Crypto Market Commentary

24 October 2019

Doc's Daily Commentary

The 10/23 ReadySetLive Update with Doc & Mav is listed below.

Mind Of Mav

The Future Of Fintech In A Post-Libra World

Predicting the future is a tricky business, and that seems to be particularly true when we try to make long-term predictions about technology. Roy Amara, an American researcher and president of the Institute for the Future, is best known for coining what is now known as ‘Amara’s law’, which states that “we tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

Popular reactions to a range of new technologies, including personal computers and the internet, have all been impacted by this phenomenon, creating the well-known Gartner hype cycle, where observers initially expect rapid and disruptive change, then dismiss the technology, only to find it a ubiquitous part of their lives a decade later.

At the same time, we can fall victim to a narrow focus on specific technologies that ignore the complex interrelationships between various technologies and the innovations they enable. For example, few could have predicted how the confluence of increased computational power, inexpensive storage, and broadband connectivity would have led to the central role that cloud computing now plays in the technologies we use every day.

Financial Times columnist Tim Hardford tells a particularly amusing anecdote of how Hollywood’s attempts to predict the future have gone astray due to just this sort of thinking. Hardford reflects on the iconic 1982 film Blade Runner, which takes place in the ‘futuristic’ world of 2019 and where the main character Rick Deckard drives a flying car and interacts with an organic robot named Rachel who is so advanced that she is effectively indistinguishable from a human. Yet, when Deckard wishes to contact Rachel in this version of2019, how does he do so? He reaches into his pocket for some coins and goes looking for a payphone.

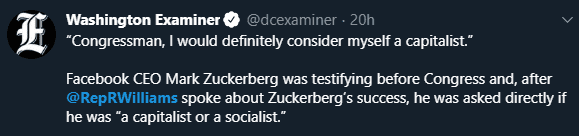

So, for today, I’d like to center around emerging fintech and the future of the financial ecosystem. This is especially relevant in response to the Libra testimony to the US Congress by Zuckerberg yesterday, so let’s start there.

In Zuck’s prepared remarks, he stated:

“The idea behind Libra is that sending money should be as easy and secure as sending a text message. Libra will be a global payments system, fully backed by a reserve of cash and other highly liquid assets.

I believe this is something that needs to get built, but I understand we’re not the ideal messenger right now. We’ve faced a lot of issues over the past few years, and I’m sure people wish it was anyone but Facebook putting this idea forward. But there’s a reason we care about this.

Facebook is about putting power in people’s hands. Our services give people voice to express what matters to them, and to build businesses that create opportunity. Giving people control of their money is important too. A simple, secure, and stable way to transfer money is empowering. Over the long term, if it means more people transact on our platforms, that would be good for our business. But even if it doesn’t, it could help people everywhere.”

Now, I’ve often said that regulation shouldn’t outpace technology. In turn, new technology shouldn’t run rampant over existing regulation — it should uplift and educate and guide society. My piece about the drawbacks of the recent cashless push highlights that well.

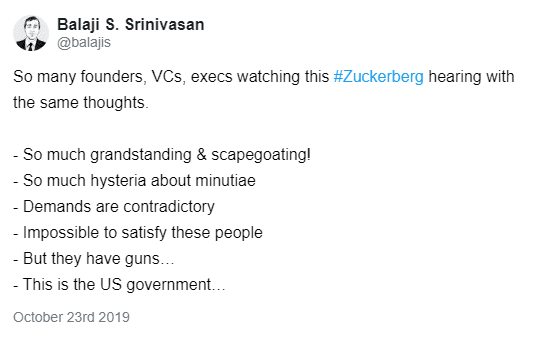

Even still, and despite your author’s feelings about Libra and Zuck, what we saw was a public shaming and crusade against the entire initiative.

From Pomp’s Off The Chain,

“Many in the crypto industry had high hopes for the hearing. It could have served as an opportunity for Congress to become more educated on digital currencies, while getting answers to meaningful questions that could help shine a light on some of the nuances or ramifications of the Libra Association’s plans.

Normally I wouldn’t be so harsh, but things got out of hand yesterday:

*At one point, California’s Representative Katie Porter started talking about Zuck’s haircut. She said “Mr. Zuckerberg, I know Facebook can be sometimes an unkind place, um, both toward my personal appearance and today apparently towards your haircut. But as the mother of a teenage boy I just want to say thanks for modeling the short cut.”

*Representative Al Green got upset because Zuck didn’t know how many employees working on Libra were members of the LGBTQ community, which insinuates that the Representative had expected Mark to ask his employees about their sexuality?!

*And then there was a slew of questions from multiple people about fake news, political ads, and other non-Libra topics. These ranged from AOC asking Zuck if she could run advertisement with lies to Bill Posey voicing his anger that Facebook would censor anit-vaxxers.”

