Doc's Daily Commentary

Mind Of Mav

8 Reasons Why Bitcoin Is Ready To Finish 2021 Strong

The month of June 2021 was marked by extreme fear in the Bitcoin market. It started in May 2021 with Elon Musk’s tweets and the announcement of China’s ban on Bitcoin. It took several weeks for the market to start digesting this.

The Bitcoin Hash Rate naturally dropped, and we began to see the great exodus of Bitcoin mining from China to the West.

All of this will be extremely positive for Bitcoin in the months and years to come. However, the majority of investors are struggling to understand this. This explains why the price of Bitcoin fell sharply in May 2021 and has been moving sideways between $30K and $40K ever since, with a range that has been tightening around $35K for the past few days.

As the FUD messages are digested by the market, investors are slowly beginning to see that the Bitcoin revolution continues to progress and that the next few months are going to be phenomenal.

In what follows, I’m going to go over 8 charts that suggest that the bottom of the Bitcoin price crash has been reached. If this proves to be true, those who want to profit from Bitcoin in the coming months would do well to take action now.

However, as always, it will be up to you to judge and then make the best decision for yourself.

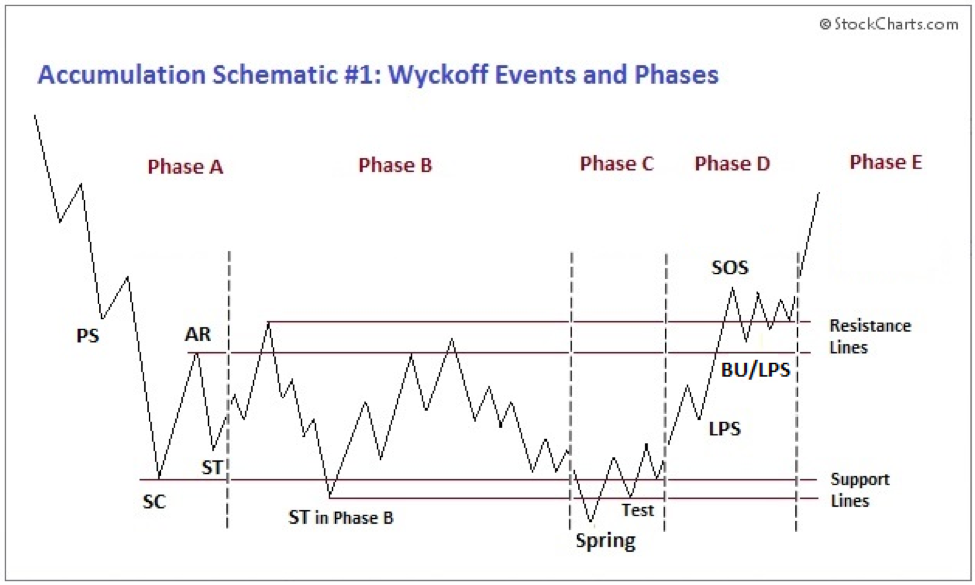

1. Range construction over the last weeks is very similar to a Wyckoff Accumulation

Since the beginning of June 2021, everyone has been talking about the possibility that the current range construction for the price of Bitcoin corresponds to a Wyckoff Accumulation.

Here is the diagram associated with this asset price pattern:

You can see that there are different phases and events. If the Bitcoin price followed this accumulation pattern, we would clearly be in phase D by now.

If you look at the evolution of the Bitcoin price over the last few weeks, you can actually see the similarities with a Wyckoff Accumulation:

Of course, the Bitcoin price will have to confirm this pattern in the coming days and weeks.

To do this, Bitcoin will need to break $35.5K as a first step before it can tackle the $38K area. The next step is the $42K resistance. If this is breached, the road to $50K would open wide for Bitcoin.

2. The Puell Multiple indicates now is a great opportunity to buy

Created by David Puell in March 2019, the Puell Multiple explores market cycles from a mining revenue perspective. This metric looks at the supply side of Bitcoin’s economy — bitcoin miners and their revenue. Bitcoin miners are often seen as compulsive sellers because of their need to cover their fixed costs for mining equipment in a market where the price is extremely volatile.

