Crypto Market Commentary

8 March 2020

Doc's Daily Commentary

The 3/4 ReadySetLive with Doc and Mav is listed below.

Checkmate's Corner

Applying Onchain Analysis Part I

On-chain analysis is pure edge.

Traditional markets are unfortunately almost completely devoid of fundamentals (perhaps with exception of the bond market) with most responding strongly to central bank policy announcements, rather than actual performance. The challenge for retail investors is that we have almost no chance beating the institutions in front running and catching undervalued gems before it is priced in.

Retail is always second in line.

Cryptocurrency markets flip this on it’s head. Not only are we in this market before the institutions, but the markets are open all day with no favoritism (relatively speaking). Sure there are still whales and price manipulation, that is never going away. What we do have, is a leg up and a relatively fair playing field.

On-chain analysis is our strongest toolkit to beat the crowd. It is most powerful when applied alongside the Monthly, Weekly and Daily timeframes. In general, it is best used to set your Macro bias which you can then carry with you into the lower timeframe trenches of the price charts. This piece will cover some of the categories of On-chain indicators, how to apply them and where you can source charts and data to use them.

I will focus primarily on Bitcoin as it has the most robust toolkit available. Future articles can focus on Decred and Ethereum which are the only other two with enough of a heartbeat to make on-chain analysis worthwhile. This will be the first part as there are so many on-chain indicators, it takes a while to absorb them all!

These indicators generally look at current price performance and compare it to historical extremes from previous cycles. Given the halving cycle is 4yrs like clockwork, we can make a reasonable assumption that this asset will go through the same cycle of capitulate > disbelief > bull > euphoria > disgust > repeat in 4yr increments which shows up in almost all of these metrics.

ON-CHAIN VALUATION MODELS

The first category is a what I call fair value models which can be used to set a basis for the centre of gravity of price. Based on probability, these models are basically where we can expect price to be attracted to over macro timeframes. When price deviates too far above or below, we can expect it to snap back towards the centre of gravity.

What is powerful is to look for a confluence where multiple models line up at the same approximate price range.

STOCK-TO-FLOW MODEL

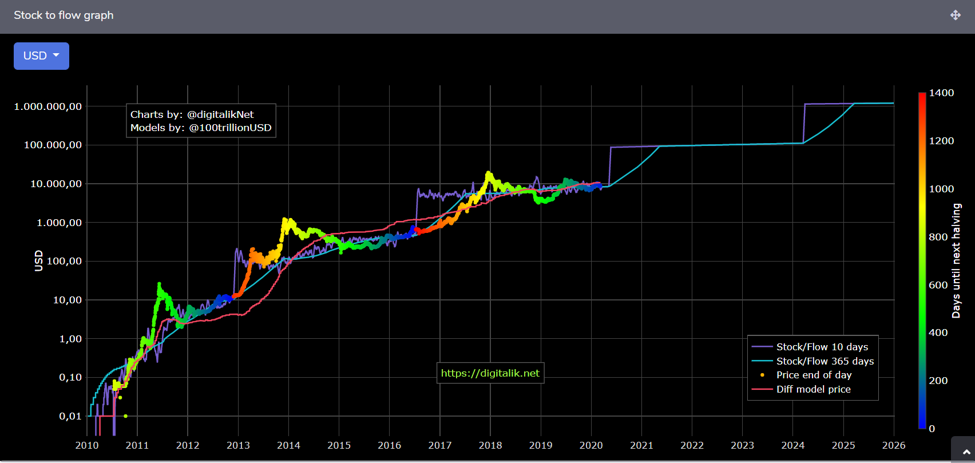

Plan B’s model has shown to be very high signal to date and is one of the best fair value models.

https://digitalik.net/btc/

This model indicates that a price of around $8200 is expected through to the halving and we usually see price converge to the S2F estimate on that date. Beyond that, who knows but the supply shock will occur whether the government, coronavirus or the greens activists petitioning against mining like it or not. The 365 day average is also shown to smooth out the estimate post halving.

