Doc's Daily Commentary

Mind Of Mav

Bitcoin Is Still Winning – How To Stop Worrying About Price

Bitcoin has been taking a beating lately — both in its market cap and its reputation. The primary despair that many people have been voicing online or in-person seems to ultimately stem from the hope that it was going to make them rich. Now they are in an uncomfortable position where they bought in higher than it’s worth. However, bitcoin was never going to be a get-rich-quick scheme for people. The days where you could buy cheap and sell 1000x later are gone, and it’s very difficult to find an altcoin with that kind of return. However, speculation and wild returns were never the promise or virtue of Bitcoin. Despite the current downturn, its true value is increasingly realized around the world, and I am confident that this advance in technology will go on to thrive.

Why? What makes me so confident?

Bitcoin is not “magic internet money.” Cryptocurrencies and other innovations based on blockchain technology often seem counterintuitive and even ridiculous at first. The recent enthusiasm and confusion around NFT’s is a good example of this stigma. A lot of people ask why digital art has been selling for thousands to millions of dollars when it seems like it could easily be copied and distributed just like everything has been in the past. Didn’t Napster already demonstrate how the virtual world has no property rights?

What Blockchain Enables

I went into more detail explaining blockchain in a previous post, but I want to emphasize some of its capabilities and implications from a bird’s eye view. There are three, in particular, I want to focus on:

1. Ownership: If you own bitcoin, an NFT, or anything on a blockchain then that is a unique transaction that belongs to you. Your rights to it are verifiable and immutable. You have proof of purchase.

2. Originality: The asset itself is distinct. Even though it seems like someone can copy and paste the NFT you just bought — the NFT (whether it’s an image, song, etc.) is embedded within a uniquely identifiable token on the blockchain ledger that cannot be duplicated. We know what the original is. A quick example: everyone knows what the Mona Lisa looks like — copies of it plaster everything from cheap reprints to 1000-piece jigsaw puzzles. But no matter how accurate a copy anyone creates — the Mona Lisa sitting in the Louvre can still be verified as the original and is the only one that holds value.

3. Decentralization: There is no central authority acting as a gatekeeper that can deny or invalidate your ownership of an asset, nor can any central authority obscure an asset’s unique and verifiable identity. Everything is decentralized.

Napster and its successors are for people who don’t care about ownership or items with a unique identity — which is a lot of us. Who doesn’t use Spotify, Netflix, Youtube — on and on? This is why the subscription model has been so successful for most businesses. Often we don’t care about ownership, and we don’t care how many times the bits have been copied or from where when streaming our music.

However, there are some important situations when I do care about ownership and something being an authentic original. For instance — dollars. I don’t want to be paid with counterfeit dollars. Also — collectibles such as art, books, etc. Blockchain empowering people with digital property rights that enable and preserve this type of value is huge.

But the third point is the revolutionary step forward: eliminating the central authority.

