Doc's Daily Commentary

Mind Of Mav

Crypto In Times Of War

The war has brought many truths to the surface: how our political leaders cannot be relied upon, how you can lose everything in a jiffy, the depths to which greed can go, the extent of lies that can be peddled—and how no currency is impervious to shocks of war, with the possible exception of Bitcoin. Wars are like the looking glass. Many things that are hidden or overlooked in times of “normalcy” become self-evident in times of war, if you look properly.

Bitcoin has, so far, played a crucial role in the ongoing Russia-Ukraine war. Whether one considers the role of Bitcoin and other cryptocurrencies as positive or negative depends on the onlooker’s bias. But that its role has been important is undeniable.

Ukraine Gets Help in Crypto

Wars mean the collapse of societal structures. These structures include everything we take for granted every day. The financial system, electricity, internet, essentials, everything is upended in times of war. So, even if you have money in your bank account, you may not have the possibility of transferring that money to someone because the bank’s servers are down. Or, you are stuck in a bomb shelter that you can’t leave.

In this scenario, though Bitcoin and cryptocurrencies, in general, cannot help hedge all the risks of war, they definitely do help hedge many such risks. One of the most evident examples of this is Ukraine receiving millions of $s worth of aid in cryptocurrency, Bitcoin making up a large part of it.

“Cryptocurrency analysts say at least $13.7m (£10.2m) has so far been donated to the Ukrainian war effort through anonymous Bitcoin donations.” – BBC

The advantage of donations via crypto is that the amount can be transferred within minutes, and does not rely on the banking system for this. So, there are fewer hands to be exchanged and a short lag time in which something can go wrong. In dire situations, receiving aid at the right time can mean the difference between life and death. Crypto helps hedge this huge risk.

The Ukrainian government created a brand new portal for anyone to donate to them in a matter of days. It accepts all major cryptocurrencies. The funds are utilized in the war effort for holding the defenses, as per ministers in the Ukrainian government.

Common people of Ukraine who are feeling due to the war have found some restitution via crypto transfers as well. In uncertain times, with a vulnerable financial system, many common Ukrainians have moved to BTC and other cryptocurrencies to secure their financial well-being and also to be able to leave the country.

As War Wages On, BTC Only Goes Up

The fall of the Ruble with the onslaught of economic sanctions on Russia was probably the start of a slippery slope, one which will affect the world economy in myriad ways. As the war continues, and inflation skyrockets in some of the world’s major economies, Bitcoin has only gone up since the start of the war.

There could be several possible reasons for this:

1. It is not exactly Bitcoin going up, but rather the Dollar getting de-valued

2. Huge transfers in Bitcoin for aid to Ukraine are pushing up the value of Bitcoin

3. With sanctions galore, more people are moving their Bitcoin, and/or buying Bitcoin as a lifeline

Even though it is a combination of all these factors and perhaps a few more that push the value of Bitcoin up through this catastrophe, the very fact that in a time when other financial systems are collapsing, currencies are crashing, Bitcoin is going up. This shows that more people are placing their trust in Bitcoin and using Bitcoin as soft insurance against the calamitous financial events of the world.

With SWIFT and Big Tech Bans Pouring in, Common Russians Move to Crypto

While the NATO countries galvanized into action with every type of sanction on Russian oligarchs and government, big tech enforced their own set of sanctions, in the process crippling normal life for many Russians who neither support the war nor have anything to do with it.

As an example, GPay and Apple payments stopped working all of a sudden in Russian cities, leaving people stranded. SWIFT ban was one of the first few sanctions to be put into effect, to financially isolate Russia from the rest of the world and sabotage their international trade and the Russian currency.

While we can argue that the sanctions were the proportionate response to the war, there is very little rationale in big tech moves to disrupt the lives of the common Russian people.

With this concatenation of financial irregularities, Russians have started to move to Bitcoin and other cryptocurrencies to hedge the looming financial risk. The collapse of the Ruble meant skyrocketing inflation and, worse, a wave of fear and pessimism in the Russian people. If the world leaders are underestimating the power of pessimism and fear in a country as huge as Russia, we clearly did not learn anything from the Great Depression.

Fortunately, unlike the Great Depression, this time we have Bitcoin. Though Russia passed a law regarding the legality of Bitcoin 2 years ago, it was not to be accepted as a method of payment. But it seems desperate times call for desperate measures. The war is changing many things, and this is possibly one of them.

As per statistics, roughly 11.9% of Russians own some type of cryptocurrency. Russia holds approximately 12% of the world’s crypto assets, estimated at $200bn. These are figures from before the start of the war. Current figures are unknown, but cryptocurrencies have shown enormous growth in Russia in the last few years, and the trend is expected to continue.