The S2F Multiple is basically a ratio between the estimated price and the actual price. This shows the potential energy to ‘snap back’ to the model when price deviates significantly in either direction. In the chart below, we can see that at the halving events (blue) price converges to a multiple value of 1.0 before expanding. Consider this akin to the chop index reaching full spring energy before being released post halving.

https://digitalik.net/btc/sf_multiple

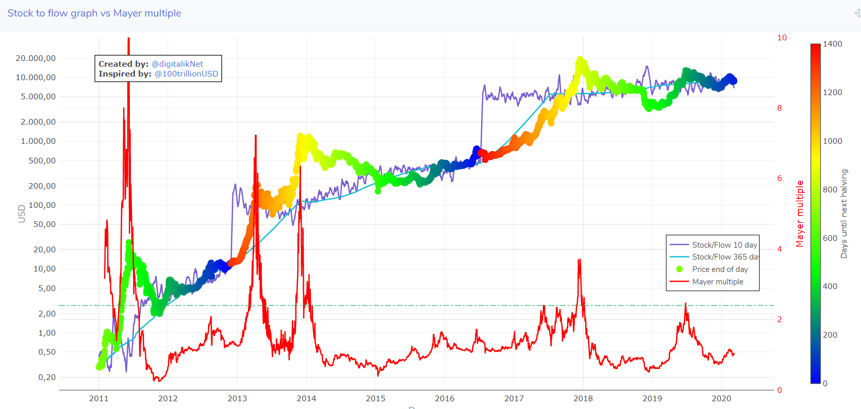

200D MOVING AVERAGE AND MAYER MULTIPLE

Similar to the S2F model, the 200D MA is one of Bitcoin’s magic lines. It is a centerline for the macro bull-bear shifts, acting as support and resistance and often a point of oscillation as the spring gets wound tight.

Historically, a Mayer Multiple (ratio of price to 200DMA) above 2.4 is a strong signal to take some value off the table and a value of 0.6 to 0.8 is a strong add point. This can be used as a ‘buy the dip indicator as well during bull markets, basically indicating that price has returned to touch or dip below the 200DMA and should bounce.

The reverse is true in bear markets when price is usually below the 200D and rallies are best sold into when they touch the 200DMA (Mayer multiple of 1.0).

https://digitalik.net/btc/mayer_multiple

Digitalik also has a Mayer Multiple bands which act similar to Bollinger bands and show periods of over and under valuation. Fairly intuitive, buy in the green zone, sell in the red zone.

https://digitalik.net/btc/mayer_bands

CYCLE LOW

Another set of tools which will be coming into good use shortly is measuring how far into a trend we are. So far, we have had two bull markets which I assume very few of us experienced more than half of one before getting slapped with an uber bear for our troubles.

The most intuitive metric is the cycle low. What is the current price appreciation since the capitulation point. Now the selection of the capitulation price is subjective and is only clear in the rear view mirror but we can quickly see that the price trend is similar across the last two bulls.

Keep note that the angle of ascent is shallower on Era 2 (2015 to 2017) than the early years of 2009 to 2012. Tis trend shows up in many indicators as the volatility and slowness of the asset increases with bigger liquidity, more participants and higher prices.

The chart below shows that, again, leading into the halving has been very similar for all eras and to be honest, gives credence to both the S2F and 200DMA fair value models. After that, it gets abit more wild and unpredictable

https://digitalik.net/btc/cycle_low_multiple

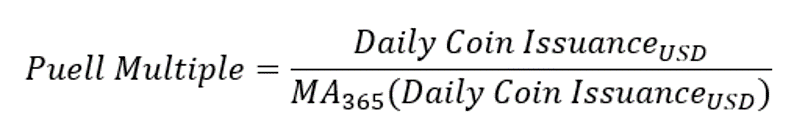

PUELL MULTIPLE

The Puell Multiple is targeted at the supply side miners who acquire BTC for power and then need to sell to recuperate their operating expenses. It is a simple formulation as the ratio of USD value issued to the 365D moving average of this value. When miners are being issued with much more value than their yearly average, the Puell Multiple will be high and at values greater than 5, has historically been market tops.

