Doc's Daily Commentary

Mind Of Mav

Is This The End Of The USD As Reserve Currency?

Is the US dollar in decline? One indicator that some individuals use to signal a fall in the dollar is recent foreign exchange market activity. Between March and August of 2020, the dollar, as measured by the US Dollar Index, lost 9% of its value. At the same time, gold prices pushed past record highs. These combined moves might suggest that something ominous is happening with the US dollar. While it’s tempting to extrapolate near-term developments into the future, let’s look at what history has to say about the dollar’s movements.

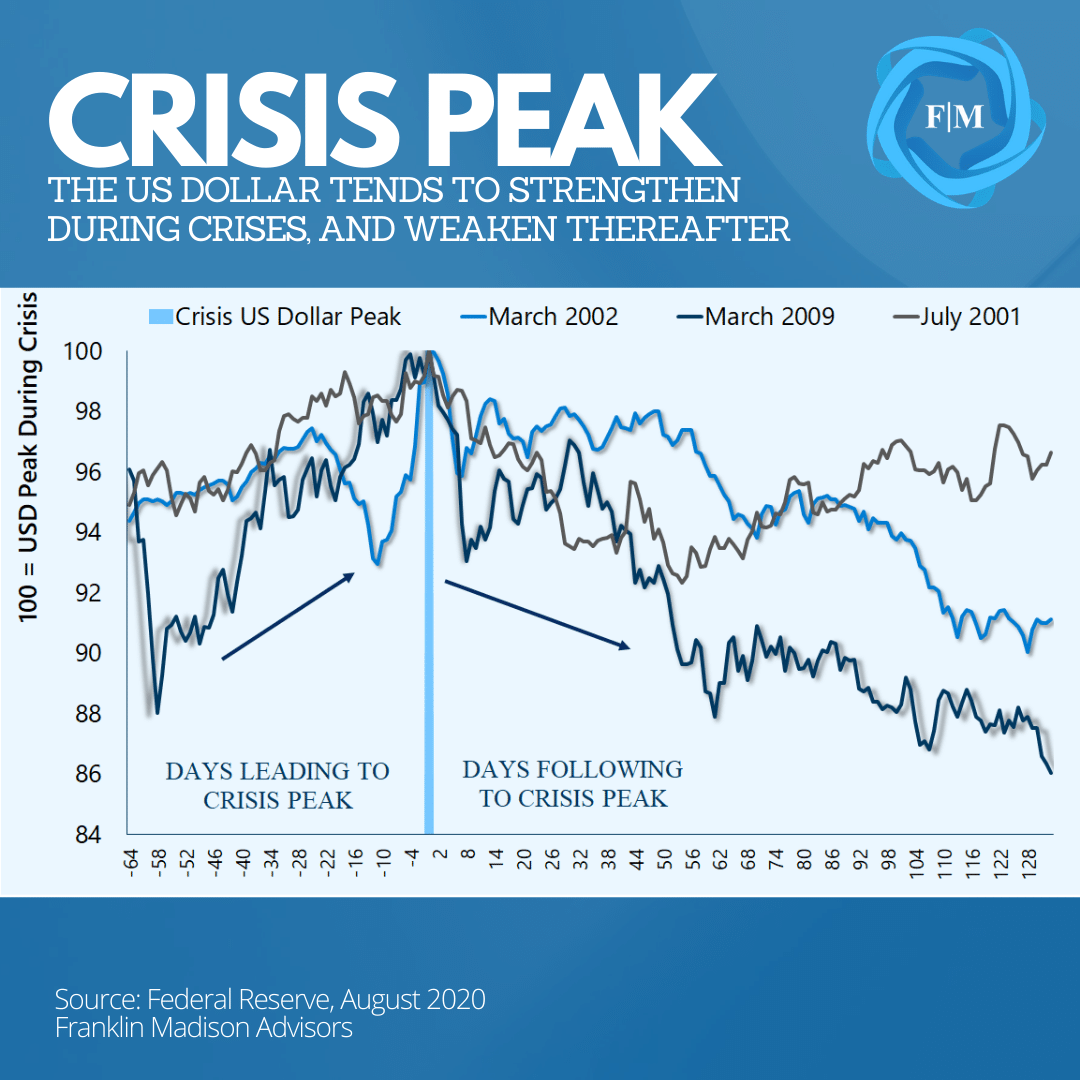

From a purely data-driven perspective, history has shown that periods of US dollar weakness are often preceded by strength, especially during crisis times. In the months leading up to its March 2020 highs, the US dollar rose in value versus its key global trading partners. This move occurred as individuals and institutions piled into perceived safe have US assets as coronavirus uncertainties weighed on the global economic outlook.

