Doc's Daily Commentary and Watchlist

Mind Of Mav

A Recession Without Mass Layoffs?

Outside a handful of announcements at some high-profile tech companies, layoff activity across the economy remains near record-low levels.

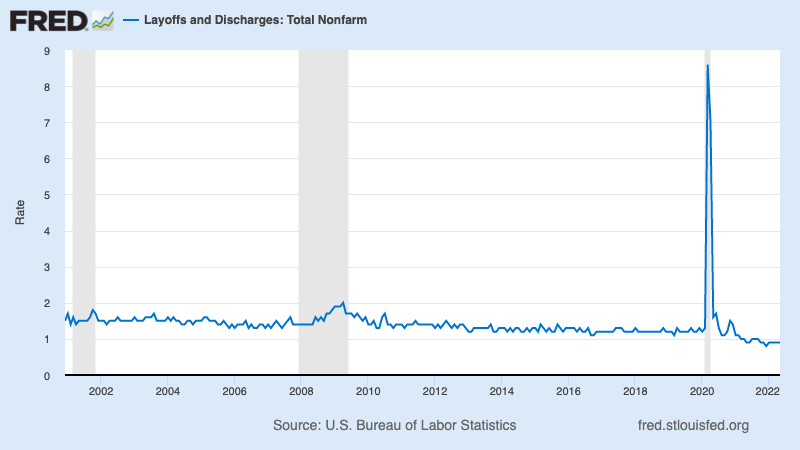

According to Bureau of Labor Statistics (BLS) data released Wednesday, the layoff rate (i.e., layoffs as a percentage of total employment) was just 0.9% in May.

“Prior to the pandemic, the all-time low for the layoff rate was 1.1%,”1 Nick Bunker, economic research director at Indeed Hiring Lab, noted. “May was the 15th straight month the layoff rate was below that level.“

This might not be what you’d expect with economic data slowing. In fact, the Bureau of Economic Analysis says GDP contracted at a 1.6% rate in Q1, and the Atlanta Fed’s GDPNow model is pointing to a 2.1% contraction in Q2.

“If the labor market were quickly and suddenly taking a downturn, we would see employers’ demand for new hires drop and their willingness to let workers go increase,” Bunker said. “For now, we aren’t seeing a sudden move in either direction.“

Employers want to hang on to workers

JPMorgan economists, who slashed their GDP growth forecasts last Friday, had something interesting to say on the matter (emphasis added): “Our forecast comes perilously close to a recession. However, we continue to look for the economy to expand, in part because we think employers may be reluctant to shed workers, even in a period of soft product demand.”

