Crypto Market Commentary

14 July 2019

Doc's Daily Commentary

Look for the next Trade School session to be posted in the OMNIA Discord channel for Friday July 12 at 1100am ET/1600 UTC.

Our most recent “ReadySetLive” session from 7/10 is listed below.

Checkmate's Corner

Cryptocurrency Resources

Today I wanted to provide some quick useful references that I use on a regular basis to study and develop my understanding of the bitcoin and blockchain industries. Hopefully you will find some new resources to help you learn and keep tabs on the markets.

Podcasts

My number one resource for keeping track of market and technology developments is podcasts. These are my top picks in order of value that I have extracted from them in each category.

Bitcoin Podcasts

Tales from the Crypt – with Marty Bent (@martybent) and Matt Odell (@matt_odell). This is my number one podcast for Bitcoiners. What is most valuable from this podcast is watching the developments happening with Bitcoin with particular emphases on the Lightning Network, Privacy features and the financialization of Bitcoin. It is pretty hard to remain bearish on Bitcoin as the ultimate digital store of value after listing to the boys banter for an hour. Note, this podcast is biased towards Bitcoin only. If you want privacy information for Bitcoin, Matt is your guy. Also, the Bent Newsletter by Marty is one of the best in the industry – raw unadulterated Bitcoinery.

What Bitcoin Did with Peter McCormack (@PeterMcCormack) who does an excellent job of interviewing a wide cross section of people who have found value or interest in Bitcoin. His guests range from developers, economists, regulators and people who were around in Bitcoins early days (pre 2013). His series on Mt Gox is the most valuable insight into the state of Bitcoin and I can’t recommend it highly enough. Pete is primarily a Bitcoiner but is open to the idea of other blockchains and thus provides a very rational and normal perspective.

Stephan Livera Podcast and the Noded Podcast are great resources for the economics and the technological aspects of Bitcoin. Stephan(@stephanlivera) is a conservative Austrian economics buff who has guests from around the Bitcoin universe and is a great way to get a grasp on the economics of why Bitcoin is important. The Noded has co-hosts Pierre Rochard (@pierre_rochard) and Michael Goldstein (@bitstein) who are both Bitcoin maximalists who have excellent connections with Bitcoin developers and is one of the best pods for the technically minded.

General Podcasts

Off-the Chain with Pomp (@Apompilano). This is the go-to podcast for overviews of the crypto industry. Pomp is a Bitcoiner however has guests from all corners of the blockchain industry. What is great about this pod is that it covers everything from Bitcoin, Ethereum, altcoins, DeFi and digital securities. Given Pomps background as an investment fund manager, he has a very rational perspective on the financialization of cryptocurrency and where the institutional money is looking. This is a must listen pod to keep track of the market moving news as well as a diversified view.

Chain Reaction with Tom Shaughnessy (@Shaughnessy119) who I would consider to be Pomp-Lite. He has a very similar scope of guests from all corners of the industry and works for Delphi digital. Tom has a more open view to altcoins and Web 3.0 so is a good resource for understanding what some of the new projects like Polkadot, Cosmos and Dfinity are up to. Tom has a good series with people from the Digital Securities industry with guests from Tokensoft, Tokeny, Harbor and Spice VC.

Hackernoon Podcast is a general technology podcast which does have relevance to what is going on in cryptocurrency and is worth scrolling through for a few hidden gems. In particular, there was a recent podcast with Jake Yocom-Piatt from Decred which was an excellent overview of the Decred project.

Ethereum podcasts

POV Crypto is one of my personal favorites as I find Christian (@ck_snarks) and David’s (@TrustlessState) banter between Bitcoin and Ethereum to be an excellent weathervane for the current discussions going on Crypto Twitter. If you are finding it difficult to stay in line with Crypto Twitter, this podcast pretty much summarises the weekly noise into the key topics of interest. This is a great way to test your own biases to see where you naturally lean by hearing both the Bitcoin and Ethereum side of the discussion. If you are feeling bold, both the hosts are very active on twitter and always up[ for a debate, get involved!

Into the Ether is a podcast hosted by Eric Conner (@econoar) and Anthony Sassano (@sassal0x) who both maintain Ethhub.io which is a central repository for all things Ethereum. I personally listen to this podcast so I can keep track of where the ETH ecosystem is and to test my own biases which tend to favor fixed supply over programmable money in the debate. They do a great job of summarizing the recent developments in the technology and various dAPP platforms that are being built out on the Ethereum platform.

Decred podcasts

Decred in Depth is a community run podcast that is only recently launched. So far, this is my number one recommendation for a crash course Decred introduction. I strongly suspect this podcast will gain increasing traction as the project commences the climb and the quality is top shelf.

Useful Tools for monitoring Blockchains

Messari.io no doubt is the best alternative to CMC for monitoring market caps and rankings. This platform provides a ‘liquid marketcap’ and ‘real 10 Volume’ which discounts much of the wash trading and false supply reported by CMC.

