Crypto Market Commentary

12 March 2019

Doc's Daily Commentary

Mav's Analysis

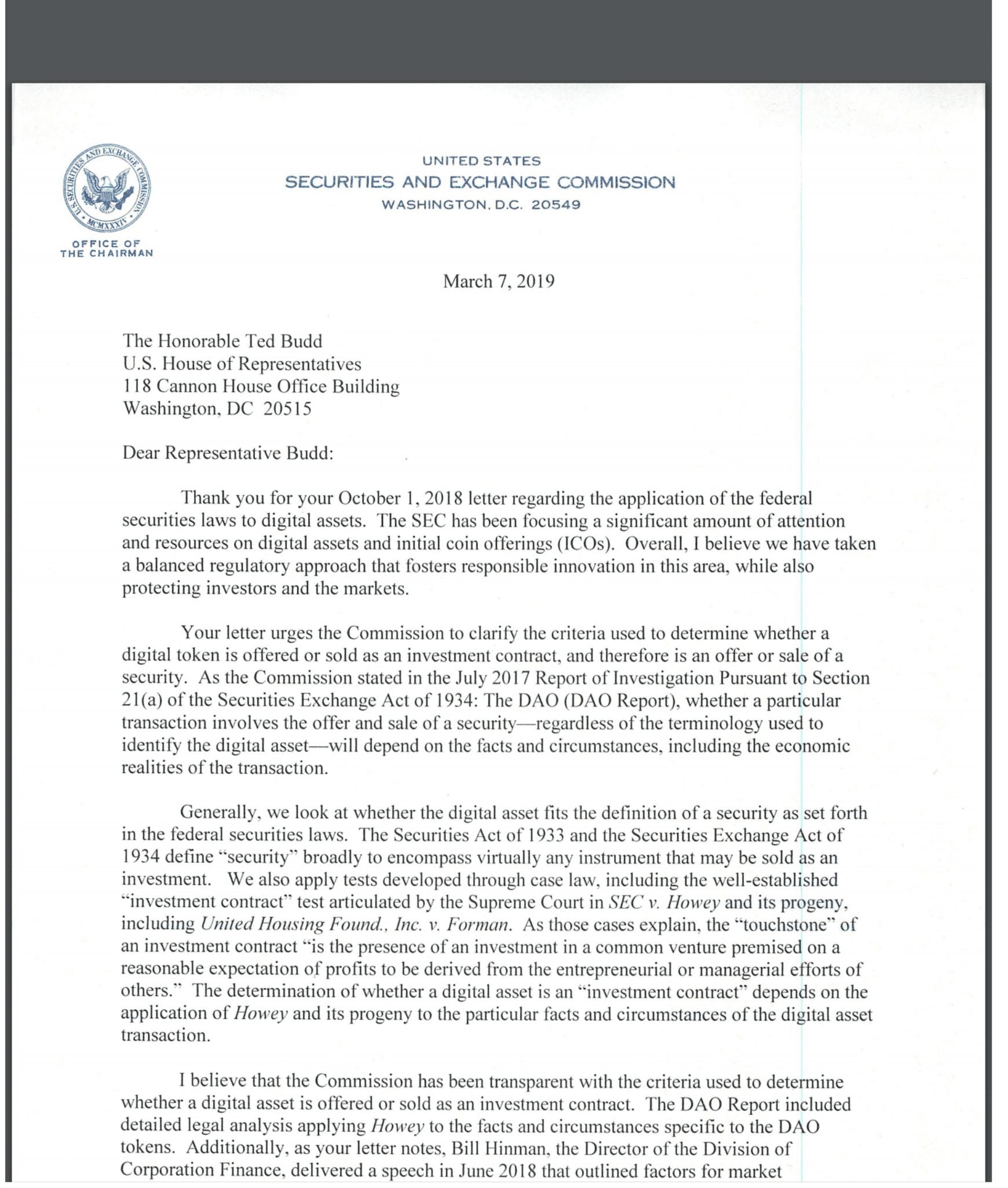

There’s a lot of misinformation flying around regarding SEC Chairman Jay Clayton’s comments regarding cryptoassets and securities yesterday.

