Doc's Daily Commentary

Mind Of Mav

Understanding Tokenomics: How To Research A Crypto Project

Microsoft word does not recognize the “tokenomics” word. It believes that word does not exist, and I have to replace it. “Tokenomics” is an unknown word for Grammarly, too. It suggests either dismissing it or adding it to the dictionary. When I wanted to find a picture for this story, I searched “tokenomics” in Unsplash, and it returned me 0 photos!

This is not a coincidence. I believe “tokenomics” did not get enough attention in the crypto community. People are following the news and checking the charts constantly. However, when it comes to the studies and researches on crypto projects, there is a gap.sss

There is also not a universal agreement on the meaning of the term.

Tokenomics = Economy of the Tokens

This definition is short and self-descriptive. Unfortunately, 99% of the articles you find online try to define “tokenomics” like that. Yet, there is a big problem with this definition. We need to define what we mean precisely by “economy”. There is no single and widely accepted definition of the “economy” of cryptocurrencies. Feel free to google. You will end up reading or hearing different opinions on the subject.

Tokenomics is the study of the economics of a crypto token — from its qualities to its distribution and production, and much more¹.

Tokenomics is the topic of understanding the supply and demand characteristics of cryptocurrency².

The tokenomics for a particular crypto token is usually thoroughly discussed in the project whitepaper, and it should help you grasp the functionality, objective, allocation policy, and more of the crypto token³.

Tokenomics is the science of the token economy. It covers all aspects involving a coin’s creation, management, and sometimes removal from a network⁴.

The token economy or tokenomics, seeks the creation of an economic ecosystem supported by tokens. An ecosystem where everything is sustained by the different possible interactions with said tokens⁵.

I honestly get all the frustration and the confusion about the term. The first time I heard someone talking about “tokenomics” and the importance of researching it, I was baffled. I did not know precisely what that term meant and where I should do research about it. Should I see the whitepapers? Should I check the “tokenomics” section of the crypto projects websites? Should I check any charts? The rest of the story is straightforward. I got confused about something, and I decided to ignore it and continue making my routine trades.

Long story short, no single point or factor addresses the whole thing. Anyone telling you otherwise either does not know the subject or redirects you to the wrong address.

Yet, the good news is that you can start to find some agreement among all those different definitions.

In this post, I will share five aspects that I believe are essential in understanding the meaning of tokenomics.

#1 — Supply

Think about dollar fiat currency. You may wonder how many dollars — in total — are in circulation now? How many more can be printed in the future? Are there any dollars printed but not in circulation? The same concerns exist in cryptocurrencies.

Circulating Supply: the amount of coins (tokens) circulating in the market and owned by people.

Max Supply: the maximum possible number of coins (tokens) that can ever exist.

Total Supply: the total amount of coins (tokens) issued until now and not necessarily in circulation. This includes the burned coins or the locked-up coins ready to be unlocked in the future.

The following image shows the supply numbers for three famous crypto projects — Bitcoin, Ethereum, and Cardano.

Here are some quick conclusions you can make after seeing those numbers:

Bitcoin and Cardano have max supplies.

Ethereum does not have any max supply.

Cardano does not have all its issued coins in circulation.

Bitcoin has 90% of its max supply in circulation.

Now you may ask why checking and analyzing these numbers are important?

These numbers are perfect indicators for analyzing supply and demand. Here are some examples:

If an asset is scarce and there is a high demand for it, it can increase its price.

No max supply can lead to an abundance of the coin in the market and a decrease in the price (not necessarily).

Once locked-up coins are released to the market, they can affect the price.

This type of analysis (and similar ones) is possible if you check the current supply values of the coins. By the way, if these numbers do not make any sense to you, always try to compare them by similar concepts in fiat currencies.

#2 — Burning

Have you ever destroyed your fiat money? Remember the money went to the washing machine, and it never came out of it? You got drunk and burned some dollars on a VIP table in a disco. You emptied your pocket into the recycle bin, and the poor money ended up in the trash. It happens to all of us. And for the record, this is something our beloved governments are also doing — time to time.

You can expect the same type of destiny for cryptocurrencies. Here, we are talking about token (coin) burning.

The crypto world does not have any washing machines, VIP tables of discos, trash bins, or governments. Yet, the burning process happens in this industry for a whole set of different purposes.

to decrease coins in the circulation

to adjust supply and demand

to make the asset less inflationary

The general idea behind the burning process is to make the coin more demanding and less inflationary.

There is no unique approach that all projects follow to burn their tokens. Some burn on scheduled intervals. Some other burn part of the transaction fees. Surprisingly enough, some projects burn tokens randomly and without notice. It is also worth mentioning that some experts also count lost coins (forgotten passwords, coins sent to wrong addresses, dead owners, etc.) as burnt.

The following image shows the burning mechanisms for two famous crypto projects — Ethereum and Binance Coin — and the renowned MEME token — Shiba Inu.

Here are some quick conclusions you can make after seeing those numbers:

Ethereum burning occurs at the transaction fee level.

