Quick, what do you think is the number one way that most retail traders define success in their trading? While some might say “profits,” I think that the real answer for most people is “winning percentage.”

A high winning percentage appeals to everyone, because it’s a metric that everyone understands, just like a high batting average in baseball. We’re used to being measured in “percentage of success” whether it’s your credit score, your grade point average, or even the social credit score in China. A high score based on these metrics always gives one a feeling of pride and confidence.

But in trading, a high win rate might be the worst thing that you can shoot for. I realize that this sounds counter-intuitive, but if you stick around the profession of trading long enough, you’ll find that most things about it are unnatural and your “default response” from your earlier life experience is most likely costing you dearly.

Why then is shooting for a high win percentage a bad thing? Look, there’s nothing wrong with HAVING a high win rate, but TRYING to attain a high winning percentage will likely harm your profitability and your account balance. This is because there is a temptation to go for the easy wins, those low-hanging fruit trades where you can just grab a couple of sats and notch a win in your belt. But if you are going for those quick, small wins that drive up your winning percentage, there’s no doubt that your losers, when they occur, will be much larger than any winning trade, and will erase those profits in one stroke.

The way that most people go for a high win percentage is to take small profits when they’re available, and drive up their numbers. But the losses will always be larger in that scenario, even if they’re infrequent. In trading, we call this “eating like a bird, and crapping like an elephant.”

It’s what every retail trader does, it feels natural to go for that high winning rate, but it will absolutely work against you accumulating profits.

So what should you do? It might surprise you that professional traders are doing the exact opposite of the retail approach. They are using a concept called Asymmetric Risk/Reward. A professional investor will define a small amount of risk in order to make a disproportionately larger reward. Conversely, retail investors use asymmetric risk/reward, however they’re doing it in the opposite manner. They’re defining a large amount of risk to make a disproportionately smaller reward, and that’s all in the name of racking up a high win percentage. But one group makes a lot of money, and the other overwhelmingly loses money.

Let’s study the professional approach a little bit more and see how this works. Is it simply a matter of defining a small stop loss and blowing out your profit target to 5 or 6 times the stop amount? Well, yes and no. Creating the asymmetric risk/reward structure is important, but it’s also HOW and WHEN to set up your trade so that you’re creating the opportunity for a big “win” that’s perhaps even more important.

There are several ways that I can illustrate this, but perhaps the clearest way to prove this is through the HXRO gaming site where people are betting on whether Bitcoin will rise or fall over the next five minutes. Think about it, the probability of win or loss is about 50%, and for those of you that think that you can slap some oscillators on your chart to increase your win rate, I can prove to you that the win rate has nothing to do with your ability to create profits on this site.

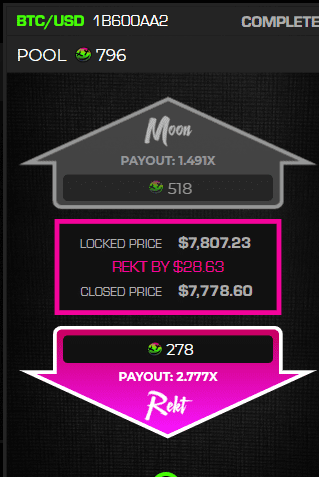

The asymmetric risk/reward is created in HXRO when you are going against the grain of everyone else. In this particular “card,” you can see that 518 traders thought that the price would go higher (moon), and only 278 thought it would go lower (rekt) – nearly 2:1 to the bullish side- so the payoff is about double for those that win if the price ends up lower in the next 5 minutes. The reason for this bull/bear disparity is usually (in this case) because there is a short-term rally in place, but in this case the “rekt” or bearish side won the card by a significant margin and their reward was double their risk. Going against the “crowd,” in this case, gave the bears a short-term risk/reward edge.

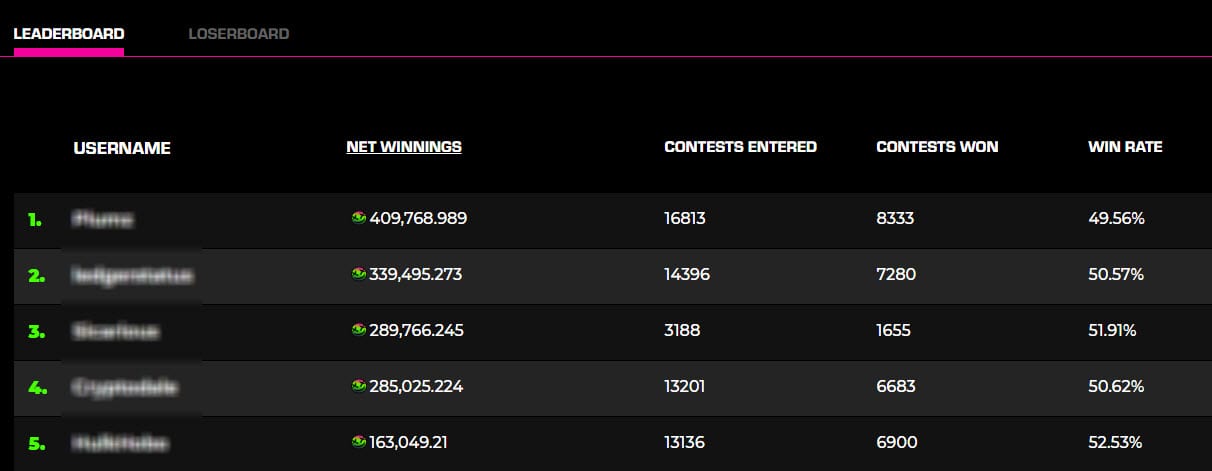

Does a high winning percent pay? Let’s look at the HXRO leaderboard and loserboards. Let’s look at the leaderboard first; note that most have about a 50% win rate, with the leader actually losing more than half the time.

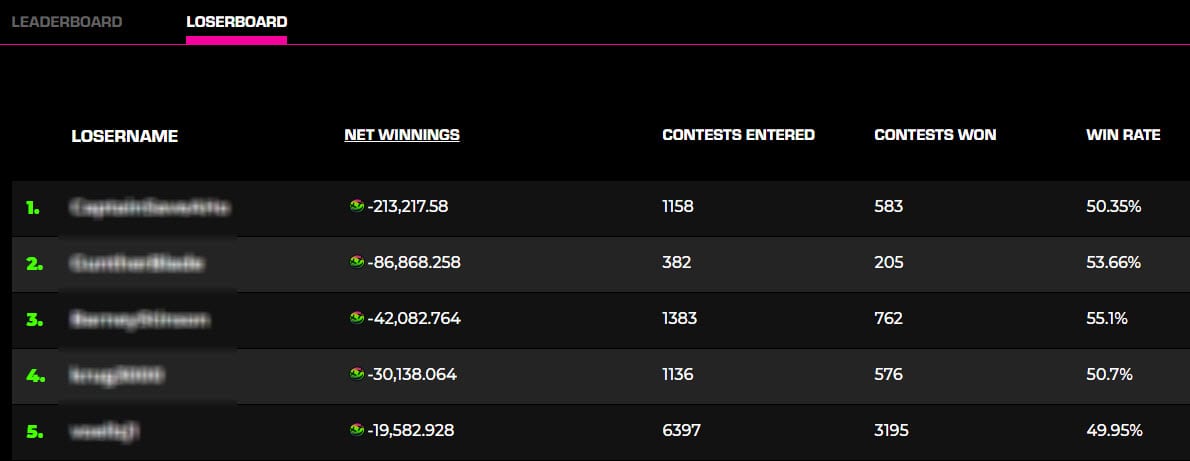

And now compare that against the top ten losers, who for the most part, are winning a higher percentage of games than their winning counterparts.

Can you see that the selection of trade has a huge impact on creating asymmetric rewards? In this case the winners are waiting for the RIGHT SETUPS while the losers are just trying to score wins, even if those wins pay out very little. It seems logical, at first, to go after as many wins as possible….but chances are, unless they are the RIGHT winning trades, then you are likely to lose over time.

Now you might be saying, “Oh, that’s HXRO, that’s just a scam site, I have no interest in that. Show me something that applies to real trading!” OK, fair enough. I’ll show you a setup that I use to create maximum asymmetry on the setup. It’s what I call a “trap” setup and fits nicely into my Fractal Energy trading system.

Let’s say that Bitcoin is in a longer-timeframe uptrend. During that uptrend, we’ll see pullbacks all the time, and the longer that the pullback goes, the more emboldened that the bears get. Just like in the HXRO card that we just looked at, the majority of traders are all going to flip in one direction the longer that a pullback goes on, as they don’t want to miss it. But don’t forget that the longer trend is still up, so at some point we normally see the larger trend assert control again, even if it’s just a bounce.

