Mind Of Mav

A Deep Dive On Cardano ($ADA): Worth The Hype?

If you watch the video of Charles Hoskins — founder of Cardano — in which he explained the Cardano project in a whiteboard session in 2017, it becomes clear that this is not a simple “we do everything better than XY” project. No, Cardano is a completely new approach in many ways.

Cardano describes itself as a 3rd generation platform and wants to significantly improve those things that have been identified as shortcomings in 1st generation (Bitcoin — decentralized money) and 2nd generation (Ethereum — smart contracts) blockchain platforms. This is not reduced to a few technical parameters, but is essentially reflected in a very scientific approach.

ARCHITECTURE:

Cardano has the advantage here of learning from the “mistakes” — especially with regard to the basic architecture — of other existing and competing offers such as Ethereum.

Charles Hoskins, as one of the co-founders of Ethereum, certainly knows how crucial it is to consider the long-term evolution of the platform in terms of scalability, extensibility and governance when making architectural decisions. Taking Ethereum as an example, we can currently see how difficult it is now to increase scalability, e.g. via sharding, or to change the consensus mechanism from proof-of-work to proof-of-stake.

PEER-REVIEW

The peer review is not limited to the Cardano developers or the community, you are looking for exchange and feedback at conferences and from universities.

This is of course much more time-consuming than reviews which only take place within the developer community.

SCALABILITY:

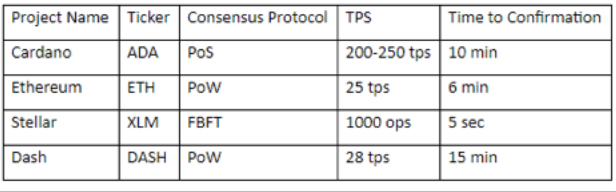

A very important point, which Cardano identified as a deficit, especially with Bitcoin and Ethereum, is the lack of scalability.

Scalability is divided into 3 areas:

1. Transactions per second (Tx/s.)

2. Network bandwidth (required for the amount of transactions required)

3. Amount of data (which data must I exchange or store in the blockchain)

TRANSACTIONS

Bitcoin, with its approx. 14 Tx/s, would of course not be able to serve as a global payment network. The main limitation here is the proof-of-work consensus. Cardano, therefore, relies on its own proof-of-stake-based consensus, called Oroboros.

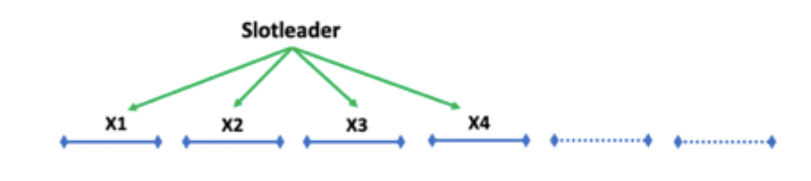

Oroboros divides the time in which the consensus is created into epochs, and chooses according to a random number the slot leader, which performs the function similar to a Miner, but without the same effort (HW& energy). Accordingly, no time is lost to find a slotleader and blocks can be created in a very fast sequence.

Slot leaders can also perform functions for sidechains.

NETWORK BANDWIDTH

Network bandwidth is also a key factor in terms of scalability. The aim is to reduce the bandwidth required for data dissemination and communication. For this purpose RINA (Recursive InterNetwork Architecture) is to be developed. RINA is a counter draft to TCP/IP. TCP/IP is a protocol stack with a layered structure based on the OSI model, where each layer fulfils a different task. Meanwhile, however, there is a multitude of protocols for each layer. RINA, on the other hand, is not based on such a layer model, but on a recursive structure for the network protocol architecture. This comprises only a few protocols, but they cover everything that services need today.

DATA

With the increasing amount of data exchanged, the size of the data to be stored grows. The goal is to reduce this amount of data. Not every participant needs all data from other transactions. When Hans and Maria exchange/transfer ADA tokens, the other users are actually only interested in the fact that the token ownership is then correctly recorded. Also in terms of privacy, a reduction of data that other participants receive about a transaction in which they are not involved is advantageous.

