Doc's Daily Commentary

Mind Of Mav

Is Ethereum Still A Good Play, Or Should It Be Avoided?

2021 was a fantastic year for crypto, in particular Ethereum. Ethereum reigns as the second-largest blockchain despite the slew of competition from Binance SC, Solana, Avalanche. But it remains far ahead showcased by various metrics, and there are no signs of slowing down.

So, is it still worth getting into? Or should it be avoided like the next plague? Let’s break it down:

Total Value Locked

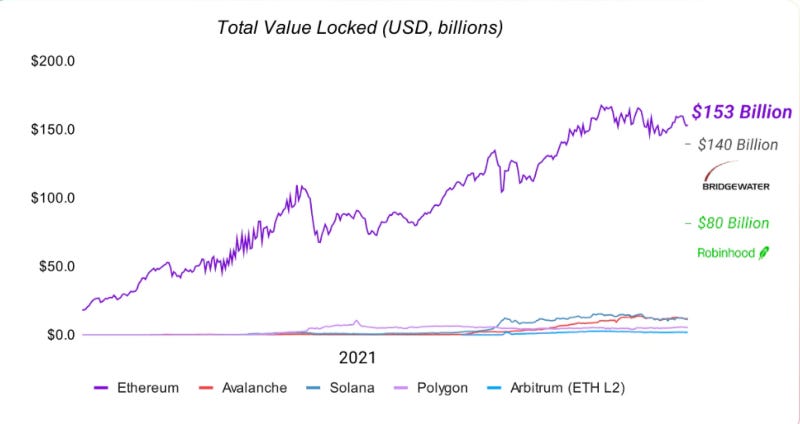

Ethereum ended 2021 with a Total Value Locked (TVL) of $153 billion and contains nearly 60% of TVL in crypto. Its nearest competitor Terra (LUNA) TVL, sits at $13.3b with 7% of the market. Despite the hype following emerging L1s they remain far from the king.

That said, Ethereum’s competitor’s are starting to catch up. The chart below shows Total Value Locked (TVL) across all chains, and you can see how Ethereum’s role as the king of DeFi has lessened over the last year while competitors have started to catch up in terms of product offering and community:

Revenue

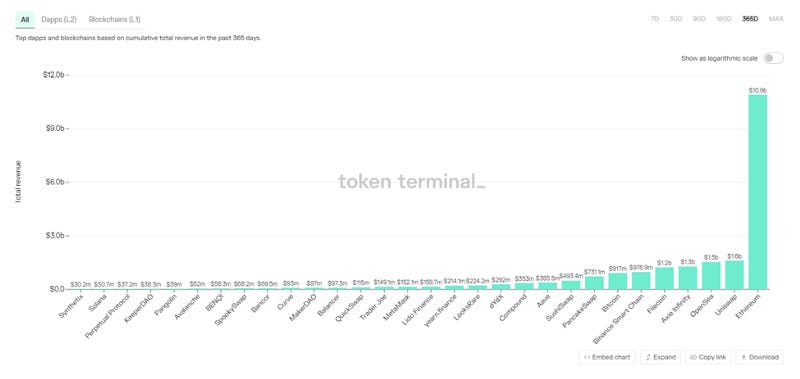

Ethereum showcased impressive revenue in 2021 totaling $10.9b. The nearest L1 was BSC, which edged on $1.0b of revenue. There are four projects on Ethereum that post larger revenue than BSC. (Filecoin, Axie, Opensea, Uniswap)

Opensea, an NFT marketplace on Ethereum, saw a revenue of $1.5b in 2021 with the emergence of NFTs.

Layer 2s on Ethereum

Layer 2 protocols are taking traction, benefitting from Ethereum’s reliability and security. In the future, Ethereum may be a consensus layer for an extensive array of layer 2s that inherit low gas fees and fast TPS speeds.

Some top names are Polygon (MATIC), Optimism, Arbitrum, Loopring (LRC), and ZkSync.

