Premium Daily Crypto Newsletter

May 1, 2018Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Markets Have A Neutral Day

Are The Bulls Or Bears Running Out Of Gas?

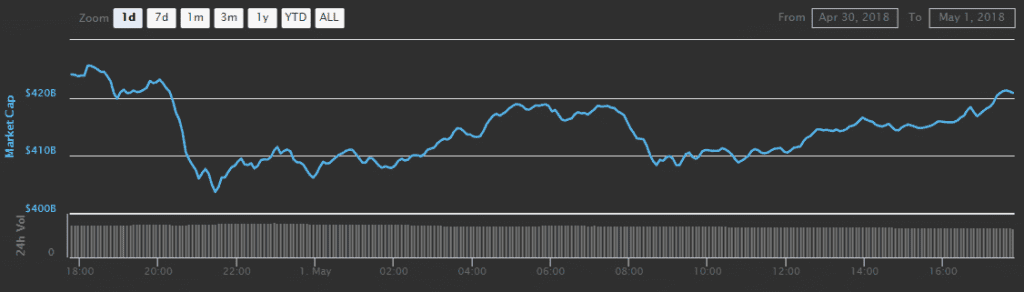

The market’s movement was largely neutral today, with several sharp corrections throughout the day and slow recoveries in between. It’s become clear that we’re back to a battle of attrition between the bulls and bears and we won’t see a resolution until a clear signal emerges.

Meanwhile, in today’s news, we learned that US federal regulators are quietly examining whether Ethereum should be classified as a security.

The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) are investigating whether many well-known cryptocurrencies — not just initial coin offering (ICO) tokens as we knew already — should be regulated as securities under federal law.

The report is sparse on details, but it cites sources who assert that regulators are evaluating whether Ethereum’s creators, “exert significant influence over their value, in the same way, a company’s stock price depends on its managers and their strategy, performance, and investments.”

The CFTC chairman Chris Giancarlo, who became a hero in the cryptocurrency community after he gave positive remarks regarding crypto in front of a congressional hearing in February, said he doesn’t see crypto legislation coming from the federal level in the imminent future.

“The statutes we are operating, you know, were written in 1935. And it’s often hard to look at those statutes and find out where something as new and innovative as Bitcoin and many other cryptocurrencies, where do they fall into a regulatory regime which was written decades ago… we see elements of commodities that are subject to our regulation, but depending on which regulatory regime you are looking at, it has different aspects of all of that.”

He continued, “There are certainly aspects of this that you might call a virtual asset like gold, only it’s virtual, it’s digital,” he said. “But it is an asset that many find worthy of holding for a long time and that has aspects to it that might not be ideal as a medium of exchange, that might be more suited as a buy and hold strategy.”

He noted that the CBOE and CME, two major US exchanges, are successfully operating Bitcoin futures contracts.

Giancarlo said that the complicated nature of Bitcoin and Cryptocurrency makes them challenging to regulate:

“…Bitcoin and a lot of other virtual currency counterparts really have elements of all of the different asset classes whether a medium of payment, whether a long-term asset, and so as regulators we’ve come to grips with this just now in real time and it’s complicated. And I don’t see it being resolved any time soon.”

While the future of crypto in the US is a bit murky at the moment, there was certainly better sentiment on the global stage. As we learned in April, the International Monetary Fund (IMF) affirmed that cryptocurrencies “do not appear to pose risks to financial stability,” in a report.

The IMF continued, “It is impossible to know the extent to which crypto assets may transform the financial infrastructure and whether most new crypto assets are likely to disappear as in past episodes of technological innovation (as many tech companies did during the boom of the late 1990s, for example). Before they can transform financial activity in a meaningful and lasting manner, crypto assets will first need to earn the confidence and support of consumers and financial authorities.”

Similar to this sentiment, the Hong Kong Financial Services and Treasury (FSTB) released its Money Laundering and Terrorist Financing Risk Assessment Report today and briefly discussed cryptocurrency.