Techniques for reducing the amount of data:

– Pruning (truncation, simplification of data sets)

– Subscriptions (Subscribing to information)

– Compression (use of compression methods)

– Partitioning (dividing the network into shards)

Reducing this amount of data is certainly one of the biggest challenges in the area of scaling!

Additional complexity results from the development of own cryptographic procedures. Even though Charles Hoskins has a lot of experience in the field of cryptography, self-developed cryptographic procedures always bear a considerable risk and significantly increase the development and testing effort. Wherever he could, Satoshi has used well-known procedures, also in the area of cryptography.

INTEROPERABILITY:

It is very likely that not only a blockchain or a crypto-currency will prevail. Therefore it will be necessary to enable an exchange between the different networks, which can do without central points like Exchanges.

Cardano wants to establish interoperability not only between blockchains such as BTC, ETH, and XRP, but also to legacy systems of the banking world (SWIFT etc.)!

But this is very ambitious and highly complex. Consider the regulatory requirements, for example, if money from Ethereum’s ICOs is to be deposited via SWIFT into an account with JP Morgan. What metadata is required and how can it be checked? KYC, AML, etc. must be taken into account, or how can I verify, when exchanging values, that these really exist on the other blockchain or network.

Cardano’s goal here is an “Internet of Blockchains”.

What one has set oneself here as a goal is another Herculean task. By the way, you also have to keep up with possible changes in the other networks, so that the exchange is guaranteed even after changes.

SUSTAINABILITY

The central question here is: “How does the system manage and finance itself?

How can it be ensured that sufficient funds are available for operation and further development? Cardano does not want the development to be influenced by companies that assign developers (e.g. Blockstream — BTC) and influence the development of Cardano in the interest of their customers.

ICOs are a one-off funding instrument, even if the revenue from them is spread over the first parts of the roadmap, the funds will eventually be exhausted.

A long-term financing model must be created that feeds a “treasury”. Here, the model that Dash has created is used as a guide.

Similar to Dash, the financing of improvements and extensions (Cardano Improvement Proposals (CIP), marketing etc.), which are submitted by independent developers, for example, will be decided by voting.

To do this in a decentralized way, to provide the right incentives to participate in the voting and to distribute the funds correctly, is by no means trivial.

Which changes should be implemented and how should this be done without splitting the community and possibly risking a split of the network after a soft- or hardfork? You don’t want to see a multitude of splits like Bitcoin. A voting system is to be implemented here to ensure that changes are only implemented if there is a high level of approval. Of course, this can also be a hindrance if too large majorities are required. However, this should be preferred over a network split.

The long-term goal in terms of governance is a self-governing system without human intervention.

ORGANISATION:

Cardano basically consists of three parts, whereby the Cardano Foundation and IOHK are closely interwoven.

The Cardano Foundation itself is responsible for community support and for work on regulatory and commercial issues. IOHK was founded in 2015 by Charles Hoskinson and Jeremy Wood.

The third part of the organizational setup is Emurgo. Emurgo is to promote the adaptation of Cardano through cooperation and consulting of companies/partners who want to implement Cardano.

TEAM:

The focus here is on IOHK’s management team, which is responsible for the development of the platform. CEO of IOHK is the founder of Cardano Charles Hoskinson. Hoskinson has experience from his time as co-founder of Ethereum, where he retired in May 2014. Previously, he was involved in the concept of BitShares under the leadership of Dan Larimer. Due to his good technical background, he can certainly be seen as a suitable CTO. Leadership experience in complex projects, which were completed on time and within budget, is not evident with him.

The second man at IOHK is co-founder & Chief Strategy Officer Jeremy Wood. He also has little experience qualifying him for this position. 6 months as Executive Assistant at Ethereum does not seem like a lot.

