Doc's Daily Commentary

Mind Of Mav

Are Security Tokens About To Have A Comeback?

For nearly two years, one of the most central theses at ReadySetCrypto has been that of the Three Pillars of Crypto.

It has been our longstanding belief that the Three Pillars — Cryptocurrency, Tokenization, and Decentralized Finance (DeFi) — are the key to a proliferation of blockchain technology.

While you’re likely familiar with Cryptocurrency, and while DeFi has quickly become a hot topic of discussion, we haven’t had much to say about Tokenization and Security Tokens lately.

After all, I was extremely adamant that Security Tokens were about to have explosive growth in use, and that private equity fundraising was going to be the newest investing craze.

. . . was I wrong?

I’ll admit that . . . perhaps I was — in the timing at least — but certainly not in the principle of the matter.

Let’s remind ourselves why Security Tokens have a killer advantage and why they’re poised for disruption. To begin, we should talk about the problem tokenization and security tokens solve. Funny enough, ICOs provide a great way to demonstrate that:

2017 was a banner year for ICOs and cryptocurrency tokens. Unfortunately, many of these ICOs raised capital as utility tokens, with no adherence to United States security laws.

This bad behavior has led to an array of SEC subpoenas and enforcement actions. The strong regulatory response is being encouraged by good actors and should cause a drastic slowdown in the number of ICOs for 2018 and beyond.

Entrepreneurs still need to raise capital though. Rather than abandon token-based fundraising, there will be a seismic shift to what many refer to as “Security Token Offerings.” These security tokens are merely token offerings conducted in a regulatory compliant way.

Ok, but hold on for a second . . . what’s a security, again?

Simply, a security is a tradable financial asset. These securities were previously presented in a physical paper certificate that represented ownership in an asset. When an asset owner wanted to sell their ownership stake, they traded the physical certificate for currency with another entity or individual.

Obviously, this Analog Age of Securities sounds archaic and inefficient. Over the years different individuals and organizations have attempted to bring securities, and the subsequent trading of securities, into the digital world.

It wasn’t until the late 1980s and early 1990s that electronic certificates and trading began to be used in a material way. This new process removed the need for stock brokers to stand on the trading floor and yell bids & asks at each other. It made the financial system more efficient. It increased the number of people who could participate. And it ultimately removed a select group of middlemen from the process.

This switch from paper security certificates to electronic security certificates was previously referenced as a digital shift. I disagree.

The digital world as we know it today, both the infrastructure and applications, was not available yet. Rather than call the period from ~1990 to now a digital period, I refer to it as the Electronic Age of Securities.

The Electronic Age has captured the minds of Wall Street and brought many benefits. Almost every security is currently held in electronic form and transacted on an electronic system. Majority of security holders never touch a physical paper certificate. The financial system looks more modern than ever before.

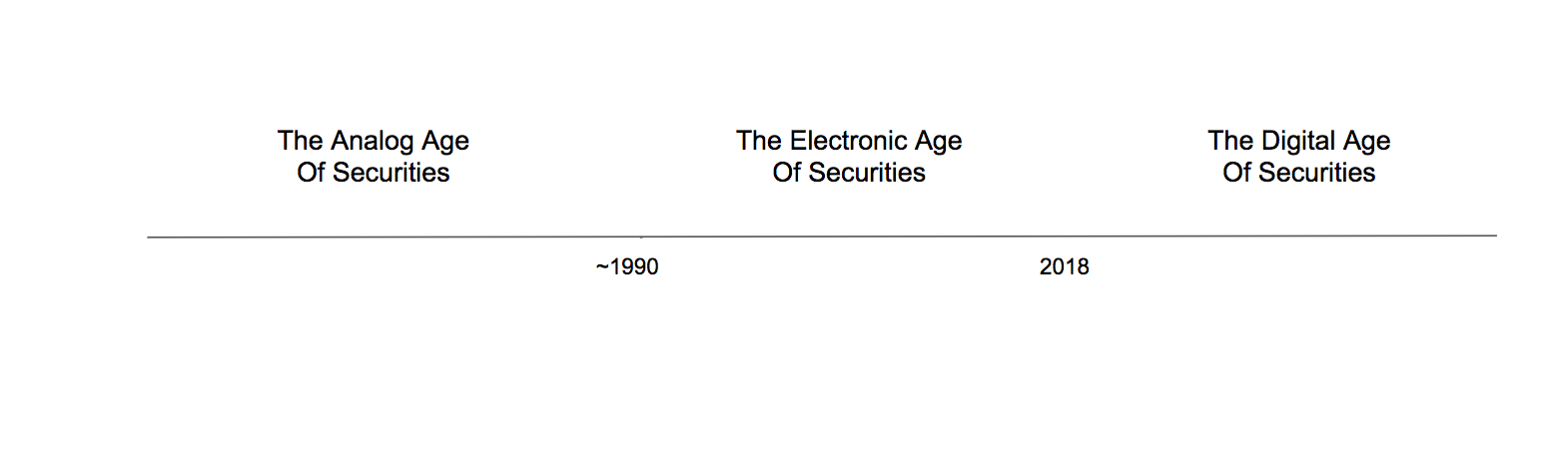

Technology waits on no one though. As Wall Street firms took the last 20–30 years to adapt to the Electronic Age, technology has continued to improve at an exponential rate. The most valuable advancement comes in the form of blockchain, a distributed digital ledger that empowers decentralized peer-to-peer transactions in a publicly transparent way.