Binance Coin has scheduled burnings.

Shiba Inu burns its token in a completely random and unscheduled manner.

Do you see how useful this data can be? It can tell you a lot about the supply of the coins, inflation/deflation, and the mechanisms applied for adjusting prices by projects.

I mentioned this as the 2nd component of tokenomics because it also has a very close correlation with “Supply” metrics. Thus, to better understand supply and demand, you must constantly check both supply and burning metrics.

#3 — Monetary Policy

In the traditional finance world, we hear the terms “inflation” and “deflation”. We also hear a lot about printing the money out of thin air. I am not going to discuss in detail why and how these things happen. Instead, I would like to highlight the fact that “inflation”, “deflation”, or “money issuance” is mainly dictated by the “monetary policies” of the governments. As the leading entities in charge of fiat money, governments and central banks moderate these factors and have an undeniable role in them.

Now, let’s switch back to the crypto world. “Monetary Policy” in the crypto assets is related to two things:

Is the coin inflationary or deflationary?

What are the plans for the coins (tokens) issuance in the future?

Both things are essential, for the same reasons they are important with fiat currencies. Inflation, deflation, and issuance play a vital role in the current and future price movements.

Now the question is how we can check these things with different projects?

Part of this data is available online. For example, a project’s CEO may announce that X tokens will be released (or unlocked) into the market in a given time. You can also check websites such as viewbase to get ideas about different projects’ inflation rates (and some other statistics).

However, the primary source of info for checking monetary policy is the Consensus mechanisms of the projects. This is something related to the source code and the infrastructure of the project under review.

In simple words, a consensus mechanism refers to any number of methodologies used to achieve agreement, trust, and security across a decentralized computer network⁶. Here are some examples:

Proof of Authority (PoA): A consensus mechanism used in private blockchains, granting a single private key the authority to generate all of the blocks or validate transactions⁷.

Proof of Burn (PoB): Miners send coins to an inactive address essentially burning them. The burns are then recorded on the blockchain and the user is rewarded⁸.

Proof of Capacity (PoC): Plotting your hard drive (storing solutions on a hard drive before the mining begins). A hard drive with the fastest solution wins the block⁸.

Proof-of-Developer (PoD): Any verification that provides evidence of a real, living software developer who created a cryptocurrency, in order to prevent an anonymous developer from making away with any raised funds⁹.

Proof-of-Donation: integration of charitable donations into the functionality of a blockchain⁹.

Proof of Elapsed Time: Consensus algorithm in which nodes must wait for a randomly chosen time period and the first node to complete the time period is rewarded⁸.

Proof-of-Liquidity: A cryptographically signed assertion by a trusted third-party auditor that an actor holds the declared number of resources⁴.

Proof-of-Replication: the way that a storage miner proves to the network that they are storing an entirely unique copy of a piece of data⁹.

Proof-of-Spacetime: someone can now guarantee that they are spending a certain amount of space for storage⁹.

Proof of Stake (PoS): A consensus mechanism in which an individual or “validator” validates transactions or blocks⁷.

Proof of Work (PoW): A consensus mechanism in which each block is ‘mined’ by a group of individuals or nodes on the network⁷.

Yes, I know! It is a lot to grasp. And every single project uses its version of the consensus mechanism. Yet, reviewing this data can give you valuable info about how coins are extracted, the inflation and deflation rates of the coins, and the rates the new coins will be introduced into the market.

Needless to say that in the crypto world, we do not have any government or central banks. The whole idea behind the entire thing is to develop scalable, secure, and decentralized networks. Therefore, in the ideal scenario, the “monetary policy” should be automatized by code. That is why you have to educate yourself about consensus mechanisms and some basic technical skills to review source codes.

#4 — Token Distribution

This is where things are getting more interesting. We all know or have heard about the stories of riches getting richer. We understand how the 80–20 rule works in traditional finance. 20% of the whole population owns 80% of the wealth or so. We all know how unfair can wealth distribution be — especially in less developed countries.

We do not want to see those things in the crypto world. We want to invest in assets that we believe have a fair distribution of their tokens. We hate whales, or big players own the majority of the tokens. We scream and demand equality. Right?

“Token Distribution” is absolutely an essential factor you need to check when investigating about tokenomics of a project. More specifically, you have to find out:

How initially were tokens distributed (pre-mining, ICOs, etc.)?

What percentage of the tokens are owned by owners, funders, developers, or partners of the projects?

What is the maximum percentage public investors like you and me can own?

Are there any locked-up tokens reserved for future distribution? If yes, what are the plans for making that happen?

Are there some big wallets holding the majority of the tokens? And at what percentages?

Is it possible that at some point, a big wallet sells its tokens and manipulates the market?

These are just some of the questions you have to ask when you evaluate the token distribution. Answers to these questions (and similar ones) give you insightful ideas about either you have to invest in a specific project or not?