Specifically, discussing criminal activity, the number of suspicious transactions has quadrupled in the past six years, while convictions have gone down.

At the same time, businesses around Hong Kong have been complaining that they are being denied banking services because of the banks’ overreaching fear of money laundering risks. This has notably hit the cryptocurrency community hard.

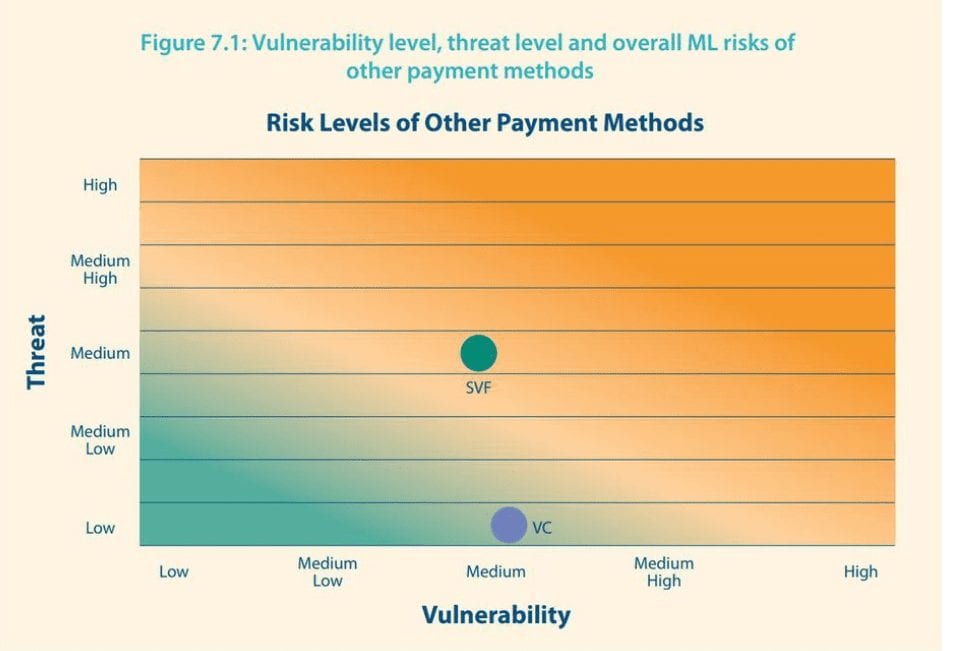

The report assumes that a system of payment, such as cryptocurrency, only becomes a risk to money laundering and terrorist financing once it becomes commonly used. The report’s risk assessment of Stored Value Facilities (SVF), such as the popular Octopus Card, Paypal or Alipay is far higher.

All in all, the report affirms that cryptocurrencies pose little risk of criminal activity.

The Hong Kong Police Force supported the report’s opinion, expressing that they see absolutely “no apparent sign of organized crime or ML/TF [money laundering / terrorist financing] concerning the trading of cryptocurrencies”.

Also coming to light is the study by the Center for Sanctions and Illicit Finance of the Defense of Democracies Foundation, which indicated only 0.61% of the fiat currency that is introduced into cryptocurrency trading has been used against regulations.

Despite the facts stating otherwise, there has still been a trend of associating cryptocurrency with illicit activities.

Earlier in April, Mark Carney, the Bank of England’s governor, alleged that a ‘huge amount’ of illicit activity is run through cryptocurrency. Despite this, his own Treasury has released a report that stresses the ‘risks of digital currency used for money laundering to be relatively low’.

Iran, in a similar move of paranoia, issued a nationwide ban on cryptocurrencies that prohibited Iranian banks from handling cryptocurrencies. Money laundering was one of the principle reasons given for the ban but no hard facts were conferred to back up the claims.

