Doc's Daily Commentary

Mind Of Mav

Investing In NFTs: Why NFTs Change Everything

Alright — hopefully if you’ve come this far, you’re at least modestly open to the possibility that some NFTs have value and that the fundamental value proposition and premise of an NFT at large is not merely a baseless collective transitory delusion of human society, or at least that if it is, few things are as valuable as collective societal delusions (such as the very concept of money, or religion [if not your own, at least you can acknowledge that all the other religions are collective societal delusions that yet still seem to have real profound impact in the world], or politics, to name a few).

Now, at long last, we can get down into the technical meat of what makes NFTs a profoundly revolutionary technological innovation. Up until now, we’ve glossed over many of the technical benefits of NFTs in favor of just trying to approximately present NFTs as digital analogs to physically scarce assets with value. Ultimately, that’s the hardest and most important conceptual hurdle to get over, but also just the tiniest edge of the true ocean of new possibilities and advantages afforded by NFTs over previous mechanisms for assigning ownership and value, designating scarcity and property rights and royalties, recording perfect and permanent provenance, enabling frictionless distribution, and so much more.

So let’s get back to basics, and dive a little deeper into just how precisely an NFT is made today. As mentioned at the very beginning of Part 2 of this article, which by now has probably already faded away into the deepest recesses of your mind, an NFT is, in the most broad sense, a bunch of data stored somewhere on a global decentralized ledger called the blockchain, which records some basic information about who owns a specific digital asset, and possibly a number of details about that specific digital asset in question.

Becoming much more specific, there are a number of different competing blockchains all working to support NFTs, but by far and away the most prominent, earliest (not counting some early starts on the Bitcoin blockchain which never really took off), and well established NFT ecosystem exists on the Ethereum blockchain, and uses what’s known as the ERC-721 standard for defining NFTs in a way that makes them easily all interoperable on the same platforms and marketplaces in the NFT ecosystem.

How do NFTs work, exactly?

First, let’s explain a little bit about why exactly NFTs predominantly exist on Ethereum, and not say, Bitcoin, and how exactly NFTs are made.

Ethereum, presently the second largest cryptocurrency by market cap second only to Bitcoin, is a monumental evolution on Bitcoin in many ways. Bitcoin, as you likely know, was the very first blockchain based cryptocurrency to come into existence. It pioneered the revolution of utilizing a global decentralized ledger (the blockchain) for the purpose of irrevocably recording financial transactions between infinitely many pseudonymous parties in a fully transparent manner. This makes it so anyone can trustlessly transact with anyone else in the world without having to rely on trusting a third party intermediary such as a bank to do so.

Ethereum, however, was the first major blockchain to realize you could do so much more with the power and potential of the blockchain. Far from just being utilized to store financial transactions, you can store any kind of arbitrary data on a blockchain — including computer code, known as smart contracts. The blockchain, then, in a sense, can be turned into a sort of global decentralized computer open for use by literally anyone in the world in a sort of global timesharing sense (spoiler alert: this is why gas fees are so high on Ethereum right now, because there are too many people trying to use the same poor globally decentralized computer — but this is soon to be a solved problem with Ethereum 2.0 and Layer 2 solutions).

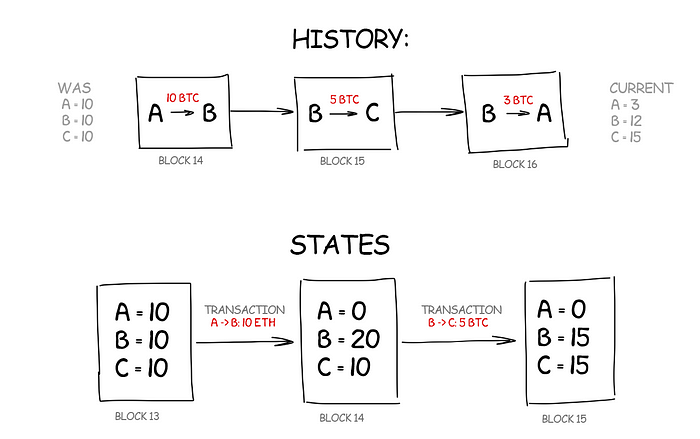

Why exactly would everyone in the world want to timeshare using the same computer? Sounds like a hearkening back to the old, much darker days of computing where everyone would just have a terminal that plugged into a mainframe and paid stupendous amounts of money for this questionable privilege at first, no? The key insight is sharing the same computer allows that computer to act as a sort of global state machine, where the state of the computer (aka the Ethereum blockchain) can act as a global source of truth regarding all the computations and transactions done on that computer and all the data as it presently stands on that computer.