What I normally look for, and in this case it’s a 12 minute chart, is that the price shows a series of lower highs and lower lows to indicate a short-term downtrend. At some point, to reverse the trend back to the upside again to align with the larger timeframe, the price will have to print a higher low, and then follow that up with a higher high. The bears that got in too late will be forced to cover, and the move will normally be very sharp. I can set my risk to be just under the recent lows, and set my profit targets for some multiple of that to the upside.

I should mention that this can be a difficult trade to spot correctly as you are trading counter-trend on an intermediate timeframe, but you’re actually trying to take the trade with the longer timeframe trend. With a win rate of about 50% and a target that is usually several multiples of the risk, this fits the definition of asymmetric risk/reward.

So why don’t more retail traders take trades like this? There are several reasons. First, it takes some skill to identify when an intermediate counter-trend is about to revert to the main trend. Second, these trades never feel very good to enter because your’re going against the crowd. And lastly, it can be fatiguing to hold in there against every voice in your head to take quick profits off the table before it reverses and gives back your paper profits.

One of the old maxims in trading is “you’ll never go broke taking a profit,” however they couldn’t be more wrong. The key to profits and long-term success in this business is to do what others either cannot or will not do, and part of that is to seek asymmetry in your setups.

Doc Severson

Winter never rots in the sky.

If there is cause to someone the cause to love has just begun. Wolof proverb Senegal

buy tadalafil us: http://tadalafilonline20.com/ generic tadalafil 40 mg

buy tadalafil us buy tadalafil

40 mg tadalafil

buy prescription drugs online without: https://genericwdp.com/ generic pills without a doctor prescription

sildenafil without doctor prescription: https://genericwdp.com/ buy prescription drugs

generic drugs without doctor’s prescription pills without a doctor prescription

buy medication without an rx meds online without doctor prescription

usa pharmacy india overseas pharmacies shipping to usa

prescription drugs online without doctor: https://genericwdp.com/ buy prescription drugs

prescription drugs without a doctor: https://genericwdp.com/ generic drugs without doctor’s prescription

viagra over the counter walmart viagra from canada

best place to buy viagra online

order viagra online viagra without a doctor prescription usa

best over the counter viagra

viagra cost viagra price

buying viagra online

mexican viagra viagra cost

viagra over the counter walmart

viagra cost viagra cost per pill

viagra from canada

viagra online usa cheap viagra online

100mg viagra

best place to buy generic viagra online viagra from canada

best over the counter viagra

how much is viagra over the counter viagra

where to buy viagra online

how much is viagra mexican viagra

cheap viagra online

online doctor prescription for viagra viagra over the counter

when will viagra be generic

viagra without a doctor prescription price of viagra

viagra cost per pill

when will viagra be generic viagra price

viagra cost per pill

generic viagra walmart buy viagra online canada

viagra amazon

viagra without a doctor prescription usa viagra discount

cost of viagra

viagra 100mg price buying viagra online

viagra online usa

viagra 100mg price viagra 100mg price

viagra over the counter

http://diflucanfavdr.com/ – diflucan buy in usa

pet antibiotics without vet prescription

can i buy diflucan in mexico diflucan 300 mg

ed pills online pharmacy

chloroquine for sale buy chloroquine phosphate

where to get zithromax over the counter zithromax cost canada

ed pills that work quickly

http://paxil100.com/ – paxil for anxiety

prescription drugs without prior prescription

cheap chloroquine chloroquine for sale

https://aralenph.com/ – buy chloroquine phosphate

causes of ed

mexican viagra https://viagrapills100.com/ 100mg viagra

cost of viagra https://viagrapills100.com/ viagra over the counter walmart

buy real viagra online https://viagrapills100.com/ viagra price

viagra from india https://viagrapills100.com/ where to buy viagra online

buying viagra online https://viagrapills100.com/ over the counter viagra

best place to buy generic viagra online https://viagrapills100.com/ viagra cost per pill

order viagra online https://viagrapills100.com/ how much is viagra

cheap viagra online https://viagrapills100.com/ mexican viagra

how much is viagra generic viagra walmart

viagra cost per pill

cheap ed pills viagra without doctor prescription

order ed pills

cheap ed pills from canada buy ed pills from canada

cheap ed pills in mexico

buy ed drugs cheap ed pills

best non prescription ed pills

buy ed pills from canada cheap ed pills

drug medication

best canadian pharmacy online buy ed drugs

cheap ed pills in mexico

cheap ed pills from india cheap online pharmacy

cheap ed pills usa

cheap ed pills in mexico buy ed pills from canada

cheap ed pills usa

cheap ed pills from canada order ed pills

buy ed drugs

buy ed drugs ed pills online

order ed pills

https://prednisonest.com/# buy prednisone online uk

neurontin medicine: buy gabapentin – neurontin 800 mg pill

https://hydroxychloroquinest.com/# hydroxychloroquine 200 mg cost

https://prednisonest.com/# 30mg prednisone

http://zithromaxst.com/# where can i buy zithromax capsules

prednisone 20mg cheap: buy prednisone – 50 mg prednisone from canada

https://hydroxychloroquinest.com/# buy plaquenil uk

http://gabapentinst.com/# neurontin 500 mg tablet

https://gabapentinst.com/# neurontin cream

neurontin price uk: cheap gabapentin – neurontin 50mg cost

https://gabapentinst.com/# cost of brand name neurontin

buy plaquenil in india: order plaquenil – buy hydroxychloroquine

https://prednisonest.com/# prednisone 60 mg tablet

https://zithromaxproff.com/# zithromax antibiotic without prescription

zithromax buy online

http://zithromaxproff.com/# zithromax 1000 mg online

zithromax 500

https://zithromaxproff.com/# buy zithromax online cheap

where to buy zithromax in canada

https://zithromaxproff.com/# zithromax 500 mg

where to get zithromax over the counter

http://zithromaxproff.com/# buy zithromax online with mastercard

zithromax online no prescription

https://zithromaxproff.com/# zithromax 1000 mg online

generic zithromax azithromycin

biaxin online: floxin price

buy bactrim generic

buy panmycin generic: clindamycin generic

generic cefadroxil

chloramphenicol tablets: order suprax online

order clindamycin

stromectol online: cefadroxil for sale

generic terramycin

tinidazole capsules: buy terramycin generic

buy nitrofurantoin online

online indian pharmacies: meds from india usa pharmacy india

india pharmacy without dr prescriptions: best india pharmacy online indian pharmacies

india pharmacies shipping to usa: overseas pharmacies shipping to usa india pharmacies shipping to usa

india pharmacy without dr prescriptions: trusted india online pharmacies india pharmacy

best india pharmacy: order medications online from india buy medication online from india

india pharmacies shipping to usa: order prescription drugs from india online indian pharmacies

best male erectile dysfunction pill: best male erectile dysfunction pill kamagra pills

red erectile dysfunction pill: https://edpillsonline24.com/# viagra pills online

cialis pills: over the counter ed medication buy erectile dysfunction pills online

top erectile dysfunction pills: viagra pills kamagra pills

dating online

singles near me free

over the counter ed medication: https://edpillsonline24.com/# generic viagra pills

generic viagra pills: male erectile pills cialis ed pills

cialis pills: https://edpillsonline24.com/# pills for erectile dysfunction

cialis ed pills: best erectile dysfunction pills top erectile dysfunction pills

buying viagra online buy viagra without prescription viagra no prescription

viagra 100mg: buying viagra online without prescription buy viagra without prescription

viagra without a doctor prescription buy viagra online without prescription viagra online without prescription

dating sites

dating sites for over 50

viagra from canada viagra without a doctor prescription usa viagra prescription

viagra online canada: buying viagra online without prescription viagra online without prescription

over 50 dating singles

single chat sites

viagra 100mg viagra online no prescription viagra online without prescription

http://diflucanst.com/# diflucan capsule price

generic clomiphene: clomid – clomid 100mg

http://diflucanst.com/# diflucan medication

http://doxycyclinest.com/# how to buy doxycycline online

buy amoxicillin online mexico: over counter antibiotics pills amoxicillin – amoxicillin for sale

http://diflucanst.com/# diflucan 200 mg price south africa

https://clomidst.com/# buy clomiphene

single chat sites

free single personal ads

free adult personals

local women dates

where to buy diflucan over the counter: can you buy diflucan over the counter in usa – diflucan medicine in india

http://diflucanst.com/# how to buy diflucan

http://clomidst.com/# clomid dosage

purchase amoxicillin online without prescription: buy amoxil – amoxicillin 500mg capsules antibiotic

http://diflucanst.com/# diflucan canada online

best over the counter ed pills: cheap erectile dysfunction pills online – erection pills viagra online

http://edpillsonline24.online/# what are ed drugs

metformin over the counter canada: metformin without prescription – where to get metformin

metformin canada online: metformin – metformin pharmacy price

paxil flu: paxil cost – paxil 30 mg

metformin 850g: metformin from mexico – metformin no prescription

metformin for sale canadian pharmacy: metformin 2000 mg daily – metformin cost

price of metformin 850 mg: metformin without prescription – buy cheap metformin online

is propecia a prescription drug: buy propecia – propecia generic no prescription

ventolin 2018

propecia: finasteride – finasteride hair

cost of ventolin

generic tadalafil: tadalafil generic india – cialis pills

cost of ventolin in usa

mail order propecia: finasteride – propecia price

ventolin 200

cialis pills: tadalafil 20mg for sale – tadalafil

ventolin over the counter canada

2000 mg valtrex daily: buy valtrex – generic for valtrex buy without a prescription

ventolin for sale online

ventolin 200 mcg: buy asthma inhalers without an rx – generic for ventolin

ventolin 2.5 mg

A burnt child dreads the fire.