The income they generate can therefore influence the price of Bitcoin over time.

There are periods of time when the value of Bitcoin mined and entering the ecosystem is too large or too small by historical standards. Those who understand these periods can benefit significantly.

Here is the current state of the Puell Multiple:

You can see that the Puell Multiple is entering the green zone as it did in March 2020 for example. If you have confidence in Bitcoin, now is probably the time to accumulate more.

The opportunity to buy Bitcoin is now to take advantage of it in the months to come when its price resumes its ascent towards the $100K mark, which for me is still a target by the end of 2021.

3. Long-term holders are accumulating more BTC

Since the beginning of June 2021, as extreme fear gripped the market, we have seen something quite classic in this situation. The long-term holders of Bitcoin started to accumulate more:

On the other hand, Bitcoin’s short-term holders have started selling massively again:

This always happens in the same way and it helps to understand why it is always the same people who benefit fully from Bitcoin. These people are simply the ones who know how to take the long view and take action when everyone else is overly afraid.

4. Funding rates are exiting from a negative area

First of all, let me redefine what funding rates are. Funding rates are periodic payments between traders to make the perpetual futures contract price is close to the index price.

Funding rates represent the sentiment of traders on the positions they take in the perpetual swaps market. Positive funding rates imply that many traders are bullish and long traders pay funding to short traders.

Negative funding rates imply many traders are bearish and short traders pay funding to long traders.

Looking at all exchanges funding rates, we can see that it is gradually moving out of the negative zone:

Those who want to make big profits with Bitcoin should probably act now. It’s when no one wants to buy that the best opportunities are available. That’s the case right now. But then again, you need to take a long-term view of the Bitcoin revolution.

5. Bitcoin Stock-to-Flow deflection is at its lowest point

In the Bitcoin world, the Stock-to-Flow model is extremely popular. The fact that it has been confirmed many times since its inception has added to its credibility. However, the recent crash in the price of Bitcoin has brought back a lot of criticism of it.

For some, this would be proof that it no longer works.

Nevertheless, this model could not foresee an event as brutal as a ban on Bitcoin from China being implemented in a matter of weeks. In fact, we will have to see if the price of Bitcoin returns to what the Stock-to-Flow model predicts in the coming weeks and months.

For those who still believe in this model, and there are many of them, you should carefully observe this chart which highlights the deflection between the current Bitcoin price and the area predicted by the Stock-to-Flow model:

This deflection has just reached its lowest point. For me, this is a new signal that Bitcoin is currently extremely undervalued. An opportunity to accumulate more of it for big profits in the future.

6. Bitcoin Liquid Supply Ratio indicates strong hands are accumulating

The Bitcoin Liquid Supply Ratio clearly shows a Bullish divergence at present:

As the price drops, strong hands are aggressively accumulating Bitcoin in preparation for the phenomenal months ahead.

This is further confirmation that the majority of Bitcoin sales are coming from new entrants to the Bitcoin world. These investors are generally referred to as weak hands. By selling their Bitcoin at a loss, they unwittingly allow strong hands to take advantage of it.

At your level, it is obviously in your best interest to be on the side of the strong hands. This means developing your knowledge of Bitcoin so that you can better manage the current situation.

Final Thoughts

Bitcoin offers a lot of security in an increasingly uncertain world. That’s why more and more billionaires and high-profile investors are joining the Bitcoin revolution.

However, in the short term, you can’t have that many guarantees about the price of Bitcoin. To profit from Bitcoin, you’ll need to take a long-term view by showing complete confidence in its revolution.

For those who still doubt the great opportunity represented by Bitcoin’s current price of around $35K, the 8 charts I’ve just detailed reinforce the idea that you need to take action to take full advantage of it in the months and years to come.

If you don’t, you should know that the strong hands are not shy about doing so on their own. It’s up to you to decide if you want to let them benefit from this incredible revolution in the future.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.