Doc's Daily Commentary and Watchlist

Mind Of Mav

Hayes Reiterates $1MM BTC Price Target

Arthur Hayes, the former CEO of the cryptocurrency exchange BitMEX, strongly advocates for investing in Bitcoin and altcoins, especially in light of the current macroeconomic environment. In a recent post on X (formerly known as Twitter), dated December 14, Hayes expressed his firm belief that shorting crypto at this time is unjustifiable, emphasizing instead the wisdom of going long on crypto.

Hayes’ stance is influenced by the anticipation of the United States Federal Reserve potentially lowering interest rates in the coming year. This sentiment was bolstered by the outcome of the Federal Open Market Committee (FOMC) meeting on December 13, where Fed policymakers decided to maintain the current freeze on interest rate hikes.

The decision, largely expected by the market, was followed by a speech and press conference by Fed Chair Jerome Powell. Powell hinted at the possibility of a “pivot” in monetary policy, indicating that while the policy rate might be close to its peak for this tightening cycle, the progress towards the 2 percent inflation objective remains uncertain.

This ambiguity has led to varied speculations about the next FOMC meeting in January. According to the CME Group’s FedWatch Tool, the likelihood of an interest rate cut in March 2024 was estimated at 71.4% at the time of Hayes’ comments.

The Fed’s decision day has since attracted mainstream media focus on the growing optimism that U.S. monetary policy might start to reverse after an aggressive cycle of rate hikes. Echoing this sentiment, Hayes reposted one such news story, asserting that the resulting increase in liquidity would significantly benefit crypto markets.

Hayes firmly stated, “At this point, there is no excuse not to be long crypto,” criticizing the decreasing value of fiat currency and underscoring his confidence in digital assets. He also reiterated his bold prediction of Bitcoin reaching a price of $1 million, a forecast he attributes to the macroeconomic trends undermining national currencies.

At the time of his post, Bitcoin (BTC/USD) was trading at approximately $42,500, following some volatility at the day’s Wall Street open..