As in previous decades, the advent of new technology brings a new age of securities and trading. Blockchain is the foundation for the Digital Age of Securities.

This Digital Age removes more middlemen, creates more efficiencies, and increases the number of people who can participate. At the heart of this technological shift are two components: digital shares (Security Tokens) and decentralized exchanges.

Security Tokens are true digital shares that allow for fractional ownership, instantaneous transaction settlement, and regulatory compliant ownership. Previously, if a single share of Apple was trading at $100, an individual could not own the share if they only had $50. Today, digital shares would allow that individual to own 0.5 Apple shares (fractional ownership).

The purchase of that Apple equity share would be executed near-instantaneously on the blockchain, if and only if, the buyer and seller were both within the regulatory guidelines for transacting that security. This regulatory compliance check is also done near-instantaneously with blockchain protocols.

Are you starting to see the killer advantage that STOs / security tokens / tokenization have? They take the private equity process, which is mostly manual & paper-driven, and make it digital — bringing with it all the many interesting possibilities and efficiencies we know and love — as well as doing it all by the book, avoiding the legal pitfalls that proved to be the doom of ICOs.

Essentially, the Digital Age of Securities is just getting started.

It is still really, really early. The writing is on the wall though — the idea of market participants trading tokenized stocks, bonds, currencies, and commodities seem like a foregone conclusion. The technology is better. It provides cheaper, faster, and more efficient trading for investors. Digital assets open the financial system to a broader set of global participants.

But . . . what makes this interesting today?

Well, the way to acceptance and adoption might finally start to open up for Security Tokens. For real this time.

According to Yogita Khatri of The Block:

“In a webinar hosted by the Chamber of Digital Commerce on Friday, Clayton said all stock trading is today electronic, compared to 20 years ago. In the past, there were stock certificates, and today there are digital entries representing stocks. “It may be very well the case that those all become tokenized,” said Clayton.

The webinar, titled “Two Sides of the American Coin: Innovation & Regulation of Digital Assets,” focused on what is needed to grow the blockchain and crypto space. Brian Brooks, the acting comptroller of the currency at the Office of the Comptroller of the Currency (OCC), also participated.

Both Clayton and Brooks said that they welcome innovation in the crypto space, but of course, within regulatory frameworks.”

For those unaware, Jay Clayton is Chairman of the U.S. Securities and Exchange Commission (SEC), and he represents the best possible weathervane for the future of digital securities. After all, the SEC is essentially the police of trading & investing, and they need to be on board with this new direction that tokenization represents.

The important takeaway is to hear how Jay Clayton and Brian Brooks focusing on this talk track. It shows that they are not anti-Bitcoin or anti-crypto. They see the potential for innovation and positive impact. It appears they just want to see working products that follow the existing legal framework.

In a sense, they get it. Sure, there’s a lot that has to happen to enable proliferation, but having the primary agency responsible for enforcing federal securities laws, proposing securities rules, and regulating the securities industry open to the possibilities is thrilling, to say the least.

So, what are the hurdles to having this idyllic world built?

The easy one is time and the hard one is technology. Creating innovative technologies like we are discussing today takes an inordinate amount of time. You need smart people, who are well funded, working for years to build a system that can work on a global scale. If you’re going to be handling trillions of dollars of transactions, then you better make sure you have everything set up and operating properly.

The technology hurdle is much more controversial. Everyone is financially incentivized to believe that their blockchain of choice is going to be the winner. If you ask me, I’ll explain why I believe the most secure chain (Bitcoin) will ultimately be the home for transacting any asset. If you ask an Ethereum believer, they will explain all sorts of things about DeFi, etc. If you ask someone who is working on a different chain, they will scream about some technical component or advantage they believe they have.

Ultimately, no individual’s opinion matters. The market will decide the winner. This disagreement on the future winner is exactly how markets get made. Some people will be right and some will be wrong. Some will create enormous fortunes. Others will destroy wealth. It is a cycle that has happened over and over again whenever there is technological innovation.

While the debate about “where will it happen?” rages on, one thing is very clear — every stock, bond, currency, and commodity will eventually be tokenized. Don’t believe me? You probably didn’t know that the largest HELOC-backed bond in a decade was recently settled over a blockchain by portfolio company Figure Technologies:

“Mike Cagney’s blockchain lending startup Figure Technologies has provided collateral for the biggest bond backed by home equity lines of credit since the American housing collapse over a decade ago.

The $308 million unrated securitization was sponsored by alternative real estate finance firm Saluda Grade and priced earlier this week. The offering is the second securitization of Figure-originated loans and one of the first asset-backed securitizations to be completed entirely on blockchain….The Heloc loans backing the deal were originated, serviced, financed and sold on Figure’s affiliated blockchain, Provenance. Figure, a non-bank lender, has originated more than $1 billion of Helocs since its founding in 2018 and expects more demand for the product as the large traditional banks retrench.”

It seems it’s just a matter of time before this becomes commonplace.

Even the regulators are starting to talk about it publicly & positively.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.