In the simplest sense, with the Bitcoin blockchain and financial transactions, the Bitcoin blockchain ‘state machine’ records the current state of all the bitcoin everyone in the world owns. When Alice decides to send 1 bitcoin to Bob, the state machine changes, or transitions, from its previous state where Alice had say, 10 bitcoins and Bob had 5 bitcoins, based on the input transaction received from Alice, to its new state where Alice now has 9 bitcoins and Bob has 6 bitcoins.

The fact that everyone in the world can thus financially transact with this one global state machine that acts as an incontrovertible and permanent source of truth regarding everyone’s current financial balances and all the transactions ever transacted in the past by anyone to anyone else is tremendously advantageous, and underpins just about everything behind the current blockchain revolution undertaking the world.

Ethereum, however, really takes this to a whole new level. When you store code, or smart contracts, on the blockchain and allow anyone to interact with it at will to modify the state, you can literally provide a global state machine for any kind of state. For instance, you can now record the state of all the NFTs in the world, or all the transactions in escrow, or all the legal documents in various states of execution, or absolutely anything else. This is, in short, why if you’re not going to put all your money into NFTs, you should, at least, be putting all of it into Ethereum. Smart contracts will change everything, to put it mildly just so I don’t lose all my credibility with you (stay tuned for DeFi 101, and DAOs 101, just kidding I’m never writing again).

So how exactly does this work for NFTs? In short, NFTs are defined and created (‘minted’ in NFT parlance) by a smart contract, which is just a piece of code that resides on the Ethereum blockchain, and specifies a number of functions that can be used to create and interact with ‘tokens’ that represent some non-fungible asset — hence, a non-fungible token, or NFT.

This is where the state machine magic bit of Ethereum comes into play. Imagine you write up a piece of code that allows someone to mint one of 1,000 different NFTs that represent unique images of cats on the blockchain (people love cats on the blockchain, as people love cats on the internet, and in real life, and basically everywhere. Cats are the ultimate meme, and self-replicate prolifically both biologically and digitally).

How this code might work is it might have a function called ‘mint’ that anyone in the world can call. When invoked, this mint function will check some global counter variable to make sure first that fewer than 1,000 cats have ever been minted on the blockchain already.

In the case that there have already been 1,000 cats minted, the mint function would then return an error to the user who invoked it saying as much, thereby preventing anyone from ever minting more than 1,000 cats — part of how the blockchain enables NFTs to have provable and permanent scarcity that can never be circumvented. Then, the mint function will go ahead and create a new NFT representing a new unique cat and transfer this new NFT token to the address of the Ethereum user who invoked the mint function.

The Ethereum blockchain, then, acts as a state machine that keeps permanent track of all these changes and activities over time. Say Alice has 888 ETH in the present state of affairs, and invokes the mint function of the RandomCat NFT smart contract, and passes it 69 ETH as payment for creating RandomCat #420.

The Ethereum blockchain state machine will then record the new state after this transaction, wherein Alice will now have only 819 ETH, but will own an NFT token in her wallet address that represents RandomCat #420, and the RandomCat NFT smart contract address will now be 69 ETH richer (smart contracts are just wallet addresses like anything else and can hold money too!).

Now say Alice decides to sell her RandomCat NFT to Bob for 100 ETH. The Ethereum blockchain state machine now transitions again to a new state as a result of this transaction, and now records the fact that Alice has 919 ETH and no RandomCat NFTs, and also that Bob now has 100 less ETH but one additional RandomCat #420 NFT.

That’s the power of having a global shared state — now, everyone in the world can transact with anyone else to do literally anything, including creating and selling and transferring NFTs, and the state of the world and everyone’s Ethereum balances as well as the balances of all the NFTs they own, and well as the provenance and history of all the NFTs ever created and sold and transferred all the way back to the very beginning of all time, will be publicly recorded and trivially available for absolutely anyone in the world to see at any time.

No more fake Louis Vuittons

A huge benefit of this, thus, is that verification of the genuine provenance and present ownership of a given NFT is entirely trivial for absolutely anyone to conduct. Hell, Twitter is literally implementing NFT verification as we speak, which will enable Twitter users to trivially prove that they truly own any NFTs they set as their profile pictures (say, CryptoPunks), by simply connecting their Ethereum wallet addresses so that Twitter can quickly check the balance of all NFTs in a given Ethereum wallet address.

Remember the whole luxury brands have value in the brand itself thing from the last section, where we talked about why a Louis Vuitton bag is worth infinitely more than an altogether identical bag without the Louis Vuitton logo?

This, of course, introduces a huge economic incentive for forgeries in the real world for luxury goods — and forgeries are so good that unless you’re an expert, it’s next to impossible to tell apart a good forgery from the genuine article.