Bitcoinity.org has some of the best volume data on bitcoin on the internet. It allows you to see the bid-ask spreads, combined order books, and exchange rankings in real time, super useful for the traders out there.

The best bitcoin explorer is most definitely Blockstream’s new blockctream.info. It shows you various estmations on fee savings form using Segwit and Bech-32 addresses and also helps you by providing guidance on best practices to avoid privacy leaking.

For estimating the best Bitcoin fees, I use BuyBitcoinWorldwide and WhattheFee which both provide a visual representation of confirmation time. This is super useful as if you remember that Bitcoin blocks are 1MB – you can see the fees that will get you into the block sooner.

Figure 1 – Right now the mempool is less than 1MB so even 1sat/byte will get included pretty quickly.

Loanscan.io is an excellent resource for watching DeFi loans and interest rates. Best to check this before engaging in DeFi to make sure you get the right product fit and rates.

For tracking the Decred blockchain, DCRStats is useful for graphics and the DCRData explorer takes this to greater detail. Some super useful charts and plots from the Decred blockchain.

On-chain analysis

Coinmetrics is the number one resource for on-chain analysis at https://coinmetrics.io/charts/#assets=btc. Coinmetrics offer a number of tools including data downloads in CSV for daily in-chain activity and a charting package to compare various metrics and coins. What is very useful for the charting package is you can setup your own analysis using the ‘Formula’ section. The below example I have calculated the 28D moving average of the number of coins in the total supply divided by the active address count for BTC, DCR and ETH.

Coinmetrics also provide a really valuable blog and newsletter looking at individual coins, events in the industry and new on-chain analysis techniques.

Woobull https://woobull.com/ is a close second in this space and is operated by Willy Woo. Here he provides both charting setups for various pricing models and on-chain indicators as well as a blog of supporting documentation. Willy is one of the pioneers in the on-chain analysis industry and is well worth a follow on Twitter (@woonomic) so is great to keep tabs on to see what is on his mind. He is particularly good at keeping a clear head and rational basis for macro shifts in the Bitcoin market.

Kana and Katana (https://www.kanaandkatana.com/valuation-depot) is an excellent resource for the top papers and articles on on-chain analysis by many of the great minds in this industry. The papers here provide useful overview of the on-chain analysis theories and indicators and has been an invaluable resource for my developing skills and the RSC masterclasses in on-chain analysis.

Crypto Twitter

Crypto Twitter is a rabbit hole of its own. No question, this is where many of the ideas you see crop up in technological developments were first discussed in public. It is a hotbed of ideas, arguments, insults and insanely smart people hashing out complex problems. It is a daunting place to post ideas at first but I assure you there is immense value (and noise) on this platform.

The best thing to do if you are just starting out is to follow the podcast hosts above and some of my top recommendations below. This will give you a flavor of what is going on and you will see who these people interact with and when they have valuable conversations with others. I would not recommend following blindly as there is a load of noise and the secret to crypto twitter is getting as much signal as possible.

My top personalities to follow as a starting point would be:

On-chain analysis

Bitcoiners

Decred

Ethereum

Chris Burniski (not only Ethereum but certainly a Multi-coiner)

Erik Voorhees (similar to Chris Burniskie)

Digital Securities and Regulation/legal

Last thoughts

It’s an information jungle out there. So much evolution and so little time in the day. Mav and I are always trying to distill as much signal as we can into the newsletters and the Discord chat room to give you all the best signal to noise ratio we can. If you come across any other resources you find value, let us know in the chat room and we can keep this list updated regularly.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

