Doc's Daily Commentary

Mind Of Mav

DeFi Tools To Improve Your Crypto Trading In 2021

Most crypto traders are comparing 2020 with 2017 when Bitcoin hit its all-time high of $20,000, and altcoins were doing a 2-5-10x in just a matter of days.

This year is different.

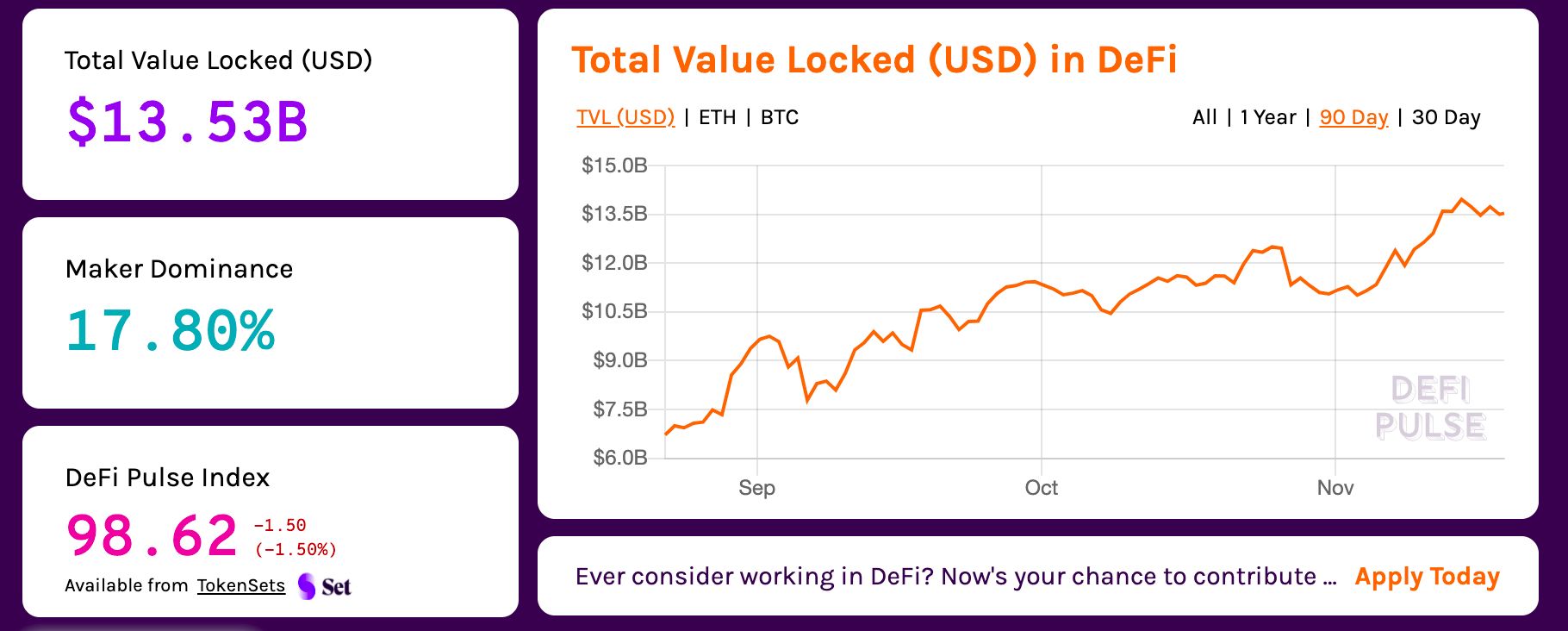

Traders, holders, and investors have more knowledge and the market growth is not based (entirely) on hype. The crypto market is much closer to reaching mainstream adoption and that wouldn’t be possible without all the infrastructure advancements being made, such as DeFi (Decentralized Finance) projects that are making crypto more accessible and easy to use for the average user.

This question came to mind as I was looking to consider how to make use of this bullish energy. I thought, ‘Why am I still using the same tools as years ago?’

That’s when I dug into the latest DeFi tools and I discovered a whole new world that not only that saves me hours of my day, but it saves me up to 50% in transaction fees and gives me data analytics that I didn’t know I could have access too.

No matter if you are an experienced crypto trader or a new investor who just found out about crypto, the tools I’m about to introduce to you will definitely improve your experience with cryptocurrency.

So, let’s understand how these tools are different than the ones you’re used to.

Why decentralized tools?

DeFi means blockchain takes control, literally.

Centralized exchanges are nice but the counterparty risk is way too big, especially if you are going to stay invested in cryptocurrency as in most countries converting back to fiat is a taxable event and you might not want to fill the government:s pocket more than you need to.