Well, with NFTs, that’s a trivially solved problem. As long as you have a reliable source of truth pointing you to the original smart contract that created an NFT (typically an official website for a project or a verified Opensea collection with a blue checkmark, etc), you can easily verify if a given user has a genuine NFT (or any NFT at all, versus just a right click saved JPEG) or not. Even better, realistically, platforms like Twitter will handle all this legwork for you in the future such that you don’t even have to do any checking yourself — you’ll just know. That’s pretty damn powerful, no?

*Caveat emptor, the NFT world right now is still a wild west and scams and fakes abound utilizing various means to prey on users who aren’t well versed enough in how the blockchain works so as to use it appropriately to verify authenticity— this will be unquestionably solved as the space matures, but as of now, users must be sophisticated and truly understand how NFTs work and how the blockchain works in order to both not buy fake NFTs and also not be hacked and lose all the real NFTs they have.

Standards are awesome

Alright, now that we hopefully have at least some semblance of an idea on how NFTs are actually made and how awesome NFTs on a blockchain are for record keeping and authenticity verification, let’s go back to that ERC-721 standard for making NFTs on the Ethereum blockchain we were talking about.

The ERC-721 standard specifies a base set of functions that every NFT compliant with the standard is required to have, and guarantees that all these functions function in precisely the same way.

Sharing a standard definition of how NFTs should be defined is groundbreaking in the same way that sharing the same standard for things like charging cables or lightbulb sizes is groundbreaking. Isn’t the world so much nicer now that most things use USB-C charging ports and you only need one charger to charge all your devices?

Because just about all NFTs on the Ethereum blockchain are defined in the same way to be compliant with the ERC-721 standard these days, it means that anyone can make, say, a marketplace for Ethereum NFTs, and then be able to connect to an Ethereum user’s wallet and automatically scan the wallet for all the NFTs the user owns and allow them to be displayed for sale or transfer, without having to manually code up a custom implementation to allow for the sale and transfer of each individual unique NFT.

Dramatically reducing inefficiencies and increasing equitable access

In some ways, you could think of this as if there existed a universal global art vending machine, instantly accessible by anyone from the comfort of their own homes. With this machine, every piece of art can be identically purchased with the same series of button clicks, and every new piece of art can be seamlessly added to be interchangeably transferable alongside every other piece of art with absolutely no manual labor on the part of anyone. That’d be pretty convenient, right?

Might that not be a slight improvement upon the inefficiencies latent in the present physical art markets? There exists no one universal repository and marketplace for all art pieces in the world today, and even if there were, that would present some serious monopolistic concerns (which are not present with the decentralized blockchain alternatives in the NFT world — web3 precisely breaks the platform lock in effect that allows web2 internet companies to monopolize industries) with proprietary siloed data in corporate owned databases.

Instead, the physical art market is hopelessly fragmented today, which dramatically limits equitable and democratic access between artists and collectors, locking wealthy collectors into a very limited set of carefully curated art pieces that have been curated less through the democratic power of online meme transmission and more through a very finely tuned network of dealers, agents, galleries, auction houses, and salespeople.

The art that becomes fine art in today’s world and fetches mind boggling prices often passes through the hands of just a few choice kingmakers clustered in the Western world.This makes it almost impossible for the vast majority of global artists from all around the world to ever have a real shot at breaking into the high end contemporary art market.

Conversely, with even the most rudimentary NFT platforms burgeoning today, access has become infinitely more accessible to everyone, allowing all talent from anywhere to have a fair shot at hitting the cultural zeitgeist on its head and making it big. Case in point — most of the 1/1 limited edition NFT art I’ve purchased has been from artists all around the world who have been to date entirely shut out of traditional art markets. These are artists I never would have ever had the privilege to come across had it not been for NFTs and the internet.

More spectacular was the disparity between what the Sculls had initially paid, in some cases only a few years prior to the sale, and the prices they commanded at auction: A painting by Cy Twombly, originally purchased for $750, went for $40,000; Jasper Johns’s Double White Map, bought in 1965 for around $10,000, sold for $240,000.

Robert Rauschenberg, who had sold his 1958 work Thaw to the Sculls for $900 and now saw it bring in $85,000, infamously confronted Robert Scull after the sale, shoving the collector and accusing him of exploiting artists’ labor. In a scathing essay published the following month in New York magazine, titled “Profit Without Honor,” the critic Barbara Rose described the sale as the moment “when the art world collapsed.”

When a collector sells a work by an artist in a secondary sale in the traditional art market, the artist (at least in America, the home of the greatest art sales, and in many other places in the world) sees zero percent of that sale. If they sell a piece for $900, and then it later sells for $85,000, and then again for millions down the line, the artist sees absolutely nothing but that first $900.