Creator Earnings

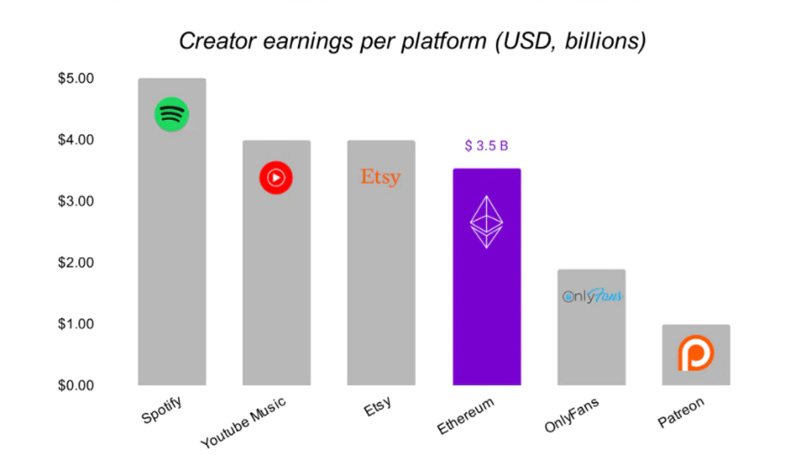

Typically, creators on centralized networks like YouTube, Spotify, Etsy, and OnlyFans, only capture a portion of the revenue they create. As the creator economy on Ethereum begins to evolve, many creators will start to see the benefits of capturing a larger percentage of value utilizing a decentralized network. NFTs for artists is a prime example. Ethereum, as a whole, competes with prominent names in creator economies.

Eth Burning and Deflationary Pressures

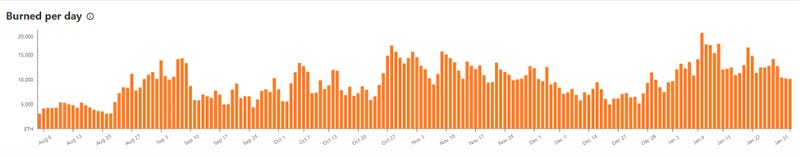

EIP — 1559 upgrade has been burned 1.7 million ETH

at a valuation of $4.6 billion since early Aug 2021. Before EIP-1559, all ETH would remain on the network. Now, supply decreases with every transaction.

Even though Ethereum remains inflationary, the increasing demand sees days of negative issuance. With ETH continuously being locked away, bought for speculation, and utilized for gas fees, Ethereum’s deflationary pressures will exceed new supply.

Those Dreaded Gas Fees

For the last year, Ethereum’s gas fees, used for transactions that power things like DeFi protocols and NFT sales, were notoriously high. However, recently Ethereum fees have fallen below $5 per simple transaction.

That’s down from circa $35 in November and May last year when ethereum’s price neared $5,000. It has fallen by circa 50% since, while fees have fallen 7x instead with more complex transactions, like Uni swaps, also down to $40 from highs of as much as $200.

Ethereum transactions have also fallen from the high of 1.7 million a day in May, to now 1.17 million transactions a day.Some of this reduction in fees and transactions may be due to an increase in usage for second layers, L2s. Arbitrum in particular is kind of taking off with $3 billion in assets on the optimistic rollup second layer.

A whole ecosystem now resides on it, with things like 1inch, Aave, Balancer, Curve, MakerDAO, Sushi, and pretty much almost everything you might need to defi. Some ethereans even claim they no longer use the base layer as things like Arbitrum provide all they need with far lower fees. More than 2 million eth now reside on second layers, up from 150,000 in August, a 10x increase in just months.

That amounts to 1.7% of Ethereum’s total supply, but of course much of eth’s supply is on cold storage or exchanges where it doesn’t interact much with the blockchain.

A better comparison might thus be with defi assets of 8.5 million eth, for which it amounts to 24%.

Thats a sufficient number to potentially start making a dent on network traffic, and that’s before zk based Ethereum Virtual Machines (EVMs) even launch. Starknet is already out there, but there is no bridge yet, while zkSync has not yet launched a zk-EVM.

Thus second layers are not being utilized anywhere near their full potential yet, but with $5 billion in assets already on such second layers, it may well be that the low fees era is here to stay at least for some defi players.

Conclusion

At the end of the day, Ethereum remains far ahead of its competition in almost all metrics. Moreover, it attracted the highest number of developers in 2021 that continue to build the ecosystem.

There are a few considerable negatives for Ethereum, no doubt. Ethereum is slow, and gas fees are still incredibly high comparatively. In addition, environmental mandates are beginning to add pressure to the “proof of work” consensus, which is still being prepared. But, Ethereum contains scheduled upgrades that will improve speed, lower gas fees, and see a switch to an eco-friendly “proof of stake.” Ethereum Consensus Network (formerly Eth 2.0) will be near completion in approximately one year.

So, what are we left with?

The largest and fastest-growing ecosystem in crypto

Significant deflationary pressures

The emergence of Layer 2 options

Dwindling supply

Hammered down ETH prices

Upcoming improvement upgrades to the network

The emergence of creator economy (NFTS, DAOs, music, writers, games)

It’s no wonder Cathie Wood and her team of quants forecast an ETH price of 180k by 2030.

2022 will be an important year for Ethereum upgrades. In the past, upgrades are often delayed and I expect no different this time. But, the process seldom detriments the network. So…

At its current price of ~$2700, Ethereum could be a complete steal, and far as the risk/reward ratio, it remains one of the best crypto investments.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.