Certainly, during times of financial stress and economic uncertainties, the US dollar is often sought after as a globally secure destination to park savings. This ebb and flow in value is not unique to 2020. In fact, it is evident in prior crises, like in March 2009, amidst the Great Recession and during the popping of the Tech Bubble in 2001. In fact, after appreciating in 2008 and early-2009, the US dollar gave up 13% of its value in the five months following stock market lows in March. In 2001, even with the events surrounding September 11, the dollar trimmed 4% of its value during the year.

The point here is that a dollar decline today might coincide with legitimate concerns about massive fiscal and monetary spending. Even so, correlation should not be confused with causation. Instead, one way to look at the recent dollar moves is from the perspective of a safe-haven currency. When economic and geopolitical uncertainties rise, there is greater demand for the safety of the US dollar. Today, it can be argued that movements in the foreign exchange market reflect less demand for US dollars as global market participants look past economic uncertainties.

What Makes a Global Reserve Currency?

If we presume that dollar fluctuations in foreign exchange markets are consistent with near-term risk-on/risk-off trends, what then can we make of the US dollar’s role as a preeminent reserve currency? In other words, why wouldn’t market participants look to the euro or Chinese yuan as dollar-alternatives during times of uncertainty? In its simplest form, there are generally three factors that make a currency a dominant global reserve: 1) it’s used to settle foreign financial obligations, 2) a means to pay for international trade, and 3) as a store of value.

Settling Foreign Obligations (Liquidity)

It’s often assumed that central banks print money out of thin air. The fact is that financial institutions are primarily responsible for affecting money supply in circulation. This occurs as banks take in deposits and issue loans. One factor that has propelled the dollar into its global reserve status is how financial institutions outside of the US have issued US dollar-based loans. We refer to these dollar-based foreign obligations as Eurodollars.

While the term was originally coined to represent dollar-based borrowing in a post-World War II Europe, today it applies to US dollar-based obligations in other parts of the world. Experience tells us that interest is often paid back to a lender on top of the principal owed when we borrow money.

Foreign individuals and firms earning money outside of the US might need to convert their own local currencies in exchange for US dollars to make their lenders whole. And by some estimates, today there well over $10 trillion is Eurodollar deposits outside of the $18 trillion in the US financial system. Taken together with loans issued by the International Monetary Fund, the World Bank and Asian Development Bank the dollar is a key source of liquidity for the global financial system.

Use to Settle Global Trade (Size)

