Doc's Daily Commentary

Mind Of Mav

Is SushiSwap The Beginning Of The End For DeFi?

Signaling is even more of an issue in the crypto markets, which has limited operating connectivity to the blood and flesh of the “real world”. So, for example, in obsessing about Total Value Locked in Defi, we may be obsessing over a gamed metric that can actually signal risk instead of progress.

A leading decentralized exchange, Uniswap, was recently attacked by having its open-source code copied, rewarding users of the copied protocol with native tokens, pulling liquidity out of Uniswap into the new protocol, and then planning to make the transfer permanent. If you looked at the metrics, it looked like Uniswap had more trading volume than Coinbase! If you looked at the underlying, it was a bleed out of capital from one venue to another — the convulsions of the animal during a vampire attack.

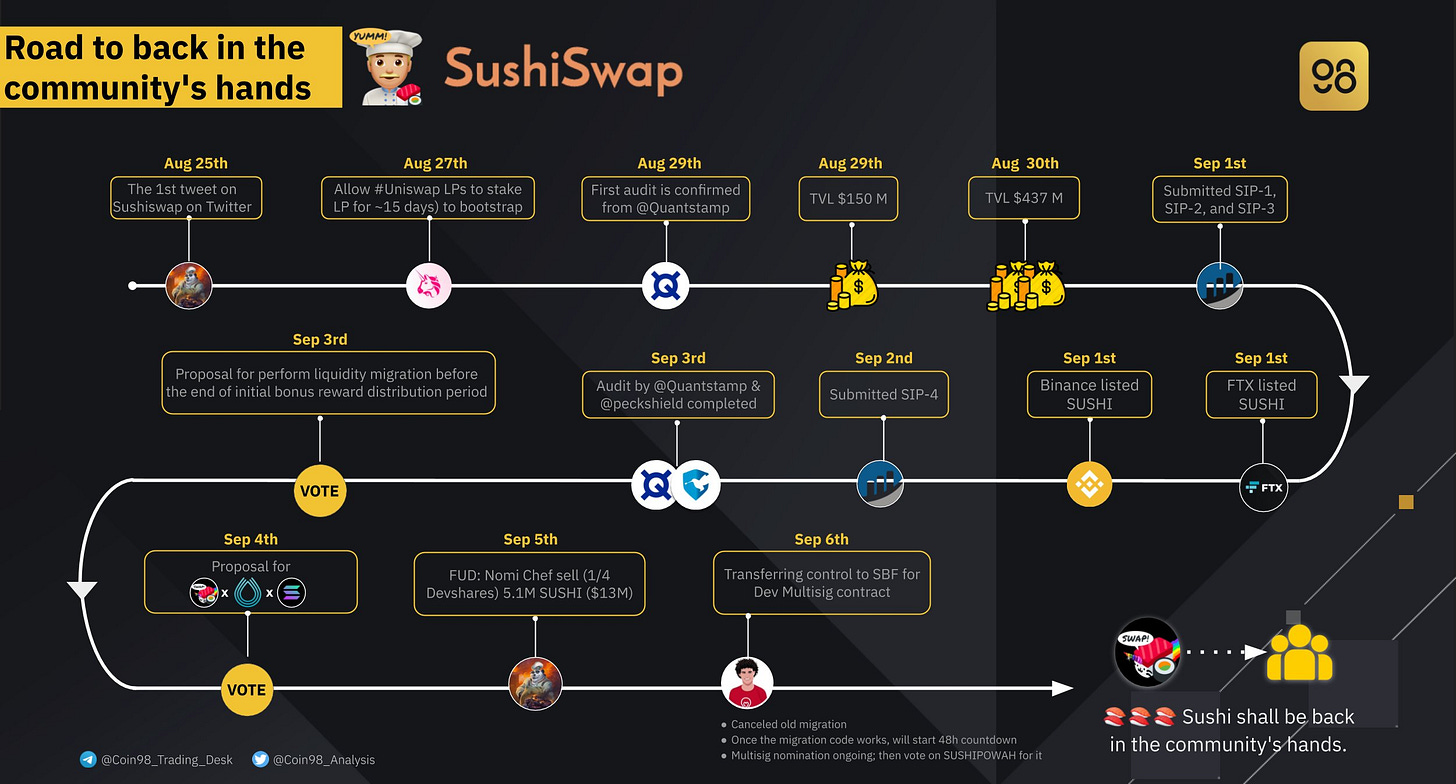

The new protocol SushiSwap signaled that it wanted to give rewards to users, its liquidity providers. It wanted to build a better version of the community project. The founder said all the right things to get people to trust a personally controlled fork of a technology. And over the weekend, that founder cashed out over $10 million in reward token allocation for himself before being expelled from the project. The codebase was “rescued” by Sam Bankman-Fried, who runs Alameda Research and FTX, a derivatives exchange. FTX wants to stand up not just a Uniswap