Now, Congress has that chance: the recently proposed American Royalties Too (A.R.T.) Act, a bill which would give artists a 5 percent cut of the profits when their works are resold at auction. The bill has its flaws: It applies only to auctions and not private dealings. But 5 percent is also a slim and fair share, compared with the auction houses’ 12 to 25 percent buyers’ premiums — though even 5 percent looks too fat to slip under the door. An earlier version of the bill, the Equity for Visual Artists Act, failed to attract a single co-sponsor in 2011, and over the past few years, Christie’s and Sotheby’s have been raining upward of $1 million on lobbying against royalties. At this writing, govtrack.us gives the A.R.T. Act a 2 percent prospect of being enacted.

Perpetual secondary sale royalties programmed into the art itself

With NFTs, the story is different. The community has already coalesced around a norm where artists are paid a royalty every time their art sells in a secondary sale after the initial sale — typically in the range of 5–15% — and this royalty can be programmed directly into an NFT’s smart contract.

Presently, most marketplaces for NFT art have already implemented their own royalty code in their smart contracts that mint NFTs for creators, and there’s an Ethereum Improvement Proposal outstanding to create a universal standard for how royalties should be specified in the smart contracts that create NFTs.

It’s all but certain that without any legal regulation whatsoever, the NFT ecosystem will almost universally enforce and honor the royalties programmed into NFTs by their creators going forward, as they already almost all universally have. As such, artists now have, unlike ever before, an unprecedented ability to profit off their future success as they continue to grow in fame and command higher prices — even if this happens after their death, as often is the case for many of the most famous artists known to history, such as Van Gogh.

These royalties will exist in perpetuity, designated in the code that spawned the NFT that represents the artwork itself. An artist can leave all these royalties to their estate, and even if they only ever made a few thousand dollars in life, if one day their art blows up and the world starts paying hundreds of millions for it, the descendants of the artist will not be penniless, but will in fact be raking in millions from a say, 10% perpetual royalty from every secondary sale.

Valuations for art, more than almost anything else, can be mercurial and inordinate in their magnitudes of change over time scales that can eclipse the mere transient life of an artist — and for the first time ever, artists can rest assured that their work will continue to reward them forever in an immutable way guaranteed by code that will last forever on the blockchain.

Cut out the rent-seeking middlemen and introduce liquidity

Arthur Hayes penned a wonderful summary of why traditional art markets are incredibly inefficient and cumbersome rent-seekers:

Trading analogue art is very expensive, due to the massive spreads the various agents take throughout the journey from the creator to the collector. These fees are necessary to pay for the enormous costs to create an environment in which rich people feel comfortable parting with their money for intrinsically useless matter.

The gallerist is the front line of the gravy train. They are trying to discover the next hot thang. A gallery is akin to an exchange. They cultivate a supply of rich patrons, and secure exclusive distribution deals with artists they believe will resonate with their collectors. For this service, galleries take a massive spread in the form of double-digit percentage markups on the artwork. The spread on its face appears egregious — but the gallery has real costs to pay. The gallery must pay rent to operate a swanky, white-walled space in prime rental districts of world financial capitals such as New York, London, Hong Kong, Shanghai, Paris, Tokyo etc. The gallery must put on shows where they supply expensive libations and finger food for free to entice would-be buyers into the space. Finally, the gallery must also cut in their salespeople as well. It’s not uncommon for a salesperson to receive a commission of 10% to 20%. This is the primary market.

Once in the hands of the “right” collector, the real fun begins. The gallery and collector work together to create the impression that this artist’s work is worth owning. They spend effort to get the works shown at museums and shows globally to create the allure of quality. Collectors who flip works quickly are looked down upon, for obvious reasons. If the artwork changes hands too quickly or too many times it appears too “commercial”. Art is not a mass market item to be bought and sold — it is a priceless piece of matter to be seen by many, but only owned by a select few enlightened and wealthy individuals. Essentially, the expectation is that once you buy something in the primary market, you are carrying it for a while. Quick liquidity is almost impossible to come by, and attempting to create a real market acts as a price dampener.

The auction houses — such as Christie’s and Sotheby’s — take their pound of canvas when collectors trade works between themselves. They usually charge 20% of the auctioned price, but they will sometimes guarantee the seller a price, which introduces market risk into their business models. The auction houses employ specialists who can tell great stories about a piece of artwork, which entices other collectors to bid on said work. They also attempt to assure the market that a particular piece of artwork is not fake (which they often repeatedly fail at).

The point of this short explanation is to illustrate that traditional works of art change hands infrequently, and transaction costs are astronomical due to all the mouths that need to be fed to keep the market functioning. While the art market trades billions of dollars a year, greater transparency and lower fees would create a more vibrant market.