So, the lawmakers spent little time discussing the potential benefit of distributed financial services and instead chose to target Facebook as a whole.

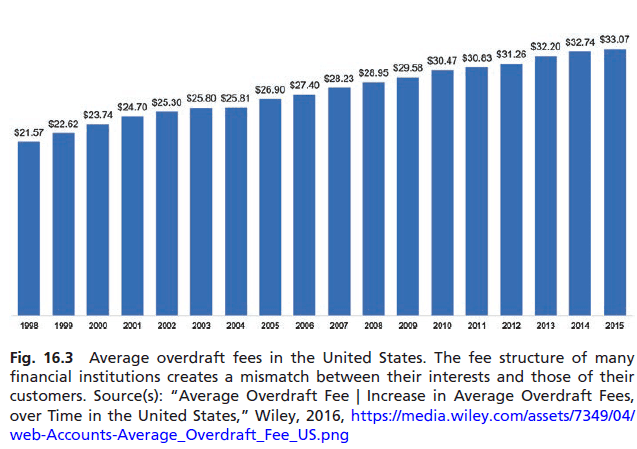

I have a lot of criticism of Facebook & Libra, but at the end of the day we need to be talking about the unbanked and the underrepresented. We don’t need to be politicizing technological progress when 8 in 10 Americans (78%) feel the big banks are to blame for the financial crisis of 2008, and more than five years later, 66% are still angry at the big banks for the crisis, according to the first Consumer Banking Insights Study.

It simply can’t be denied that the world is changing fast for

executives at incumbent financial institutions.

Fintech startups that were once dismissed as irrelevant now play an important role in shaping the pace and direction of innovation, forcing incumbents’ labs and corporate venture funds to compete for the opportunity to partner with them. At the same time, the threat that the largest technology companies in the Western world will decide to compete for a piece of the financial services pie feels ever more inevitable. Whereas a few short years ago, the world’s largest financial institutions might have seemed unassailable, today it is clear topmost that their existing business models will

need to be transformed to remain economically viable.

But to think about this transformation as simply a competition between incumbent financial institutions and fintech new entrants, or even a battle royale that includes techfins, is to miss a central aspect of the change that is currently underway.

The very structure of the financial ecosystem is shifting. This shift will impact not just whom you purchase your financial products from, but also the way in which those products are designed, built, bought, and delivered.

The future of financial services is marked by both excitement and uncertainty.

Unlocking the full potential of financial innovation will require all stakeholders to work together to ensure that current and future innovations serve the core objectives of the financial system. New innovations should facilitate a more inclusive economy, the effective transfer of risk, the formation of capital for economic growth, the accumulation of saving for retirement and more, all while ensuring that the system for doing so is fair, stable, and secure.

Achieving this won’t be easy—new innovations can bring just as many risks as they bring opportunities. But if innovators, incumbents, regulators, and consumers all work together, new technologies have the potential to create a transformational and better financial system for all.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