COMMUNITY

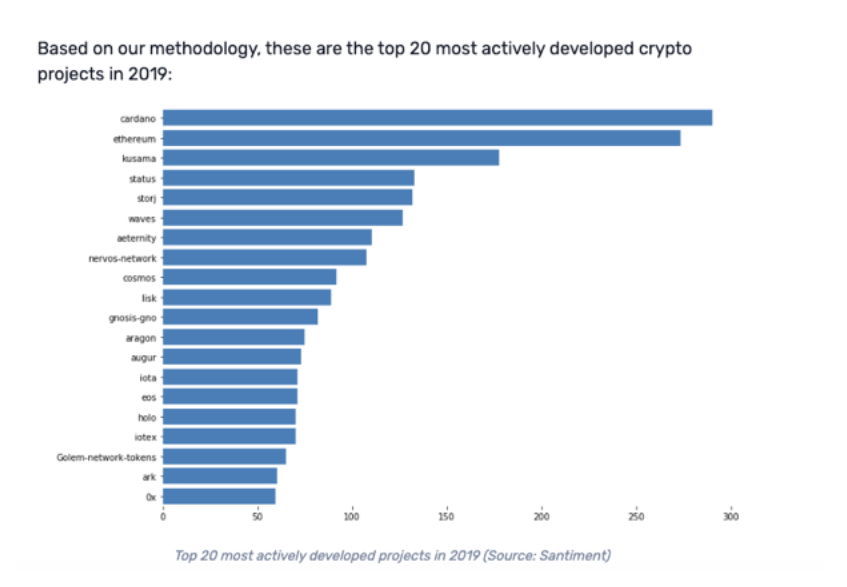

The Cardano Community currently comprises around 490,000 members. Furthermore, there are 142,000 followers on Twitter and 77,000 members on Reddit. According to the Santiment’s, 2019 Market Report Cardano 2019 was the project with the most activity (before Ethereum).

PARTNERSHIPS:

Due to the very science-oriented approach, a cooperation with the European Union was established to research use cases for blockchain and distributed ledger technology (DLT). There is a cooperation with the state of Georgia in the field of public administration and education.

A recent report on the cooperation between Cardano and PwC with regard to the development of a commercial strategy for Cardano caused a sensation. However, all the information on this seems to be based essentially on statements by Charles Hoskinson on this subject.

STATUS:

When Charles Hoskinson presented the Cardano Project in the video mentioned at the beginning of this article, a time frame within 2018 had been specified for the processing of all major building blocks of the project.

The following five versions are planned:

Byron: First version (Foundation) of Cardano Purchase/sale of ADA, Ouroboros Consensus Protocol, Deadalus Desktop Wallet, Block Explorer, Testnet (in addition to Mainnet), Exchange Interfaces & Support

Shelley: Second version (Decentralization) Focus: Decentralization

Goguen: Third Version (Smart Contracts) Focus: Smart Contracts & dApps, Creation of fugible & NFT Token

Basho: Fourth version (scaling) Focus: Performance improvement, sidechains (offload work to sidechain via sharding)

Voltaire: Fifth Version (Governance) Focus: Autonomous System,

Implementation Voting & Treasury especially for Caradano Improvement Proposal (CIP)

FINANCE:

An ICO, which was concluded on January 1, 2017, has brought Cardano a total of 62.2 million USD through the sale of 57.6% of the tokens. More detailed information can be found in the ADA Distribution Audit. Information on the use of the collected funds is not included in the audit.

The current market capitalisation is USD 1.05 billion and the token price is USD 0.04. This is certainly based on the expectation of a successful course of the project, even if probably few ADA token owners expect the planned milestones for the outstanding versions to be met.

CONCLUSION:

As mentioned at the beginning, Cardano is an extremely ambitious project! The motto is: “Only the best”. While the vision of Cardano is being realized, the developments of the other blockchains do not stand still, of course. In the end Cardano has to compete with the current state of Bitcoin, Ethereum & Co.

In particular, the increased scalability of Bitcoin through L2 technologies, such as the Lighting network or PoS and Sharding for Ethereum have changed a lot compared to 2017. Bitcoin and Ethereum can already rely on a functioning network, a very active community and corresponding network effects. As we know from other examples (e.g. Facebook, Twitter etc.), network effects are often more important than some features and can hardly be caught up on.

Pros:

– Scientific and structured approach

– Focus on scalability (Tx/s., NW bandwidth, data)

– Interoperability as an essential objective

– Financial security of the project

Cons:

– Far behind the own plan

– The main challenges are still open (decentralisation, smart contracts, scaling, governance)

– Charles Hoskinson as an absolutely central figure

Now I would be interested in your conclusion about Cardano — let me know in the Discord and which coin we should look at next!