The last sentence there is critical — these inordinate fees charged by the middlemen in traditional art markets produce profound deadweight loss, which substantially dampens the overall size of the art market today, particularly in volume. When every time an art piece changes hands you can end up losing 20% or more of the sale price, art is going to change hands a lot less often, and a lot less art is going to even be purchased in the first place with such premiums threatening the possibility that a buyer can ever recover their investment price.

NFT markets get away with all of this, in no small part because all the art is completely digital and can be easily displayed in infinitely scalable virtual galleries for millions of people to see from all around the world. As this is all part of the culture in which the new cryptorich are very comfortable parting with their many, many crypto millions, there’s no overhead necessary to pay for extremely expensive physical galleries situated all around the world in the richest cities with the most costly real estate. No hors d’oeuvres, no attendants, no auctioneers, no salespeople, no tremendous middleman cut.

Artists can also now sell directly to collectors on digital platforms like Opensea, Foundation, Rarible, MakersPlace, and more. No more needing to have an agent represent you or wait for a gallery to choose to show your work, or not be able to set your own prices and conditions, or anything else. The control and leverage is firmly shifting into the creator’s hands, and not the hands of the intermediaries, when it comes to NFTs.

Bullish on virtual reality? That’s bullish for NFTs

A huge part of the anticipated appeal of NFTs and digital art in the future predicates itself on the whole concept of the metaverse, which is another one of those things that I’ll need to write a Metaverse 101 article on to properly convince a skeptic about.

Suffice it to say that if you do believe in things like virtual reality and do believe that the fidelity and coherence of our future virtual worlds will continue to improve over time, it stands to not unreasonable reason that we will be spending ever more time in virtual reality in the future, to the point where, just as some of us already spend most of our day transfixed to a mere rectangular screen, oft of proportions smaller than our hand, many of us will predominantly reside in a virtual reality and not a physical one.

When that day comes, with the infinitely greater possibilities afforded in a virtual space entirely unbound by physical constraints, how much value might be ascribed to digital NFTs versus physical tangible goods? Are digital assets not in many ways superior to their physical counterparts? They can be scaled infinitely, seen by millions with no geographic limitations, and be constructed in ways that are literally impossible to replicate or express in real life, and can in fact even be fully dynamic interactive immersive experiences that utilize code to change in a way no physical object can.

Here are some choice quotes from Mark Zuckerberg on why he’s betting the future of Facebook on the metaverse:

We will effectively transition from people seeing us as primarily being a social media company to being a metaverse company.

You can think about the metaverse as an embodied internet, where instead of just viewing content — you are in it. And you feel present with other people as if you were in other places, having different experiences that you couldn’t necessarily do on a 2D app or webpage, like dancing, for example, or different types of fitness.

I don’t think that this is primarily about being engaged with the internet more. I think it’s about being engaged more naturally.

We’re basically mediating our lives and our communication through these small, glowing rectangles. I think that’s not really how people are made to interact.

In any case, speaking of infinite scale and replication…

Infinite replication for free is a tremendous feature, not a bug

As with the right-click save argument we touched on in Part 2, the fact that digital assets can be infinitely replicated by anyone in the world trivially for free is most often viewed as a huge disadvantage of digital assets over physical assets. But now that we’ve hopefully addressed that superficial concern, the reality becomes clear: infinite redundancy in perfect duplication of a digital asset, coupled with the immutable concept of singular ownership, is a gargantuan improvement over the current state of physical affairs.

Some of the most expensive works of art in the world have either been destroyed in things such as accidental fires or wars, or have been stolen or even simply lost. Even things that aren’t lost, destroyed, or stolen oftentimes just literally degrade over time, like the $12 million shark Damien Hirst made, and then literally had to replace because the first one had deteriorated to the point that the shark had to be skinned and only the skin could be displayed (which, incidentally, Hirst acknowledged invited a fascinating philosophical question on the concept of the physically manifest nature of art in the first place — quote, “It’s a big dilemma. Artists and conservators have different opinions about what’s important: the original artwork or the original intention. I come from a conceptual art background, so I think it should be the intention.” [in short, if you subscribe to the conceptual art movement whatsoever, you should really be into NFTs and CryptoPunks — the physical art is just a symbol for the idea, history, context, and everything else, which is the true art piece]).

With some caveats*, that’s next to impossible for NFTs. NFTs can never degrade, and when artworks are stored directly on blockchains, they will never cease to exist so long as the blockchain never ceases to exist, which may be never (more on that in the next section). The fact that these digital assets can be replicated with perfect fidelity a trillion times over precisely aids this fact, compared to a physical reality where if you accidentally screw up once in the many hundreds to thousands of years an art piece must be preserved for, it’s game over for all eternity.

