Doc's Daily Commentary

Mind Of Mav

Why Is The IPO Process Broken?

Something I need to really stress is that the shift towards SPAC IPOs vs. Traditional IPOs is about more than just stocks.

You see, Traditional IPOs are the bread-and-butter of Big Finance & Wall St. An IPO was literally a central plot point of The Wolf Of Wall St.

But, just like how The Big Short, another movie depicting Wall St., showed us, the financial instruments Wall St. uses can become grossly corrupted.

In the case of 2008, it was the Mortage-Backed Security, but today it’s the Traditional IPO.

Thankfully, the IPO won’t cause a global financial meltdown (like the MBS did), but its problems will cause a paradigm shift.

So, what’s the problem with the Traditional IPO?

There are two key problems with IPOs in general:

-

They tend to occur when the overall market is at a peak.

-

The issuing company usually will IPO when it’s “hottest”, i.e., has the most hype.

However, that has more to do with market dynamics and less to do with the IPO itself.

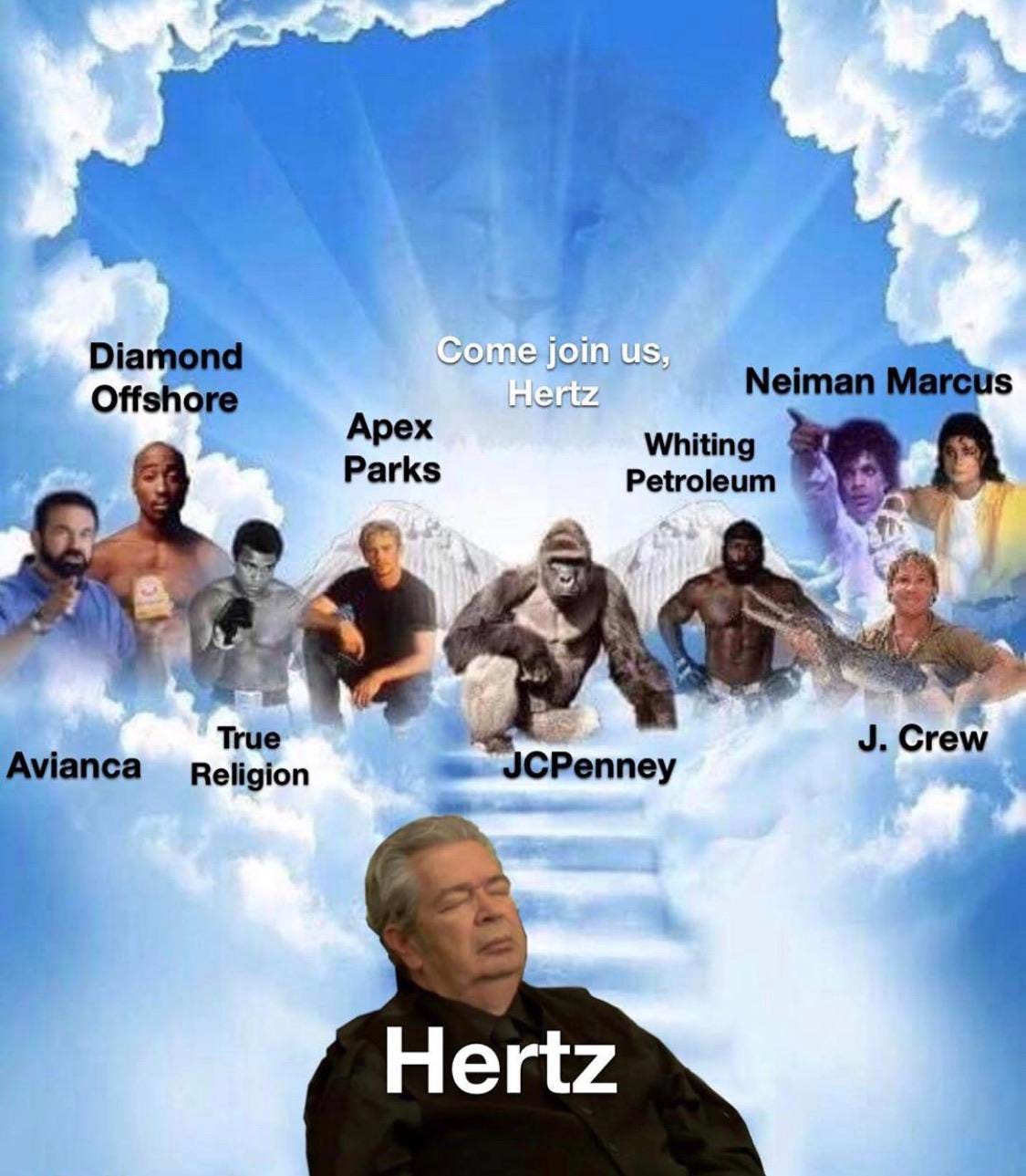

There are always going to be vehicles for hype . . . yes, even you, Hertz.

So, aside from the fact that any IPO model, be that the Traditional one or SPAC IPOs, will have unsustainable hype surrounding it and inherently be risky, what can be said about the Traditional IPO model itself . . . and what’s wrong with how it works?

What Wrong With The Traditional IPO

Simply put, it’s broken.

More specifically:

-

The pricing structure is all out of whack, and

-

The fees banks charge are downright criminal

Suffice to say, the traditional process for pricing an IPO has increasingly swung financially in favor of investment bankers and their clients.

Sure, greedy bankers are about as surprising as the sun coming up or the Cleveland Browns disappointing their fans . . .

. . . but let’s start with understanding the general process & flow of the Traditional IPO process:

Companies declare that they plan to go public, they select an investment banking team to work with, the bankers set up a roadshow full of presentations from management, an IPO price is set, and the company eventually enters the public equity markets at the pre-determined price per share.

Seems uncomplicated, right?

Well, in the next article, we’ll cover why the whole process is busted.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.