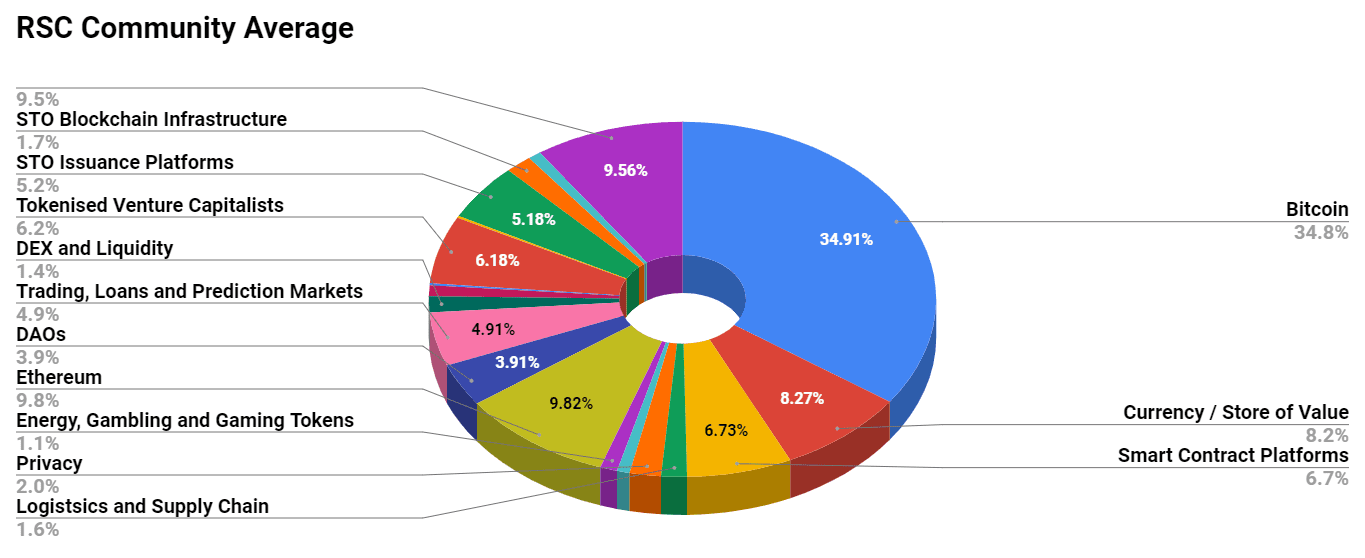

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

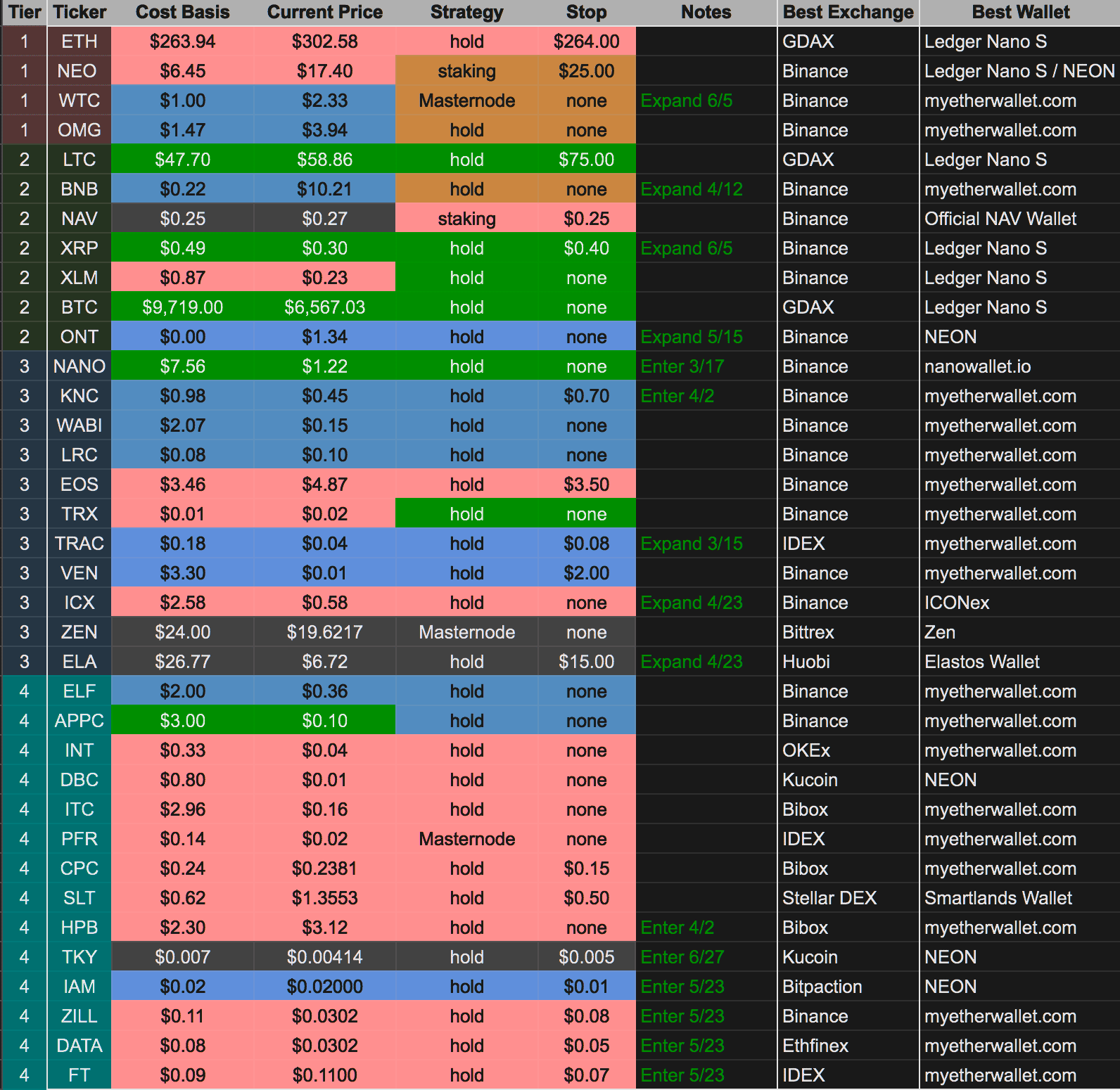

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)