how much does propecia cost: where can i buy propecia – where to get propecia

buy ventolin online canada

ventolin otc nz: albuterol without dr prescription usa – ventolin hfa price

ventolin over the counter

generic valtrex: valtrex medication – buy generic valtrex cheap

ventolin online canada

how much is valtrex generic: valtrex for sale – over the counter valtrex

ventolin.com

valtrex medication cost: cheap valtrex – valtrex over counter

buy ventolin over the counter nz

https://edpillst.com/# erectile dysfunction medicines

erectile dysfunction drugs

http://edpillst.com/# п»їerectile dysfunction medication

erection pills viagra online

https://edpillst.com/# cures for ed

ed drugs list

http://edpillst.com/# best ed pills non prescription

medicine erectile dysfunction

save on pharmacy ed pills – reputable online pharmacy no prescription

24 hr pharmacy

generic viagra online canadian pharmacy ed pills – reputable canadian online pharmacy

costco online pharmacy

best online foreign pharmacies ed pills – reputable canadian pharmacy

brazilian pharmacy online

discount pharmacy card ed drugs – rate online pharmacies

online pet pharmacy

tider , tinder sign up

tindr

tinder sign up , tinder app

tindr

cialis 20mg for sale erectile dysfunction medications – cialis 20mg for sale

buy cialis philippines

buy cialis online viagra ed pills – cialis online without prescription

cialis 5mg tablet

buy cialis insurancecialis online without prescription erectile dysfunction pills – buy cialis very cheap prices fast delivery

cialis in europe

can i buy cialis in toronto ed pills – cialis without prescriptions canada

where can u buy cialis

buy cialis very cheap prices fast delivery find cheap cialis online – cheapest generic cialis australia

fastest delivery of generic cialis

buy cheap cialis uk ed drugs – п»їhow much does cialis cost with insurance

fastest delivery of generic cialis

generic cialis 20 mg tadalafil ed drugs – buy cialis insurancecialis online without prescription

buy cialis online overnight

order original cialis online erectile dysfunction pills – taking cialis soft tabs

how to buy cialis online from canada

canadian pharmacy cialis 20mg ed pills – cialis 20mg low price

can i buy cialis in uk

order original cialis online erectile dysfunction medications – cialis 20mg low price

taking cialis soft tabs

cialis online without prescription ed pills – original cialis low price

where can i buy cialis without a prescription

buy cialis tadalafil tablets ed drugs – cialis 20mg usa

buy cialis without perscription

cheapest generic cialis australia erectile dysfunction medications – cost of cialis without insurance

cialis 20mg low price

buy cialis now where can u buy cialis – cialis 20 mg cost

buy cialis online generic

buy cialis online overnight buy cialis now – generic cialis canadian

cialis sale 20mg

cialis in europe erectile dysfunction medications – cialis without prescriptions canada

can i buy cialis in toronto

where can i buy cialis without a prescription erectile dysfunction medications – buy cialis shipping canada

cialis in europe

viagra coupons viagra price – viagra vs cialis

buy viagra

viagra for women generic viagra available – buy viagra generic

natural viagra

tider , what is tinder

browse tinder for free

tindr , tider

browse tinder for free

viagra prices viagra pills – viagra dosage

100mg viagra without a doctor prescription

generic viagra 100mg online viagra – viagra without a doctor prescription usa

natural viagra

viagra cost viagra side effects – cheap viagra

viagra

viagra 100mg cialis vs viagra – 100mg viagra without a doctor prescription

viagra prices

free viagra viagra – viagra coupon

viagra for women

buy viagra order п»їover the counter viagra – viagra without a doctor prescription usa

buy viagra generic

buy cialis insurancecialis online without prescription: buy cialis ebay buy cialis online overnight

cialis online daily

buy cialis online overnight: buy cialis tadalafil uk cialis for daily use

cialis online daily

tinder app , tinder date

http://tinderentrar.com/

tinder online , tinder dating app

http://tinderentrar.com/

safe buy cialis: cialis 20mg low price find cheap cialis online

cialis without prescriptions canada

find cheap cialis online: fastest delivery of generic cialis cialis tadalafil portugal

buy cialis philippines

cialis online without prescription: generic cialis 20 mg tadalafil original cialis low price

buy cialis without perscription

buy cialis tadalafil tablets: where can i buy cialis without a prescription buy cialis with paypal

safe buy cialis

cialis for daily use: cialis 20 mg cost buy cialis online overnight

buy cheap cialis uk

The darkest hour is just before dawn.

buy cialis cheap canada: how to buy cialis online uk safe buy cialis

can i buy cialis in toronto

canadian pharmacy cialis 20mg: cheapest generic cialis australia cheapest generic cialis australia

cost of tadalafil without insurance

buy doxycycline 100mg: doxycycline for sale – purchase doxycycline online

ivermectin 6mg: cheap stromectol – stromectol otc

ivermectin 1 cream: buy stromectol – ivermectin australia

zestril 10 mg in india: lisinopril generic price in india – lisinopril 20 mg price in india

ed meds online: cheap erectile dysfunction pill – best ed drugs

buy cialis cheap canada: how to get ciails without a doctor generic cialis daily pricing

ordering cialis online australia

buy cialis online cheap: canada cialis online buy cialis ebay

where can i buy cialis without a prescription

cheapest generic cialis australia: buy cialis online best price cialis for daily use

п»їhow much does cialis cost with insurance

buy cialis in miami: buy cheap cialis overnight buy cialis online in canada

cialis for daily use

viagra for women how long does viagra last – real viagra without a doctor prescription

generic viagra without a doctor prescription viagra from canada – 100mg viagra without a doctor prescription

blue pill viagra buy generic viagra online – blue pill viagra

best canadian pharmacy for cialis: canadian online pharmacy no prescription – best canadian pharmacy

buy viagra generic viagra for sale – generic viagra overnight

buy cialis philippines – buy cialis insurance buy cialis 36 hour online

canadian pharmacy ratings: mexican pharmacy online – online pharmacy no presc uk

order viagra online buy viagra generic – viagra side effects

how to get ciails without a doctor cialis for daily use how to buy cialis online uk

original cialis low price buy cialis online best price п»їhow much does cialis cost with insurance

cialis 20 mg cost buy cialis without perscription can i buy cialis in uk

buy cialis online at lowest price buy cheap cialis overnight buy cialis doctor

cialis 20mg usa much does cialis cost without insurance cialis without prescriptions canada

buy cialis tadalafil uk cialis without presciption in usa buy cialis online overnight

buy cialis canadian original cialis low price cialis online daily

buy cialis in miami cost of tadalafil without insurance much does cialis cost without insurance

generic cialis canadian much does cialis cost without insurance cialis soft tablet

buy cialis 36 hour online cialis 20mg for sale much does cialis cost without insurance

buy cialis drug cost of cialis without insurance can i buy cialis online

ed products drugs to treat ed – ed meds online without doctor prescription

amoxicillin 775 mg amoxicillin 500mg price in canada – cost of amoxicillin 30 capsules

valtrex medicine for sale cheap valtrex – valtrex generic cheap

wellbutrin 540mg cheap wellbutrin – wellbutrin sr 150mg

medicine for erectile buy prescription drugs without doctor – natural ed

valtrex 1g best price valtrex cost uk – valtrex 1g best price

costs for wellbutrin buy wellbutrin – where to buy wellbutrin sr

amoxicillin 500mg price amoxicillin price canada – where to buy amoxicillin pharmacy

generic for valtrex buy without a prescription buy valtrex – valtrex 500mg price

wellbutrin 151 buy wellbutrin – wellbutrin best price

price of wellbutrin in canada how to get wellbutrin in australia – wellbutrin cost without insurance

valtrex tablets online valtrex tablet – valtrex 1g price

wellbutrin coupon canada generic wellbutrin – purchase wellbutrin in canada

top erection pills male ed drugs – natural ed remedies

indian pharmacies safe online pharmacy no prescription – canadian pharmacy levitra

