Doc's Daily Commentary

Mind Of Mav

Retire Early With Bitcoin

Ten years ago, if you put aside $4 for that cup of Starbucks tall coffee into Bitcoin, you’d be sitting on a whopping $688,050 today.

Insane right?

That’s an annualized return of 234%.

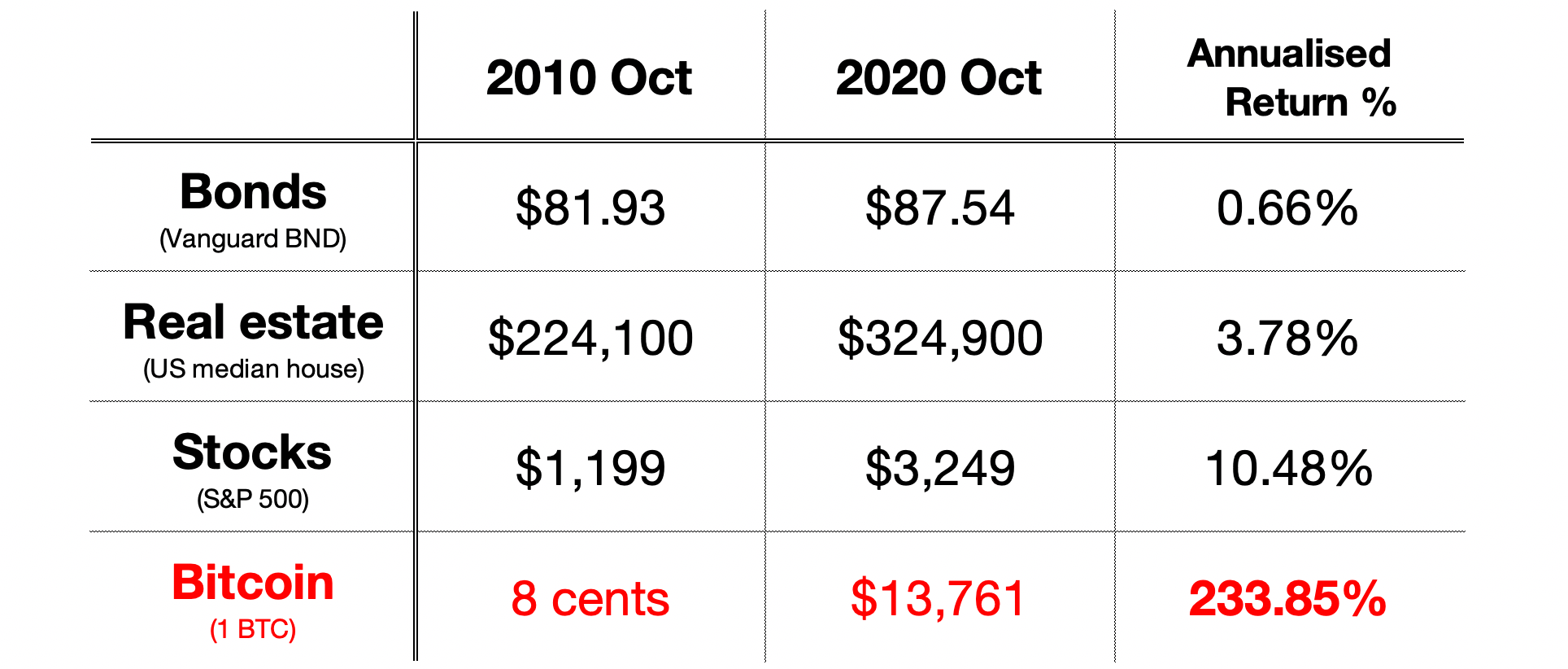

Compare that with:

— stocks (10.5% for the S&P 500 index),

— real estate (3.8% for US median house price) and

— bonds (0.7% for the Vanguard BND Total Bond Market ETF).

This made Bitcoin’s return orders of magnitudes above equities, real estate and bonds. To see this better, we can standardise the above figures and compare how each of these assets would have grown $100.

A single dollar put into Bitcoin in 2010 could get you a house today. A hundred dollars and you could retire right now, whatever your age.

Importantly, Bitcoin is here to stay, with its long-term prices increasing in a somewhat mathematically predictable way due to its limited supply. Everyone should incorporate some Bitcoin in their portfolio. By the end of this article, I hope to convince you that it’s a no-brainer.

Why Bitcoin will explode in 2021

A combination of mathematical, economic, and evolving consumer behavioral reasons ensures a stellar year for Bitcoin in 2021 and beyond.

1. Mathematical Reasons— Bitcoin Halving

Like gold, bitcoin is scarce.

There is a finite amount of it — 21 million, to be exact.

This scarcity pushes Bitcoin prices to rise, and so far we’ve seen it rise linearly on a log-scale, which means prices actually increase exponentially. All other asset classes (bonds, stocks, real estate etc.) increase in price linearly. In other words, while other investments grow steadily, Bitcoin grows at an expanding rate. This is jaw-dropping.

