Doc's Daily Commentary

Mind Of Mav

Why DeFi Is Blowing Up The Finance Industry

Disclaimer: this is JUST my personal opinions/views and NOT financial advice.

“An entire new financial industry is being built on the top of DeFi”.

I’m sure you have heard this sentence somewhere. Is it true? Can DeFi actually replace the traditional “centralized finance”?

This question is more pertinent in 2021 when DeFi came out of the crypto caves to become a David fighting Goliath.

Thanks to DeFi, financial instruments (like loans, savings, trading, etc.) can now be decentralized, trustless, and available anywhere in the world. This is possible due to some of the DeFi technology characteristics such as Interoperability, Composability and Programmability.

In this article, I will break down 7 reasons why DeFi may be more than just hype. I mean…. waaaaaay more than hype!

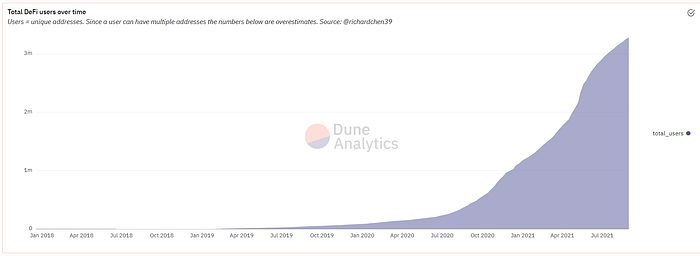

Nowadays, around 3 million Ethereum wallets interact with DeFi protocols, moving many billions of dollars every day.

One of the most beautiful things about DeFi protocols is that very often, the team behind building these protocols that move billions every day isn’t even known. Why would you care who the CEO is when you can audit the Smart Contracts, the token economics, and everything is transparent on the blockchain? Additionally, DeFi projects can be built on the top of DAOs — Decentralized Autonomous Organizations. DAOs governance model relies on the community. The token holders are the real decision-makers, and they can vote and participate in the governance by steering the project. Beautiful and democratic!

1. The exploding adoption

2% of the Ethereum addresses interact with DeFi

Of the 170 Million Ethereum addresses, 3.3 Million are interacting with DeFi protocols!

Metamask passed 8 Million, active users, according to Consensys. This is also probably fueled by the entire NFT market that has been exploding in 2021!

I can only think about one thing when I hear these numbers:

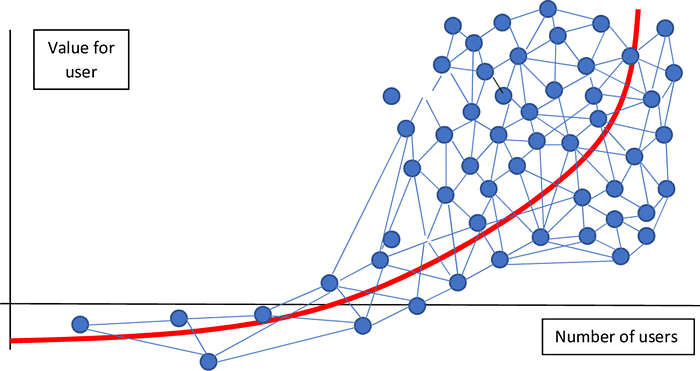

Metcalfe’s Law and Network Effects!

the value of a communications network is proportional to the square of the number of its users

Translating: DeFi and Ethereum passed the tipping point. This technology is unstoppable. These network effects are now uncontainable!

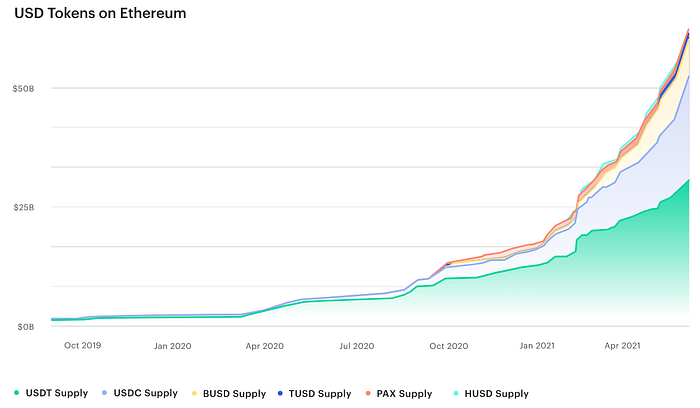

2. Stablecoins or Rockycoins?

The Stablecoin market is now over USD 65 Billion, 60% up in 2021. This reflects well the money flowing to the DeFi and crypto markets, but it also reflects the power/role of the centralized entities that issue those stablecoins. Because they are centralized, companies like Tether (USDT) and Circle (USDC) could eventually be regulated by governments in a way that could negatively impact the crypto market. Let’s wait and see. In the meantime, I will continue minimizing my stablecoin wallet. At the end of the day:

Cash is trash!

I have to agree that the growth is impressive tho.

Stablecoins are backed mostly by USD reserves, treasury and unspecific “commercial paper”.