Conversely, when miners are being issued with substantially less than their yearly average, it indicates miner stress and potential undervaluation. Values below 0.6 have historically been strong buy points and often occur during capitulation and after immediately the halving.

One can also see trendlines emerge in the Puell Multiple which once broken, can indicate a trend reversal.

The original paper for the Puell Multiple and the chart are here:

https://medium.com/unconfiscatable/the-puell-multiple-bed755cfe358

https://digitalik.net/btc/puell_multiple

CLOSING THOUGHTS

On-chain analysis is an expanding tool-set. This will be the first of a few parts looking at some key indicators and has inspired me onto a few new tasks. One, I will compile a Masterclass that runs through a full suite of indicators, how to use them and where to find them. Second, I will develop a cheat sheet for RSC members only which you can use through the bull market to hopefully buy the best dips and sell the strongest tops.

Finally, I will be updating my charting suite and posting more regular updates on what I am seeing out there in the wild. Stay tuned for more metrics for DCR as well which is gradually developing a very robust toolkit.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

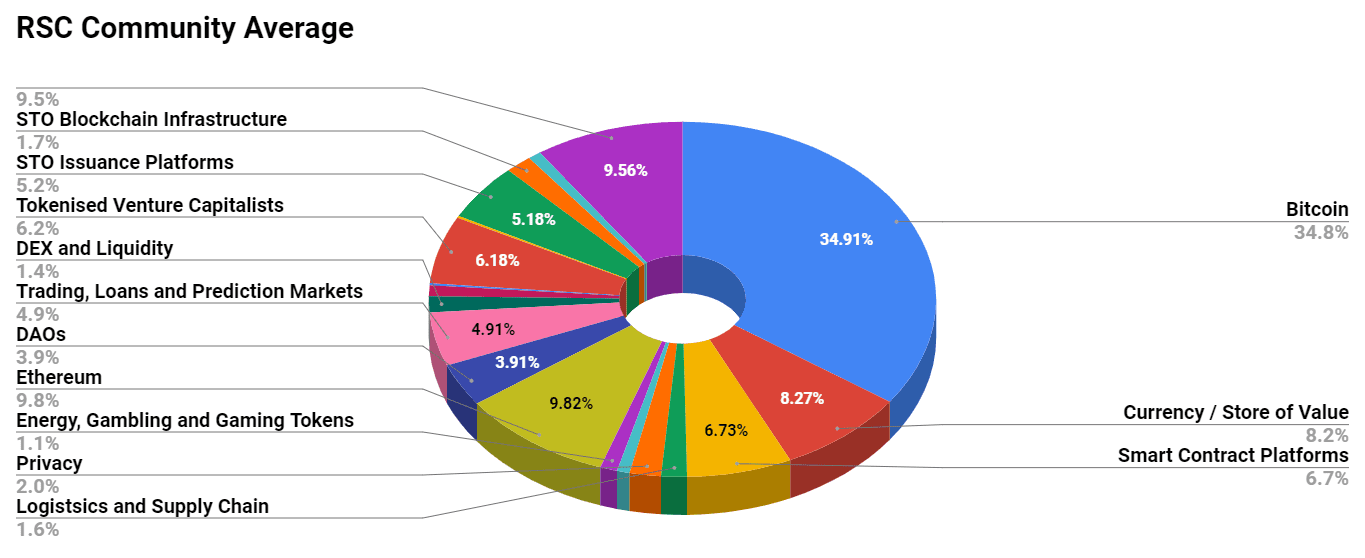

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

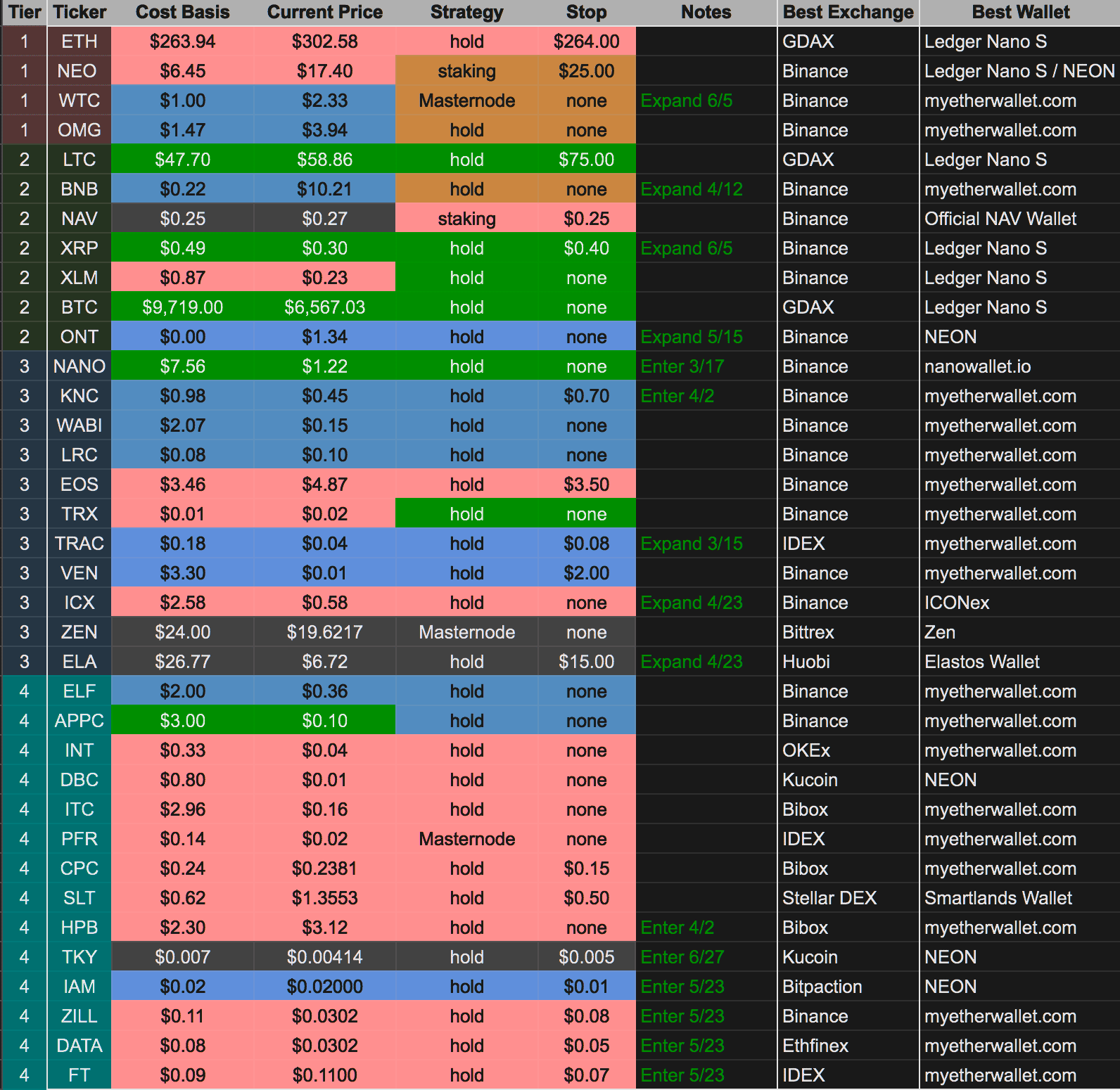

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)