The big headline that seems to be making the rounds right now is, “Ethereum Declared To Not Be A Security!”

Here’s the thing: He said nothing of the sort.

Let’s dive into what he actually said and why it’s bigger than Ethereum.

If you’re looking for the actual takeaway from the three page letter, it’s that Clayton agreed with Director of the Division of Corporate Finance William Hinman’s prior analysis that it’s possible for a cryptocurrency to go from being a security to not.

In that sense, there are implications of that which do suggest a sufficiently decentralized cryptoasset like Ether is free from being labeled as a security.

But, don’t mistake that for finality, and don’t jump to conclusions like those who’s desperation is palpable.

When a cryptoasset moves beyond being labeled as a security due to its decentralization, it is legally unclear what that state is. I would speculate it resembles a commodity more than anything at that point, but that’s merely speculation.

Remember that just because the SEC Chairman says something, especially in a letter, it does mean that is absolute law. They are attempting to move forward on this in a deliberate manner, which you can see from these excerpts:

“I agree with Director Hinman’s explanation of how a digital asset transaction may no longer represent an investment contract if, for example, purchasers would no longer reasonably expect a person or group to carry out the essential managerial or entrepreneurial efforts. Under those circumstances, the digital asset may not represent an investment contract under the Howey framework.”

…“No one is creating it for their own … control of bitcoin, it’s designed to be a payment system replacement for sovereign currencies. We’ve determined that that doesn’t have the attributes of a security … as far as I’m concerned, that’s designed to be akin to the dollar, the yen, the euro … and it operates that way. People who purchase it are expecting it to operate that way.”

“I agree that the analysis of whether a digital asset is offered or sold as a security is not static and does not strictly inhere to the instrument. A digital asset may be offered and sold initially as a security because it meets the definition of an investment contract, but that designation may change over time if the digital asset later is offered and sold in such a way that it will no longer meet that definition.”

So there’s definitely pieces to unpack there, and lingering questions too.

Let’s first remember that the Howey Test, which defines a security, is made of four principle elements: 1: Is it an investment? 2: Is it an investment in a common enterprise? 3: Is it an investment in a common enterprise with the expectation of profit? 4: Is it an investment in a common enterprise with the expectation of profit derived from the work of others?

That is the definition of a security which has held unchanged for nearly 100 years.

And it’s precisely that which is at question here. Obviously there is a common enterprise of people investing in Bitcoin and Ethereum with the expectation of profit.

There are parties which control the fate of the network, such as through mining, and there are those that control the fate of the code, such as core developers. If either of those parties violated the collective charter by, for example, trying to 51% attack the network or releasing bad code, it was absolutely adversely affect the price.

On the contrary, if they excel in their roles, more people will be attracted to the network, increasing the NVT Ratio and the overall value of the network itself.

The problem, as Clayton discusses, is that these groups, and those that are participatory in the network in other ways, are ever-changing.

Furthermore, there are many people who do not expect Bitcoin or Ethereum to act as a network, a payment method, or whatever superfluous technological fad is being pushed right now.

They see it as an early stage investment and expect it deliver high returns. To them it is not a competitor to the Euro or Dollar, but is an investment in the future.

Add on the complexity of dealing with decentralization. Even if the SEC declared Bitcoin or Ethereum a security, it does not mean the rest of the world would follow suit. They would be complicit in holding back US investors from participating in a major technological innovation.

So, here’s the real takeaway from all of this:

The existing securities laws work fine for centralised assets, but fail to adequately capture the nature of decentralized ones.

It could be time for a new Howey Test that is more attuned for a quickly evolving world.

I’d like to submit the that “Satoshi Test” be taken into consideration.