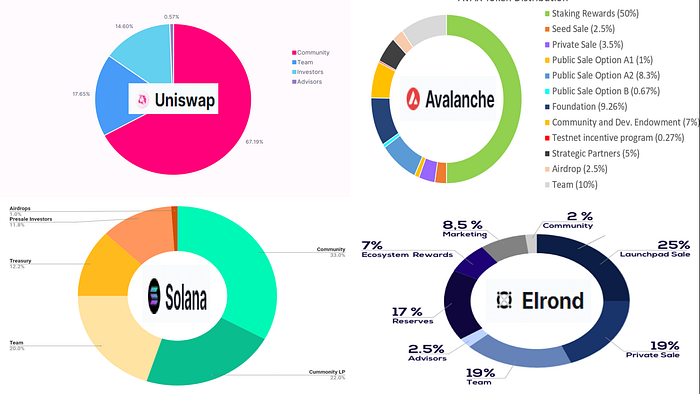

Let’s review the token distribution of four famous cryptocurrencies — Uniswap, Avalanche, Solana, and Elrond.

After reviewing these charts (and the similar ones), you can see that different projects have different distribution strategies. In some projects, founders, developers, or investors own a significant percentage of the tokens. Some projects even lock up some tokens for future distribution or their development purposes. Public share is also highly variant among projects.

Token distribution is a fantastic indicator that can reveal lots of valuable information. If you learn how to analyze and interpret these data, you will make better decisions in your crypto investments.

#5 — Earnings

In blockchain-based models, sharing benefits or profits with stakeholders of the projects is a possibility. This means earning some passive income — on top of your main holdings — while you are contributing as a user in the network.

There are several reasons to distribute these rewards between users:

to incentivize the miners (in PoW consensus models)

to secure the network (in PoS or similar consensus models)

to confront inflation

For example, these are three famous ways for earning rewards:

Mining: is the process of gaining cryptocurrencies by solving complex mathematical problems using the processing powers of miners’ computers.

Staking: is the process of gaining cryptocurrencies by setting aside a certain amount of your tokens. By staking, you become a validator of the transactions in the network and as an incentive, you get some rewards back.

Running Masternodes: is the process of running a cryptocurrency full node or computer wallet in charge of maintaining a real-time record of the blockchain activities. Masternodes are complicated to run and on top of that, they have an important role in the blockchains. Therefore, as an incentive, they receive rewards or interests.

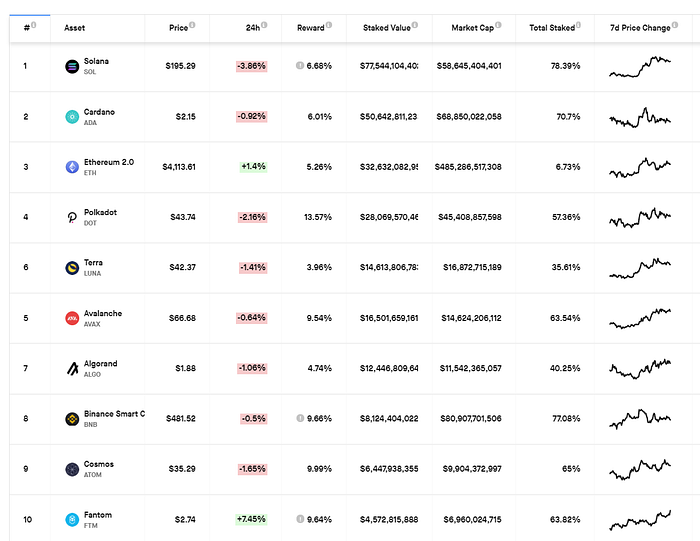

You have to check the websites of each project to get the exact information for mining, staking, or running nodes. Moreover, you can check other online resources such as the StakingRewards website. There you can find:

The estimated reward you earn per year, calculated with real-time blockchain data.

The total value of tokens participating in staking.

The percentage of eligible tokens that are being staked.

Calculators for your earnings.

As we move forward and with the new consensus mechanisms, more ways to earn passive income and incentivize the users of the blockchains emerge. Yet, the main question to ask remains the same:

Does the project give its users some options to earn money on top of their money by means of some passive work (mining, staking, running nodes, etc.)?

Final Thoughts

I don’t know when Microsoft word or Grammarly will add the “tokenomics” word to their dictionary. I also do not know if any photographer in Unsplash or other platforms will add any photo with a “tokenomics” tag. However, I know that when you want to invest in a cryptocurrency project, you have to research “tokenomics” aspects of it. There is no doubt about this.

To summarize, here are some takeaways:

✔️Check Circulating, Total and Max Supply. This data will give you some basic idea about supply and demand.

✔️Check if your coin has some “burning” or similar policies to combat inflation? This data will complement your findings from supply metrics.

✔️Check the “monetary policy” behind the project. Educate yourself on “Consensus Mechanisms” and always follow the official announcements and news around the project.

✔️Check the “token distribution” to find out how fair the allocation of the coins?

✔️Check if the project has some ways to incentivize its users and give them some passive income?

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.