Premium Daily Crypto Newsletter

February 5, 2018

Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

Markets plunge further

Investors cry out for Satoshi to save them

Our main story today is the hearing scheduled for tomorrow, as the heads of the Commodity Futures Trading Commission (CFTC) and U.S. Securities and Exchange Commission (SEC) will testify on cryptocurrencies before the Senate Committee on Banking, Housing, and Urban Affairs. Made available this afternoon, you can read the pre-written testimonies here:

CFTC:

SEC:

The hearing is entitled “Virtual Currencies: The Oversight Role of the U.S. Securities and Exchange Commission and the U.S. Commodity Futures Trading Commission“.

The SEC Chairman Jay Clayton wrote:

“As I have stated previously, these market participants should treat payments and other transactions made in cryptocurrency as if cash were being handed from one party to the other.”

Here’s our thoughts on the testimonies:

Of particular note is the SEC testimony. Clayton emphasizes that they are keen on preserving innovation.

“These warnings are not an effort to undermine the fostering of innovation through our capital markets – America was built on the ingenuity, vision and spirit of entrepreneurs who tackled old and new problems in new, innovative ways. Rather, they are meant to educate Main Street investors that many promoters of ICOs and cryptocurrencies are not complying with our securities laws and, as a result, the risks are significant.”

He stresses the need to continue efficacy of the Howey test as it relates to crypto. The “Howey Test” is a test created by the Supreme Court for determining whether certain transactions qualify as “investment contracts.” If so, then under the Securities Act of 1933 and the Securities Exchange Act of 1934, those transactions are considered securities and therefore subject to certain disclosure and registration requirements.

Clayton highlights that the SEC and CFTC are working closely together and have the situation under control:

“With the support of my fellow Commissioners, I have asked the SEC’s Division of Enforcement to continue to police these markets vigorously and recommend enforcement actions against those who conduct ICOs or engage in other actions relating to cryptocurrencies in violation of the federal securities laws. In doing so, the SEC and CFTC are collaborating on our approaches to policing these markets for fraud and abuse. We also will continue to work closely with our federal and state counterparts, including the Department of Treasury, Department of Justice and state attorneys general and securities regulators.”

It also seems as though he is intent on making this a federal matter and maintaining enforcement of exchanges above the state level.

“It appears that many of the U.S.-based cryptocurrency trading platforms have elected to be regulated as money-transmission services. Traditionally, from an oversight perspective, these predominantly state-regulated payment services have not been subject to direct oversight by the SEC or the CFTC. Traditionally, from a function perspective, these money transfer services have not quoted prices or offered other services akin to securities, commodities and currency exchanges. In short, the currently applicable regulatory framework for cryptocurrency trading was not designed with trading of the type we are witnessing in mind. As Chairman Giancarlo and I stated recently, we are open to exploring with Congress, as well as with our federal and state colleagues, whether increased federal regulation of cryptocurrency trading platforms is necessary or appropriate. We also are supportive of regulatory and policy efforts to bring clarity

and fairness to this space.”

Some interesting takeaways are that Regulation D applies to ICOs, indicating that SAFT sales would be possible.

“It is possible to conduct an offer and sales of securities, including an ICO, without triggering the SEC’s registration requirements. For example, just as with a Regulation D exempt offering to raise capital for the manufacturing of a physical product, an ICO that is a security can be structured so that it qualifies for an applicable exemption from the registration requirements.”

He stresses some concern over leveraged trading, and states a position very similar to what we’ve seen in other countries such as South Korea — they are not banning crypto, they are going after the “fringe” elements that are scamming and defrauding people:

“In this regard, the SEC is monitoring the cryptocurrency-related activities of the market participants it regulates, including brokers, dealers, investment advisers and trading platforms. Brokers, dealers and other market participants that allow for payments in cryptocurrencies, allow customers to purchase cryptocurrencies (including on margin) or otherwise use cryptocurrencies to facilitate securities transactions should exercise particular caution, including ensuring that their cryptocurrency activities are not undermining their anti-money laundering and know-yourcustomer obligations. As I have stated previously, these market participants should treat payments and other transactions made in cryptocurrency as if cash were being handed from one party to the other.”

He also took the time to comment on the ETF requests made of late, essentially stating that they need more time to properly implement them:

“Finally, financial products that are linked to underlying digital assets, including cryptocurrencies, may be structured as securities products subject to the federal securities laws even if the underlying cryptocurrencies are not themselves securities. Market participants have requested Commission approval for new products and services of this type that are focused on retail investors, including cryptocurrency-linked ETFs. While we appreciate the importance of continuing innovation in our retail fund space, there are a number of issues that need to be examined and resolved before we permit ETFs and other retail investor-oriented funds to invest in cryptocurrencies in a manner consistent with their obligations under the federal securities laws. These include issues around liquidity, valuation and custody of the funds’ holdings, as well as creation, redemption and arbitrage in the ETF space.”

