Crypto Market Commentary

10 October 2019

Doc's Daily Commentary

The 10/9 ReadySetLive Update with Doc & Mav is listed below.

Mind Of Mav

Big FinTech Is On Fire – What You Need To Know

Quick disclaimer: I am not a fan of China from a moral perspective, but I will not hold a biased opinion for or against their financial potential as it should be analyzed with impartiality.

So, let’s talk Big FinTech.

The stellar FT Partners quarterly research report is out, and you can see continued health in the sector.

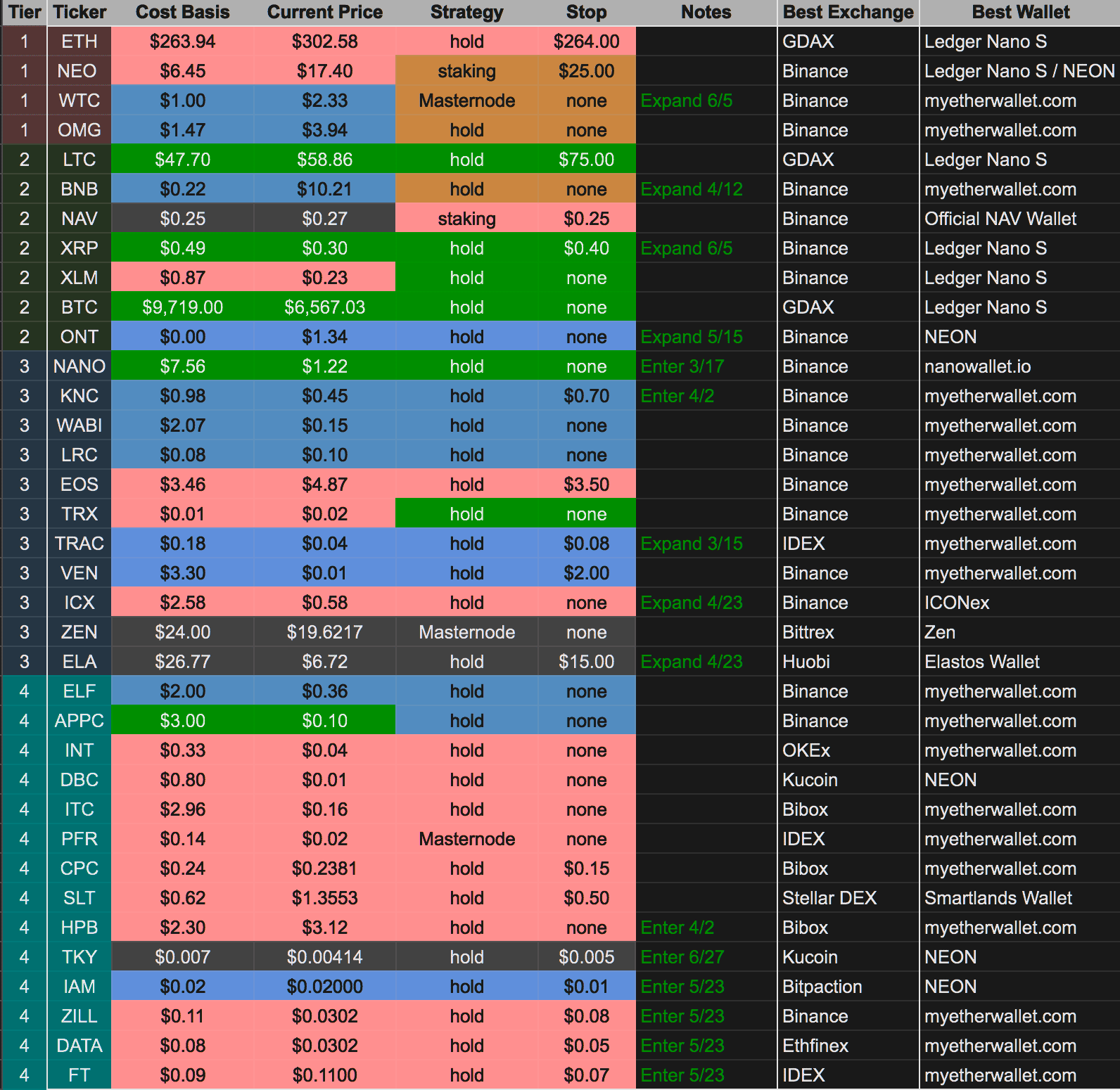

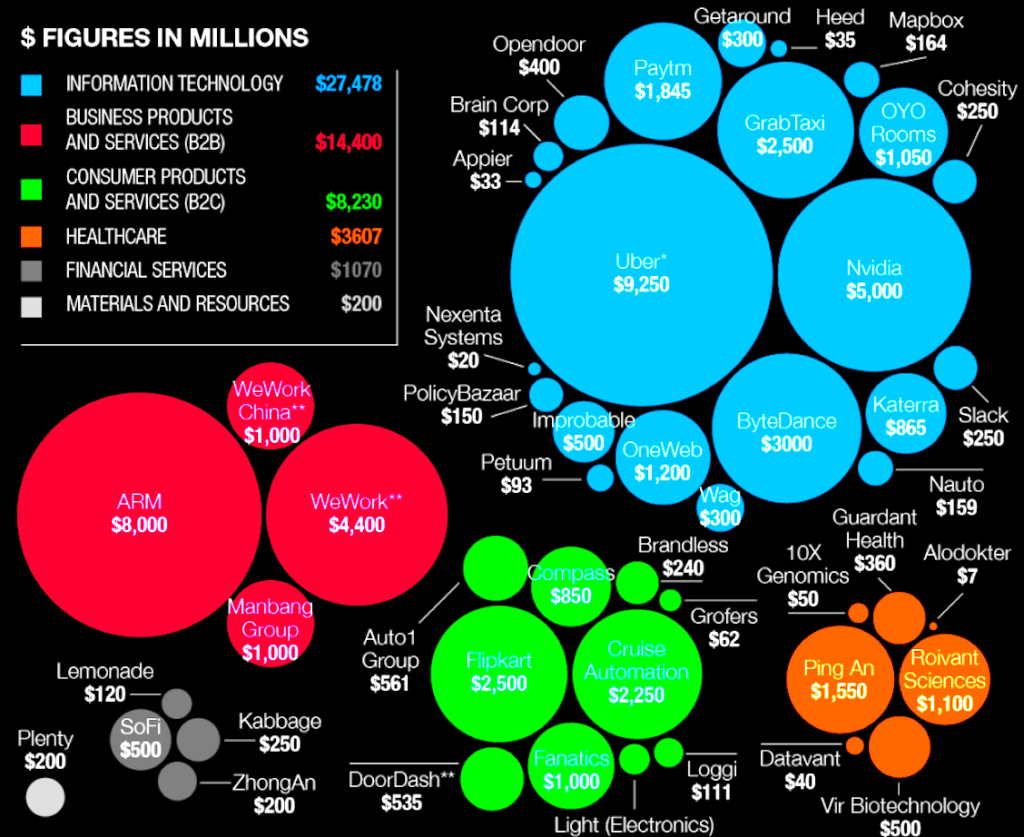

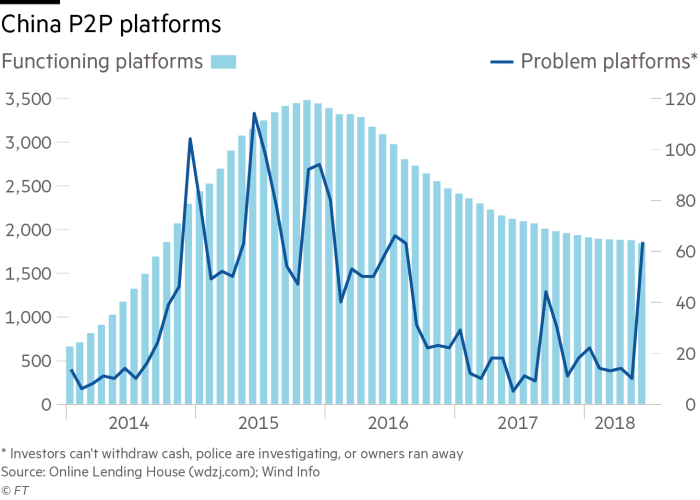

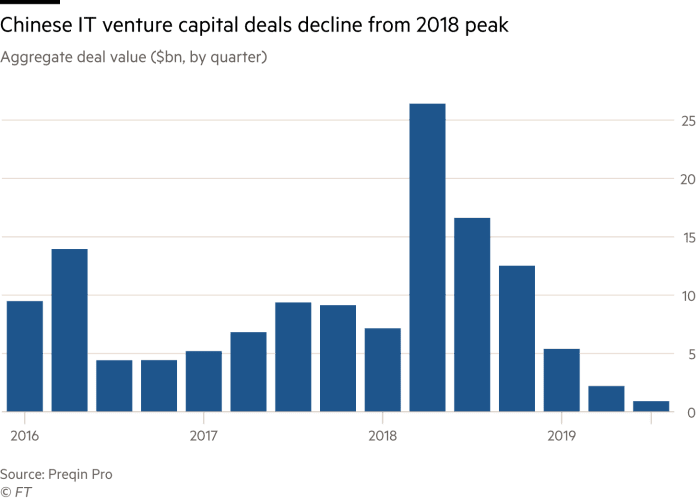

In terms of North America, we can expect over $20 billion in venture financing this year again — much of it flowing to data aggregators, banking-as-a-service entrants, and insurtech (e.g., Plaid, Lemonade). In Europe, over $10 billion could be invested