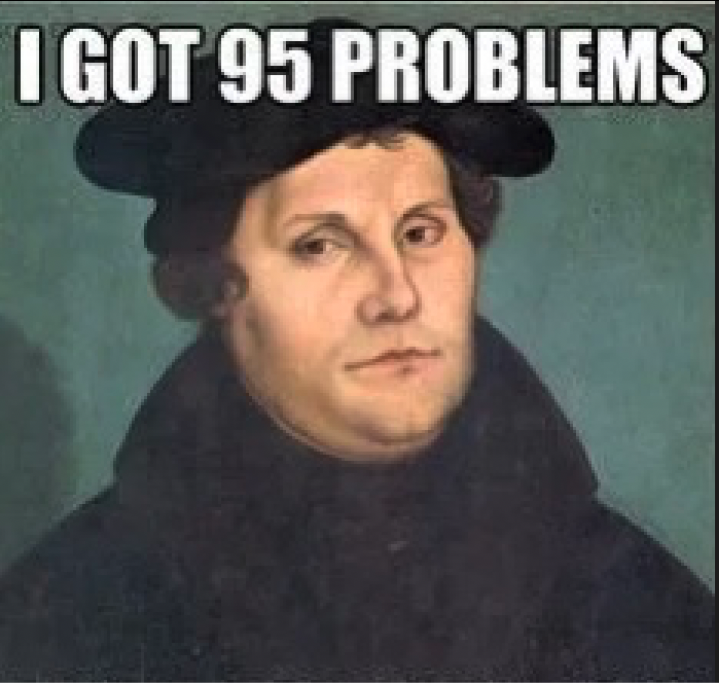

The Printing Press Revolution

I have seen some great analogies that compare Bitcoin to the printing press — and I don’t think it’s hyperbole. Before the printing press, information (in particular, scripture) flowed from authority. The Church. The King. But with the advent of the printing press, information went from being centralized to decentralized. You no longer needed a monastery full of celibate monks focused on transcribing one document to another. Instead, the technology made the information so accessible that people could own books, write books, and widely distribute books.

This inspired some panic as authorities and elites began to realize the implications of the power they lost. One abbot is recorded as accusing people that “he who ceases from zeal for writing because of printing is no true lover of the Scriptures.”

Which is absurd. I think the real cause for alarm was that people could clearly see how they had been manipulated and oppressed by these “lovers of scripture” once they could actually own and read the scriptures themselves. This led directly to the Reformation.

The Bitcoin Revolution

Similar to the Church deriving power from controlling the accessibility of scripture, a significant amount of power is derived from controlling monetary policy. And we should trust the authorities in charge of our money less than we trust Facebook with our data. What would it look like if monetary policy and social media were decoupled from centralized authorities?

It would be as significant as the printing press.

Earlier I said that I don’t want to be paid in counterfeit money. But neither do I want to be paid in money that the Federal Reserve has decided to inflate year after year. I want what I own to retain authentic value. Some may argue that people are not financially literate enough to understand money without the government and banks interpreting it for them — but those were the same arguments against the printing press. And just as actual literacy spread because of the printing press, I believe blockchain will drive financial literacy. It becomes in our best interests to know more and to know better. And — as Michael Saylor observed — how transformative would it be to have “a monetary system that doesn’t rest on the threat of violence?”

Similarly, I don’t want my social media feeds manipulated. And even more, I increasingly have this sick feeling in my stomach that makes me skeptical when I buy eBooks. Has this been edited? How do I know? Did someone, somewhere decide to “virtuously abridge” (or some other New Speak vocabulary) my download of Huckleberry Finn so that some particularly offensive content was censored? Again, this issue of trust can be solved via blockchain. It is a system that guarantees a digital asset’s integrity while circumventing any possible censorship because it eliminates the middlemen.

For The Win

Yes, Bitcoin has taken a beating lately — falling from an all-time high of over $60k. Bitcoin will continue to be volatile. There will be new all-time highs and also crashes.

But the more it is adopted, the more it will stabilize. El Salvador already, soon Paraguay, and it appears many more countries in both South America and Africa are developing legislation to recognize Bitcoin as legal tender. A critic may say they are “small, insignificant countries” — but maybe exactly because of that marginalization, they are uniquely qualified to recognize how Bitcoin can empower them in a world that dismisses them. Also, if you’re sitting on a savings account making 1% interest while inflation is 3% + … maybe you should not be scoffing. Bitcoin is still one of the best-performing assets in our lifetimes.

What I hope is understood is how successful a technology this is — and how significant and revolutionary it is that Bitcoin is even worth $1. This shows the promise of blockchain technology not only in the cryptocurrency space but also in many other industries.

We have a printing press moment. A chance for ownership, authenticity, and freedom from censorship. Blockchain technology will change the world as dramatically as the internet. Bitcoin is one of the first examples of this technology — a bright spark of a free human spirit and independent mind that I hope is the first of many, eventually growing into a fire that sweeps the globe like the Enlightenment and reforms the Pareto distribution that our society has become.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.