DEXs (Decentralized Exchanges) were the first tools that allowed you to trade cryptocurrency without losing control of your coins in the process. Great tools . . . but, in terms of usability, DEXs are a mess.

If you ever tied one, you know. You will spend double or even triple the time you would normally do just to double-check every address and every detail before placing an order.

Not only are they inefficient, but they also lacked liquidity. Filling an order would take days, most likely because everyone was using a centralized exchange and wouldn’t want to make a change.

I don’t blame them; I was in the same place, too.

The new DeFi tools are different.

They are non-custodial financial products (like DEXs) but they improved a lot on the user experience. Not only that but they are including features that weren’t accessible before in any other exchange. The tools I’ve chosen are becoming a one-stop-shop for me to do all my cryptocurrency trades so I’m sure I’m not losing on any possible gains. Here are three tools you might consider using for your next trades and investment choices.

Simplified Finance is a decentralized finance protocol formed by two core products: GNS (Gas Reduction Token) and SMFI (Governance Token) that are designed to help you handle your trades at just a fraction of the cost you are paying at any of the other decentralized finance protocols like Uniswap, 1inch.exchange and Yearn Finance.

GNS gives you the benefit of hedging against the volatility of gas fees. This means that when the prices are going up and the gas prices spike, you won’t have to pay those extremely high fees.

SMFI makes sure that the ecosystem remains healthy with governance and incentives. New users will be brought in through the referral protocol and buyback burn mechanism to make sure that only the most invested users will be able to vote on future protocol decisions.

Simplified Finance is not an exchange although you can trade your tokens as you’d do on one. It doesn’t have an order book. It’s working on a model called Constant Asset Market Maker where reserves are provided by liquidity providers. Anyone can be a liquidity provider and every trade happens on-chain through smart contracts.

Regardless if you choose to participate as a trader or a liquidity provider you are going to win:

1.As a liquidity provider, you are going to earn from the trading fees

2.As a trader, you are going to pay significantly less fees than on any other platform

Other options are Uniswap, 1inch.exchange and Yearn Finance. Uniswap is the most popular right now and has a battle-tested algorithm to determine the prices. 1inch.exchange has a great API and many developers are choosing to implement it. And Yearn Finance is the new kid in town with better deals. But neither comes even close to Simplified Finance low fees.

Dune Analytics for market data

Dune Analytics is a blockchain data analytics startup. As you need data to decide on what tokens to get, this tool is a global, real-time platform for on-chain data analysis. I’m talking about charts, diagrams, tables, a place where you can get and remix data in any way possible.

Currently, Dune is the most open and up to date platform in the crypto space. Here you can make sure that your data is synced fast as its competitors are putting restrictions in terms of what you can query. Some traders are considering Dune the default platform for getting market data and not only them. You don’t need to be tech-savvy to use it. Instead of blindly trusting a project, you can give Dune a try to verify its data on-chain for yourself beyond whatever their website or white paper claims.

Let me explain a query in more simple terms so you know what you’d be facing.

In your dashboard, you’ll have access to live Ethereum data like blocks, events, transactions, receipts, contract messages. You can look for a specific transaction or track a certain address, or you can choose a time range and pull up all the events of a type, all the blocks where a certain type of transaction took place or even look for ERC20 transfers.

Other alternatives are Bloxy, Stablecoin Index, or Uniswap.vision. Bloxy extends its analytics to margin trading positions if you are interested in that kind of data. Stablecoin Index offers dedicated analytics for stablecoins. Uniswap.vision is a collection of community-made charts.

StablePay for Cryptocurrency Payments

StablePay is a decentralized payment platform which helps you to make payments with ETH or any other ERC20 token. It’s an important tool as I mentioned in the beginning of the newsletter that it’s best to keep your funds in cryptocurrency while trading. Let’s say you would want to get back into USD so you’re not exposed to other tokens volatility. There are many stablecoins backed by USD like USDT and DAI. With StablePay you can keep your funds in one of these coins and spend them with ease.

The projects created an ecosystem where any ERC20 tokens gets instantly converted into a token of the receiver’s choosing. The mechanism is leveraging the liquidity of several liquidity providers to help the receiver to avoid the volatility of the crypto space during the transaction.

The transferred tokens can be in any token and the process is as simple as PayPal or other email-based payment platforms. Within the app, you are getting a personalized link to request a payment via the URL. You can receive payments, donations, tips, it can be used in any possible way. Once a transaction reaches your wallet, your newly received funds will start generating interest. The whole process takes seconds!

Other alternatives are Sablier and Request. Sablier is a platform where the funds are being streamed to a dedicated address during a determined time. Request is a platform that allows invoicing for cryptocurrency payments. But neither of them has the option for the users to earn interest on their newly received funds.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.