An Update Regarding Our Portfolio

RSC Subscribers,

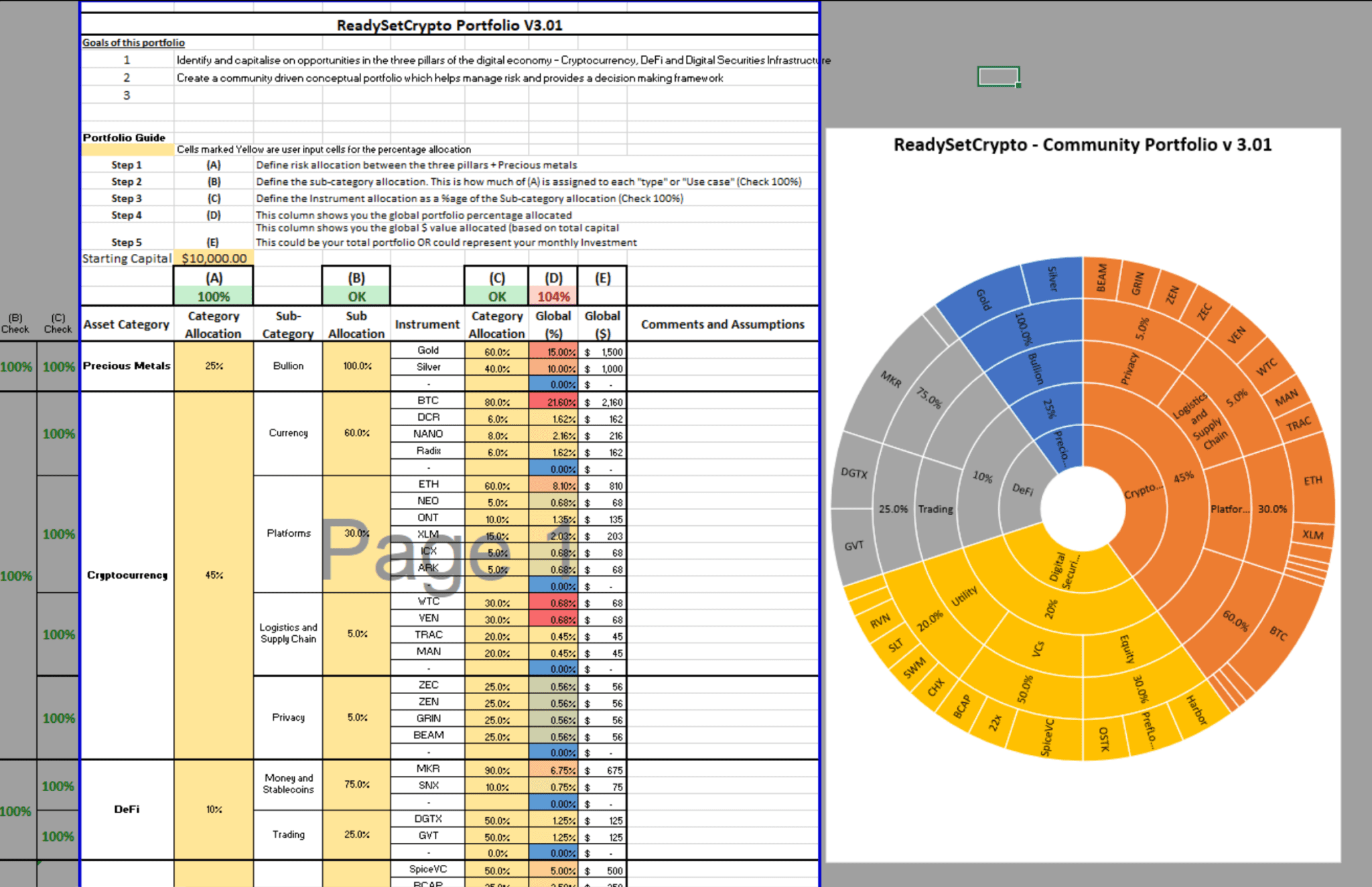

We are diligently working on providing you with our new RSC Managed Portfolio (V3.01) in the coming weeks. We will be posting iterative updates in the discord.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects.

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Thank you for your patience.