Russia Decides to Accept Oil Payment in BTC

Wars change the status quo. One such change that happened over the course of the Russia-Ukraine war is that Vladimir Putin has decided to accept payments for their oil and gas exports in Bitcoin from “friendly countries.” Other “unfriendly countries” must pay in Ruble, which has taken a dive. This policy of Russia clearly shows that even Putin believes in the power of Bitcoin to revive an economy and bolster a failing financial system.

“Russia is open to accepting bitcoin for its natural resources exports, the chairman of the country’s Congressional energy committee, Pavel Zavalny, said in a press conference on Thursday.” – Bitcoin Magazine

It is also important to note that many other countries have been buying oil and gas in currencies other than the Dollar. So, there is a change in the status quo bigger than just the war happening though at the same time.

In the future, countries (other than Russia) may choose to use Bitcoin as a payment method, thus initiating the global move away from the Dollar as the world’s default currency and toward Bitcoin.

While Government Sites Keep Getting Hacked, BTC Keeps Getting Stronger

Cyberwarfare is one of the unique features of the Russia-Ukraine war. Many cyberwar groups formed during the last month, taking down Russian websites, releasing data of Russian banks, and causing mayhem in the digital world for Russia. Ukraine as well has faced its share of cyberwarfare.

This raises pertinent questions about cyber security in turbulent times. What if the bank you use to store your money gets hacked and the funds emptied out? This is a legitimate and real concern for many people impacted by the war as of this writing.

Worth noting is that though cheesy scams did crop up on Twitter, Bitcoin itself did not collapse due to any cyber attacks, nor did it get disrupted due to the ongoing war. This is enough evidence to verify the claim that the decentralized, permissionless nature of Bitcoin really does make it a beast that cannot be brought down that easily. This is a crucial aspect of Bitcoin as a survival tool for many people around the world.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