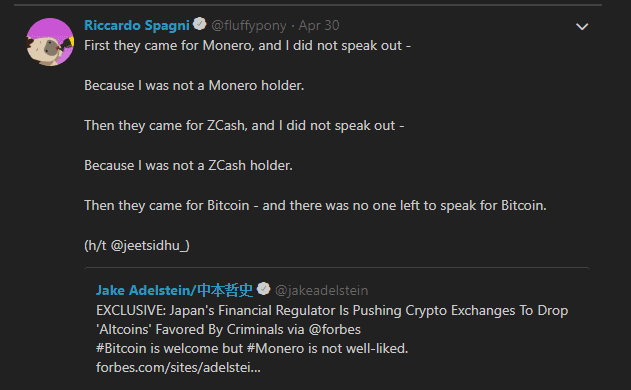

Just today, the Financial Services Agency of Japan [JFSA] is putting a lot of pressure on the country’s various cryptocurrency exchange platforms to stop trading privacy focused coins such as Monero [XMR], Zcash [ZEC], and Dash [DASH] claiming that various investigations have revealed that these are favored by criminals.

Despite these setbacks, we are still very positive for the direction things are going. As an indication of that, Coinbase announced it is is preparing to open an office in Chicago and add support for block trading. Block trading allows traders to place large orders outside of the exchange’s normal order book. This is clearly Coinbase getting ready to build out its institutional client base and solve a key pain point. We clearly see this as the direction the market is taking, and this is just one more weathervane indicating to us that institutional investment is quickly coming.

Talk to you tomorrow.

New to Cryptocurrencies? Check out our archived classes “Intro to Cryptocurrency Trading”, “How to Find Your Next Big Cryptocurrency: Intro to Fundamental Analysis” and Doc’s new one, “Introduction to Technical Analysis” which are now all available for immediate purchase/viewing in the Premium Member’s Home. View more about them at our online store by CLICKING HERE.

Missed our recent webinar on Wallets and Security? You can listen to it in the Member’s Area or here. The new “Security and Wallets” class is now available in our “Store” at the top of this page, use the coupon below for a $10 discount.

We’ve been nominated for an award! We’d really appreciate if you voted for us here under the “Best Video Production” award! Thanks!

Sign up for our NEW Telegram channel by clicking here!

Watching on Mobile? Click this link to watch in HD

Click here for audio link of today’s video

If you go to buy any of our courses at our online “store” you can receive $10 off the street price with your member’s “coupon code” of member18crypto

Offensive Actions for the next trading day:

- See Doc’s ADA/BTC swing in the last section below.

- None.

Desired Holdings

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

None.

None.

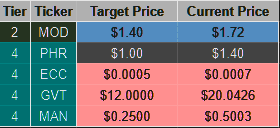

Tier 2

MOD

Tier 3

REQ

SUB

LINK

NANO

KNC

Tier 4

BNTY

TAU

WISH

PHR

LOCI

XBY

ELA

ECC

POE

HPB

BIX

EVE

XVG

NULS

DNA

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Libra Credit

For flipping Neutral.

For long-term holding Neutral.

What is it?

A decentralized lending ecosystem that facilitates open access to credit anywhere and anytime based on the Ethereum blockchain.

What is our verdict?

What we like: Working with excellent projects such as MakerDAO and has a strong advisor group.

What we don’t like: Crypto based lending is already a crowded space of really good projects, and the roadmap is rather vague