*Okay, caveat time. So it’s important to make sure the art your NFT represents is actually stored on the blockchain for the greatest amount of security, but oftentimes that isn’t quite feasible because it’s extremely costly to store things directly on the blockchain. The next best thing to do is to ensure that it’s stored on a decentralized peer to peer filesharing network like IPFS, which utilizes widely distributed decentralized redundancy to ensure your files don’t disappear just when a centralized service like AWS might go out of business or have a server meltdown. This is in fact what the vast majority of NFTs utilize, but even then if you don’t pin your data in IPFS, it can be garbage collected and disappear. There are other decentralized blockchain based solutions like Arweave that aim to store all data permanently for all of eternity, so things are getting better, but as of the present day there are still some caveats to be aware of when it comes to longevity.

The other part of this equation is you also, as the owner of an NFT, need to make sure you don’t lose your private key to your Ethereum wallet. If you lose your private key, the NFT will still exist for all of eternity, but you just…won’t exactly be able to access it. Kind of like if you had a truly impermeable vault secured by an invincible lock in which you stored all your artwork, and you just whoops! lost the key, so yeah, don’t do that. And also don’t give anyone else your private key either, because then they will actually probably steal your art.

Anyway, moving on:

NFTs actually have more permanence and consequent long term value retention than physical objects — no degradation, either!

It’s a common refrain that the internet is forever, but that’s not quite as true as might commonly be conceived. The long tail of the internet has quite often been forgotten and lost to the sands of time, and moreso, as web pages and content dynamically change and evolve day in and day out, older iterations of content are often lost forever even if some newer version still exists in some form or another. This has necessitated the formation of explicit projects and foundations dedicated to the direct preservation of content on the Internet, such as the Internet Archive, without which infinitely more content would already have been lost, and with which much content is still being lost every day.

The blockchain, however, truly may be forever, and even all past state changes on the blockchain, as a necessary condition of the blockchain being forever, are also here to stay forever.

This is an extreme statement — one that even I’m a little startled by, frankly, which is why I’m greatly relieved not to be the one making it. Rather, all the blame in boldness can be directly attributed to a scholar infinitely more esteemed, brilliant, and prophetic than myself, who can incidentally also withstand the reputational damage of being outlandish far better than myself.

Meet Dan Boneh, one of the most respected academics in the field of blockchain, who heads the Center for Blockchain Research at Stanford and has been a professor of cryptography and computer science there since literally before the dot com bubble. And here’s him saying literally on record in a conversation with a16z General Partners Chris Dixon and Arianna Simpson that

NFTs are a perfect application for blockchains — interestingly, the reason blockchains are such a good fit for NFTs is because of the permanence of the blockchain. Something you put on the blockchain today will stay on it forever. I think that the Bitcoin and Ethereum blockchains will be with humanity forever.

In the year 3000, the era of Futurama, we’re still going to be looking at the Ethereum and Bitcoin blockchains. Maybe they won’t be called that — maybe instead of Eth 2 we’ll be onto Eth 15, but the data you put on them today will still be available in the year 3000.

And I think that’s really important to understand — when you buy an NFT today, that NFT is yours forever, until you sell it or give it away. So if you don’t sell it and you keep it to yourself, even in the year 3000, it’s still going to be yours, or your descendants. And that permanence, I think, plays a critical role in why blockchain is such a good fit for NFTs.

Frankly, I’ll be astounded if most of the physical art from today is still around in the year 3000, just as I’m pretty sure the vast majority of art from the year 1000 has already been lost forever. But literally everything on the blockchain might still be there, so if you really care about your great, great, great, great, great, great, great, great, great grandchildren being definitely the coolest and richest kids in their Matrix tower with the most OG art pieces, you probably want to pass down NFTs in your will and not physical art pieces.

Aligned economic incentives between creators and fans — fans are now all investors, and digital creators can earn money directly from their creations for the first time ever

I mentioned this briefly in passing when speaking about CryptoPunks yesterday, where I noted that all these insanely influential celebrities and other brand and taste makers had not merely not been paid to promote CryptoPunks like rabid dogs, plastering these pixelated punks all over their profile pictures in lieu of their actual faces, but rather had literally paid tens to hundreds to millions of dollars for the privilege of being uh, reverse-paid promoters?

Let’s pause for a moment and let that concept truly sink in. Up until the present day, digital content creators/artists typically earn a living through either prostituting their skills out to mega corporations with a regular day job or to their fans with commissions, or through selling cheap prints and merchandise of their work, or through advertising and brand promotion income streams, or through essentially begging for patronage on sites like Patreon, hoping for fans to give them money out of predominantly the sheer goodness of their hearts, or some combination of all of the above.

This works…okay for some, and not at all for others, but isn’t ideal for anyone. At heart, what creators want to do is be creators, and create what they want to create, and ideally get rich off the basis of doing that alone, without having to beg for patronage or sell their work in large print sets for fractions of what they could command if their work were physical in nature and not digital, or have to ‘sell out’ with advertising and so on, and so forth.