this year, doubling that of 2018 and driven by the sector’s leadership in integrated digital banking (e.g., Revolut, N26). In Asia, however, the numbers are slowing down. That’s partly due to the Ant Financial outlier last year, partly due to the collapse of the P2P digital lending industry, and partly (I think) due to the rise of crypto assets (e.g., excluding $1 billion for Tether).

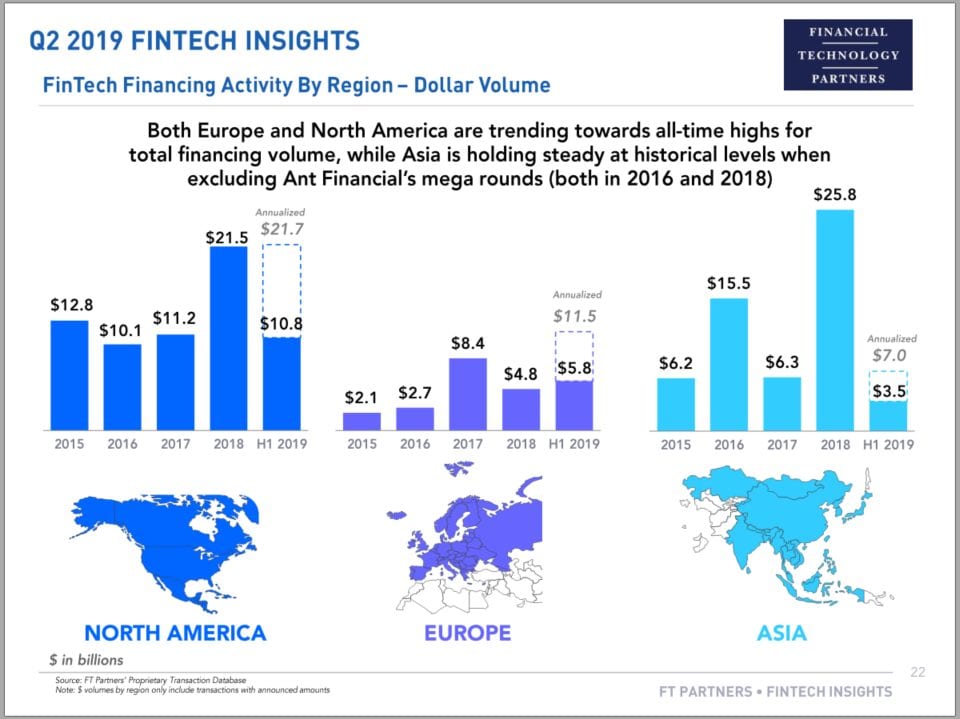

Let’s cut to the chase: Fintech is hot.