Website: https://libracredit.io/

Whitepaper: https://www.libracredit.io/page/Libra%20Credit%20Whitepaper.pdf

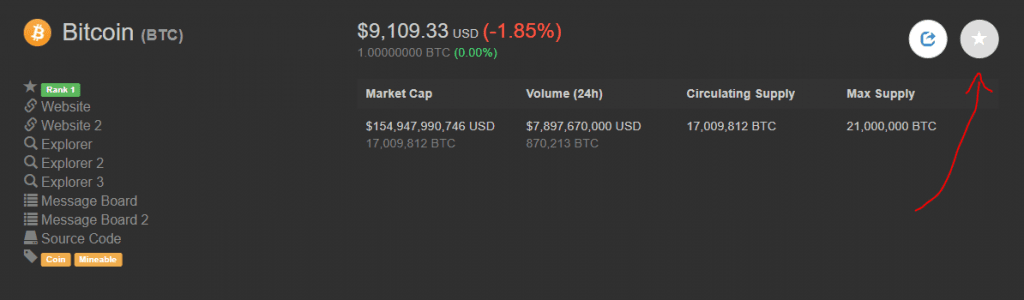

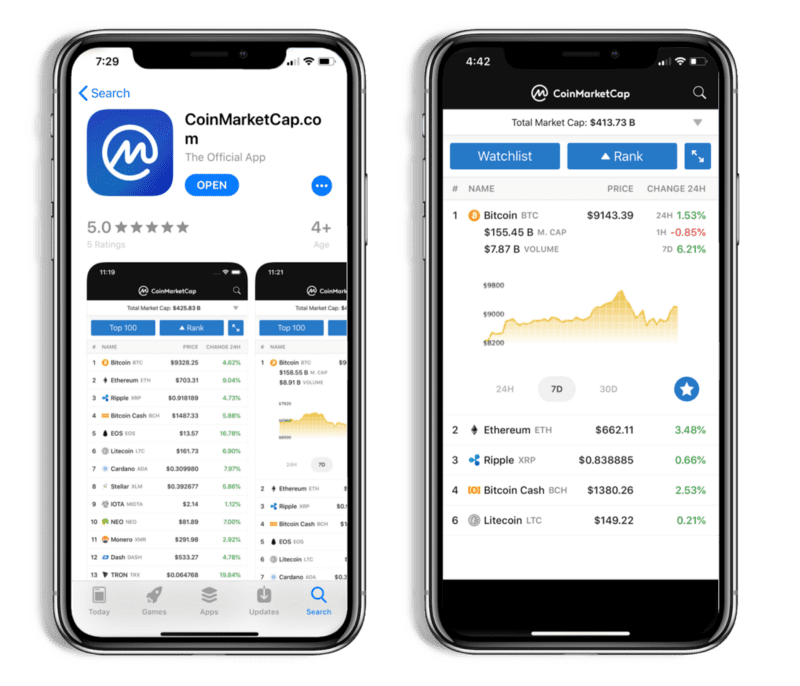

“The official CoinMarketCap mobile application is now available on the iOS App Store! Download it here to manage your Watchlist and stay up to date with our market capitalization and pricing information on the go.”