Clayton’s final statement is one worth reading. It is a very succinct and eloquent statement that evokes the exact sentiments we desire in government regulation of cryptocurrencies — working with crypto, not against it. All in all, we find this to be a comprehensive and encouraging vignette of the cryptocurrency regulatory space:

“Through the years, technological innovations have improved our markets, including through increased competition, lower barriers to entry and decreased costs for market participants. Distributed ledger and other emerging technologies have the potential to further influence and improve the capital markets and the financial services industry. Businesses, especially smaller businesses without efficient access to traditional capital markets, can be aided by financial technology in raising capital to establish and finance their operations, thereby allowing them to be more competitive both domestically and globally. And these technological innovations can provide investors with new opportunities to offer support and capital to novel concepts and ideas.

History, both in the United States and abroad, has proven time and again that these opportunities flourish best when pursued in harmony with our federal securities laws. These laws reflect our tripartite mission to protect investors, maintain fair, orderly and efficient markets and facilitate capital formation. Being faithful to each part of our mission not in isolation, but collectively, has served us well. Said simply, we should embrace the pursuit of technological advancement, as well as new and innovative techniques for capital raising, but not at the expense of the principles undermining our well-founded and proven approach to protecting investors and markets.”

|

Tonight we are running a free, live “Bear Survival” member’s-only webinar tonight to talk to you folks about what we’re seeing, to give you some guidance on how to handle this Bear, as well as how to handle future ones. Just register by clicking on the link below and join us TONIGHT at 8pm ET (New York)/1am UTC. Can’t join us? No problem, we’ll record and archive the webinar in the “Live Classes” section of the member home. There’s no cost, no hassle, we just want to connect with you and give you some tools to handle today’s volatility. Registration Link (Please click this now to get registered) https://attendee.gotowebinar. |

If you missed our class “Introduction to Cryptocurrency Trading” that we held on last weekend, it’s available now in our Premium Member’s Home as an archived class for those that purchase it. You can view more about it and watch the class today by visiting this link here.

Click here for audio link of today’s video

Watching on Mobile? Click this link to watch in HD.

Offense – Adding Trades

Offensive Actions for the next trading day:

- Added Vechain ($VEN)

Defense – Managing Risk

Defensive Actions for the next trading day:

- Exited LINK & PHR

Current Portfolio

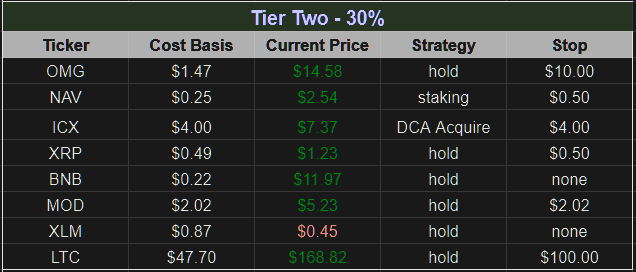

How to read this portfolio: Ticker: Contains the ticker code for the coin. You can search this ticker in Coinmarketcap to learn more about the coin. The color denotes the risk tier by our evaluation. Dark Red = T1, Dark Green = T2, Dark Blue = T3, Light Blue = T4 (Colors in the Ticker column do not interact with the colors in the other columns) Cost Basis = Our average purchase price for this coin. Current price = The average price of the coin based on the exchanges it is listed on. Strategy = What we plan to do with this coin. Staking is receiving dividends for that coin. Master node is also staking, but with a higher return rate for having a (large) number of that coin. Stop = Our exit point, if it exists What do the colors mean? The colors in the ticker column represent the risk profile of that coin. The colors in the other columns reflect what sector(s) that coin belongs to. Some coins belong to multiple sectors, which is indicated by multiple colors. The colors correspond to our 7 categories in the graphic below.

Tier 3

Vechain

VeChain is a global leading blockchain platform for products and information.

VeChain is the world’s leading Enterprise-focused dApp/ICO platform for products and information. It aims to connect blockchain technology to the real world by providing robust infrastructure as well as IOT integration, with scalability up to 10,000 tx/s and pioneering in building real world applications. This is being achieved through partnerships and collaborations with innovative brands and industries.

As of today, VeChain has established partnerships with PricewaterhouseCoopers, DNV GL, Renault Group, KUEHNE+NAGEL, D.I.G., China Unicom, etc., and accumulated extensive experience in an ever expanding list of industries including pharmaceuticals, liquor, auto, luxury goods, retail, logistics, supply chain,food and cold storage and more.

Tier 2

OMG

OmiseGO is a public Ethereum-based financial technology for use in mainstream digital wallets, that enables real-time, peer-to-peer value exchange and payment services agnostically across jurisdictions and organizational silos, and across both fiat money and decentralized currencies. Designed to enable financial inclusion and disrupt existing institutions, access will be made available to everyone via the OmiseGO network and digital wallet framework.