I wouldn’t mind being a private-equity backed CEO.

That said, it’s not a fresh tech stack. If anything, it is the opposite of a fresh tech stack — rather, it is the financial optimization of a massive financial industry data infrastructure founded in 1850 . . . and that managerial optimization of legacy finance is something that the United States is really good at doing.

Gigantic, global, US-headquartered businesses are consolidating into immobile utilities that define what is possible for entrepreneurs. How can you not be excited about Crypto, when your only alternative is to buy a Bloomberg (or Refinitiv) terminal? Why would you want to buy $7 billion of accounting goodwill on solidifying this infrastructure, when $7 billion of venture activity can get you a super highway to the future? Most of the banks are getting it now — whether you are Deutsche Bank or JP Morgan or BBVA, the story is how you will spend $10 billion on digital transformation and fire all your employees.

Big Funds

Venture investors invest in ventures, and traditional investors invest in tradition. This gets me to other side of the barbell — SoftBank and China. SoftBank is launching a $108 billion follow-up to its first Vision Fund, which unwitting public investors could get to own any day now. While it is easy to snipe at SoftBank for sky-high price-insensitive valuations, it is wrong to dismiss the strategy without appreciating the results. SoftBank famously played the key role behind Alibaba (cashing out $11 billion), which launched Ant Financial, arguably the most important fintech company in the world. Without Ant, we wouldn’t have Facebook building Libra, or the Chinese payments revolution. Without SoftBank, we also wouldn’t have many of today’s American and European fintech unicorns, from SoFi, to Robinhood, to Revolut. When you are price insensitive, a $100 million option bet on a owning an entire market of future consumers is a fair gamble.

So, real quick; what is SoftBank?

It is, at its core, an Internet company. It wants to spends its winnings to do to Finance — companies like Refinitiv — what it did to Media.

Who is investing in their second Vision fund?

Microsoft, Apple, and Foxconn.

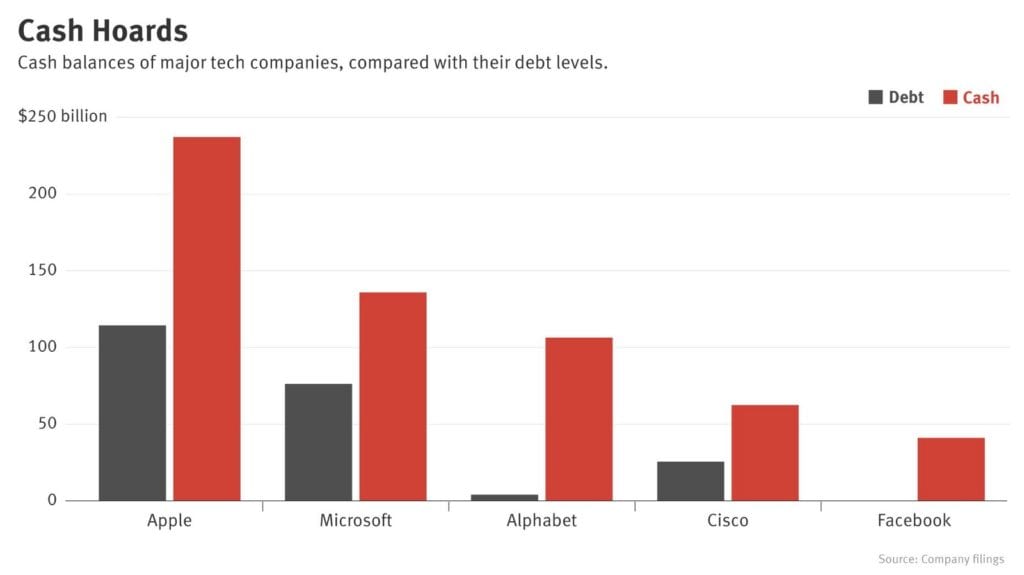

Facebook, Google, and Amazon are building Fintech solutions directly, so no need for side-car bets with idle cash.