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

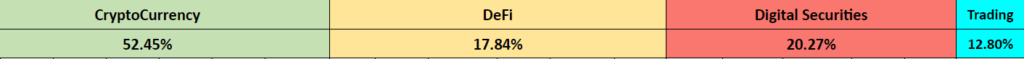

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

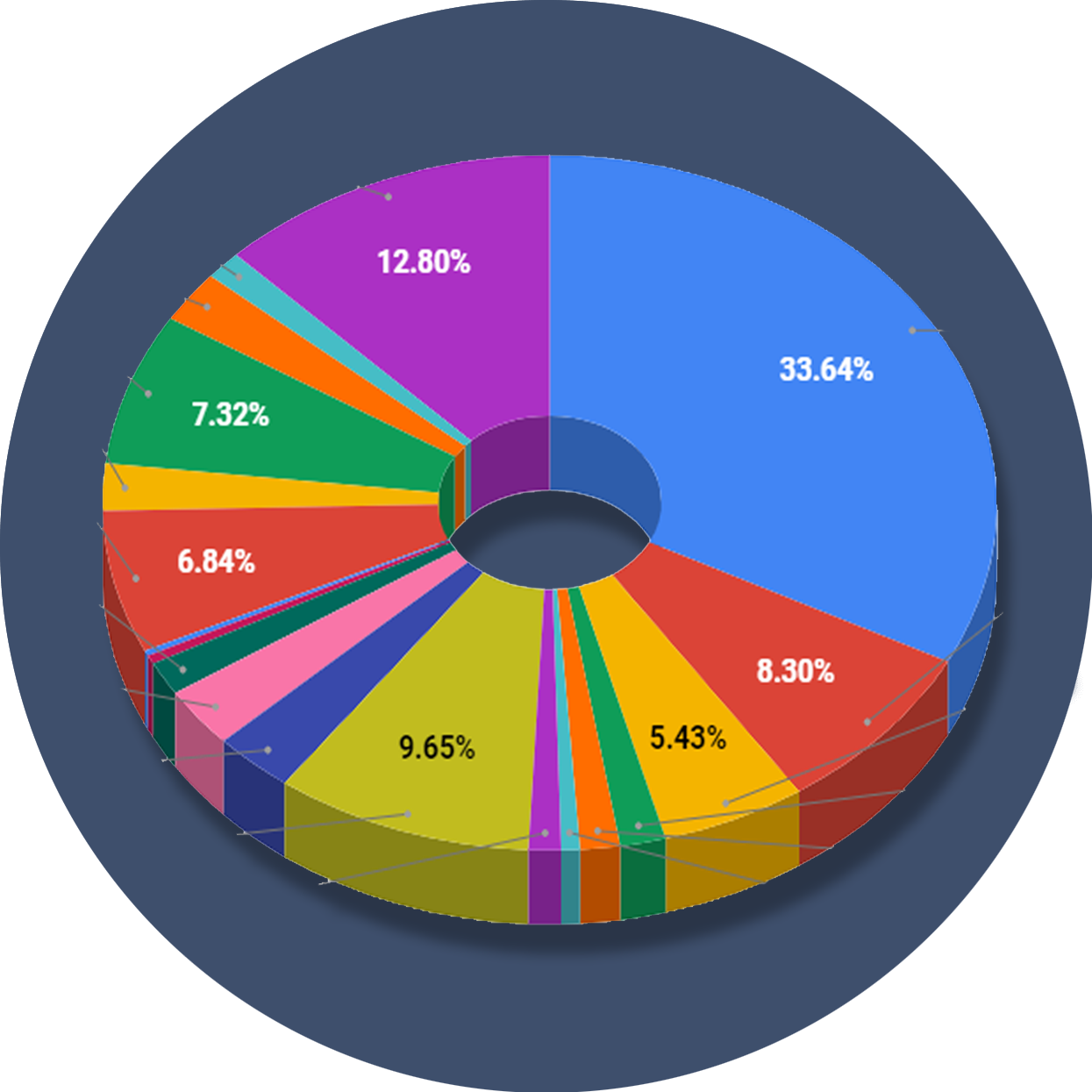