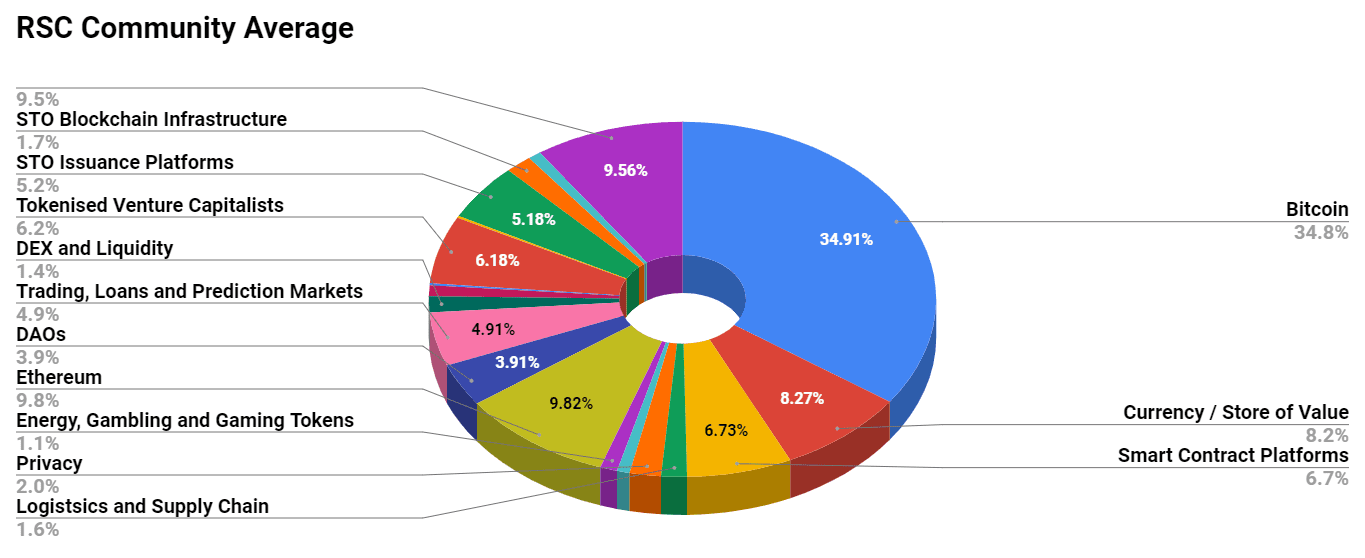

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

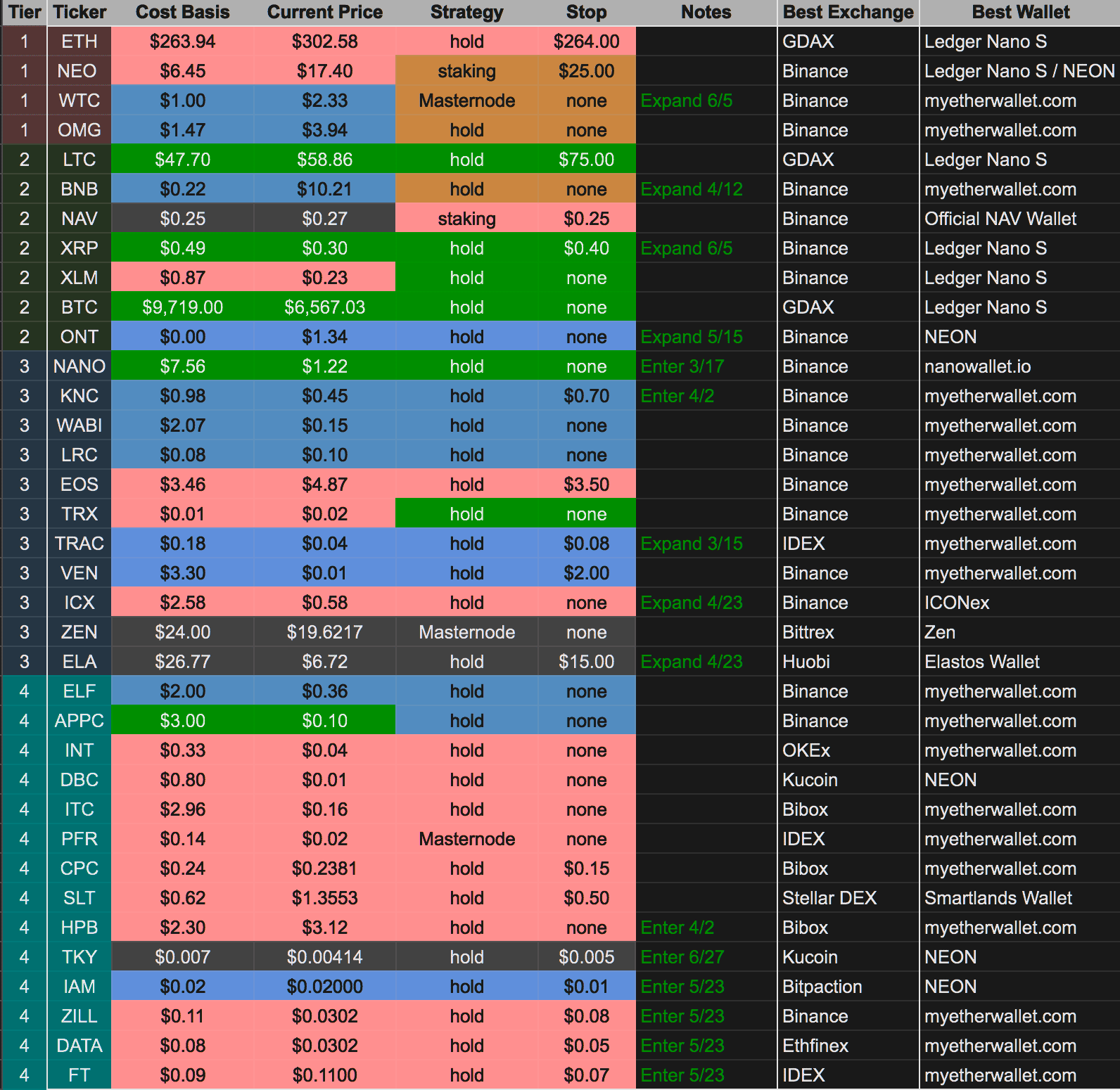

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)