How much of that cash is there? Between the top US tech companies, there is at least $500 billion of a balance sheet. You still think Deutsche’s Bank $10 billion digital transformation makes any long-term difference to anything except the CEO’s golden parachute?

Big China

The last puzzle piece in our journey is China, with Alibaba’s success largely subsidizing SoftBank’s swashbuckling. I want to point you to a couple of high-quality pieces. Fortune’s piece entitled China’s Biggest Private Sector Company Is Betting Its Future on Data walks through how Ping An generates about $160 billion of revenue and uses AI to settle 7 million auto accident claims per year. The company collects data on hundreds of millions of customers, and re-uses that data across healthcare, insurance, and wealth management. Its products are distributed by over 1 million independent sales agents.

Check out this a great write-up on Tencent’s WeBank (by Norbert Gehrke), which is another top Chinese fintech company that delivers products across lending, investing, banking, and wealth management. While the West is just starting to think about Fintech bundles, the Chinese apps started to spin out one finance feature after the other. What really stuck with me, however, is that WeBank has a valuation of about $30 billion after receiving its license in 2014. Deutsche Bank, that giant of suits and accountants, boasts a market capitalization of less than $15 billion.

Big Improvement

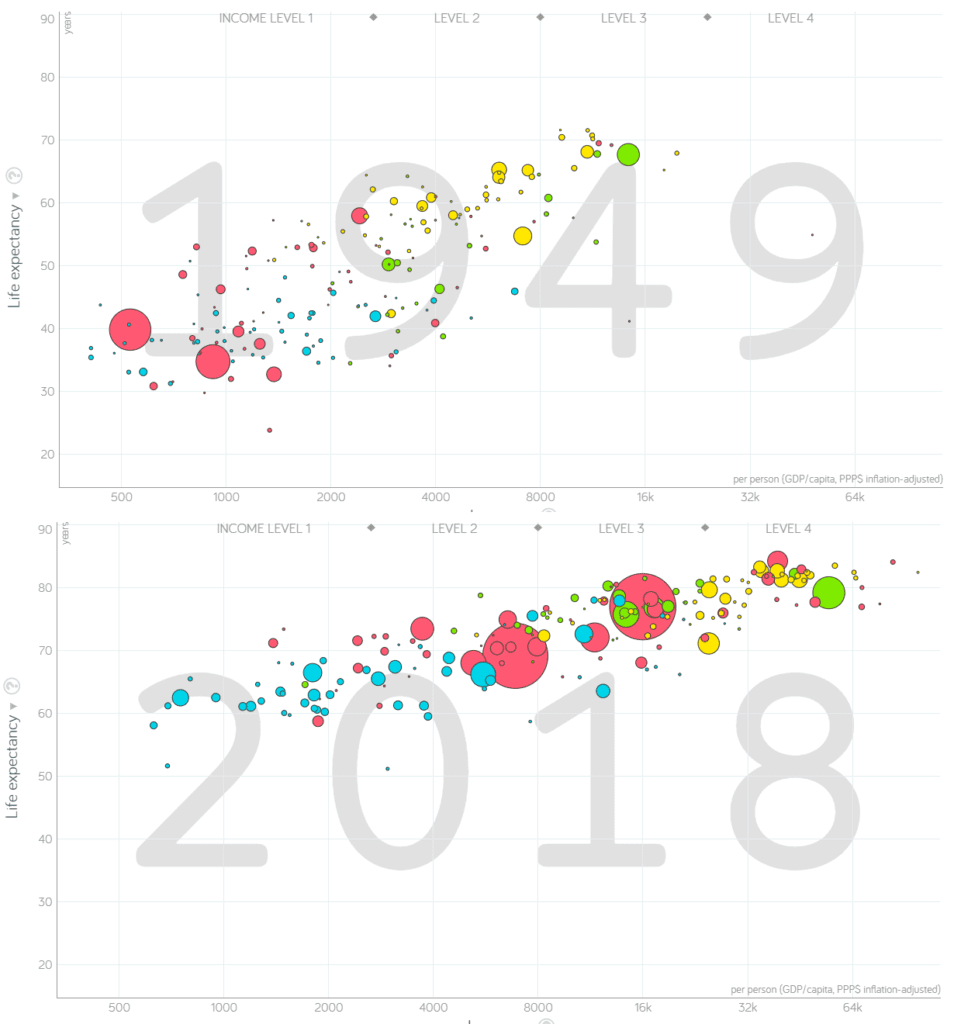

Here’s an excellent macro mental model (from Gapminder) to explain why Fintech activity in the East is both more innovative and more valuable. The vertical axis is life expectancy, and the horizontal is a logarithmic plot of income.

Each bubble is a country, color coded for its continent and sized for its population. That big green one on the right is the United States, surrounded by smaller ones like Singapore and Sweden. The two big Red bubbles are China and India, with China having higher GDP per capita.

We’re looking at two time periods about 70 years apart, and the simple answer is that all countries are floating up and to the right, improving both their life expectancy and GDP per capita. The two are deeply interlinked.