competitor, but an Ethereum competitor called Solana. To do this, it has also recently acquired Blockfolio and its 6 million users for a reported $150 million. This is not a clean story of Total Value Locked going up = DeFi is winning.

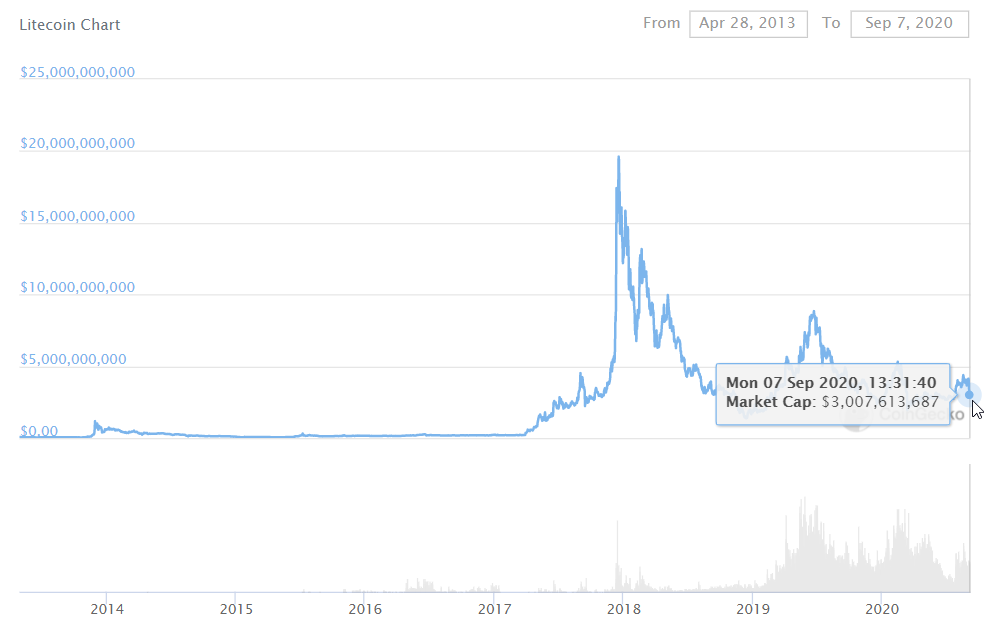

I can think back to Charlie Lee, the founder of Litecoin selling all of his Litecoin assets at the top of the 2017 ICO market, for what likely approached USD billions. Litecoin is a fork of Bitcoin with some properties that make it a cheaper alternative, or a testnet for the actual Bitcoin network. It is not unlike SushiSwap relative to Uniswap. Charlie himself is an engineer, had helped build Coinbase, and has nearly a million Twitter followers. Those are strong, positive signals. What has it meant for Litecoin investors over the last 2 years? Not much. LTC is down 85% since Charlie sold his position.

We of course have to measure things. There need to be ways to understand value and market capitalization and success. But we also need to pay careful attention to whether the squiggly line we track on performance charts captures something that one should care about, or is just a proxy for exclusivity and social standing. And when metrics change quickly, as in the market shifts in Fintech or Crypto, we have to pay attention to whether the new metrics are signals of the type that we are used to in the old world, or are more nebulous and subject to gaming.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.