ELF

Based in Singapore, aelf is a crosschain blockchain protocol that intends to become the new internet infrastructure to support the next generation of digital businesses. The team and its advisors have been advising numerous blockchain projects in the past and they see a few industries who could be the early adopters of aelf: financial services, insurance, digital identity and IPs, smart city, and internet of things. Aelf will actively identify new business opportunities and dApps to be part of the aelf ecosystem. Below are some of the things that they are planning to do: Interoperate with existing dApps on existing chains Nurture new start-ups ideas Educate and transform established companies to be blockchain savvy As a “third generation” blockchain, aelf strives to provide a breakthrough in 3 areas: performance, resource segregation, and governance structure. We will explore these features in more detail below.

Tier 3

REQ

SUB

LINK

Tier 4

XBY

BNTY

TAU

WISH

TRAC

PHR

ReadySetCrypto’s 7 Categories Of CryptoCurrency

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

Tier 3 coins are those coins which we have moderate investments and we believe have a possibility of high performance in the future, but as of yet have not shown enough performance to reduce their risk profile. Tier 3 coins are coins which are moderately risky, but due to our risk analysis of the project and team we believe have minimal chance of failure.

Tier 4 coins are coins which we have minimal stake in, are highly risky, and we are contributing no more than 2% of our portfolio to. These coins represent the outer fringe of our risk analysis, in that we have little information to work with, have little insight into the coin’s performance, and at the very best we are making an educated guess that they will be successful. If a coin performs well and proves that it has a commitment to its compelling feature, it will be moved to the Tier 3 status.

Fundamental Currency Research

As the market starts to reach a point of saturation where additional bad news has no additional effect on the market, traders will wonder “where is the bottom?”

We’re seeing a trend, now expanded today with the US and China, that countries are cracking down on the fringe elements of crypto but not stopping crypto from becoming a widely used technology. As the SEC chair confirmed, smart countries do not want to get in the way of progress because they stand to lose out on the potential benefits from this wave of technological innovation. We’re seeing more and more countries, having defined their positions, embrace crypto in an effort to sap the innovation from countries who flatly reject it.

As countries get closer to a state owned cryptocurrency, it will be interesting to see if they continue to allow the free and open market to operate independently or they outlaw it.

Until then, we expect the trend to continue where countries work with crypto, not against it.

This fairly interesting article details some points of conjecture about Tether that are worth considering. It could be that Tether is solvent but the CFTC needs to dig deeper into it. For what it’s worth, if Tether had an empty bank account they would have been shut down already, especially when subpoenaed back in December.

Regardless if Tether is going to go under or not, it further highlights something worth mentioning:

We say exchanges are the least secure place to store crypto not only because of a lengthy history of hacks in the crypto space, but also because any of these exchanges could go under without any notice and take your crypto with it. Moving crypto off exchanges protects you from hacks (most of the time) and exchange mismanagement. You can never be too careful.

In this section we’ll feature a daily ICO or new coin we think you should check out. Based on your country, you may not be able to participate in the ICO, but you will be able to trade the coin once it is listed on an exchange following its ICO (usually only a couple of weeks). ICOs are where a lot of money in crypto is made. Here’s proof. That said, we should warn you: ICOs are highly risky endeavours and you need to mitigate any potential losses. Treat it as money you’ve lost the moment you contribute to the ICO. We are not responsible for the ICO’s performance. Today’s featured ICO / New Coin is:

Friendz

For flipping Good.

For long-term holding Good.

What is it?

Friendz is a fast-growing company whose main goal is to connect brands with their target audience, taking advantage of the most powerful marketing tool ever: the word of mouth on social media. Friendz is proud to have introduced in the digital marketing scenario a new way of doing advertising, based on peer-to-peer communication.

What is our verdict?

What we like: Good idea, great marketing, they already have a functioning product that’s brought in 2M, solid team, lots of potential.

What we don’t like: Not much other than a tough sector to break into.

Website: https://friendz.io/

Whitepaper: https://friendz.io/file/whitepaper_icofriendz.pdf

Technical Analysis Research

Again there’s no point in doing a top-ten coin analysis until the capitulation is here. I hope that you can catch our free webinar tonight (https://attendee.gotowebinar.com/register/9010920390661021185) where you can interact with us. Depending on the outcome of tonight’s webinar, we may do more of these in the short term.

As soon as we finish the webinar tonight, we will render and post an online version of it in the member’s home, under the “live classes” area.

We had an excellent class last weekend, Introduction to CryptoCurrency Trading. (Click here for more information and to sign up) This class is really targeted at the Crypto investor who wants to get moving but is somewhat uncertain about what they should do, and how to go about it. Another great candidate would be the recent investor who bought in at the top and is unsure of their actions. While you can’t attend the live class and the Q&A any more, the content is all there and we give you the slide download as well.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.