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

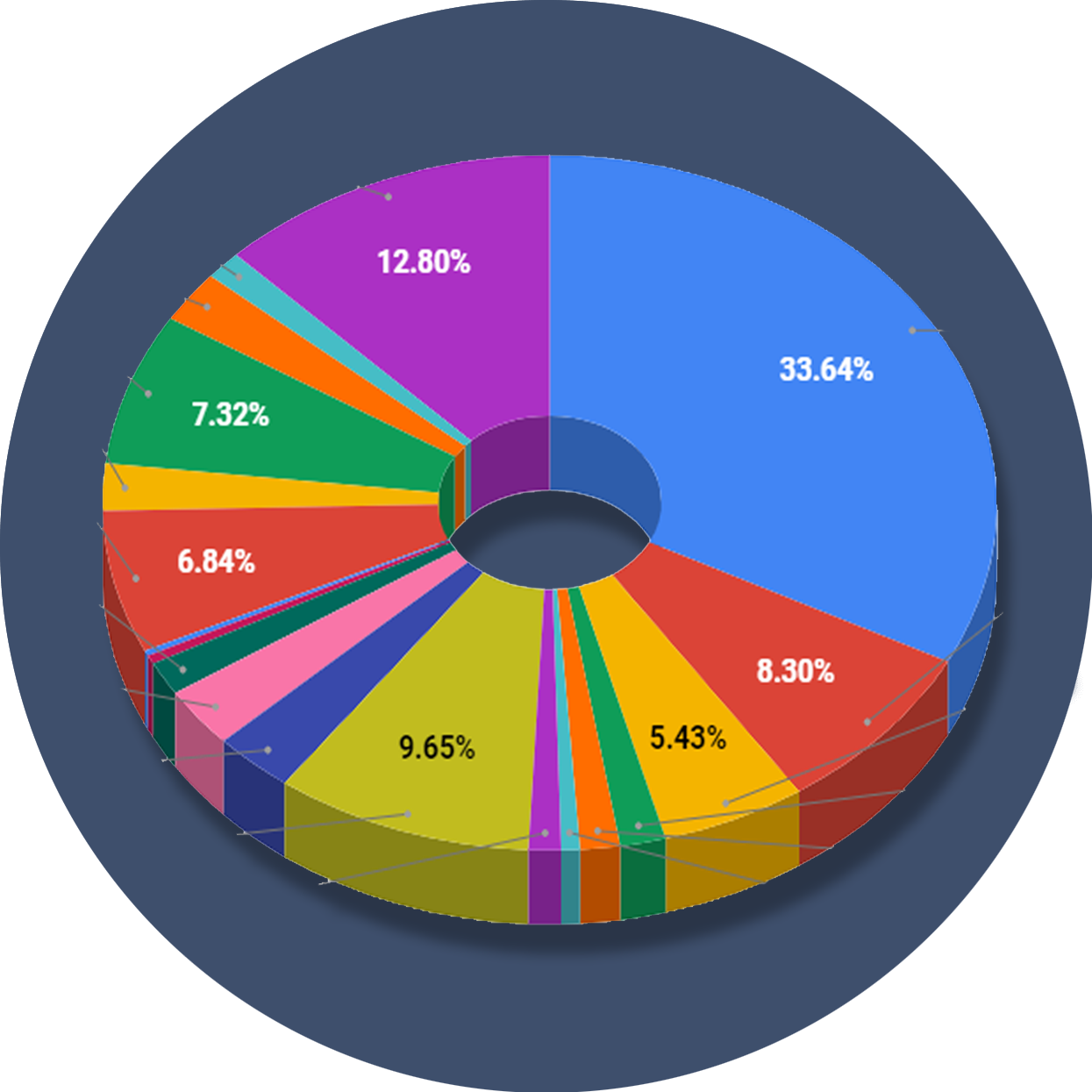

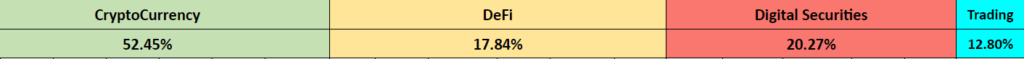

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

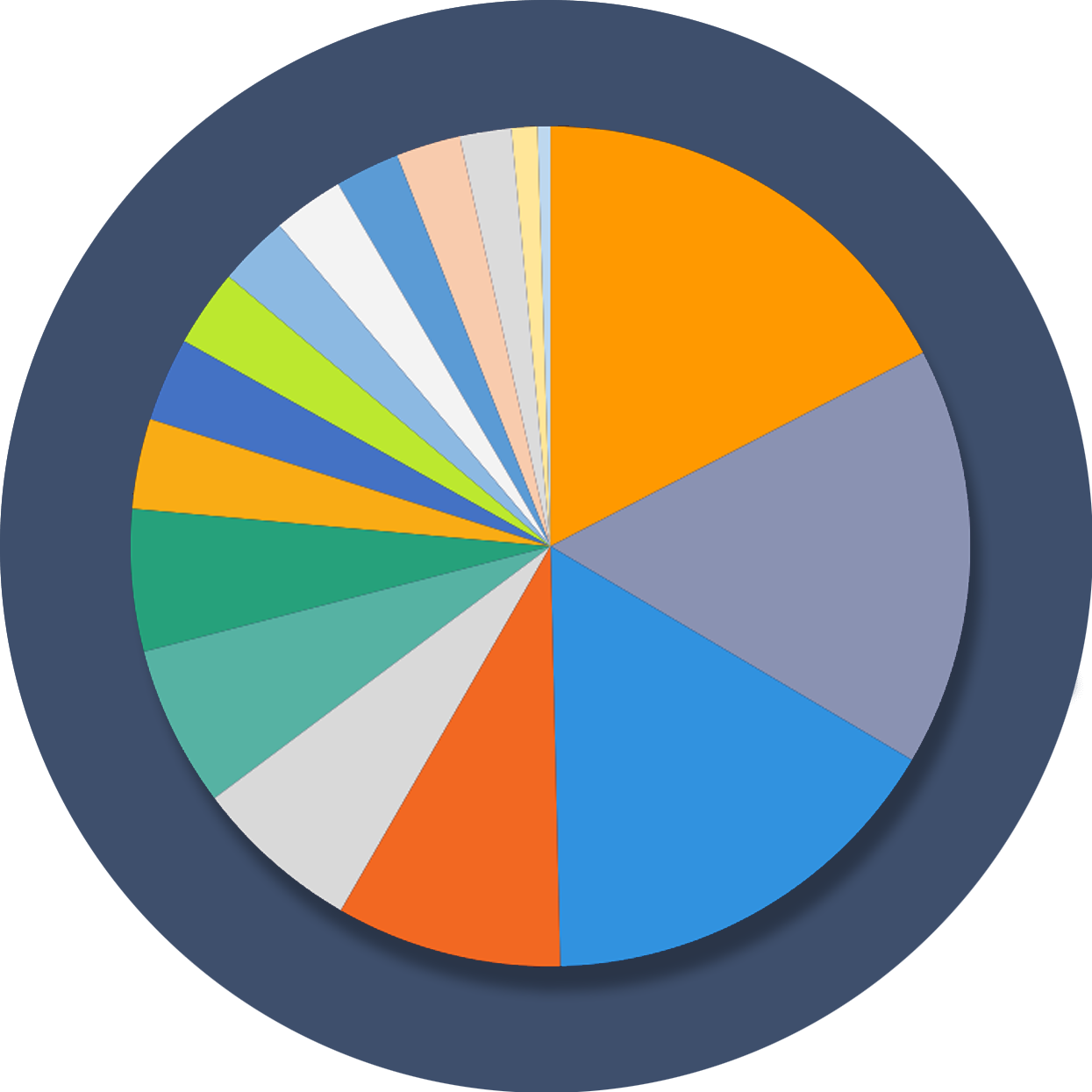

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.