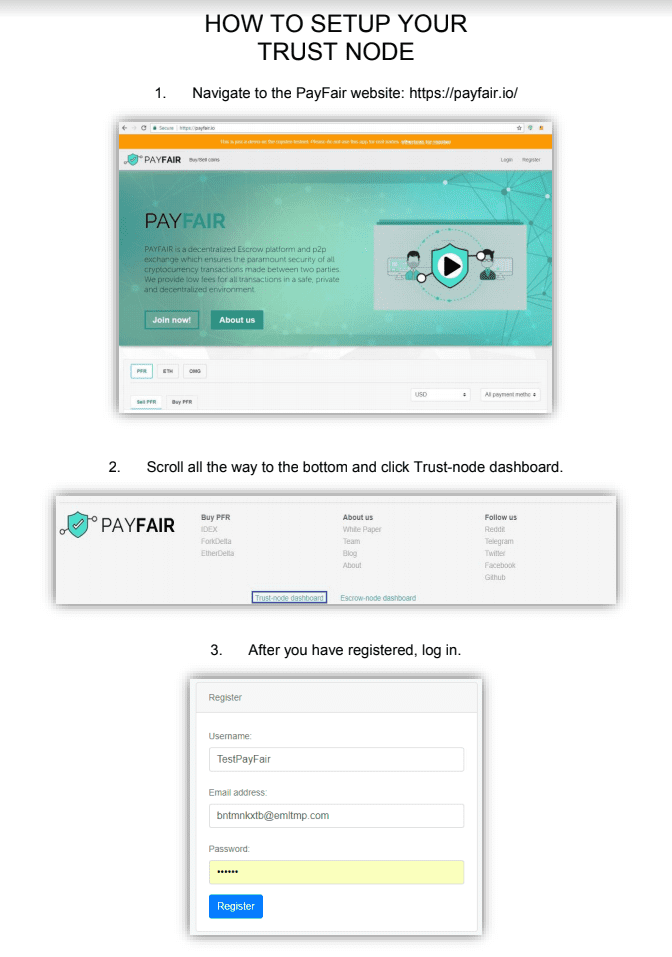

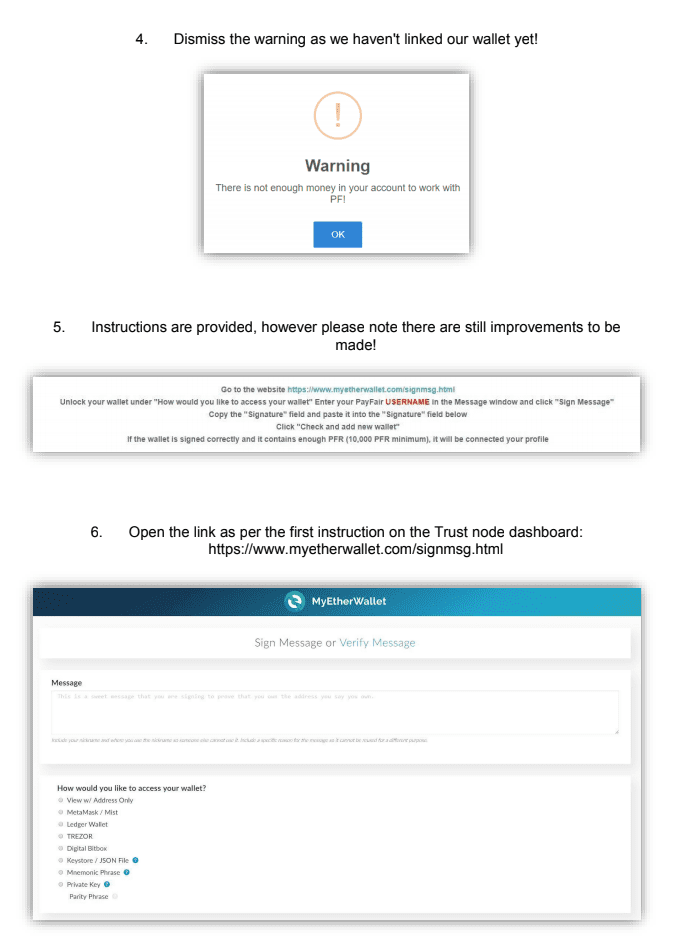

Payfair (PFR) went live allowing anyone to buy and sell crypto tokens and exchange for cash via direct p2p exchange – all secured via a decentralized escrow system.