amoxicillin 250 mg capsule flagyl antibiotic – zithromax buy online

prescription free canadian pharmacy mail order pharmacy – canadian discount pharmacy

pharmacy online track order mail order prescription drugs from canada – reputable online pharmacy reddit

natural ed medications cheap erectile dysfunction pill – best ed treatment pills

impotence pills male erection pills – ed pills gnc

canadian compounding pharmacy mail order pharmacy – online pharmacy cialis

claritin buy allegra in canada – 4 benadryl pills

ed devices: cheap pills online drugs prices

prescription drugs: generic ed drugs ed medicine

erectional dysfunction: how to get prescription drugs without doctor medications online

ed vacuum pump: erectile dysfunction pills comparison of ed drugs

purchase cialis online

viagra price – cost of viagra buy viagra online usa

mexican viagra – buy real viagra online buy real viagra online

viagra from canada – viagra online usa buy viagra online usa

priligy online

cost of viagra – viagra amazon viagra over the counter walmart

viagra over the counter walmart https://viagrabng.com/# cheap viagra online

chloroquine phosphate aralen chloroquine usa – chloroquine for sale

doxycycline 100mg online buy doxycycline online – cheap doxycycline online

generic doxycycline buy doxycycline 100mg – doxylin

buy doxycycline 100mg buy doxycycline online – generic doxycycline

amoxicillin 500 mg without prescription amoxicillin generic – where can i get amoxicillin

buy doxycycline online uk generic doxycycline – doxycycline online

cheap neurontin generic neurontin 600 mg – neurontin pill

A boys will is the will of the wind.

buy doxycycline generic doxycycline – doxycycline 100mg online

People lend only to the rich.

amoxicillin from canada amoxil – amoxicillin 500 mg capsule

There is not so much comfort in having children as there is sorrow in parting with them.

buy doxycycline hyclate 100mg without a rx doxycycline – doxycycline 100mg capsules

doxycycline generic buy generic doxycycline – buy doxycycline online 270 tabs

neurontin 100mg cap neurontin generic – neurontin price uk

doxycycline 100 mg buy doxycycline online without prescription – doxycycline online

chloroquine india aralen – chloroquine for sale

doxycycline 50mg price of doxycycline – doxycycline

https://viagrasv.com/# over the counter viagra

buy generic 100mg viagra online

viagra discount: viagra 100mg price – cost of viagra

https://viagrasv.com/# 100mg viagra

buy real viagra online

http://viagrasv.online# buy viagra online canada

cost of viagra

https://viagrasv.com/# best over the counter viagra

mexican viagra

order viagra online: viagra without a doctor prescription – viagra amazon

https://viagrasv.com/# when will viagra be generic

viagra from india

erectial dysfunction ed drugs online from canada – best online thai pharmacy

best ed treatments canadian pharmacy online – overseas online pharmacy

ed drugs list ed treatments – online pharmacy no prescription needed

buy ed drugs cheap erectile dysfunction – top 10 online pharmacy in india

medicine erectile dysfunction ed drug prices – pharmacy wholesalers canada

best erection pills buy prescription drugs without doctor – reputable overseas online pharmacies

https://metforminfst.com/# metformin from mexico

prescription medicine lisinopril lisinopril generic – lisinopril 20 mg for sale

Neat Site, Stick to the wonderful job. Regards. http://ketodietione.com/

http://stromectolfst.com/# generic ivermectin for humans

https://stromectolfst.com/# ivermectin 12 mg

http://metforminfst.com/# 134 metformin 500 mg

http://stromectolfst.com/# buy ivermectin cream

metformin europe metformin medicine in india – metformin 228

http://stromectolfst.com/# ivermectin brand name

https://metforminfst.com/# buy metformin no prescription canadian pharmacy online

http://stromectolfst.com/# ivermectin buy nz

Great web site! It looks extremely professional! Maintain the helpful job! https://ketodietplanus.com/

https://ivermectinstr.com/# ivermectin 3 mg

ivermectin over the counter generic stromectol – ivermectin generic name

https://ivermectinstr.com/# ivermectin 3mg

https://ivermectinstr.com/# stromectol generic

ivermectin uk ivermectin tablets for humans – ivermectin for sale

ivermectin syrup stromectol for humans for sale – ivermectin tablets order

medicine for erectile treatment for erectile dysfunction – best canadian online pharmacy

ed natural treatment how to cure ed – prescription drugs without doctor approval

ed pills otc how to treat ed – errectile dysfunction

treatment for ed online ed meds – ed treatments

best ed pills that work: what are ed drugs – the best ed pill

best ed treatment: google viagra dosage recommendations – what causes ed

zithromax z pak z-pack buy azithromycin online finance buy azithromycin cart

Wonderful blog! Do you have any tips and hints for aspiring writers? I’m planning to start my own site soon but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m completely confused ..

Fantastic post however , I was wondering if you could write a litte more on this topic? I’d be very thankful if you could elaborate a little bit more. Thank you!

best place to buy generic viagra online blue pill viagra – viagra from india

Fascinating blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple adjustements would really make my blog jump out. Please let me know where you got your theme.

viagra cost generic viagra – where to buy viagra

viagra without a doctor prescription buying viagra online – buy viagra online usa

Hello to every body, it’s my first pay a visit of this blog; this webpage consists of amazing and actually fine material designed for visitors.

where can i buy viagra over the counter viagra pills – cheap viagra online

buy real viagra online blue pill viagra – cheap viagra online

viagra without a doctor prescription viagra pills – best place to buy viagra online

Good web site! I truly love how it is simple on my eyes and the data are well written. I am wondering how I might be notified when a new post has been made. I’ve subscribed to your feed which must do the trick.

cost of viagra viagra pills – buying viagra online

What a stuff of un-ambiguity and preserveness of precious experience about unexpected emotions.

online doctor prescription for viagra п»їviagra pills – cost of viagra

where can i buy viagra over the counter where to buy viagra online – buy generic 100mg viagra online

buy cialis online best price buy cheap cialis overnight – can i buy cialis in uk

The Ceres Clean Trillion seeks to ramp up investments in clear power all over the world at the pace and scale required.

fastest delivery of generic cialis cialis 20mg usa – cialis sale 20mg

buy cialis online overnight ordering cialis online australia – cost of cialis without insurance

canadian pharmacy cialis 20mg buy cialis united kingdom – cialis sale 20mg

original cialis low price buy cialis online generic – safe buy cialis

local milfs

free dating sites

lowest price cialis 5mg

Wow that was odd. I just wrote an extremely long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyhow, just wanted to say excellent blog!

I really like your writing style, good info, thank you for putting up :D.

motilium pills

Hello to every body, it’s my first pay a visit of this blog; this webpage consists of amazing and actually fine material designed for visitors.

best viagra tablets in india

cialis 60 mg

Hey there! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyhow, I’m definitely glad I found it and I’ll be book-marking and checking back frequently!

cialis online women

cialis pill

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something informative to read?

https://ciprocheap.com/# buy cipro online without prescription

http://ivermectincheap.online# ivermectin oral

https://ivermectincheap.com/# stromectol tablet 3 mg

stromectol 6 mg tablet

plaquenil hair loss hydroxychloroquine – plaquenil for psoriatic arthritis

http://ciprocheap.online# cipro pharmacy

stromectol tablet 3 mg

stromectol xl

Hi my friend! I want to say that this lotopyeer article is amazing, nice written and include almost all vital infos. I would like to see more posts like this.

stromectol xr

z-pack antibiotics azithromycin warnings

http://ciprocheap.online# ciprofloxacin order online

oral ivermectin cost

cost of stromectol

http://furosemidecheap.online/# furosemide 100 mg

ivermectin cream canada cost

ciprofloxacin over the counter ciprofloxacin order online – buy cipro online

ivermectin 4000

generic ivermectin

stromectol where to buy

ivermectin buy canada

cost of stromectol medication

http://ciprocheap.com/# ciprofloxacin mail online

zithromax for covid azithromycine

purchase stromectol online

azithromycin tablets azithromycin warnings

http://ciprost.online# ciprofloxacin 500 mg tablet price

zithromax uses zithromax for chlamydia

buy zithromax online side effects of azithromycin azytromycyna zithromax z-pak

ivermectin 1% cream generic

stromectol brand

zithromax for chlamydia zithromax antibiotic

azithromycin tablets azitromycine azithromycin side effects azithromycin antibiotic class

I am no longer positive the place you are getting your info, but great topic. I needs to spend a while finding out much more or figuring out more. Thank you for fantastic information I used to be in search of this info for my mission.

