist, the great hate of democrats and republicans. Historically there has been solved one way: war. Now the US is too woke to enter into a direct war with anyone. However, the United States is set to spend $768 billion next year on the military. This is much more than the year before, but this year the US has already exited Afghanistan and isn’t active in any public conflict.

Up for “democratisation” and country reshaping are Ukraine and Taiwan. Most likely, the US would enter into a proxy war with China and Russia through these 2 fronts. Also “protecting” the South China Sea and its allies in the region. Nothing unites a country more than war and threat of foreign fighters…

Finally, interest rate hikes. Most central banks around the world announced no hikes for Q1 of this year fearing it would hamper recovery, and blaming the supply shortage for inflation even though inflation has happened everywhere in the world and debt is reaching pretty extreme levels. Most central banks did mention intentions to start hiking interest rates later in the year.

Once this happens, it can spark a quick selling of on-risk assets as well as a general deleveraging in the market. Big players don’t want to hold onto loans as it isn’t cheap anymore to have outstanding debt. Yes the whole economy runs on debt, but it is all about who ends up holding that bag of debt. As interest rates begin to pick up, the hot potato will begin moving around until the last person gets stuck holding the bag.

Bull market, blow off top, bear market. What will (likely) happen

With all that has been explained until this point, this is what it predict for the year 2022:

I expect Q1 and possibly Q2 to be part of a blow off top mania phase, mostly due to big money looking to exit pump before interest rate hikes and the impending war.

Events to watch for tops:

— Bitcoin backed ETF announcement is set for February to likely launch in March.

— Interest rate hikes. This is said to be re-evaluated quarterly but most likely will begin in the second half of the year Q3.

— War. This only will be harder to see a clear start, but Russia acting on Ukraine or China getting violent will be clear enough.

Lastly, it is important to monitor exchange inflows to see when big money is starting to move out. Smart money sells into strength — not on the other end as price starts to move down.

We must look for dormancy to start to pick up — this would mean old money is preparing for a move. Next blow off tops tend to have 2–6 weeks of exchange inflows as price continues to rally. So when your aunt asks you how to buy some of those “Crypto coins”, tell her how to but that it’s all NFA and then subsequently exit all positions.

Good luck this year, and I look forward to chatting with you in our Discord.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.