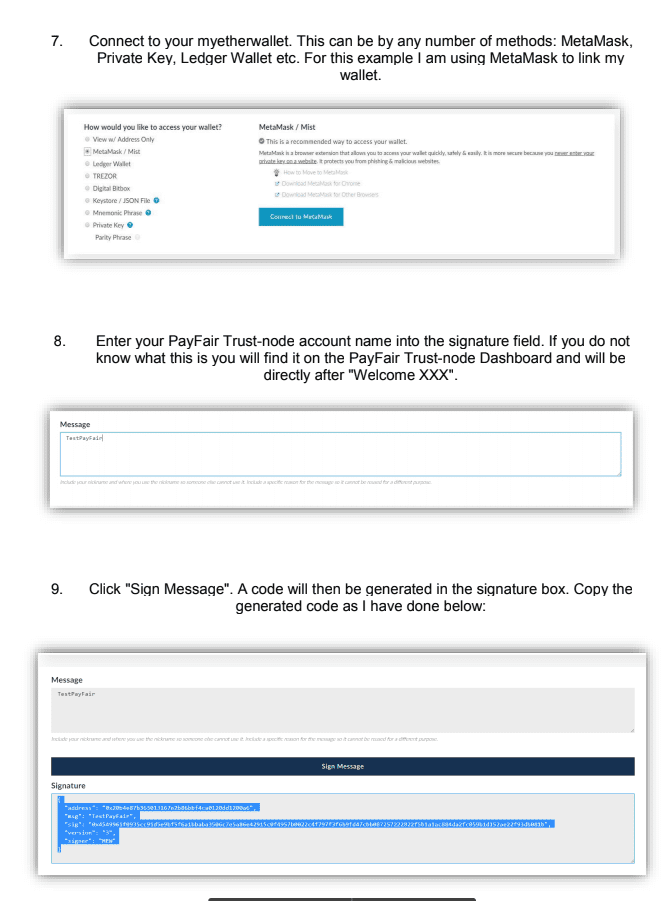

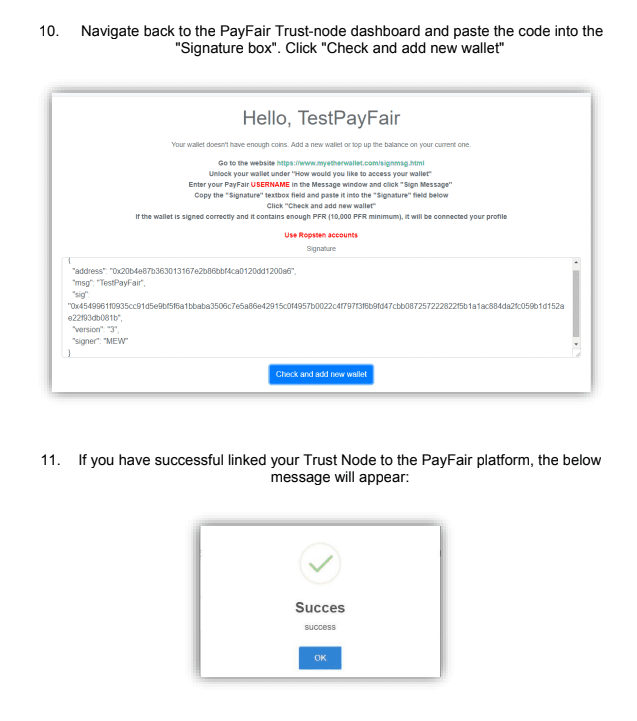

Check it out here!: https://payfair.io/ Additionally, for those who have 10,000 PFR, you can set up a trust node in order to earn 0.8% of the daily trading fees! Follow this simple guide to set up your trust node!

Here are the recent swings that we’re tracking in the portfolio below:

- WTC/BTC – Long @ .00155980BTC (4/23). My target exit is at .002BTC. Doing just fine.

Please keep in mind that if you want to follow these trades, I am using FIXED RISK POSITION SIZING. This means that I am using a fixed amount of risk capital that is based on my account size, like 2%. I am assuming that the trade will burn to the ground and that I will lose that entire capital position! Only in this manner can one effectively manage a position the way that you have to. If you’ve every checked your blockfolio nervously every 5 minutes when you’re underwater, this will prevent that. I will track these positions in this area and not in the main portfolio section. I will use a public portfolio tool to do so, which you can access by clicking below:

Public Swing Portfolio Link

If you missed my earlier webinar, “More Profits in 2018; Ten Ways to Chart Like a Pro.” then you can catch the replay here. My new class “Introduction to Technical Analysis” is now available via our online store.

If you go to buy any of our courses at our online “store” you can receive $10 off the $59 street price with your member’s “coupon code” of member18crypto..

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

I am also trialing the Profit Trailer and CryptoHopper trading apps which are working well in this choppy market.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.