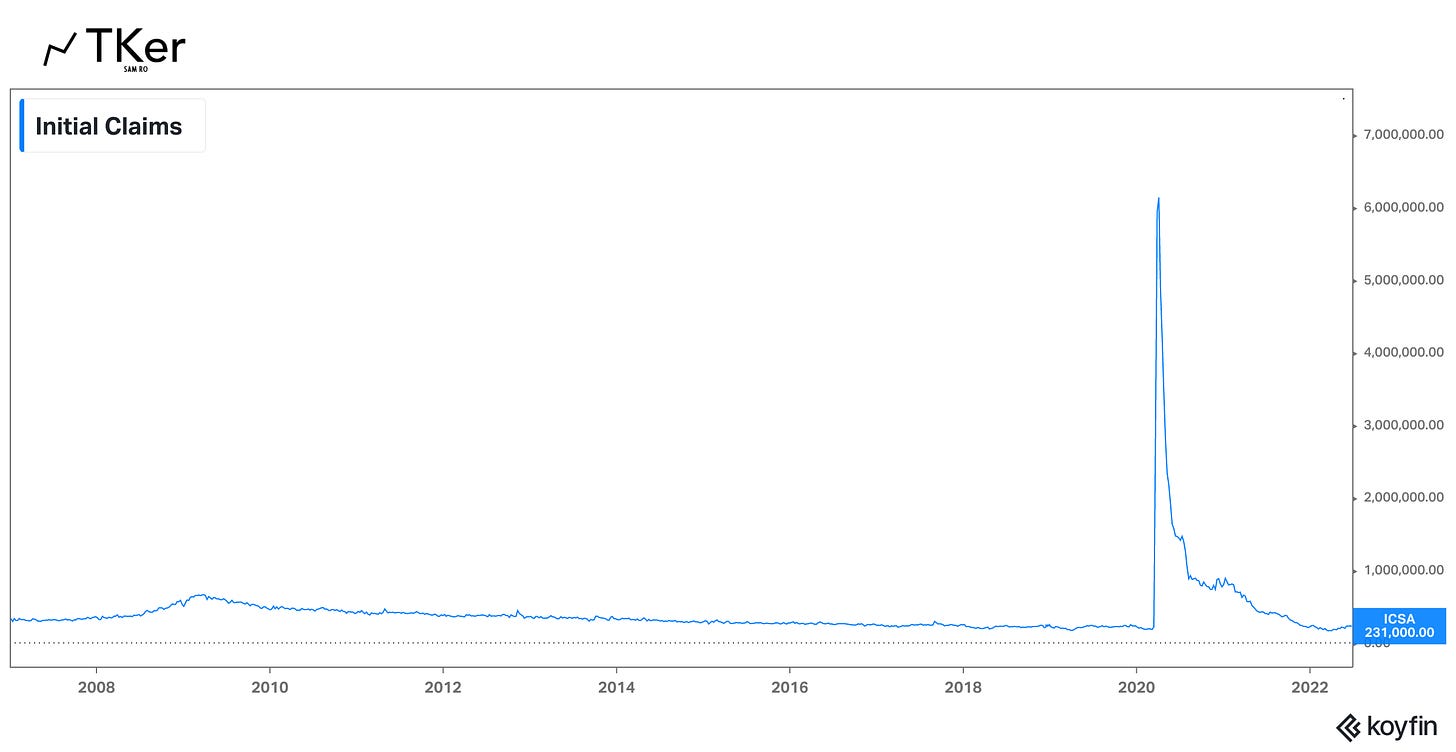

They pointed to how weekly initial claims for unemployment insurance, while above a six-decade low of 166,000 in March, remain depressed at levels associated with economic expansion.

And it’s not just the absence of a significant uptick in layoffs or unemployment claims.

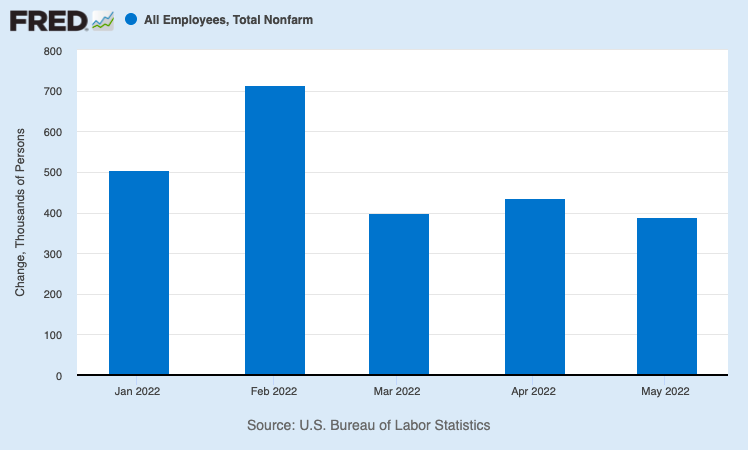

The U.S. economy continues to add jobs at an impressive clip.

U.S. employers added a whopping 2.34 million jobs in the first five months of 2022 alone. And economists estimate another 275,000 jobs were added in June. (We’ll find out more when the BLS releases that data on Friday.)

Why this might be happening

When growth is slowing or contracting, you expect companies to trim headcounts in their efforts to preserve profits. It’s certainly what happened at the onset of the coronavirus pandemic, when employers cut 22 million jobs from February through April 2020.

So what explains the current reluctance to shed workers?

Maybe recent experience has something to do with it.

Much of the ongoing economic recovery has come with persistent labor shortages. Employers haven’t been able to hire fast enough to keep up with the booming demand for their goods and services.2

At least some of the employers seeing business slow right now remember how hard it was to recruit talent over the past two years and would rather just hang on to employees, even if it comes with carrying costs.

Assuming any economic slowdown or recession is short-lived, it’s arguably a sensible move especially with the recruiting environment remaining challenging. According to the BLS data released Wednesday, there were 11.25 million job openings in May. That compares to the 5.95 million unemployed during the same period. With nearly two job openings per unemployed person, this is a very tight labor market.

By the way, laying people off isn’t necessarily cheap. Many employers continue to pay salaries and provide benefits for weeks or months after laying off employees. And hiring isn’t cheap, either. Employers have to spend a lot of time and resources to recruit and train new employees.

In the long run, it may be cheaper to just hang on to employees during this lean period.

History is not on the worker’s side

While dislocations in the labor market continue to favor workers, there’s certainly no guarantee that dynamic will last forever.

If we do head into a recession and if that recession gets deep enough, then the layoffs should come.

Indeed, history shows there have been recessions that saw employment grow for months before eventually succumbing to the invisible hand.

Liz Ann Sonders, chief investment strategist at Charles Schwab, explored this: “…many often ask how recession can be close when jobs are still being created, but reality is payrolls are coincident with economic growth, often contracting when recession had already started… For example, in 1970 recession, payrolls didn’t peak until March 1970, 3 months after recession started … in 1973 recession, payrolls didn’t peak until July 1974, 7 months after recession started.“

The big picture

While the near-record level of job openings represents a massive economic tailwind, it also helps to explain why we have high inflation. That’s why the Federal Reserve is actively targeting the metric in its effort to bring down inflation.

The good news is that the Fed, so far, appears to be succeeding in its effort to cool the economy without seeing unemployment surge.

The unanswered question is how soon it will be until we get “clear and convincing” evidence that inflation is on its way lower, because we’re not there yet.

Until we get that evidence, expect the Fed to continue to put the brakes on the economy. The longer this goes, the more likely it becomes that people start to lose jobs as part of the economic pain required to rein in prices.

“There will be a time when the U.S. labor market takes a downturn, jobs are shed at a higher rate and workers stop quitting their jobs,” Indeed’s Bunker said. “But that time has yet to come. The labor market remains very tight and very hot.“

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.