Here’s a sneak peek at the new portfolio:

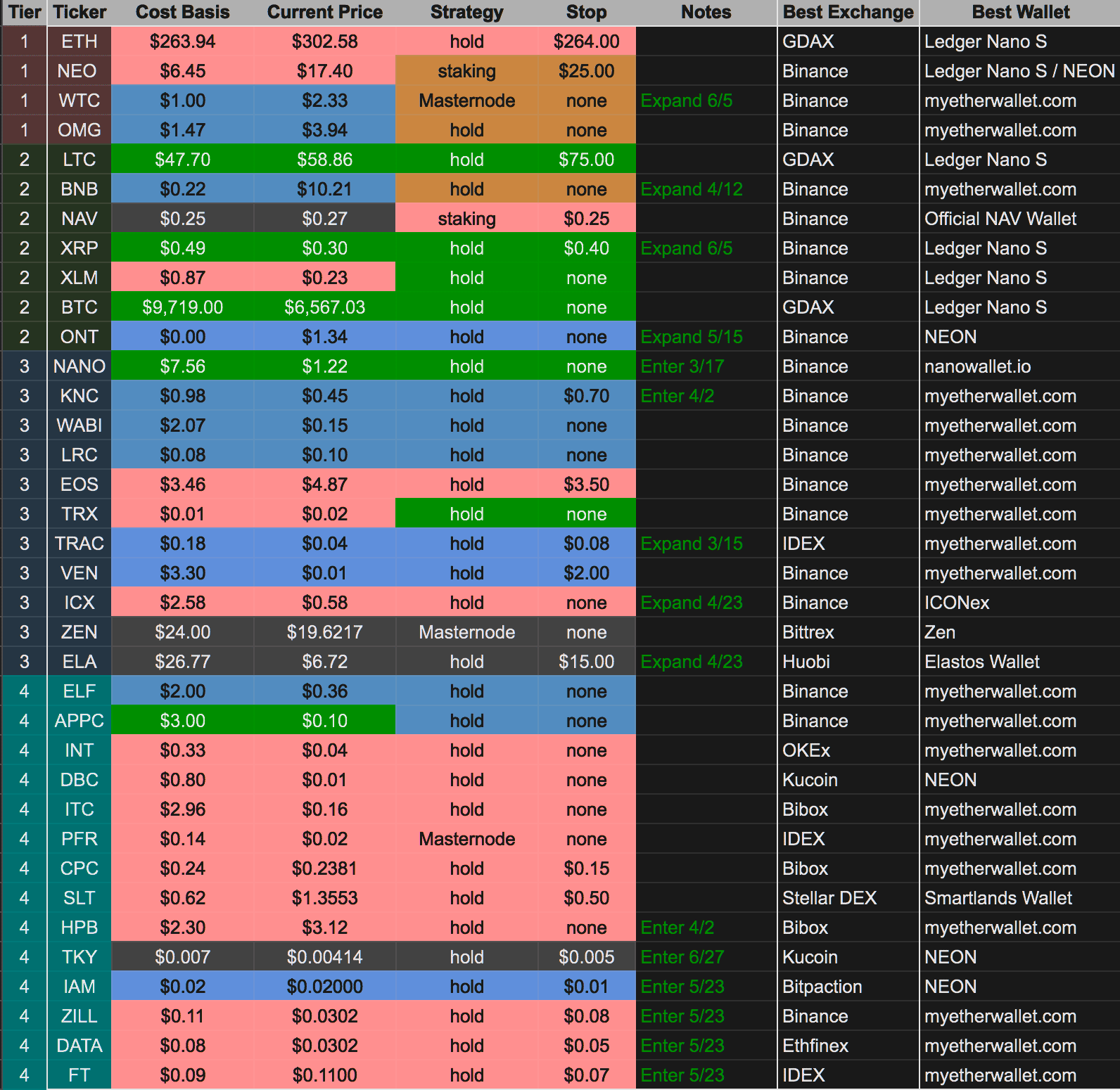

Here’s our past portfolios for reference:

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)