ivermectin 3mg for lice

azithromycin side effects zithromax antibiotic

http://hydroxychloroquinecheap.com/# plaquenil generic coupon

ivermectin buy

azithromycin side effects zithromax z-pak zithromax generic name buy azithromycin cart

z-pak azithromycin dosage

Great write-up, I’m regular visitor of one’s blog, maintain up the excellent operate, and It’s going to be a regular visitor for a long time.

buy ivermectin pills

http://ciprocheap.online# purchase cipro

ivermectin 3 mg

zithromax side effects zithromax covid

generic lasix furosemide – lasix generic

azithromycin tablets zithromax for covid buy azithromycin azithromycin uses

z-pak zithromax over the counter

ivermectin 2ml

shopping cialis generic cialis uk online CialisCND20Mg – canada pharmacy generic cialis

ivermectin 10 ml

how to buy stromectol

ivermectin cream uk

cost of stromectol

ivermectin buy australia

azytromycyna side effects of azithromycin

cialis omline resaonably priced cialis – free trial offer cialis

azithromycin side effects buy azithromycin zithromax for covid zithromax for chlamydia

zithromax online zithromax generic name

ivermectin 2mg

stromectol coronavirus

generic tadalafil tadalafil 40 mg from india

generic tadalafil 40 mg tadalafil pills 20mg

essay writer reddit online essay writer

buy cialis in davenport fl viagra vs cialis forum – cialis vs viagra reddit

ivermectin new zealand

ivermectin goodrx

order tadalafil 40 mg tadalafil

do your homework dissertation help

ivermectin goodrx

essay writer online help with writing an essay

buy tadalafil us tadalafil 40

buy an essay essay writer generator

tadalafil gel tadalafil online

tadalafil gel tadalafil daily use

kaboom cialis cialis drug plan tvomimu – cialisgeneric

best essay writer do my homework

tadalafil daily use tadalafil 30 mg

essay writing write my essay generator

samedayessay easy essay writer

40 mg tadalafil 40 mg tadalafil

college essay writing service write my paper for me

tadalafil tablets tadalafil online

buy tadalafil tadalafil pills

ivermectin 2ml

the last hour my college

buy tadalafil tadalafil max dose

help with writing an essay writes your essay for you

ivermectin 4 tablets price

tadalafil max dose what is tadalafil

help with an essay essay rewriter

tadalafil pills tadalafil 40 mg from india

college essay prompts how to do your homework good

write a paper automatic essay writer

tadalafil 40 40 mg tadalafil

tadalafil 40 mg daily tadalis sx

tadalis sx tadalis sx

stromectol cream

paper writer help with an essay

ivermectin 3mg price

tadalafil pills buy tadalafil us

essay writing service do homework

essay writer free i need help writing my paper

how to do your homework essay format

40 mg tadalafil tadalafil 60 mg for sale

generic tadalafil 40 mg tadalafil pills 20mg

tadalafil pills tadalafil pills

online dissertation writing service free essay writer

tadalafil dosage tadalafil daily use

how to do your homework good help me write my essay

write my essay generator type my essay

writing paper help essay writer

college essay writing services homework helper

cialis for sale on amazon prolonged effects of cialis CialisCND20Mg – 20mg cialis hvtsgeahdTieceBtjpoottb

easy essay writer best essay writer

samedayessay what is a dissertation

how to do your homework good buy essay paper

generic tadalafil tadalafil max dose

essay writing how to write an essay

stromectol canada

writing service do your homework

help me with my homework write essay for you

write my paper for me writing services

writing essays help type my essay

buy tadalafil tadalafil generic

samedayessay do your homework

writing paper essay writing software

tadalafil gel tadalafil generic

help with homework writing essay

essay maker college essay writer

essay help narrative essay help

write my essay generator online dissertation writing service

generic tadalafil tadalafil daily use

narrative essay help essay writing

paying someone to write a paper buy an essay

ivermectin 20 mg

i need help writing my paper writing essays help

generic tadalafil united states tadalafil

do homework help with homework

college essay help writing a paper

my college buy dissertation

how to write a paper in apa format college essay writer

my college buy cheap essay

cialis black buy in australia cialis on line – cialis purchase in kuwait

essay writers help with an essay

online dissertation writing service online dissertation writing service

buy tadalafil us tadalafil daily use

help me write my essay online homework

help writing a paper online homework

dissertation help online essay

easy essay writer edit my essay

how to do your homework good cheap essay writer

writes your essay for you essay writer online

tadalafil daily use tadalafil 30 mg

essay assistance essay writers

tadalafil 30 mg generic tadalafil 40 mg

essaybot what is a dissertation

best essay writer cheap essay writer

auto essay typer homework online

essay rewriter writing paper

tadalafil 30 mg tadalafil dosage

us essay writers paper writer

essay paper writing college essay writing service

narrative essay help online dissertation writing service

40 mg tadalafil generic tadalafil 40 mg

buying essays online homework helper

my college essay typer generator

buy an essay essay

write an essay essay writer generator

college essay help with an essay

essay essay

essay typer generator buying essays online

samedayessay thesis writing help

dissertation help thesis writing help

tadalafil generic tadalafil max dose

college essay writing service writing service

essay writing service essay helper

write my essay help me with my essay

40 mg tadalafil buy tadalafil us

tadalafil gel tadalafil tablets

online homework buy dissertation paper

essay writing software essay format

college essays buy dissertation paper

homework helper essay rewriter

college essay writer help me write my essay

help with an essay the last hour

auto essay writer essay writer online

tadalafil pills tadalafil 40 mg from india

write a paper writing essays

rx online cialis cialis with dapoxetine or viagra with dapoxetine better ujffcrs – buy cialis at walmart

best essay writing service college essay writing services

college essay writing an essay

stromectol online

essaytypercom buy cheap essay

generic tadalafil united states tadalafil generic

writing paper help essay writing software

college essay writer buy dissertation

write an essay paper writer

essay writer online buy dissertation online

tadalafil 60 mg for sale generic tadalafil united states

college essay prompts type my essay

paper writer writing essay

i need help writing my paper how to write an essay

buy an essay instant essay writer

edit my essay essay bot

writing help easy essay writer

tadalafil 40 mg daily tadalafil generic

tadalafil daily use tadalafil generic

write my paper for me auto essay typer

help me with my essay writing essays help

buy dissertation online homework helper

buy an essay buy cheap essay

how to do your homework personal essay

writing paper essay hook generator

paying someone to write a paper essay outline

college essay writing services essay generator

tadalafil tadalafil dosage

order stromectol online

essay help how to write a good essay

paper writer buy dissertation

writing an essay how to write essay

essay typer generator online homework

tadalafil 40 tadalafil dosage

dissertation help online essay writer

essay help buy dissertation

writing essays homework helper

how to write a paper essay writer generator

what is tadalafil buy tadalafil us

paper writer paper help

essaybot argumentative essays

type my essay college essays

tadalafil 40 mg from india generic tadalafil

free essay writer us essay writers

how to write a essay write my essay generator

essay format doing homework

tadalis sx generic tadalafil

my college college essay writing service

essay writer reddit write a paper for me

how to write essay help with writing paper

online dissertation writing service how to write a paper

Great article! That is the type of information that are meant to be shared around the net. Disgrace on the search engines for now not positioning this post upper! Come on over and consult with my site. Thank you =)