While the US has a bit more room to squeeze out, it is pretty much on top of the world.

That said, nobody is standing still.

And if you look forward 70 years, what possible outcomes do you see? Covering the ground of bringing a billion people towards AI-enabled financial services is a much bigger opportunity than optimizing how institutional traders download their PDFs.

Big Risk

That said, there is a high amount of irrational exuberance around this thesis, and it is easy to lose your shirt. It is difficult in the mainland to go public or achieve a free-market exit, other than flipping the company to Baidu, Alibaba or Tencent.

This limits the upside structurally. Separately, opportunism and scams have been rampant in both P2P lending and crypto businesses, resulting in increasing central government control and legal action. Thousands of companies have been shuttered, users have lost access to their invested capital, and unscrupulous entrepreneurs are being tracked on public offender maps.

Chinese tech company valuations are more expensive than ever. User attention is over-saturated with commerce, lending, and other financial products across dozens of competing apps. As a result, venture investment into the sector is slowing, with bike companies dying left and right. If you go back to the very first chart above, you’ll see that the Asian numbers are the only ones down year-over-year.

In this context, it is interesting to think about the opening up of Chinese financial markets just initiated by the central bank. One of the main barriers — a restriction on foreign investors owning more than 25% of a company’s shares — has been removed. Similarly, foreign rating agencies can now rate bond instruments in the inter-bank markets, as well as make their own investments, and set up money management enterprises (from wealth to pension funds). Will Facebook and Google now be able to acquire a Chinese high-growth lending Fintech? Will Ant Financial stake and distribute Libra through its mobile app?

Needless to say, FinTech holds promise and is going to be hot for years to come.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