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

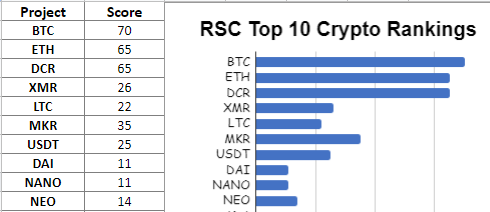

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

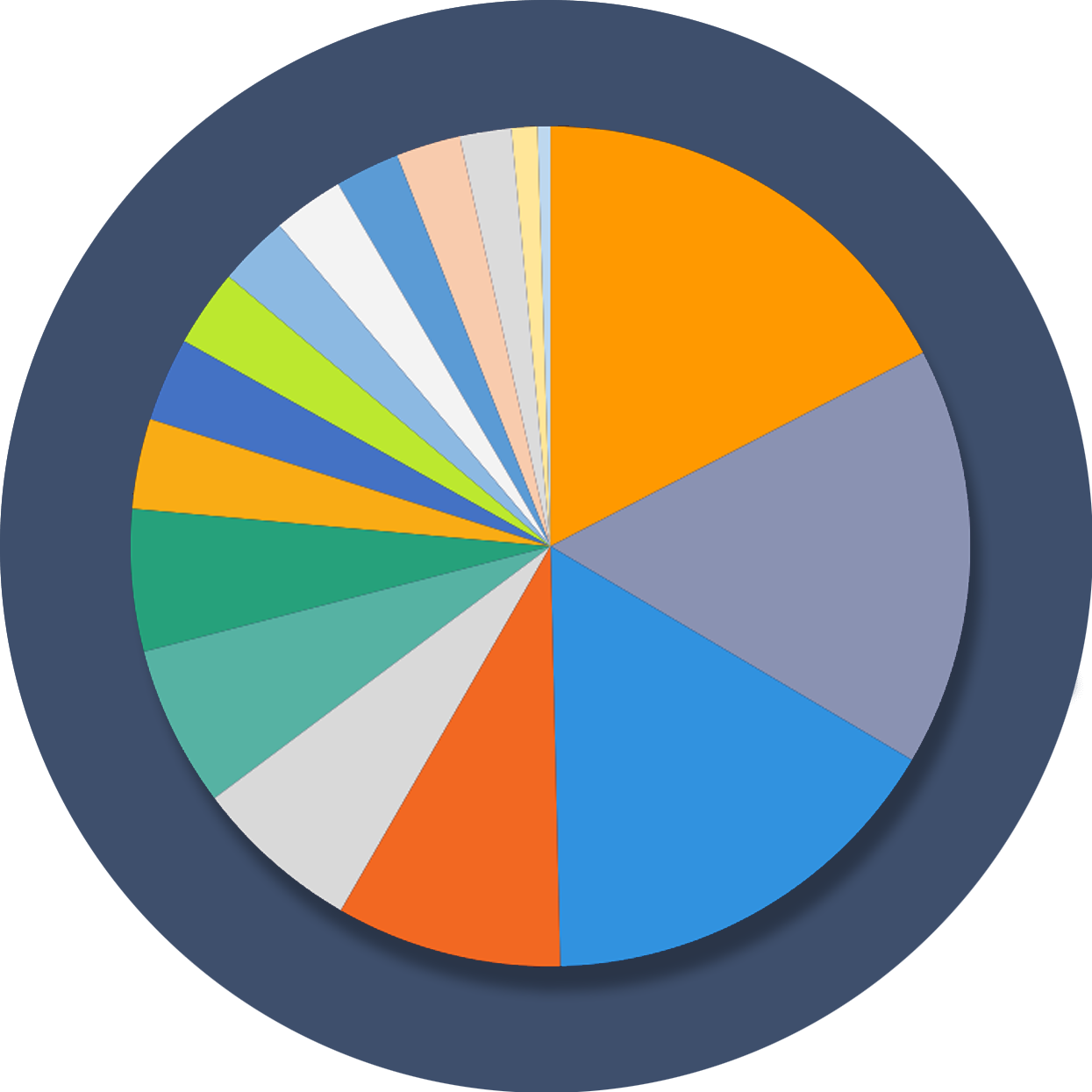

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.