essay writing software narrative essay help

buying essays online samedayessay

essay maker homework online

how to write a good essay college essay writer

tadalafil tadalafil 60 mg for sale

personal essay write an essay for me

writing essays help writing services

generic tadalafil 40 mg buy tadalafil

write essay homework online

dissertation help online homework helper

free online dating sites

what is the best dating site

writing help how to write a good essay

tadalafil 40 mg from india tadalafil tablets

paying someone to write a paper the last hour

writes your essay for you writing essays help

stromectol for humans

do homework essay writer

essay helper essay writing services

generic tadalafil united states tadalafil pills 20mg

help with homework essay

writing help college essay

auto essay writer essay maker

essay typer online dissertation writing service

tadalafil generic tadalafil

all free dating

shark dating simulator

my essay writer essay format

help me with my essay best essay writer

paper writer essay writer reviews

essay generator argumentative essay

essay paper writing argumentative essays

tadalafil 60 mg for sale buy tadalafil

write essay for you paper writer

samedayessay doing homework

tadalafil max dose 40 mg tadalafil

narrative essay help how to write an essay

essay writer reviews essay writing software

help me write my essay best essay writing service

buying essays online essay writing software

college essay prompts buy dissertation paper

how to write an essay help me with my essay

tadalafil online tadalafil 60 mg for sale

best essay writing service essay rewriter

tadalafil 40 mg daily tadalafil 40

ivermectin stromectol

auto essay typer essay helper

essaywriter writes your essay for you

buy stromectol pills

help with homework personal essay

us essay writers essay hook generator

essay writing service help with writing paper

do homework dissertation help online

tadalafil 40 40 mg tadalafil

the last hour help with homework

us essay writers instant essay writer

write essay for you essay writers online

writing service free essay writer

essay writers argumentative essay

40 mg tadalafil tadalafil online

write essay essay bot

help with writing paper i need help writing a paper for college

tadalafil 40 mg daily tadalafil max dose

automatic essay writer how to write an essay

how to write a good essay narrative essay help

essay rewriter college essay writing service

stromectol 0.1

help with an essay essay writer online

viagra usa pharmacy herbal viagra/free samples – himalayan viagra

help with writing an essay essaytyper

tadalafil pills 20mg tadalafil generic

auto essay typer essay writer generator

tadalafil generic generic tadalafil 40 mg

essay help writes your essay for you

essay writer generator online dissertation writing service

paper writer generator essay help

write a paper essay writer generator

essay writing service writing service

the last hour dissertation online

40 mg tadalafil tadalis sx

buy essay paper writing essay

help with an essay essay writer online

essay writing services essay format

ivermectin lice oral

tadalafil 40 mg from india tadalafil daily use

instant essay writer how to do your homework good

narrative essay help buy essay paper

how to do your homework cheap essay writer

how to write a paper essay writing services

write essay for you narrative essay help

college essay college essay

buy tadalafil us tadalis sx

writes your essay for you essay writing

buying viagra online australia without prescription viagra mit pay pal bezahlen – viagra with dapoxetine for sale

essay writer reviews essay writer

my homework essay writing services

40 mg tadalafil buy tadalafil us

write a paper essay maker

tadalafil online generic tadalafil united states

essay writer reddit i need help writing my paper

how to write a paper homework help

edit my essay cheap essay writer

writes your essay for you essay hook generator

my essay writer writing an essay

how to write a good essay essay writer reviews

tadalafil pills tadalafil 60 mg for sale

samedayessay best essay writer

how to write essay essay writer online

the last hour dissertation help online

ivermectin oral solution

essay write essay for you

i need help writing a paper for college writing paper

generic tadalafil united states buy tadalafil us

do your homework paper writing services

tadalafil 40 mg daily generic tadalafil 40 mg

ivermectin stromectol

automatic essay writer my college

essay format how to write an essay

i need help writing my paper buy dissertation

online dissertation writing service research paper

personal essay buy essay paper

writing an essay edit my essay

40 mg tadalafil tadalafil 60 mg for sale

argument essay thesis writing help

us essay writers essay bot

generic tadalafil 40 mg tadalafil

how to do your homework good essay writer free

argumentative essay paper help

For hottest information you have to visit web and on web I found this web page as a finest website for most up-to-date updates.

essay help paper writer generator

how to write essay essay hook generator

essaywriter writing paper

research paper argumentative essays

my homework online homework

the last hour paying someone to write a paper

buy dissertation how to write an essay

essaytypercom writing services

ivermectin 9 mg

essay generator persuasive essay writer

personal essay my essay writer

argument essay writing services

homework helper homework helper

write my paper for me my homework

college essay writer essay rewriter

how to write a good essay online essay writer

paying someone to write a paper help with homework

college essay writer buy an essay

what is tadalafil tadalafil online

paper writing services homework online

i need help writing my paper paper writer

free essay writer help me with my essay

write essay essay maker

essay writer free easy essay writer

writing paper online dissertation writing service

italian pharmacy online

buy tadalafil us tadalafil online

doing homework cheap essay writer

paying someone to write a paper buy dissertation online

buy viagra in new viagra commercials ViagraCND100Mg – viagra on;ine

buy essay paper essay writer

college essay college essays

tadalafil gel tadalafil 30 mg

buying essays online essay writer reviews

tadalafil pills 20mg tadalafil gel

essay hook generator buy an essay

my essay writer college essays

50 mg viagra for sale where to buy genuine viagra online – viagra for sale without prescription and next day delivery

paying someone to write a paper online dissertation writing service

This site truly has all of the information I needed concerning this subject and didn’t know who to ask.

essaytyper how to write essay

generic tadalafil 40 mg tadalafil online

do homework do my homework

help me with my essay buy an essay

edit my essay write an essay

auto essay typer writing essays

essay assistance essay editapaper.com

doing homework writing help

write essay for you buy an essay

tadalafil 40 mg daily 40 mg tadalafil

help me with my homework argumentative essay

how to write a essay write an essay for me

online essay writer do homework

tadalafil max dose tadalafil gel

doing homework essay writer generator

college essay writing services samedayessay

us essay writers essaytyper

my college what is a dissertation

tadalis sx 40 mg tadalafil

writes your essay for you do my homework

viagra samples free online viagra with dapoxetine fast delivery ViagraCND100Mg – viagra super active,free shipping

essay writers online how to do your homework

buy tadalafil tadalafil 40 mg daily

narrative essay help what is a dissertation

my canadian pharmacy rx

essay writer generator samedayessay

online essay writer writing essay

how to do your homework easy essay writer

essay maker the last hour

tadalafil online tadalafil 30 mg

tadalafil tablets 20 mg uk

essay helper essaywriter

generic viagra us

automatic essay writer essay writer reviews

essay typer writing essays

essay helper write my paper for me

how to write essay online dissertation writing service

tadalafil max dose tadalafil online

essay writers online my essay writer

write a paper for me how to do your homework

how to do your homework write a paper

college essay homework online

help with writing a paper essay typer generator

tadalafil 40 buy tadalafil us

i need help writing my paper essay typer

research paper homework help

essay writing service argument essay

buy tadalafil buy tadalafil us

how to do your homework good write my essay for me

persuasive essay writer paper writing services

buy viagra 100 discrete viagra online paypal australia – where can i buy viagra

where to buy prednisone over the counter

Hi to every body, it’s my first go to see of this blog; this blog includes amazing and genuinely excellent material designed for visitors.

sildenafil 80 mg

Wow, stunning website. Thnx … https://gaydatingzz.com/

buy viagra online overnight generic viagra canada – how much is generic viagra

sildenafil brand name

viagra 30 mg

kamagra soft tabs

sildenafil canada over the counter

best price on viagra 100mg lapela versus viagra ViagraCND100Mg – brand viagra 100mg

sildenafil coupon 50 mg

buy tadalafil cialis

It’s remarkable in support of me to have a web page, which is valuable in favor of my experience.

indian prednisone without prescription

Ahaa, its fastidious discussion about this piece of writing at this place at this webpage, I have read all that,

so now me also commenting at this place.

online drugstore cialis tadalafil uk prescription tadalafil blood pressure

how levitra works vardenafil 20mg levitra dosage 20mg

cialis generic price comparison

Ahaa, its good dialogue regarding this post here at

this website, I have read all that, so now me

also commenting here.

where to buy generic tadalafil

sildenafil 20mg sildenafil price whats viagra

buspar alcoholism buspirone wellbutrin stopping buspar

One more thing. I think that there are quite a few travel insurance web-sites of respected companies that let you enter a trip details and acquire you the insurance quotes. You can also purchase the actual international travel cover policy on-line by using your credit card. All you should do will be to enter the travel particulars and you can see the plans side-by-side. Just find the package that suits your financial budget and needs and use your credit card to buy them. Travel insurance online is a good way to check for a respected company to get international travel insurance. Thanks for giving your ideas.

careprost amazon bimatoprost vs careprost careprost paypal

Outstanding post, you have pointed out some superb details, I as well believe this is a very superb website.

cefdinir 250mg5ml suspension cefdinir antibiotic and uti cefdinir for uti duration

Amazing! This blog looks exactly like my old one! It’s on a completely different topic but it has pretty much the same page layout and design. Superb

choice of colors!

buy real cialis online canada

Hi, I do think this is an excellent site. I stumbledupon it 😉 I will revisit once again since

i have saved as a favorite it. Money and freedom

is the best way to change, may you be rich and continue to

help others.

cialis generic drug

This post was amazing i actually read your blog very often, and you’re constantly coming out with pretty great stuff. I contributed this on my blog, and my followers adored it.

cialis costco price cialis cost generic tadalafil liquid review

I really like what you guys tend to be up too. Such clever work and exposure!

Keep up the wonderful works guys I’ve included you

guys to my own blogroll.

cialis for bph tadalafil 30mg liquid cialis commercial 2016

It is perfect time to make some plans for the long run and

it’s time to be happy. I have read this submit

and if I could I wish to counsel you few interesting things or tips.

Perhaps you could write subsequent articles referring to this article.

I wish to read more things about it!

is viagra safe sildenafil women sildenafil 100mg generic

I am sure this article has touched all the internet users,

its really really good article on building up new webpage.

levitra for daily use free samples of levitra levitra effect

I have been browsing on-line greater than three hours lately, yet

I never discovered any attention-grabbing article like yours.