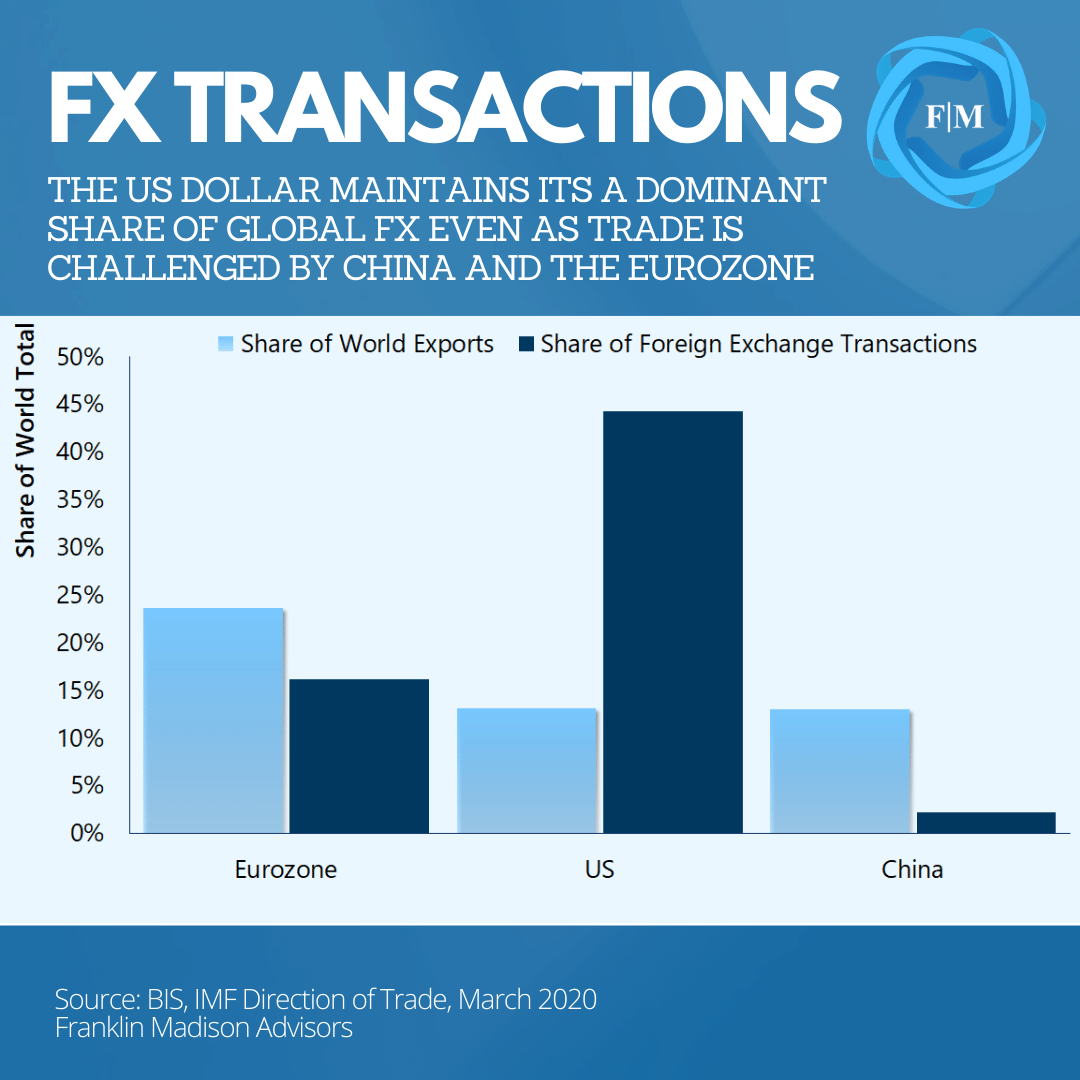

Another factor that distinguishes a global reserve currency is its use to settle trade in international goods and services. In the post-War era, the US was a dominant leader in global trade, given the fact that it was essentially the last major economy standing. In the decades since the Eurozone has become one of the world’s largest trading powerhouses and China has risen in prominence as an essential exporter of global goods. Even so, data continue to show that the lion’s share of world trade is settled in US dollars.

According to data from the Bank for International Settlements, foreign exchange transactions in US dollars were nearly three times higher than the euro. Indeed, even as China has risen to be a key leader in terms of global trade volumes, the use of the yuan in foreign exchange markets remains a mere fraction compared to the US dollar’s use.

Looking beyond manufactured goods, essential commodity items like gold, oil, and soybeans contracts are largely priced and settled in US dollars. The point here is that buyers and sellers of goods and services globally affect millions of transactions that follow through foreign exchange markets every year and remain overwhelmingly reliant on the US dollar.

Store of Wealth (Stability)

A third factor that makes a global reserve currency is in its perceived ability to store wealth. Put differently, holders of a currency must have a strong belief that its value will remain generally stable over time. Strength in a country’s economy, government, and monetary system all contribute to the collective perception of stability underpinning a country’s currency.

