Doc's Daily Commentary

Mind Of Mav

Is Crypto Winter Here To Stay?

Crypto has had a great run over the past few years.

The pandemic got everyone interested in this supposedly “futuristic currency system.”

Hell, even nations have accepted crypto.

But this crypto-mania may soon be coming to an end thanks to the recent crypto market crash which saw investors losing $200 billion in a day and $600 billion in a week.

But what’s caused this crash?

? Unstable Stablecoins

It all began with the crash of the twin cryptocurrencies Terra and Luna last week.

Both currencies fell over 99%, losing almost their entire value. The crypto’s market value fell from $40 billion to $500 million in days.

Why?

To understand this, we first need to understand how Terra and Luna work.

Terra is an algorithmic stablecoin — these are the non-volatile version of cryptocurrencies that, you guessed it, remain stable.

How do they remain stable?

Well, not all stablecoins are the same.

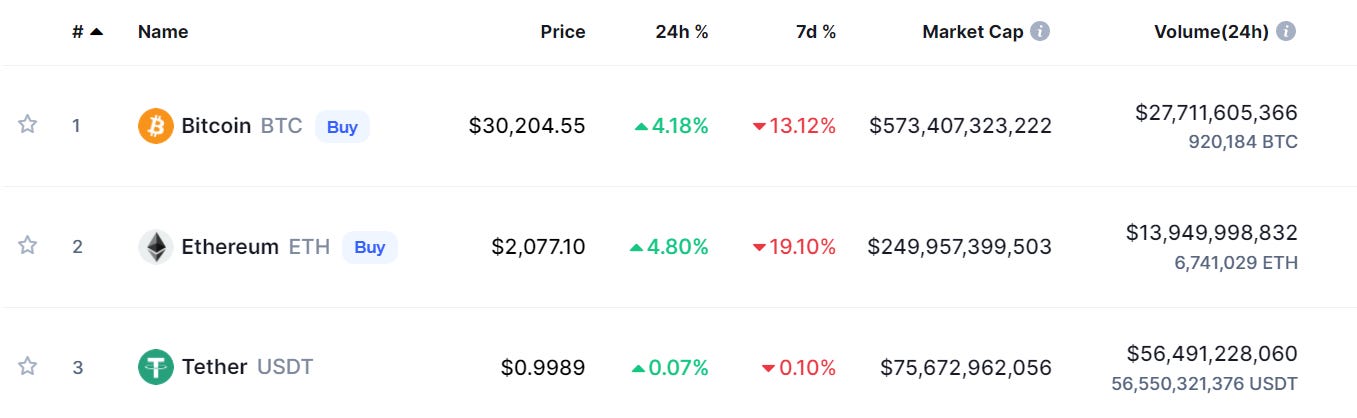

Some stablecoins are linked to a real-world asset or currency, like the dollar. Companies that launch stablecoins usually have dollar or other currency reserves equivalent to the number of their stablecoins in circulation. So, the price of Bitcoin may fluctuate, but the price of these stablecoins is expected to remain the same. For instance, the price of Tether (a well-known stablecoin that was also a victim of the crypto crash) promises to give you $1 every time you sell one Tether.

But algorithmic stablecoins are different.

They aren’t backed by dollars but a complex mix of maths and code . . . And a whole lot of faith.

Terra, for instance, is backed by a code that ensures you can always get $1 for a Terra when you sell it.

But unlike Tether it doesn’t give you that $1 directly.

It gives you $1 of Luna (its sister currency that operates on the same blockchain) in return. And the price of Luna isn’t fixed. It works just like other cryptos: it runs on faith.

So, you see, Terra isn’t all that stable.

And this instability is what caused the crypto to crash.

? The Downfall

Because of Terra’s complex underlying mechanism, the coin is very popular with traders.

You see, everytime Terra’s value falls a little, people buy Terra and exchange it for $1 of Luna, earning extra money on each transaction.

But despite this loophole, the system worked because Terra didn’t really plummet that much.

Until last week.

The Terra blockchain also has a DeFi platform called Anchor. It incentivizes people to park their Terra on the platform, which it then loans out. The depositors then get interest on their deposits.

About $14 billion worth of coins were deposited in Anchor in the beginning of May, but suddenly last week a large number of depositors withdrew their money from the platform, causing deposits to fall to $1.6 billion.

This caused Terra’s value to fall way down and traders began buying the currency to exchange it with Luna.