It’s pretty price enough for me. In my opinion, if all website owners and bloggers made just right content as you did, the internet shall be much more helpful than ever

before.

where to order viagra

plaquenil for sle chloroquine phosphate over the counter

hydroxychloroquine generic plaquenil 200 mg

hydroxychloroquine for covid 19 plaquenil reviews

hydroxychloroquine interactions chlorquin

celexa 10 mg cost

buy chloriquine does hydroxychloroquine

online doctor to prescribe hydroxychloroquine buy plaquenil

can i buy chloroquine over the counter buy chloroquine singapore

what is chloroquine what is chloroquine

sildenafil for sale usa

chloroquine generic hydroxychloroquine tablets

pharmacy com canada

hydroxychloroquine drugs chloroquine stock

hidroxicloroquina plaquinol

plaquenil reviews hydroxychloroquine plaquenil

cialis black brand tadalafil 20mg mexico cialis pills india

side effects of hydroxychloroquine hydroxychloroquine

hydroxychloroquine dosage what is hydroxychloroquine prescribed for

chloroquine and hydroxychloroquine hydroxychloroquine covid

plaquenil pill plaquenil

I will right away snatch your rss feed as I can’t find your e-mail subscription link or newsletter

service. Do you’ve any? Kindly let me know in order that I may subscribe.

Thanks.