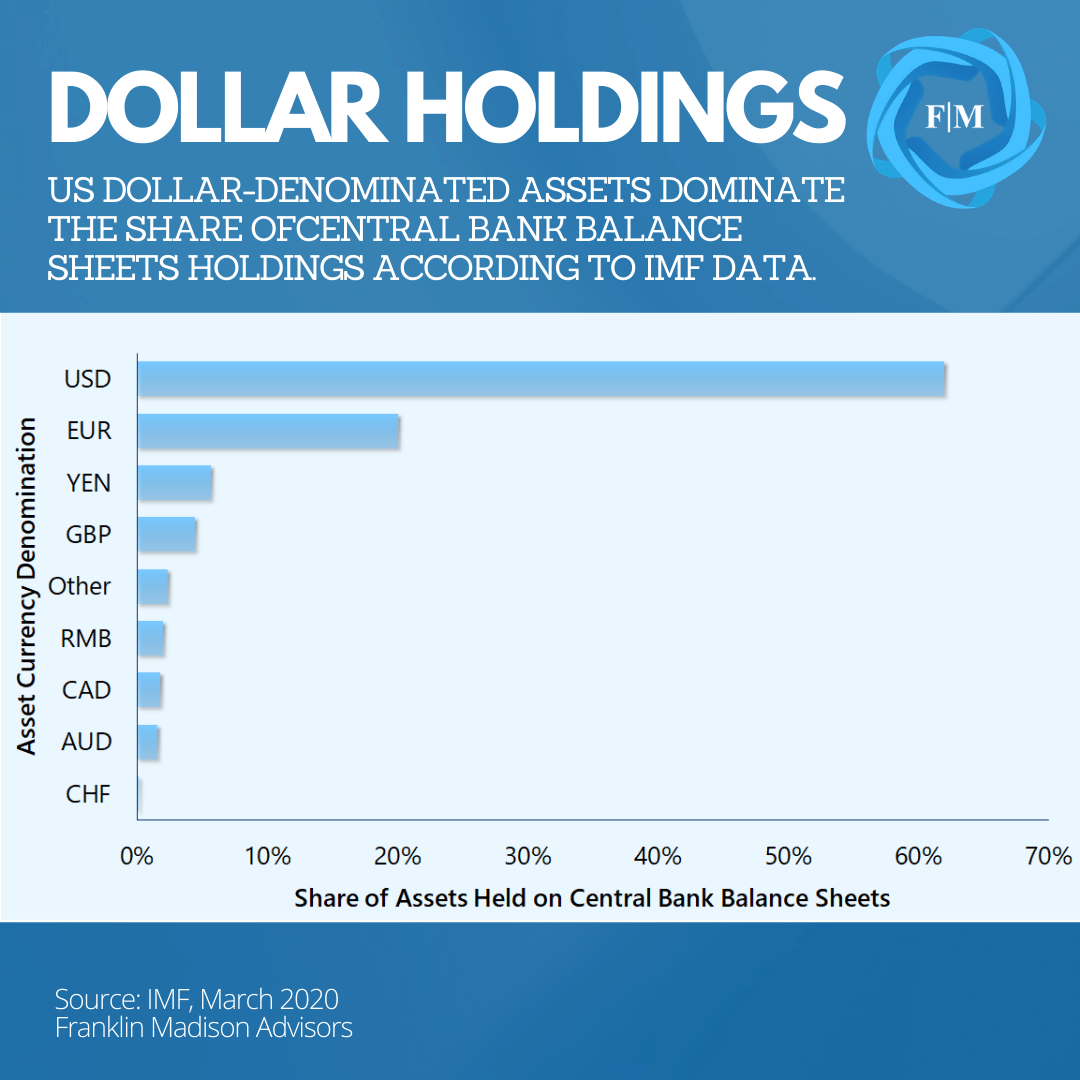

And despite a number of developments over the past decade, the fundamental factors underpinning the US economy, its government institutions, and monetary system remain on solid footing compared to other global alternatives. To be sure, it’s this stability in growth and governance that has led to demand foreign capital flows into US markets and a still outsized demand among foreign central banks for US reserve assets.

For example, US equity and debt markets account for 40% of global market capitalization. This size makes US markets the single largest and most stable investment destination for foreign investors. And while US government debt continues to rise and foreign policy changes have led to more uncertainties lately, China and Japan, remain two of the world’s largest holder of US federal debt reflecting ongoing trust in US institutions.

Another factor to consider is that US-dollar denominated holdings make up well over 60% of the world’s central banks’ assets according to data from the IMF. These assets are used by central banks to help fund obligations in their own domestic financial systems. Indeed, these assets held often reflect a need that banks or institutions in their own country might have for a particular currency. Taken together, this demand for US dollars by foreign individuals, governments, and institutions suggest ongoing faith in the US dollar.

