Doc's Daily Commentary

Mind Of Mav

How To Find The Next Crypto Unicorn

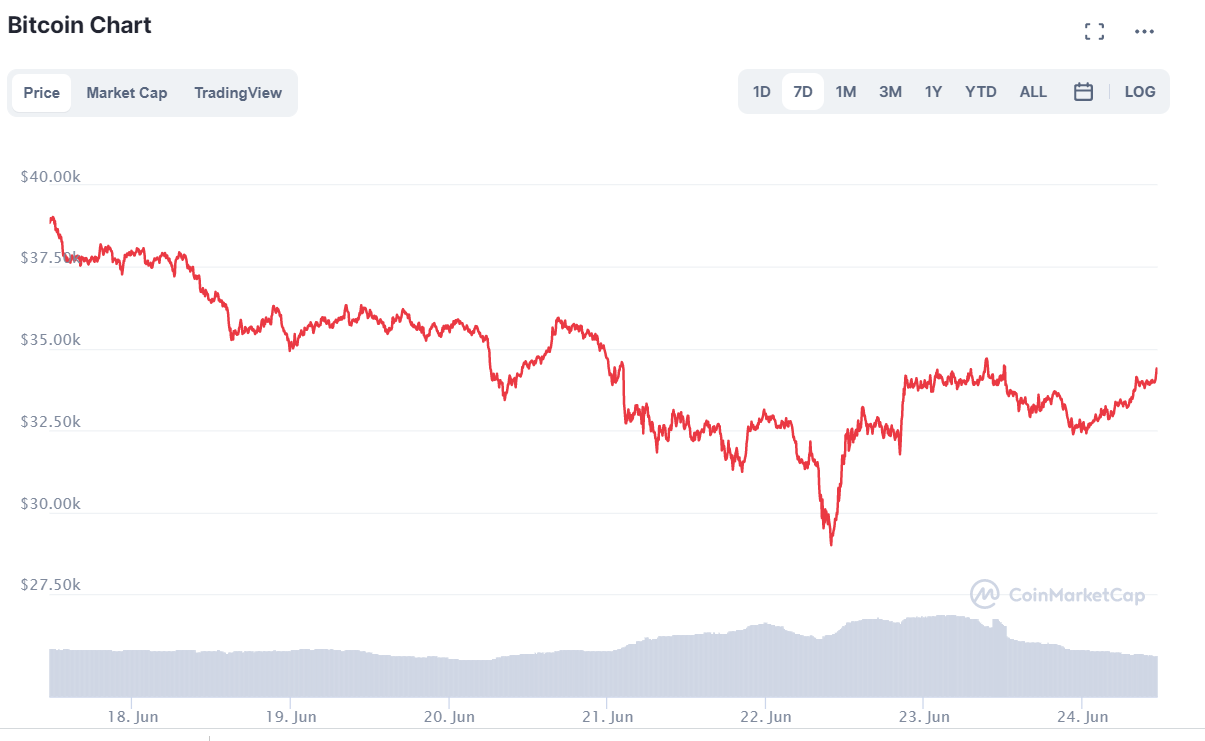

After Bitcoin fell from $60,000 to $30,000 and brought all other coins down with it, many thought the correction was over, and that Bitcoin was preparing for a monumental rise to $100,000 or higher. Instead, the price continued to correct downwards after a slight upwards movement, and the market capitalization of cryptocurrencies has lost as much as $500 billion in the past week. This is due to several factors, including the exodus of Chinese miners, potential manipulation, and the traditional market cycle.

Even though most investors know that cryptocurrencies are incredibly speculative and subject to major crashes, nobody likes to see their investment decrease by 20% or more overnight. Unfortunately, this is exactly what has happened lately with cryptocurrencies, as the correction from last month has become revitalized and caused the price of Bitcoin and other cryptocurrencies to decrease even more. A lot of the daily volatility of Bitcoin has no real cause, and thus is hard to correlate with events. However, this most recent downtown may have a correlation with real world events that have proven to be negative for the cryptocurrency market as a whole.

One of the biggest news stories in crypto over the past couple of months has been the banning of cryptocurrency mining in China, which follows their ban on trading cryptocurrencies from 2017. This is significant, as 65% of Bitcoin’s hashing power comes from miners and mining hardware in the country, and miners from all provinces, regardless of whether they use green or dirty energy, have been forced to shut down. The Chinese government’s reasoning for this ban is to protect investors from the wild and speculative nature of the markets, and most likely has to do with the rollout of their own central bank digital currency. Ever since the bans started taking effect, the hashing power of the Bitcoin network, which is a measure of its security, has been decreasing significantly, and is now down over 44% from its all-time high. This has spooked some investors, who take this as a sign that it is the beginning of the end for Bitcoin.

While it is true that the short-term outlook of Bitcoin is negative due to the mining bans, it will have a positive effect in the long-term. Miners will be forced to move to other areas, which will help decentralize the network and promote the use of green energy. So even though the network is not as strong as it once was, it is almost guaranteed to come back stronger than ever once the miners are finished relocating. Additionally, the hashing power of the network now is still five times higher than it was in the previous 2017 bull market, meaning the network is still incredibly secure.