Now, with NFTs, that’s actually possible for the first time ever. Creators can sell their digital content/artwork directly to fans and collectors for the same amount it might command if it were a physically limited and scarce piece of content, and earn far more from the process than they ever did through any convoluted means of making a barely sufficient living in the past.

What’s more — fans are actually buying these digital works for record breaking sums of money not out of the pure goodness of their hearts, but because they actually expect that the work will either retain its present value or indeed increase in value in the future. In short, fans have all become investors in the common enterprise of the creator, and now, with very vested and aligned financial interests, are more motivated and incentivized than ever before to proselytize their chosen favored creators and ensure the continued rapid growth and success of those creators.

How incredible is that? Content creators no longer have to be sole marketers working a double shift as creator and promoter — every single fan that purchases one of their NFTs de facto volunteers to sign on as a promoter as well, and soon enough, hopefully this little army of literally invested fans will self-replicate themselves into a very large army of fans, and the creator can rest content to make butt loads of money just doing what they love, and nothing else: creating.

Trivial fractionalized ownership of NFT assets!

If I succeeded in persuading you that CryptoPunks are actually justifiably worth their present valuation, you may have gone and looked up the present going price of the cheapest CryptoPunk, and then cried tears of anger, frustration, despair, and existential nihilistic crisis like I did after realizing the cheapest CryptoPunk now goes for more than $400,000.

But fear not, for NFTs have already solved this problem, and for the low price of ~3.5 cents today, you too can buy your fair share of a CryptoPunk, without having to buy all of one. Granted, for 1 FLOOR token purchased for ~3.5 cents, you’ll own all of 1/9,615,385 of a single CryptoPunk, so you’ve got a ways to go before getting yourself all the way up to a whole CryptoPunk, but hey — always good to start somewhere and work your way up. It’s not even that bad — FLOOR actually trades at a discount, proportionally, to the actual floor price of a whole CryptoPunk out there in the wild today.

There are 1,000,000,000 FLOOR tokens representing ownership stake in 104 CryptoPunks, and at present prices, the implied valuation of all these 104 CryptoPunks is ~$36,500,000, which comes out to approximately ~$350,000 per CryptoPunk — more than $50,000 cheaper than the actual cheapest single CryptoPunk you can buy! Not bad at all.

In short, plenty of people have realized that the average consumer is quickly getting priced out of some of the most desirable NFT collections on the market today. These people have then gone and solved this problem by creating liquid markets wherein individual NFT pieces, or baskets of NFTs, can be fractionalized, and buyers can buy just fractions of a given NFT and gain exposure to the potential growth of that NFT over time without having to shell out the big bucks for an entire NFT all at once.

Fractional and Niftex are just two of the projects enabling users to buy fractions of NFTs, and already the experience is far more seamless, accessible, and devoid of massive middleman fees than the experience of attempting to buy fractionalized physical art.

Trivial borrowing against your NFT assets as collateral!

On another side of things, maybe you already YOLO’d all your life savings into NFTs, and are now struggling to pay rent. If this is you, fear not. You can now use platforms like NFTfi to put your NFT assets up as collateral for a loan, and continue not being homeless while also continuing to not have to sell your NFTs to pay for that privilege.

Same as above, the entire process for doing this is already far more seamless and accessible than with physical art, and will only continue to become even more seamless over time as the space matures. The possibilities afforded by having such liquid and composable markets for digital assets truly are endless.

Portable assets across applications/the metaverse at large

Let’s move back to games for a quick hot second, so we can better illustrate another massive advantage of NFTs. This advantage plays firmly into the whole theme of Web3 versus Web2, where data/digital assets are owned by individuals themselves, and not by massive corporations such as Facebook, Youtube, Twitter, Instagram, and so forth in the case of social media, and Valve, Epic, Sony, Nintendo, Microsoft, Activision Blizzard, Riot, EA, and so forth, in the case of games.

What does this shift in the ownership of assets enable? Just about a million things, but let’s just focus on one thing for now — the portability of your assets across different applications. Right now, if you own a digital avatar in a game created by say, Epic Games, that digital avatar is stored on Epic Games’ centralized and siloed personal corporate databases, and can’t be accessed and referenced freely by various other games or other applications made by other developers.

This may seem like a bit of a strange concept, because that’s the way things have always been, and it may not have seemed like there was a problem with that, but the reality is it’s been inhibiting a massive amount of possible applications whereby a user’s assets can be seamlessly transferred and utilized between multiple games, or even more broadly in the metaverse at large.