There is No Good Alternative

So far, we’ve discussed factors that make the US dollar a global reserve currency. Now a key question you might be asking is what could change the US dollar’s status. Well, anthropologists have pointed out that when it comes to an individual’s choice to migrate from one geography to another, they not only need a desire to leave their current situation but also have a destination to move towards. From a dominant reserve currency perspective, few countries possess the size, liquidity, and stability factors to overwhelmingly support financial transactions, trade, and use as a store of value.

Now, the euro and yuan have often been pointed to as potential alternatives to the US dollar. A key question is whether they meet all three criteria of a dominant reserve currency. In terms of the euro, the currency increasingly benefits from its size and liquidity factors but suffers from uncertainties surrounding its political stability. Consider the Eurozone. It represents a subset of countries within the European Union and its currency, the euro, is largely used to facilitate trade and financial transactions.

Nevertheless, the EU itself remains a confederation of sovereign states and not a single country when compared to federalism in the US. And in recent years, the EU has experienced its fair share of political instability, including the departure of the UK (Brexit) and populism that threatened Greece’s EU withdrawal. What about China?

China has undoubtedly made an effort in recent years to internationalize the yuan. It’s currency’s inclusion in the IMF’s Special Drawing Rights basket, lending efforts across the Belt and Road Initiative, easing its peg to the US dollar, and opening up its capital markets have all been aimed at greater foreign adoption of the yuan.

And while China is the world’s second-largest economy and accounts for a large portion of global trade, a foreign market for the yuan remains small and illiquid on a global relative basis. In terms of stability, President Xi Jinping’s pivot away from Deng and toward Maoist ideology introduces a host of uncertainties related to the rule of law and foreign policy in China.

When it comes to finding a suitable replacement to the dollar as a preeminent reserve currency, the simple fact is that there is no good alternative right now. Until countries like China or the EU step up to address size, liquidity, and stability concerns, the US dollar is likely to remain a dominant reserve currency into the foreseeable future.

Effects of a Structurally Weaker Dollar

Up to this point, we have made a case for a generally stable role for the US dollar as it relates to its status as a dominant reserve currency. However, a moment could come in our lifetimes when the US dollar may lose this coveted status. What might this development mean for your finances?

Well, a slow transition from a dominant role to a second-run reserve currency measured over decades might have little noticeable impact for the average household. Indeed, inflation running at a 4% rate could lead to the cost of living doubling in 18 years compared to 36 years at current inflation rates. Given time, policymakers and business leaders might be able to introduce strategies and technologies that help pivot the economy in light of a changing financial environment.

Indeed, a structurally weaker US dollar could change the economics of US goods manufacturing and lead to higher levels of reshoring and job opportunities at home. At the same time, US firms doing business abroad likely would also see earnings rise as foreign currencies strengthen when US dollars are brought back home.