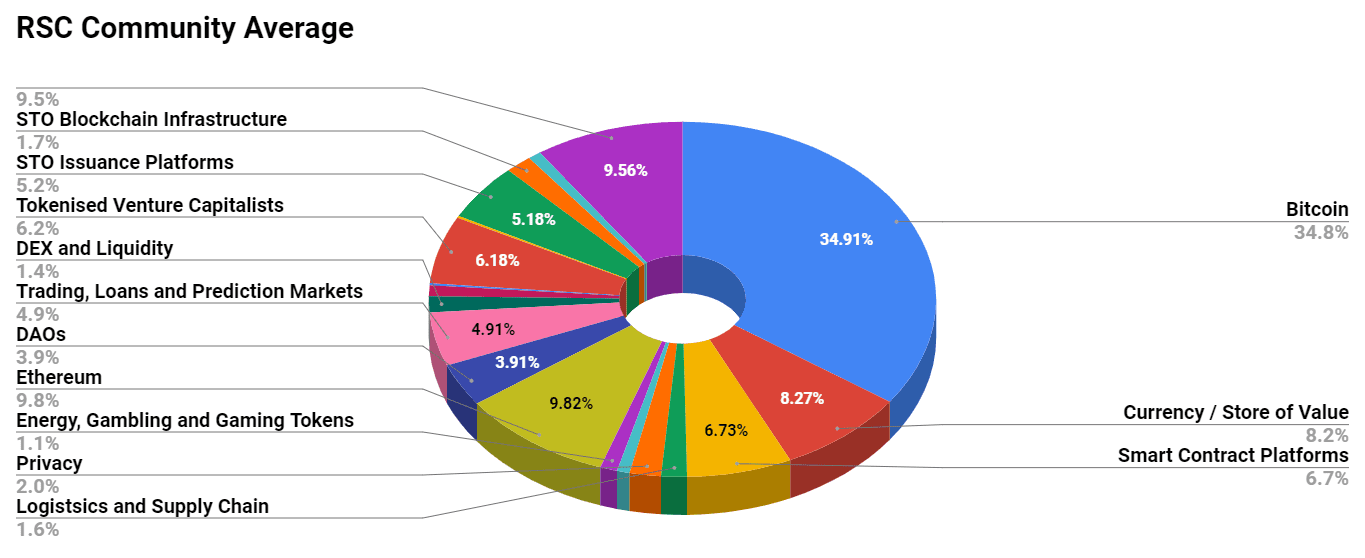

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

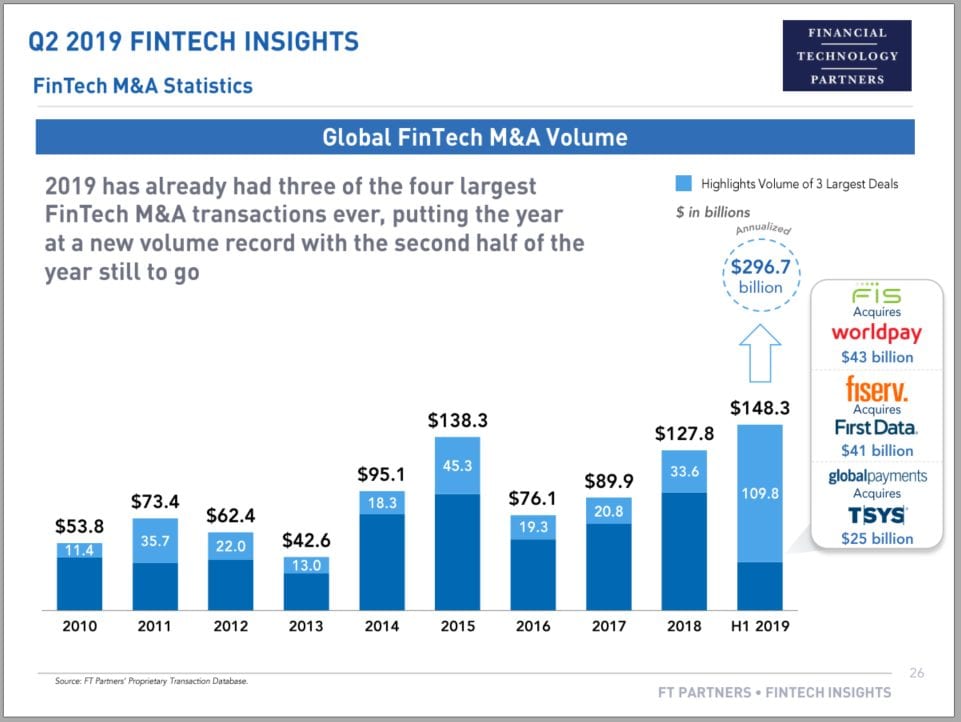

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)