Indeed, this is a core problem inhibiting the overall growth of the metaverse today — without NFTs on a globally accessible and decentralized blockchain, chances are all the digital assets you’ll have in the metaverse will be siloed and centrally owned by various companies competing with misaligned incentives to silo your data and your assets in a bid to retain platform lock in effect, so you can’t just take your data and slip away to a less monopolistic and domineering competing interface for using your data in whatever way you’d like.

With NFTs, you truly own all your data, and the flip side of that is you are free to allow any application you’d like use that data — such that you could, in the future, truly live in a Ready Player One or Daemon esque metaverse where your avatar and its items can travel freely between games and worlds and other virtual experiences, and everything seamlessly connects together. Kind of insane and far fetched for now, so don’t get too caught up with this stuff if it doesn’t resonate with you — I’m just throwing stuff out there for the true believers among you all now. The future is coming, and it’s fucking awesome.

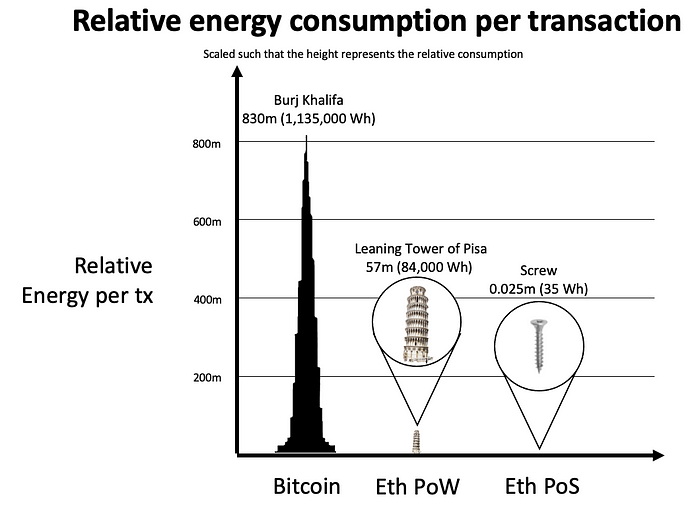

Don’t worry, energy consumption isn’t a real concern. Less overhead, really

Finally, a common criticism of NFTs earlier this year was that they consume massive amounts of energy and are thus ethically indefensible as giant environmental drains on the earth.

One thing to keep in mind is that NFTs in of themselves don’t precisely really cause any blockchain to consume more resources than they would otherwise, and the amount of hash power used to secure a given blockchain at the present moment predominantly only correlates to the price of the cryptocurrency that blockchain powers. Even if no NFTs were being bought and sold on Ethereum, if the price of Ethereum rose, there would be increased power consumption right now, and even if all that’s happening on Ethereum is NFT minting and selling, if the price of Ethereum dropped, there would be decreased power consumption.

Another thing to note is that energy ‘wasted’ is a fairly interesting and subjective word. By 2025, the internet is projected to consume literally 20% of all the world’s electricity. Is that a ‘waste’? Now that we understand the utility behind NFTs (and, if you read Cryptocurrency 101, hopefully you’ll be convinced on all the utility inherent in blockchain powered cryptocurrencies).

Arguably, email is far less environmentally costly than mailing a letter, and in the same way, buying and selling NFT art is far less environmentally costly than transporting physical art all around the world and flying out artists and collectors in the same fashion to partake in physical gallery showings and auctions.

But that’s all beside the point, really, because Ethereum actually isn’t going to be environmentally harmful going forward, and will use “at least ~99.95% less energy” after Ethereum Proof of Stake goes live, on the order of ~2.5 megawatts or so, which is less energy than ~2500 American households, apparently.

So yeah, you should probably feel better about engaging in NFT art versus physical art, and feel like you’re partaking in the less ecologically damaging form of art, because you uh, are. No more having every art piece shipped to Switzerland to be stored in a giant soulless Geneva Freeport warehouse that has to be maintained constantly at great expense just so you can save on taxes or something.

There’s much more, but I’m tired, and you’re tired and/or dead

Okay — I’ve realized at this point I could go on literally forever, and indeed many others have, but I have to stop somewhere, and I feel like I’ve sufficiently covered at least some of the myriad novel possibilities and advantages NFTs provide over the status quo to hopefully adequately whet your appetite and encourage you to dig deeper into this space on your own.

In case you are interested in learning much, much more about all the things I’ve covered here at a surface level, an excellent starting point is a16z (one of the top VC investment firms in Silicon Valley, founded by brilliant pioneers of both the internet and now crypto)’s NFT Canon, which is a truly excellent compilation of thought pieces on NFTs that covers everything from the core concepts and benefits of NFTs to their technical underpinnings to the history of NFTs to how to get started with the space, and much more.

For now, let’s move on to the final part tomorrow, and teach you how to actually get started either buying or creating NFTs, or both. Hopefully you’re not literally dead yet. That would make one of us making it through this thing alive.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.