Daily Trade Ideas & Trends

?

21 May 2020

Doc's Daily Commentary

Mind Of Mav

If Rates Go Negative, Will Bitcoin Go Positive?

For months, Donald Trump has been calling Jerome Powell to lower the Fed’s interest rates to zero. Jerome Powell ‘resisted’ as best he could, but the pandemic 2020 has clearly changed things.

In March, the Fed cut interest rates in two steps by a total of 150 basis points. Suddenly the door was open and the abyss stared back — Interest rates at zero were suddenly the norm, not the grotesque exception.

But for Trump, as with most things, it was not enough. He has often cited the example of the European Central Bank (ECB) operating with negative interest rates for several years now.

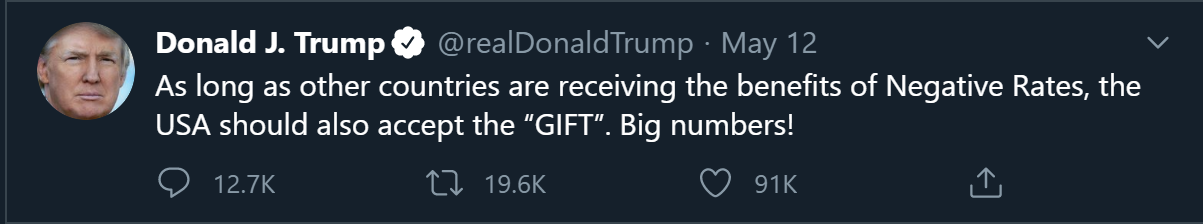

So, Trump is now calling on Jerome Powell to ensure that the Fed follows the example of the European Central Bank. He made another appeal in one of his many tweets:

This tweet clearly shows that Donald Trump considers negative interest rates a gift . . . but, as if often the case, fact is stranger (and more complex) than fiction.

Importantly, let’s tie this to why I think that the Fed’s implementation of negative rates would ultimately benefit Bitcoin, which is increasingly seen as the best hedge against the great monetary inflation that we are experiencing.

For the time being, Jerome Powell says that he is against the implementation of these negative interest rates. He reiterated this in his recent interview on the 60 Minutes program:

“I continue to think, and my colleagues on the Federal Open Market Committee continue to think that negative interest rates is probably not an appropriate or useful policy for us here in the United States.”

— Jerome Powell

Nevertheless, Jerome Powell was also against zero interest rates a year ago. We must therefore remain wary. Anything is possible in today’s world as the economic crisis of 2020 changes all the established codes.

Let’s now imagine for a moment that the Fed gives in to Trump and the financial markets by setting negative rates.

Let’s take the example of an American citizen who has $1,000 in cash to invest. Currently, by buying one-year U.S. Treasury bonds, he is guaranteed to get $1,000 back after one year. This is already not very exciting in terms of returns, especially since with current inflation you are already losing money in reality.

With negative interest rates, the investor wouldn’t even get back his initial amount. He would have $970 or $950 depending on the rates actually applied.

In fact, the purchase of U.S. Treasury bonds is no longer interesting for individuals. From a psychological point of view, this seems obvious. If you are told that you can have $1,000 today, or $950 guaranteed in a year, or ten years, what will you choose?

You will, of course, choose to keep your present $1,000 in order to make better use of it.

In a normal world, this would be a problem for the American government, which would not be able to find as many buyers as needed for its bonds. However, we live in a world where quantitative easing is king.

With its unlimited quantitative easing program, the Fed has already printed nearly $3 trillion. This money printed from thin air is injected directly into the monetary and financial system.

Since the Fed can print as much U.S. dollar as it wants, the Fed is able to buy U.S. Treasury bonds even though it is not making any money.

When money doesn’t cost you anything, you can afford to buy anything you want without looking at the returns.

These purchases by the Fed are reflected in the huge increase in its Balance Sheet, which shows +64% in just 10 weeks:

With its purchases, the Fed thus supports the American economy by allowing the government to continue to borrow a lot of money. More than $3 trillion has already been borrowed by the U.S. government since the beginning of the crisis, and a new $3 trillion stimulus package is currently being debated in the US Senate.