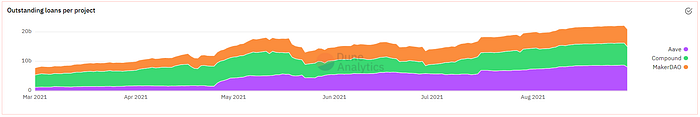

3. DeFi Lending Market

This one is my favourite: the total democratization of the lending world!

The total outstanding DeFi debt is now MORE than $20 Billion! Impressive right?

So… what is this for? Well, DeFi lending platforms allow you to get a loan with attractive interest by giving your crypto as collateral. This is ideal if you, for example, don’t want to sell your Bitcoin but need some cash to pay some bills. So you put your Bitcoin as collateral for the land and get some USDT.

On the other hand, you can also lend your crypto and gain some interest.

What is mindblowing here is that everything happens inside totally automated Smart Contracts. Lit!

4. DEXs — The cool kids in the neighbourhood!

Decentralized exchanges, token swap smart contracts, automated market makers. They allow us to transact in a peer-to-peer way, without centralized authorities!

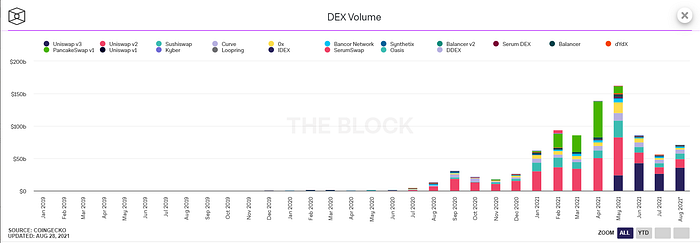

In Q2 2021, DEXs volume reached 350 BILLION dollars! More than most big centralized exchanges! Check also the updated chart below here.

The number of Decentralized Exchanges out there is also growing, and each one of them looks cooler than the other! Slick user interfaces, smooth user experience and security, these Decentralized Exchanges offer you the best of 2 worlds: Uniswap, Sushiswap, Kyber, Dodo, Curve, 1inch and many many others! Comment below if you think I should add any DEXs to the medal of honour list!

5. Institutional Finance coming to DeFi?

From the data and analysis presented, it’s not hyperbole to claim that the entire financial system is being rebuilt from first principles with more security, transparency, and composability across protocols. — Consensys DeFi report

What if you can choose between these 2 options for your USD:

1 – Saving account at the bank that pays 0.5% interest

2 – DeFi protocols that pay 4%, 5% or even 6% for the same USD

Hmmm…. this one isn’t that hard!

No wonder so much money flowing to DeFi!

Now you may wonder. What’s the catch? Why are yields so attractive? Well, the answer is that the market is still small, and there’s more demand for USD in this market than the existing supply. And in DeFi, there’s no Central Bank to dictate the rates. The rates are dictated by supply and demand.

Just some additional numbers to make your mouth juice:

According to PWC, 47% of traditional hedge fund managers are looking at investing in crypto. This could represent an additional $180 Billion!

Another survey shows that hedge fund managers may allocate 7% of their assets to crypto, representing $312 Billion!

Additionally, some custodians like Coinbase, Gemini and BitGo (the keep the crypto on behalf of the customers, including institutional customers) have at the moment the growing number of Assets Under Management

6. DAO — Delicious Autonomous Organizations

DAOs control now a larger and bigger amount of money.

For example, $22 Billion dollars are now held by the top 20 DAOs, but there are over 1 thousand DAOs out there!

Among the top 20 DAOs, you can find Balancer, Uniswap, Compound, Aave, MarkerDAO, Sushi, Tornado, BarnBridge and Achemix.

You can also find below a great diagram for the DAO ecosystem:

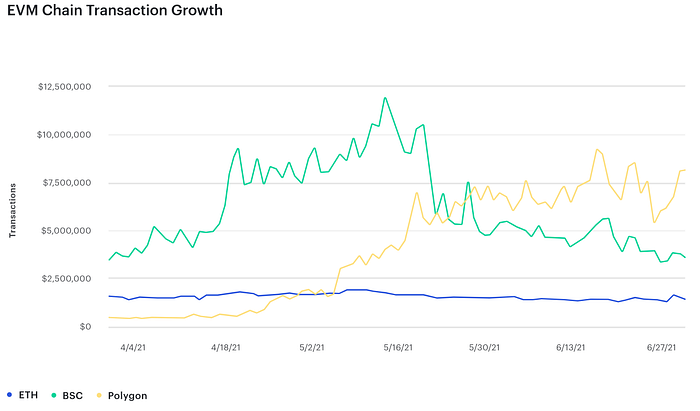

7. DeFi and Ethreum scalability

You may be asking yourself… can Ethereum, with its high transaction fees, be the solution and the problem for DeFi?

The answer for this is 2nd layer. Platforms like Polygon are solving the scalability issue. At the same time, more and more projects s build on BSC — Binance Smart Chain.

Now that we are reaching the end of this article, what’s your truth or dare question for DeFi?

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.