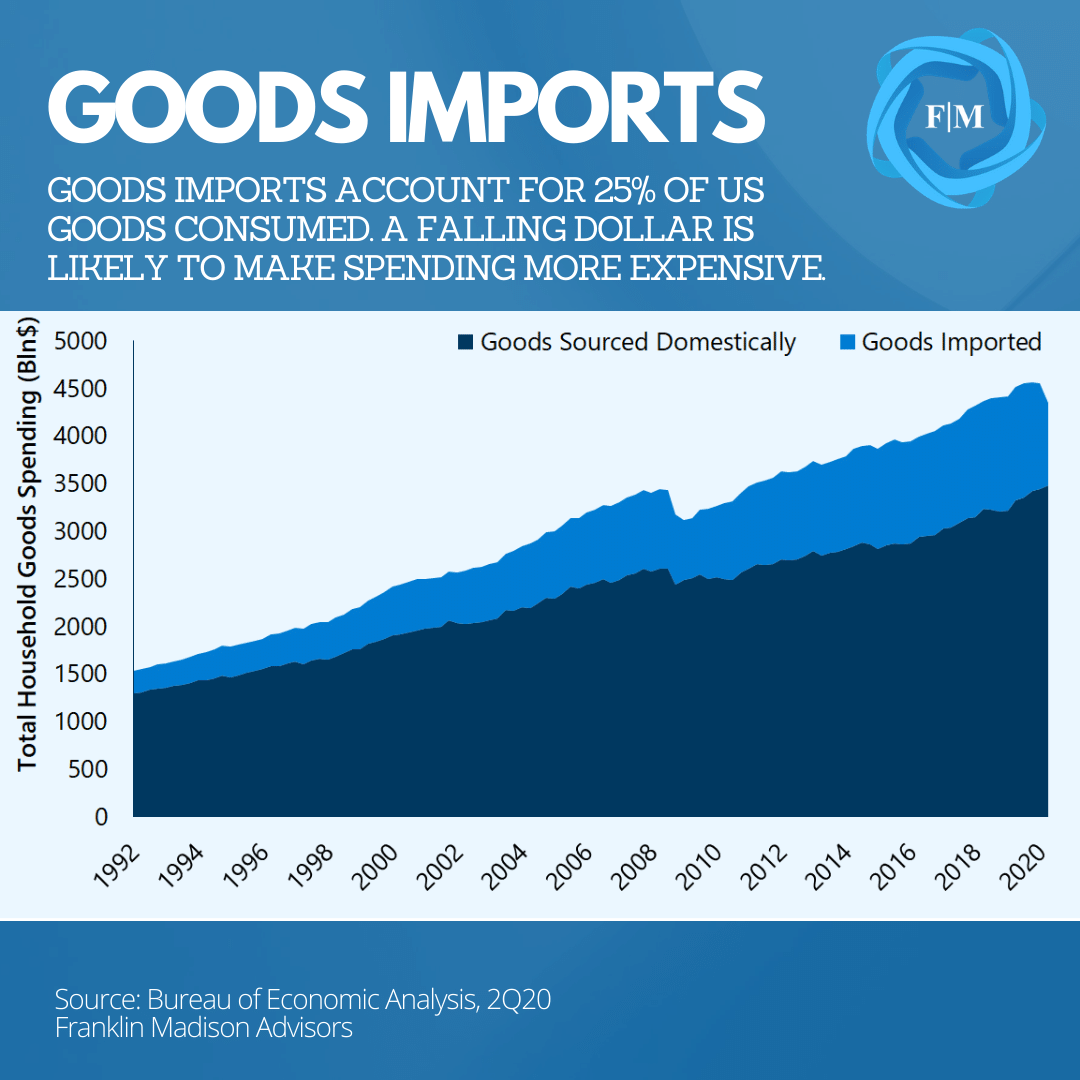

Sudden Currency Shock

On the other hand, a sudden shock, like war or an unmitigated economic collapse, might lead to a sharp drop in the US dollar and make it more expensive for households to spend or borrow. How so? According to government data, households spent $4.3 trillion on goods at an average annualized rate during the first half of 2020. At the same time, over a quarter of the goods consumed were imported from abroad. This point is important because when the dollar falls, the cost of goods imported rises, leading to higher inflation rates. And a sudden drop in the dollar could lead to noticeably more expensive goods on store shelves.

Another thing that a weaker dollar could do is push up borrowing costs. Should confidence in the US dollar finally wane, the Federal Reserve likely would be forced to raise interest rates to incentivize foreign investors to hold dollars. And when the Fed makes changes to its interest rate policy, it can affect borrowing costs that likely would make spending more expensive.

In fact, rising interest rates might make it more expensive to borrow when it comes to purchases like a house or a new car. At the same time, higher interest rates could lead to stagnating home prices as values are typically inversely related to interest rates. Higher interest rates would also make it more expensive for local and federal governments to borrow, challenging their finances and their ability to fund essential programs like Social Security and Medicare.

The point here is that effect on your finances as it relates to a weaker dollar likely will depend on whether the dollar’s fall from grace occurs over a short or long period of time.

US Dollar Dominance Likely Here to Stay (For Now)

Today, some individuals point to near-term weakness in foreign exchange markets or the rise of currency alternatives like gold or bitcoin to signal an imminent demise in the US dollar. The fact is that the world remains heavily dependent on the dollar to affect international trade, settle financial transactions, and in its use as a trusted store of value.

While the impact of a sudden loss in reserve status might lead to higher inflation and borrowing costs, it remains likely that the dollar’s fall from grace might occur over an extended period. This potential could give US leaders time to enact policies that could help mitigate the world’s shifting preference toward the euro or yuan as a preferred reserve currency.

Even so, if your concern is rising inflation, then history has shown that financial assets are an optimal means for hedging against the rising cost of living. Until then, the size, liquidity, and general stability of institutions supporting its use are likely to uphold the US dollar’s preeminent status into the foreseeable future.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.