The U.S. public debt has already exceeded $25 trillion, and we are headed straight for $30 trillion at the current rate of progress.

Individuals, but also institutional investors, are looking for more profitable investments.

Naturally, they are moving into equities. So it’s no coincidence that the Dow Jones or the S&P 500 rebounded sharply from March 23, 2020 when the Fed lowered interest rates to zero.

Their focus is on technology startups like Tesla, Uber, or Spotify for example. The +128% increase in Tesla’s share price since the Fed lowered interest rates to zero clearly confirms this shift to equities:

Fortunately, the Fed still does not have the right to buy stocks directly as other central banks have the ability to do. But in the future, this may very well change. Former Federal Reserve Chair Janet Yellen confirmed that this could be a good thing that Fed could buy equities in the future during an interview for Squawk on the Street :

“It would be a substantial change to give the Federal Reserve the ability to buy stock. I frankly don’t think it’s necessary at this point. I think intervention to support the credit markets is more important, but longer-term it wouldn’t be a bad thing for Congress to reconsider the powers that the Fed has with respect to assets it can own.”

— Janet Yellen

Many people are pleased when stock prices on the stock exchange reach record highs. This may be true in some cases, but it is not always true. In this case it is not.

The stock market is far too high given the state of the real economy where the number of additional unemployed in the United States is approaching 40 million since the start of the coronavirus crisis.

In just a few weeks, the U.S. has gone from full employment with an unemployment rate of 3.5% to 20%.

Requests for bailouts from businesses are pouring in to the federal government. The federal government favors large companies, which will result in the bankruptcy of many small businesses. This will put millions of people in extremely precarious situations.

Added to this will be the great monetary inflation that we all have to face. It is the result, in particular, of the unprecedented increase in the outstanding money supply of the U.S. dollar decided by the Fed since it has been conducting its unlimited quantitative easing program.

As always in such a situation, it is the poorest who suffer the most like stated Jerome Powell in his interview for the 60 Minutes show.

Indeed, their wealth is composed mainly of cash, and they do not have the opportunity to protect themselves against currency devaluation by buying real estate, stocks, or gold.

As the theories behind the Cantillon Effect teach us, the richest will emerge even richer from this economic crisis.

This monetary inflation also aims to push small savers to spend their money to support American consumption. In the same way, borrowers are encouraged to borrow and to go further into debt, with this easy money policy conducted by the Fed.

The disconnection between the real economy and the market is, therefore, being confirmed.

The poorest people must, therefore, seek solutions to protect themselves against this great monetary inflation. So must institutional investors, even if they do so for another reason: to maximize their profits.

In this unprecedented context, Bitcoin appears to be the solution that will allow millions of people to protect themselves against monetary inflation. All you need to buy Bitcoin is a smartphone and an Internet connection. That’s all.

Because Bitcoin is divisible up to eight digits after the decimal point, anyone can get started, regardless of their budget. You can perfectly start buying $50 of Bitcoin per month. With gold, that’s impossible. So Bitcoin is a much better store of value for the masses than gold.

And this is also one of the reasons why the current situation will benefit enormously to the Bitcoin adoption in the coming months.

Unlike the economy, which is manipulated by the Fed and the U.S. government, which chooses which companies will be allowed to survive by granting them bailouts, Bitcoin is the only true free market in the world.

The Whales’ manipulations only affect Bitcoin’s price for short periods of time. By buying Bitcoin for the long term, you can protect yourself against it quite easily.

More and more people are realizing the advantages of Bitcoin. The Generation Z that is starting to enter the world of work sees Bitcoin as a unique opportunity to have a chance against a monetary and financial system that benefits especially those who have already accumulated a lot of wealth.

Bitcoin is going to be the standard for Generation Z.

The current economic crisis, and all the decisions that are being made by central banks and governments, is already setting the perfect stage for Bitcoin’s adoption to explode in the coming months.

By going even further, with negative interest rates, the Fed would be taking another historic step. Bitcoin would probably be the big winner in the end.

We can therefore better understand why Jerome Powell is so reluctant to answer Donald Trump’s recurring calls for negative interest rates.

But he will fold. It’s all a show.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.