Like gold, bitcoin can also be mined.

To extend the life of Bitcoin and ensure it remains a deflationary asset, Bitcoin creator Satoshi Nakamoto wrote into Bitcoin’s code that the reward given to miners is halved every 210,000 blocks, or roughly every four years. This unique feature of BTC divides its timeline into distinct four-year epochs.

Historically, each halving event has resulted in a bull run where prices skyrocket over the length of a year.

— 1st halving (2012): Bitcoin did a 10X in the post-halving bull run, increasing an order of magnitude from the $100 range to $1200.

— 2nd halving (2016): Bitcoin did a 20X in the post-halving bull run, increasing an order of magnitude from the $1000 range to $20,000.

— 3rd halving (2020): Since the halving in May ($10,000), the price of a BTC has gone up to $15,000 at the time of writing.

We’ve just begun (or will shortly be in) the latest post-halving bull run, projected to last until Q4 2021. The price of Bitcoin could reach as high as $325,000. Many analysts suggest that prices should hit at least $100,000. I would say the lower bound is around $70,000. That’s a 4–20 fold increase over the next year, which would continue Bitcoin’s reputation as the best performing asset by far.

If you miss out, you will have to wait until the next halving event in 2024. Time is of the essence.

You can read more about halvings and price predictions here, here, here, here, here, here and here.

2. Economic reasons — inflation hedge in the face of COVID-19

As COVID-19 ravages world economies, reserve banks around the globe continue to pump extra cash into the economy.

This causes investors to park their money into scarce assets to hedge against inflation and government tomfoolery. That safe haven has traditionally been gold, but is now includes Bitcoin, which can be thought of as digital gold.

According to JPMorgan, older investors tend to go for gold, while more younger and fintech-savvy investors go for Bitcoin.

3. Consumer Behavioural Reasons— Bitcoin is Going Mainstream!

Scarcity and inflation-hedge alone can’t account for Bitcoin’s rise. Otherwise, explains Charlie Morris, the price of gold would rise to infinity if we suddenly shut down gold mining.

Bitcoin prices rise because of widespread adoption. People are transacting with it, with cryptocurrencies increasingly becoming a mainstream fixture in our financial world. As Sylvain Saurel argues time and time again, Bitcoin is money, not just another technology. Its rise in value is almost inevitable.

Some recent highlights:

— Mainstream institutional adoption. Take MicroStrategy, a NASDAQ-listed company, recently made Bitcoin its primary treasury reserve asset after stockpiling $425 million worth of BTC. Square did the same in early 2020 October. A former Goldman Sachs hedge fund manager predicts some of the world’s biggest companies — like Apple and Microsoft — are gearing up to add Bitcoin to their balance sheets. Any of these companies parking just a tiny portion of their excess cash into BTC would cause prices to skyrocket. Finally, Fidelity Investments, one of the largest fund managers in the world, launched an ETF for qualified investors and suggested holding 5 percent BTC in their portfolios. Currently, run of the mill retail investors won’t be able to buy this ETF, but this should change in time.

— Mainstream consumer adoption. Take PayPal, which announced in late 2020 October that it will allow its 346 million users to buy and spend Bitcoin and a handful of other major cryptocurrencies. Afterwards, Virgin Galactic’s chairman remarked that:

…every major bank is having a meeting about how to support bitcoin. It’s no longer optional.

How To Invest & Trade The 2020-21 Bull Run

You’ve now made the decision to profit from Bitcoin’s current bull run. What’s your strategy? You’ll want to decide on one before you get in, because trading a volatile asset without a strategy is the surest way to lose your money.

Let’s consider three strategies based on experience level and effort:

— Buy and hold. Buy as much Bitcoin as you plan to invest right now and hold onto it until the end of the bull run in 2020 Q4. This is by far the easiest option, and probably the most sensible for a lot of people. Jordan suggests that Bitcoin under $20,000 is cheap Bitcoin. So until BTC hits 20k, you could just continue to pump regular savings into your holdings.

— Buy, hold and buy more during big corrections. Bitcoin’s journey to the next all-time high (ATH) isn’t expected to be smooth. At times, there may be drawdowns as big as 30%. Jordan suggests that whenever this happens, simply buy more BTC.

— Buy, hold and time the big corrections. This one is very difficult to pull off. Jordan makes a point to stress how difficult it is to correctly identify when big 20–30% corrects are about to occur. That’s the nature of Bitcoin. However, looking at past data (2017 post-halving bull run), he noticed that corrections tend to occur after prices reached roughly 160–170% of their previous ATH. Thus as a rule, you may want to close some of your positions once the price reaches around 150% of the previous ATH. Jordan does NOT recommend you close your entire position — this is simply too risky.

No matter what, remember that Bitcoin is still speculative, volatile, and won’t reflect your desired price no matter how much you want it to do so. Set your expectations accordingly, trade dispassionately, and don’t be afraid or sad to take well-earned profits. Stay smart and stay in the game.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.