Another event that may be causing the cryptocurrency downturn is potential manipulation from Bitcoin whales. Due to the lack of regulation in most countries, the manipulation of Bitcoin’s price is completely legal, which allows the biggest holders to change the price to make a profit. This means that some of the world’s biggest companies, hedge funds, and individuals could be working together to suppress the Bitcoin price and buy more at these decreased levels. Although this is complete speculation and it is in no way proven that there is mass collusion in the space, there have been appearances in the price charts of Bitcoin that suggest that manipulation is taking place. If this is true, and Bitcoin whales are suppressing the price to accumulate more, the cryptocurrency downturn will quickly reverse once the manipulation stops and whales are comfortable with their increased crypto holdings.

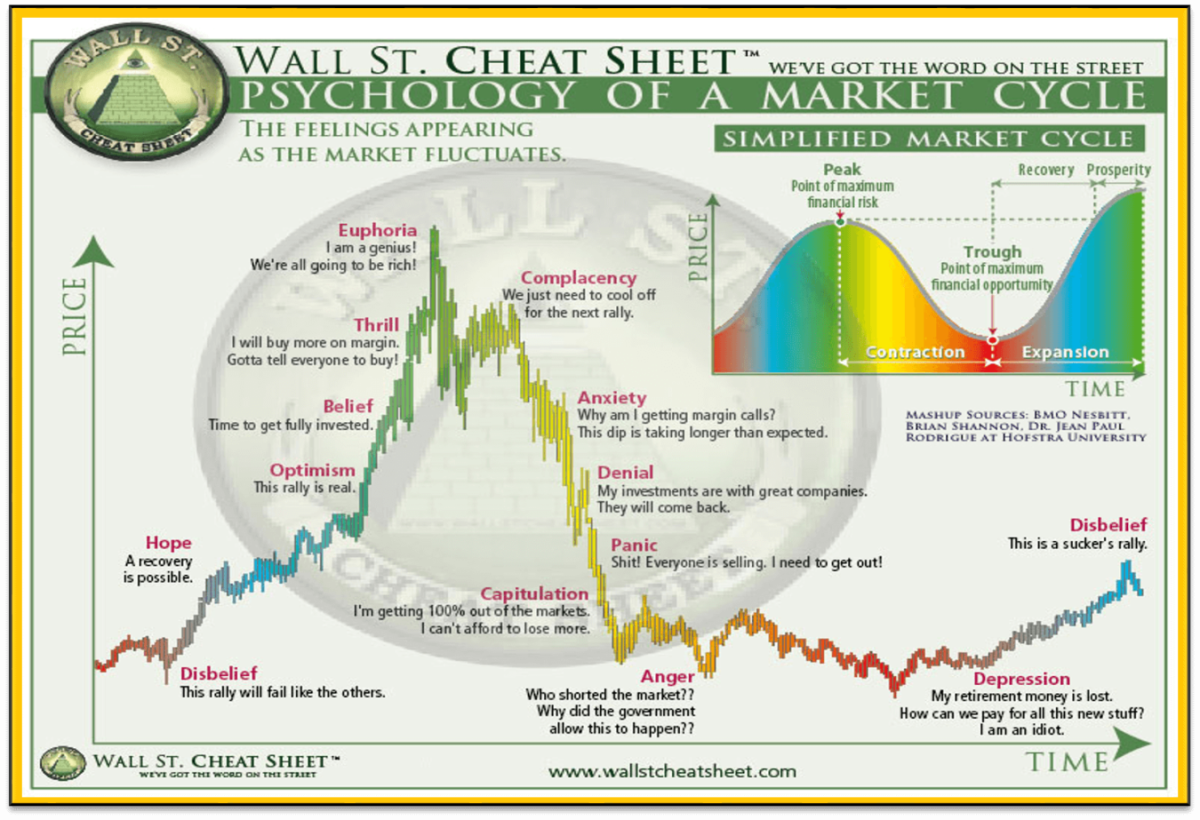

The most likely cause of the downturn is simply due to the cyclical nature of the market. Cryptocurrencies have seen their fair share of price volatility in their short history. Since Bitcoin was created in 2008, there have been about four market cycles, each following a similar pattern: Bitcoin starts low, increases rapidly to a new all-time high, then comes crashing down to a value near the all-time high of the previous market cycle. This trend is exactly what we have seen so far in the 2021 bear market: Bitcoin started the year around $10,000, sharply rose to $60,000, and is now hovering in the $20,000 to $30,000 range, which is around the previous all-time high from 2017 of $20,000. It typically takes around three years for one of these cycles to complete, so if this is what is happening, Bitcoin may not reach $100,000 until 2023 or later. However, as soon as a pattern can be identified in the market, it is no longer a pattern, as traders try to take advantage of this “predictable” action, which ends up making it unpredictable once again.

Even though nobody truly knows why the crypto markets move in the way they do, it is important to remember that the short-term price fluctuations have no effect on the technology, impact, or long-term potential of digital assets. Furthermore, every possible cause discussed has a solution that will inevitably happen, which will make the entire ecosystem more decentralized, mature, and ready for worldwide adoption

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.