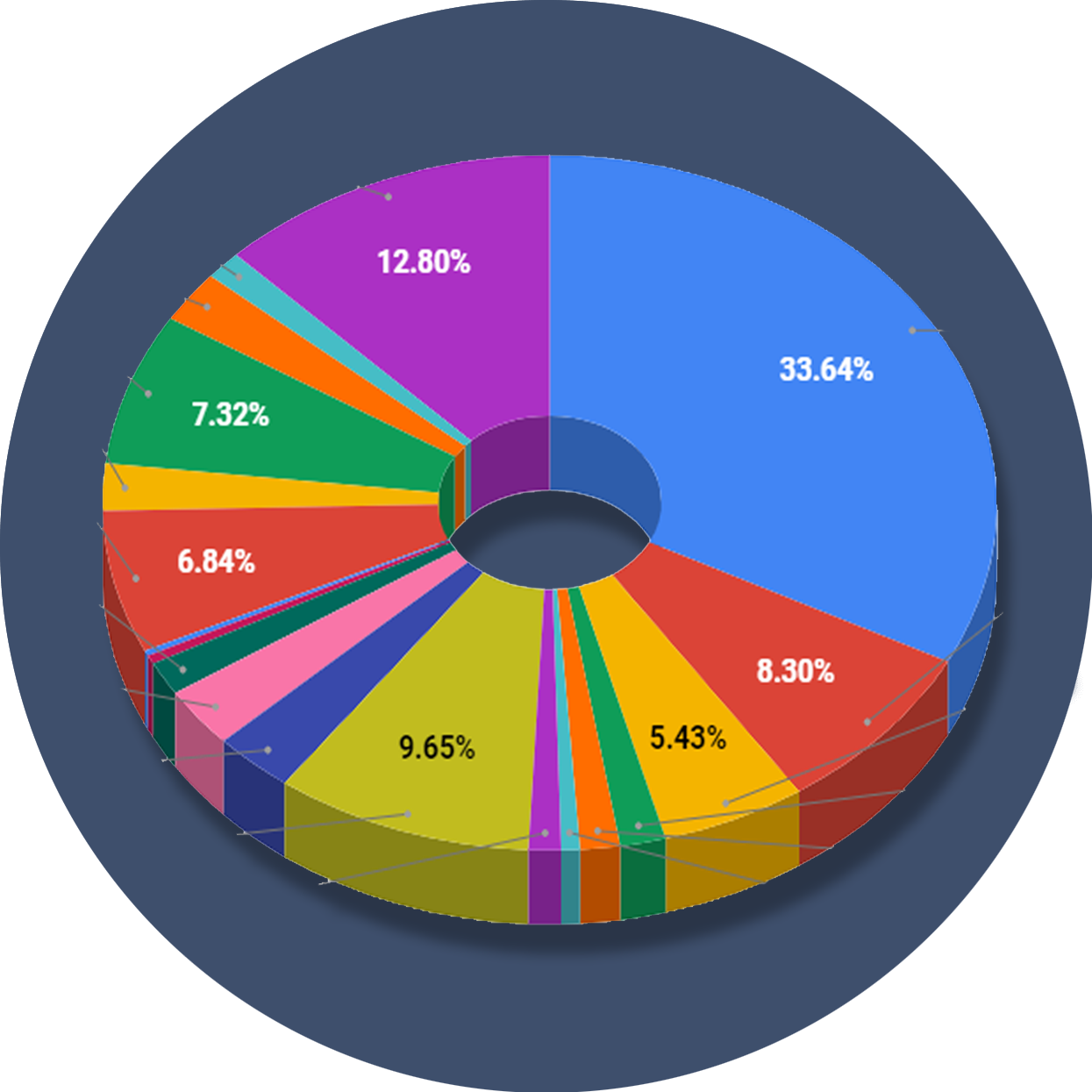

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

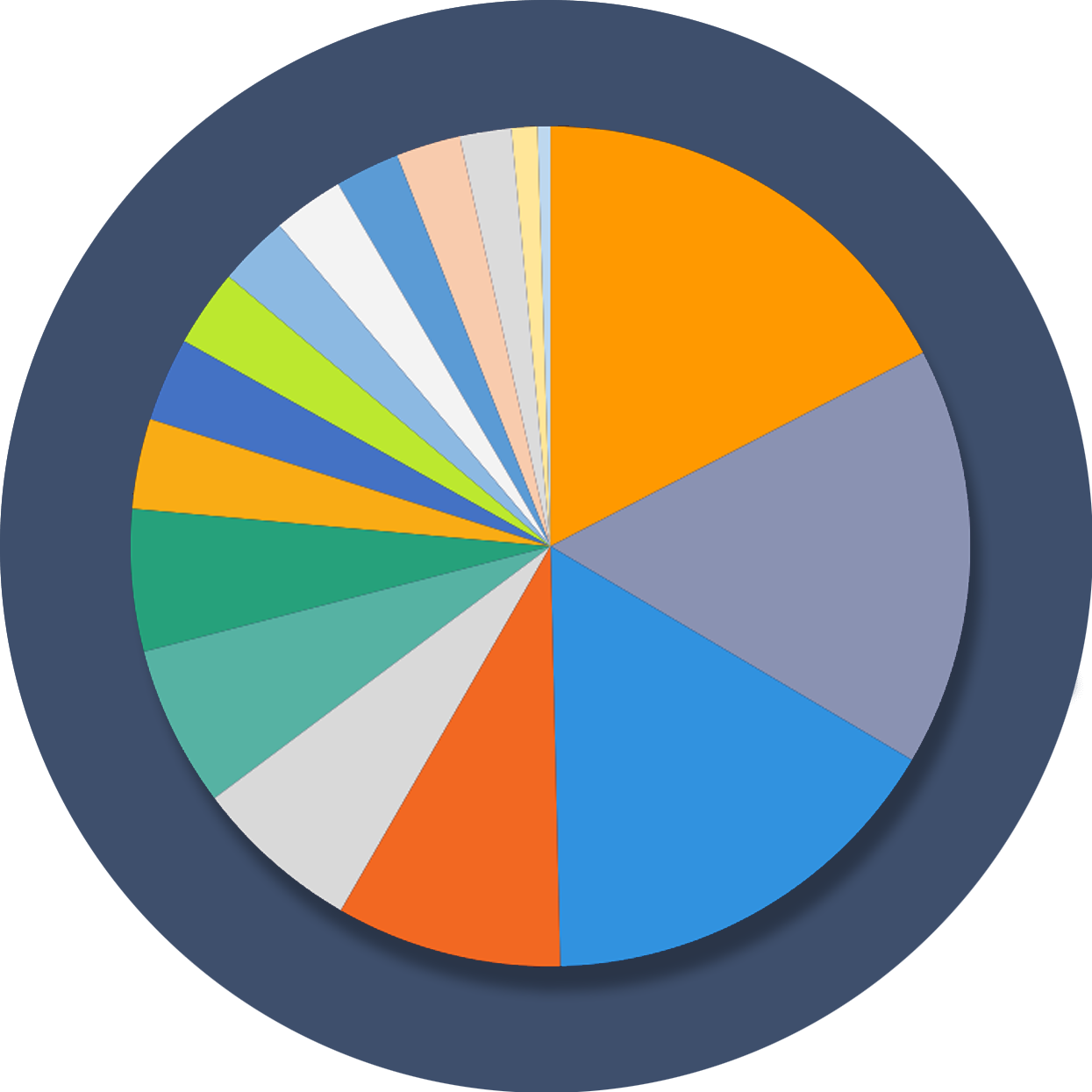

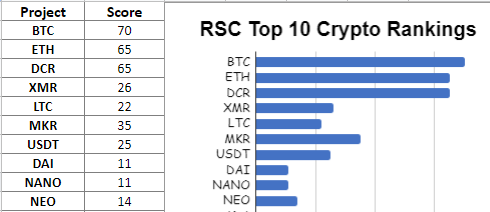

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.