Doc's Daily Commentary

Mind Of Mav

The New King Of DeFi

Uniswap has attracted interests from all around following its governance token issued.

$UNI soared in price shortly after launching, from $1 on Thursday to its peak of $7.37 on Saturday. Major exchanges, among them Coinbase, Binance and Bitfinex, listed the token. But $UNI’s pump wasn’t to last—though, just four days into trading, no conclusions can be drawn about the coin’s fate.

The coin is a riposte to SushiSwap, a clone of Uniswap that launched its own governance token, $SUSHI. Like $UNI, $SUSHI is earned from using the protocol. SushiSwap took business away from Uniswap, so Uniswap minted its own governance token.

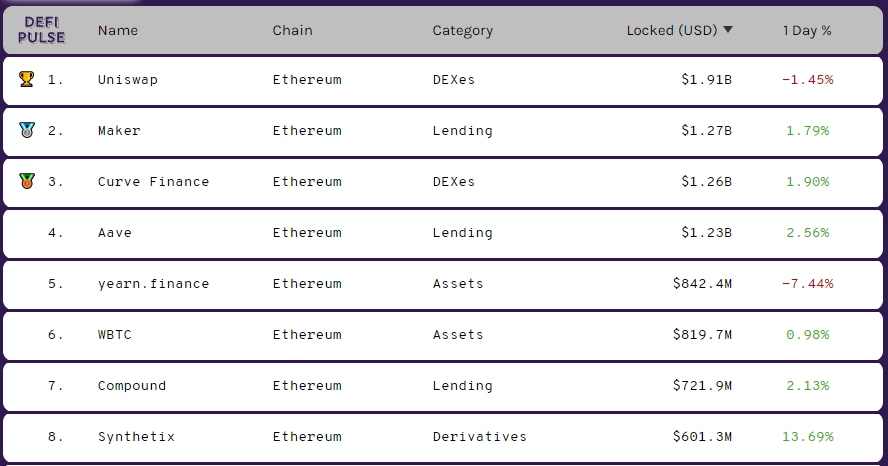

So far, the plan has worked. On September 17, the day after launch day, customers had locked in $748 million worth of cryptocurrency in Uniswap’s smart contract, according to DeFi Pulse. Now, $1.93 billion is locked up in its smart contracts. Meanwhile, the amount of crypto locked in SushiSwap has declined, from a peak of $1.42 billion on September 12 to $447 million today.

Despite Uniswap rising to become the leading decentralized finance (DeFi) protocol by total value locked (TVL), its newly issued UNI token price crashed along with many other DeFi tokens.

UNI traded at USD 4.35, having declined 23.35% over the past 24 hours. And despite the token increasing more than 186% from the launch price of USD 3 last Thursday, to a high of USD 8.6 the day after, the early excitement among users now looks to have cooled off.

Moreover, the losses over the last day also positioned UNI as the day’s worst performing token among the top 50 crypto assets by market capitalization, which is currently closely followed by Aave (LEND) and yearn.finance (YFI).

Despite the fact that UNI token has lost nearly 50% of its value from its high last Friday, the Uniswap protocol continues to gain ground in the DeFi sphere. As announced by DeFi Pulse last Friday, the protocol has now secured the position as the leading DeFi protocol by total value locked (TVL), ahead of its competitors Aave and Curve Finance (CRV).

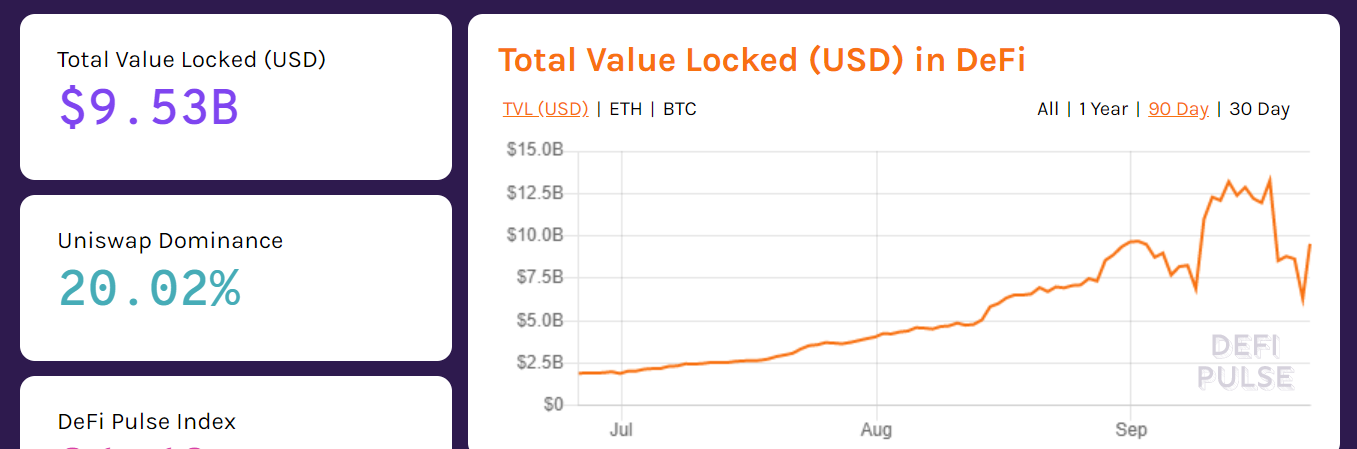

The reshuffling of the DeFi ranking comes as the total value locked (TVL) in the space as a whole reached a new all-time high yesterday of USD 9.77bn. The record follows a correction in the amount of capital locked in DeFi protocols earlier in September, which had seen the TVL fall from USD 9.6bn on September 2, to a low of USD 6.8bn on September 9.

Along with UNI, LEND, CRV, and several other DeFi tokens, however, the Ethereum network’s native token ETH also faced heavy selling today, falling by 8.1% over the past 24 hours to a price of USD 348.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.