In an effort to maintain Terra’s dollar pegs, the Luna Foundation Guard (the foundation which maintains Terra’s dollar peg) sold its reserves (which contained over $3 billion worth of Bitcoin and other cryptos) to pay back investors.

This massive sell-off spread like wildfire in the market, with the panic taking down the price of other cryptos.

Tether, which is one of the top three cryptocurrencies in the world, also lost its dollar peg, falling to $0.96 earlier this week before recovering. It still hasn’t reached the dollar mark yet.

This is despite the fact that Tether’s chief technology officer ensured that sellers were still easily getting $1 in exchange for the coin and the company had enough reserves to honour all transactions.

This just proves that stable or unstable all crypto coins run on faith.

Once panic sets in, nothing can save these coins. And a widespread panic has set into the market not just thanks to this sell-off, but for multiple other reasons like the interest rate hike and the stock market crash.

To add fuel to this fire, Coinbase recently announced that if it went bankrupt all of its users’ money would go down with the sinking ship.

What?

? The Exchange Problem

Regulators have always been after crypto exchanges (and rightly so).

And looking at the current market volatility, regulators forced Coinbase to accept publicly that if it ever went bankrupt it would not be returning their money. It would go towards paying off its debts.

This statement came along with a less than optimistic first-quarter earnings report, making crypto users warier.

And Coinbase is not the only exchange in trouble.

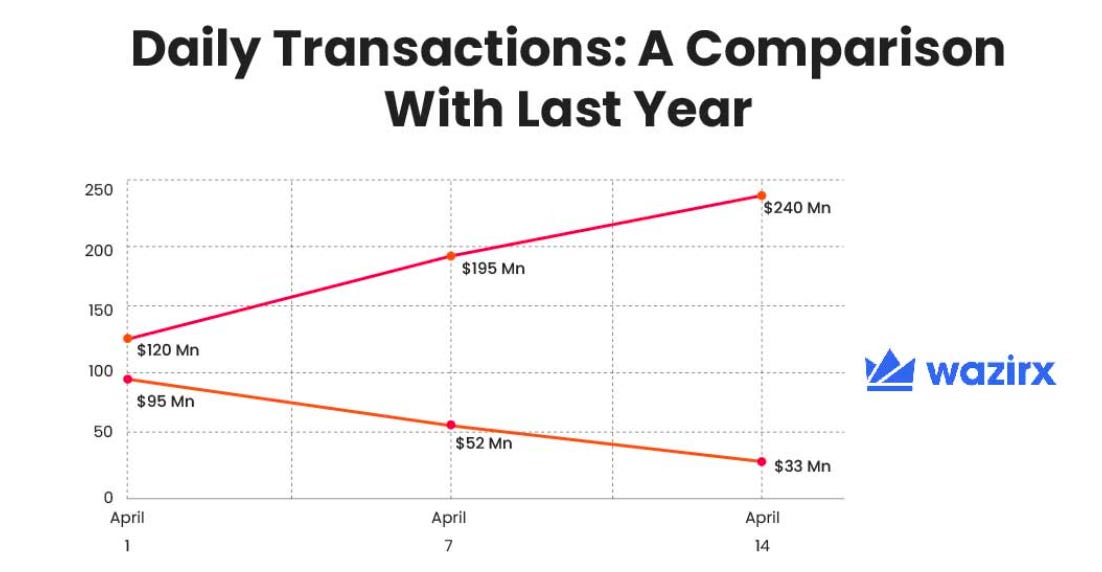

Indian exchanges like WazirX and CoinSwitch Kuber are also facing issues.

You see, the National Payments Corporation of India recently made an announcement that it wasn’t aware of any crypto exchanges using UPI.

This indirectly could mean that no crypto exchange had secured permission to use UPIs.

So, these exchanges shut down UPI transactions. Some have even stopped accepting NEFT transfers or net banking as banks are also not cooperating with these exchanges until NPCI clarifies things.

So, users are moving away from crypto voluntarily or involuntarily, and if more countries now introduce a safer Central Bank Digital Currency, it could be a death knell for a lot of speculative cryptos.

Does this mean crypto is over?

Well, no.

No matter how hard regulators try, ending the reign of cryptos like Bitcoin and Ether is going to be nearly impossible — crypto will survive in at least some form.

Now only time will tell which cryptos make it and which vanish forever.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.