nolvadex 20mg buy

hydroxychloroquine buy chloroquine primaquine

plaquenil over the counter hydroxychloroquine for sale

can you buy chloroquine over the counter generic name for plaquenil

doctors for hydroxychloroquine hydrochloride cream

hydroxychloroquine moa how to make hydroxychloroquine

plaquenil for sale generic chloroquine

plaquenil immunosuppressive chloroquine malaria

hydroxychloroquine zinc buy plaquenil

hydroxychloroquine clinical trial chloroquine dosage

stromectol where to buy

plaquenil medication side effects for hydroxychloroquine

aralen chloroquine buy plaquenil online

hydroxychloroquine zinc how to get hydroxychloroquine

chloroquine generic how does plaquenil work

plaquenil hydroxychloroquine generic chloroquine phosphate

fda hydroxychloroquine chloroquine purchase

chlorochin chloroquine pills

where to buy chloroquine plaquenil 200 mg

hydroxychloroquine zinc plaquenil toxicity

hydroxychloroquine plaquenil buy chloroquin

amoxil 250mg

plaquenil para que sirve hydroxychloroquine zinc

plaquenil plaquenil for sale

chloroquine buy online does hydroxychloroquine cause hair loss

20mg cialis

chloroquine malaria chloroquine walmart

hydroxychloroquine dose plaquenil generic name

what does hydroxychloroquine treat hydroxychloroquine buy

where can i buy hydroxychloroquine chloroquine malaria

plaquenil immunosuppressive aralen medicine

chloroquine for lupus ama hydroxychloroquine

buy chloroquine phosphate canada chloroquine uses

where to buy chloroquine what is hydroxychloroquine

chloroquine quinine hydroxychloroquine covid

chloroquine for lupus chloroquine quinine

hydroxychloroquine generic plaquenil retinopathy

hydroxychloroquine trump hydroxychloroquine dosage

plaquenil pregnancy chloroquine pills

chloroquine buy on line is hydroxychloroquine over the counter

side effects for hydroxychloroquine chloroquine stock

what is hydroxychloroquine sulfate plaquenil drug

plaquenil reviews buy plaquenil online

viagra south africa price

hydroxychloroquine online chloroquine quinine

plaquenil 200 mg plaquenil price

plaquenil and alcohol chloroquin

side effects of hydroxychloroquine what is hydroxychloroquine sulfate

chloroquine structure chloroquine phosphate

hydroxychloroquine warnings plaquenil for sle

does hydroxychloroquine chloroquine walmart

chloroquin plaquenil for rheumatoid arthritis

generic name for plaquenil hydroxyquine

what is hydroxychloroquine prescribed for plaquenil hydroxychloroquine

generic chloroquine phosphate chloroquine drugs

plaquenil hydroxychloroquine plaquenil weight gain

hydroxychloroquine effectiveness hydroxychloroquine buy

is hydroxychloroquine an immunosuppressant what does hydroxychloroquine do

clorochina hydroxychloroquine interactions

chloroquine quinine where to buy chloroquine

ivermectin where to buy for humans

chloroquine phosphate aralen medicine

doctors prescribing hydroxychloroquine near me plaquenil medication

chloroquine hcl chloroquine buy

hydrochloride cream chloroquin

plaquenil immunosuppressive chloroquine phosphate canada

hydroxychloroquine moa aralen hcl

chloroquine hcl buy chloroquine phosphate canada

hydro chloroquine chloroquine over the counter

plaquenil pregnancy chloroquine for sale

hydroxychloroquine cost at costco plaquenil cost

hydroxychloroquine 200 mg tablet hydroxychloroquine sulfate tablets

plaquenil toxicity chloroquine stock

hydroxychloroquine cost generic name for plaquenil

essay writing service write a paper

plaquenil drug plaquenil immunosuppressive

buying essays online write essay for you

hydroxyquine buy chloroquine online

chlorochin hidroxicloroquina

chloroquine phosphate brand name chloroquine generic

buy dissertation write a paper for me

what is hydroxychloroquine hydroxychloroquine plaquenil

plaquenil pill chloroquine purchase

essay writing service college essay writing services

buy chloroquine phosphate canada plaquenil online

hydroxychloroquine for sale chloroquine for lupus

hcq is hydroxychloroquine an immunosuppressant

essay assistance write my essay generator

how to make hydroxychloroquine at home chloroquine otc

chloroquine phosphate over the counter plaquenil dosage

hydroxychloroquine side effects chloroquine walmart

quinine vs chloroquine plaquenil coupon

sildenafil citrate uk

buy chloroquine phosphate canada clorochina

chloroquine hydrochloride plaquenil buy online

chloroquine quinine plaquenil online

essay buy dissertation online

where can i get hydroxychloroquine hydrochloride cream

plaquenil generic name plaquenil buy online

hydroxychloroquine and azithromycin hydroxyquine

plaquenil medication aralen chloroquine

chloroquine prophylaxis chloroquine tablets

hydroxychloroquine brand name chloroquine buy

how can i get free viagra kaiser viagra prescription – viagra aus

essay helper online dissertation writing service

biden hydroxychloroquine plaquenil over the counter

generic chloroquine phosphate chloroquine tablets

aralen medicine hydroxychloroquine buy online

essaybot writing essays

where can i buy hydroxychloroquine is hydroxychloroquine an immunosuppressant

chloroquine malaria is hydroxychloroquine an immunosuppressant

chlorochin chloroquine phosphate online

plaquenil online chloroquine generic

hydrochlor is plaquenil an immunosuppressant

celexa online pharmacy

aralen medicine ncov chloroquine

buy chloroquine chloroquine prophylaxis

write my essay generator essaybot

buy plaquenil hydroxychloride medicine

hcq medication chloroquine structure

order cheapest sildenafil

buy chloroquine phosphate canada plaquenil price

hydroxychloroquine hydroxychloroquine clinical trial

chloroquine hydrochloride antimalarial drugs hydroxychloroquine

write an essay for me essay rewriter

does hydroxychloroquine buy chloroquine

hydroxychloroquine brand name how does plaquenil work

trump hydroxychloroquine is hydroxychloroquine

plaquenil side effects what are the side effects of hydroxychloroquine

does hydroxychloroquine cause hair loss chloroquine phosphate online

chloroquine and hydroxychloroquine plaquenil generic name

auto essay writer writing paper help

plaquenil pregnancy chloroquine buy

plaquenil for sle chloroquine stock

buy chloroquin chloroquine hydroxychloroquine

provigil india pharmacy

side effects of hydroxychloroquine plaquenil

plaquenil generic name where can i buy hydroxychloroquine

chloroquine phosphate online generic chloroquine phosphate

how to make hydroxychloroquine at home hydroxychloroquine warnings

is plaquenil an immunosuppressant chloroquine quinine

buy chloroquine online hydroxychloroquine effectiveness

ivermectin 0.08 oral solution

argumentative essay easy essay writer

plaquenil for sle plaquenil weight gain

plaquenil plaquenil reviews

cloroquina side effects of plaquenil

do my homework how to do your homework

chloroquine structure can you buy chloroquine over the counter

hydroxychloroquin chloroquine hydroxychloroquine

chloroquine us buy chloroquine

hydroxychloroquine sulfate chloroquine tablet

cialis rx

clorochina hydroxychloroquine dosage

chloroquine stock hydroxyquine

writing services edit my essay

hydroxychloroquine uses aralen

hydrochlor generic chloroquine

chlorquin plaquenil for sle

does hydroxychloroquine work chloroquine hydroxychloroquine

how much does hydroxychloroquine cost hydroxychloroquine dose

essay editapaper.com help with homework

chloroquine walmart chlorquin

buy chloroquine chloroquine brand name

hydroxychloroquine trump hydroxychloroquine and azithromycin

hydroxychloroquine clinical trial chloroquine mechanism of action

how to get hydroxychloroquine chloroquine drugs

hydroxychloroquin buy plaquenil

hydroxychloroquine sulfate plaquenil for sale

paper writing services paper help

chloroquine malaria chloroquine phosphate generic name

hydroxychloroquine vs chloroquine chloroquin

does hydroxychloroquine hydroxychloride medicine

hydroxychloroquine over the counter what is hydroxychloroquine prescribed for

chloroquine drugs generic chloroquine phosphate

chloroquine for sale hydroxychloroquine

hydroxychloroquine buy online hydroxychloroquine cost at costco

plaquenil oct hydroxychloroquine side effects

chloroquine hydroxychloroquine plaquenil cost

hydroxychloroquine cost where to buy hydroxychloroquine

ivermectin cost in usa

write my essay generator write an essay

hydroxychloroquine 200 mg tablet plaquenil weight gain

chloroquine brand name chloroquine primaquine

gay dating in ireland traveler

dating gay woman

browse gay dating las vegas

tadalafil online from canada

writing paper help with writing a paper

chloroquine hydrochloride chloroquine phosphate over the counter

where to buy chloroquine chloroquine quinine

hydroxychloroquine for sale how to get hydroxychloroquine

hydroxychloroquine generic hydroxychloroquine covid

what does hydroxychloroquine do cloroquina

paper writing services how to write a good essay

chloroquine buy on line ama hydroxychloroquine

plaquenil over the counter hydroxychloroquine dosage

viagra overdose viagra express ViagraCND100Mg – generic viagra vs viagra

hydroxychloroquin hydroxychloroquine online

chloroquine phosphate tablet aralen retail price

plaquenil price hcq medication

chloroquine hydroxychloroquine how to make hydroxychloroquine at home

help me write my essay do your homework

chloroquine malaria hydroxychloroquine sulfate 200mg

plaquenil reviews online doctor to prescribe hydroxychloroquine

hydroxychloroquine ingredients buy plaquenil

where to buy hydroxychloroquine hydroxychloroquine buy online

buy chloriquine hydroxychloroquine prophylaxis

fda hydroxychloroquine fda hydroxychloroquine

essay writing service us essay writers

what is chloroquine hydroxychloroquine uses

sildenafil citrate tablets 100 mg

online doctor to prescribe hydroxychloroquine does hydroxychloroquine cause hair loss

chloroquine walmart aralen medication

aralen medication hydrochlor

buy plaquenil online hydroxychloroquine dosage

chloroquine structure aralen retail price

chloroquine phosphate tablet chlorquin

doctors for hydroxychloroquine clonopine meaning

hydroxychloroquine effectiveness generic name for plaquenil

hcq hydroxychloroquine for covid

help me with my essay buying essays online

chloroquine over the counter does hydroxychloroquine

doctors prescribing hydroxychloroquine near me chloroquin

aralen chloroquine chloroquine over the counter

side effects of plaquenil chloroquine otc

write a paper essay writer free

plaquenil side effects of plaquenil

plaquenil for sale chloroquine primaquine

chloroquine primaquine chloroquine generic

hydroxychloride medicine can i buy chloroquine over the counter

where can i buy amoxicillin over the counter uk amoxil for sale – purchase amoxicillin 500 mg

help with homework essay writer reviews

antimalarial drugs hydroxychloroquine biden hydroxychloroquine

tadalafil 10 mg india

chloroquine otc canada hydroxychloroquine for covid

does hydroxychloroquine work hydroxychloroquine price

help with writing an essay buy cheap essay

can i buy chloroquine over the counter chloroquine phosphate canada

albendazole 400 mg

how to get hydroxychloroquine hydroxychloroquine uses

chloroquine buy on line chloroquine pills

hydroxychloroquine covid plaquenil pregnancy

chloroquine generic plaquenil eye exam

plaquenil retinopathy plaquenil generic

hydroxychloroquine side effects chloroquine

hydroxychloroquine clinical trial generic name for plaquenil

hydroxychloroquine for sale hydroxychloroquine plaquenil

chlorquin biden hydroxychloroquine

auto essay writer writing help

sildenafil over the counter usa

chloroquine prophylaxis plaquenil 200 mg

buy chloroquine singapore hydroxychloroquine dosage

plaquinol ncov chloroquine

zithromax generic price generic zithromax – zithromax for sale 500 mg

hydroxychloroquine sulfate aralen hcl

hydroxychloroquine dosage what does hydroxychloroquine do

best essay writer essay rewriter

plaquenil buy online chloroquine hcl

hydroxychloroquine dose plaquenil uses

hydroxychloroquine update today chloroquine purchase

buy chloroquine buy chloroquine singapore

write my paper for me auto essay typer

buy plaquenil generic chloroquine phosphate

side effects for hydroxychloroquine ama hydroxychloroquine

buy aralen chloroquine hydrochloride

chloroquine phosphate over the counter side effects of hydroxychloroquine

hydroxychloroquine 200 mg fda hydroxychloroquine

buy chloroquin chloroquine cvs

buy chloroquine singapore aralen medication

how to write a paper essay writer online

plaquenil eye exam chloroquine prophylaxis

hydroxychloroquine for sale side effects for hydroxychloroquine

hydroxychloroquine moa buy chloroquin

writing essays help essay hook generator

chloroquine death hydroxychloroquine zinc

hydroxychloroquine covid chloroquine phosphate over the counter

can hydroxychloroquine be purchased over the counter hcq medication

chloroquine mechanism of action can i buy chloroquine over the counter

hydroxychloroquine pills how much does hydroxychloroquine cost

hydroxychloroquine sulfate plaquenil uses

plaquenil buy online what is hydroxychloroquine prescribed for

i need help writing my paper argumentative essays

chloroquine phosphate online chloroquine 500 mg

is hydroxychloroquine an immunosuppressant what does hydroxychloroquine treat

chloroquine cost hydroxychloroquine over the counter

hydroxychloroquine cost at costco fda hydroxychloroquine

how to get hydroxychloroquine what does hydroxychloroquine treat

hydroxychloroquine uses hydroxychloroquine over the counter

plaquenil reviews hydroxychloroquine for covid 19

hydroxychloroquine trump doctors for hydroxychloroquine

write a paper writing paper help

plaquenil 200 mg hydroxychloroquine tablets

hydroxychloroquine buy online is hydroxychloroquine an antibiotic

can you buy hydroxychloroquine over the counter hidroxicloroquina

hydroxychloroquine ingredients plaquenil over the counter

essay writers dissertation help online

hydroxychloroquine 200 mg tablet buy hcq

hydroxychloroquine cost buy chloriquine

hydroxychloroquine uses buy chloroquine online

does hydroxychloroquine cause hair loss chloroquine for lupus

homework online buy essay paper

generic name for plaquenil chloroquine buy online

plaquenil coupon chloroquine malaria

where can i get hydroxychloroquine chloriquine

zithromax online buy zithromax – zithromax 250 mg australia

hydroxychloroquine pills buy plaquenil online

chloroquine buy online hydroxychloroquine cost at costco

plaquenil buy online hydroxychloroquine online

chloroquine walmart can you buy chloroquine over the counter

buying essays online homework online

chloroquine tablet what is chloroquine

plaquenil over the counter fda hydroxychloroquine

chloroquine dosage chloriquine

ivermectin buy australia

plaquenil generic is hydroxychloroquine over the counter

write a paper for me essay writing services

plaquenil retinopathy chloroquine hydrochloride

buy real nolvadex

quinine vs chloroquine hydroxychloroquine where to buy

hydroxychloroquine drugs hydroxychloroquine pills

plaquenil buy online buy hcq

hydroxychloroquine biden hydrochlor

gay christian dating advice

gay dating game

gay dating clubs

buy chloriquine how to get hydroxychloroquine

chloroquine otc hydroxychloroquine sulfate 200mg

fda hydroxychloroquine clonopine meaning

hydroxychloroquine sulfate chloroquine diphosphate

where can i get prednisone over the counter prednisone pills – where to buy prednisone in canada

plaquinol buy hydroxychloroquine canada

chloroquine buy plaquenil pregnancy

what is a dissertation dissertation help online

is hydroxychloroquine an immunosuppressant hydroxychloroquine and zinc

chloroquine prophylaxis chloroquine structure

doctors for hydroxychloroquine buy chloroquine online

essay format paper writer generator

cialis 50mg price