Doc's Daily Commentary and Watchlist

Mind Of Mav

Anticipating The Structural Shift In Crypto

Sentiment in the crypto markets has flipped to more positive tones as global market cap keeps above the $1T mark.

Majors hover above key lines such as BTC’s $20k which is currently trading at $22.2k on Monday morning.

For several weeks, beta has been consolidating within tight channels with BTC now breaking above its own signalling potential bullish momentum medium-term.

Technicals like RSI were showing growing momentum build from oversold conditions while price chopped around.

However, it’s not clear if it’s the strength of the cryptoasset market or the (temporary?) retreat of the macro headwinds at play. Simply looking at global spot volumes paints a dreary picture with lower peaks and lower lows being flavour of the year.

We have also yet to see on-chain indicators signal medium-term price reversal including Bitcoin hash ribbons which considers the continued fall in miner hash power despite rising spot action. Once that reverses only a ‘buy’ signal indicating more sustained price action can occur.

All eyes were on the dollar index last week as high US CPI prints, potential inbound hawkish central bank moves, and global demand for the greenback pushed the indicator higher.

Now DXY is retreating from overbought levels which is giving crypto assets some breathing room – perhaps before another leg up resumes.

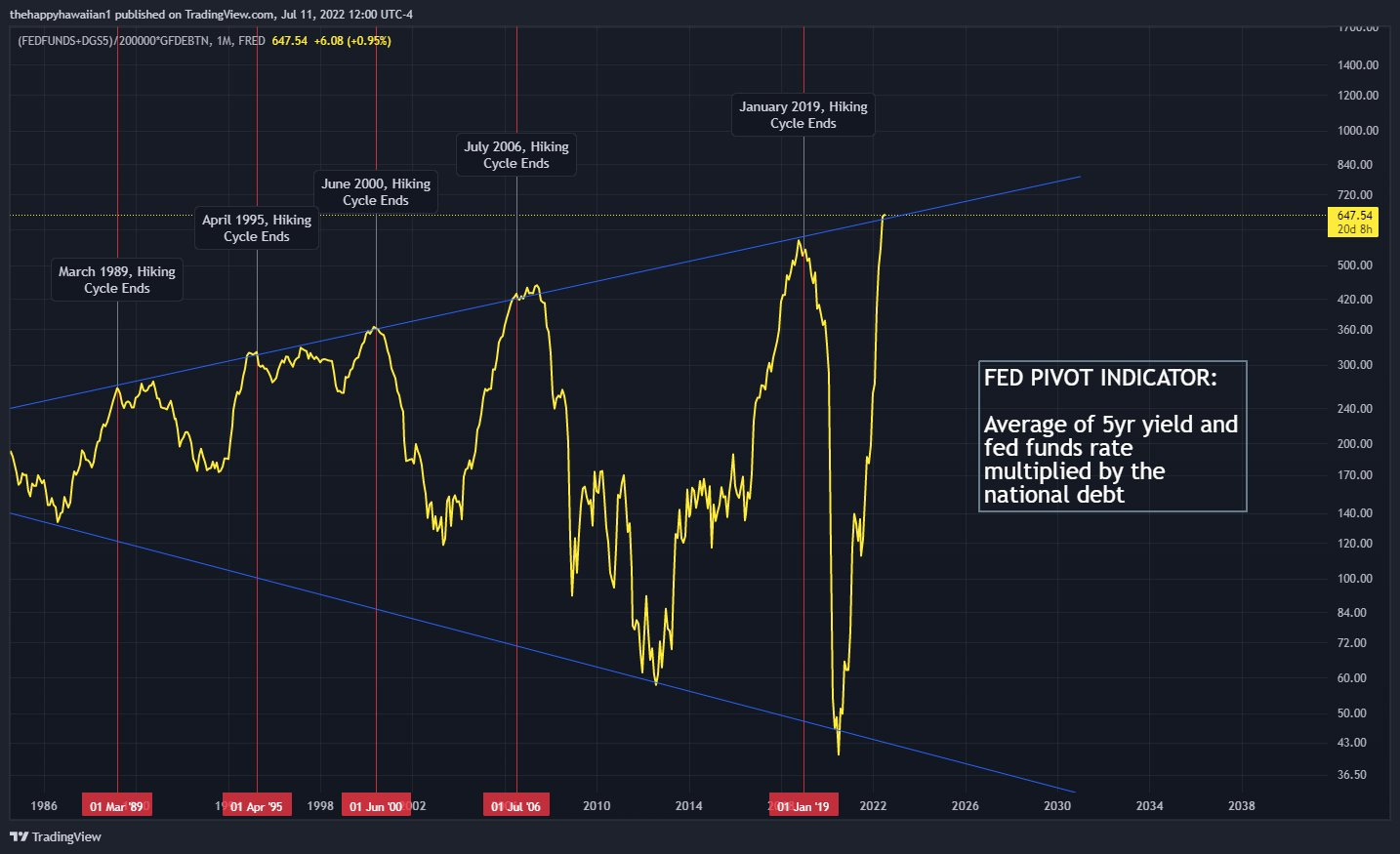

As earnings growth for equities is slowing, concerns more recently by the market have been centred around the ability to reach 3% terminal rates while the short-dated treasury bond yield remain high.

As the cost of providing high yields become more untenable, we would be at the point where The Fed would halt rate hikes and look to begin easing once again.

To ensure the US government doesn’t enter a debt death spiral, The Fed may soon look to issue more instruments to fund interest (and essentially pivot from current course). A change in course would be conducive for risk assets including cryptoassets.

While you could argue that macro signals like dollar weakness is likely simply boosting risk assets in general, recent moves in the cryptoasset market are notable ones. Factor in the possibility of a Fed pivot within 6 months and these moves become even more interesting.

ETH Merge

A key driver of optimism has been centred around Ethereum and its upcoming merge.

ETHUSD is fast approaching its 2001 support lines once again. The strength of ETH, which is up 26% on the week, is so strong its outperformed the wider crypto market by 21% for the past 6 days.

On its BTC ratio, ETH has already broken key resistance (0.064) and it’s likely that this relative performance may signal to both institutional and retail traders the merge momentum trade is well underway.

Search indices also indicate web traffic picking up as price picks up too and supports the idea that headline and social discussions may help drive momentum further. Of course, indicators like these are backwards looking.

For Grayscale’s ETHE trust, the discount has narrowed significantly (-25.5%) and indicates a growing demand for ETHE shares over the past week supported by strong volumes on the secondary market. The ETHE discount appears trade in line with ETH/BTC for now.

Finally, applying a Metcalfe’s law +++ model (active addresses*on-chain volume) shows no notable increase in the model’s value over the past week. In other words, recent price rallies appear to be momentum (catalyst) driven vs. fundamentally driven.

The divergence seen between MCAP and the model value may be attributed to the launch of layer 2s where the divergence coincided with L2s seeing >$1B in ~March 2021.

It’s clear that momentum around the merge is starting to pick up but what is less clear is if this is a relief rally in the broader down market we have been so used to in 2022.

For now it, it appears likely that capital is chasing momentum after a prolonged period of market inertia and time will tell whether now marks a more fundamental structural shift.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.