Premium Daily Crypto Newsletter

April 2, 2018Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

Q1 In Review

Easter Weekend Does Not Resurrect The Bull

And we’re back!

We hope you enjoyed the weekend, and now it’s time to get back to talking crypto with you.

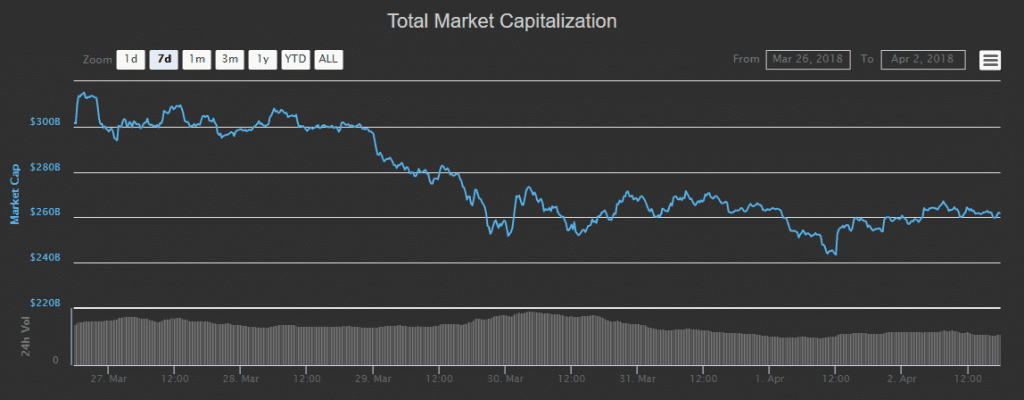

It was clear the market didn’t appreciate us taking the weekend off, as we saw a dip of nearly 40 Billion to our new yearly low of 243 Billion as well as a record low for the volume.

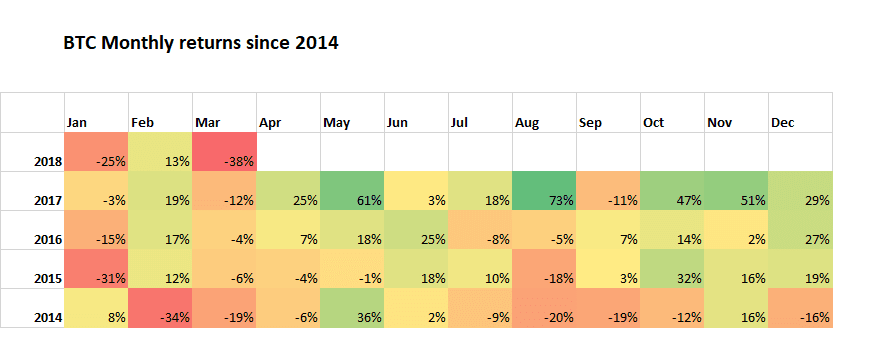

It’s clear the market wanted to give March, and Q1, a proper send off. In fact, looking at a chart of the entry and exit prices for each month, March 2018 was the worst month for Bitcoin in the last 5 years.

However, if you look at the difference between the monthly highs and lows, you’d find that December 2017 was the best month for Bitcoin in 5 years. Suddenly, the picture starts to become a little less opaque.

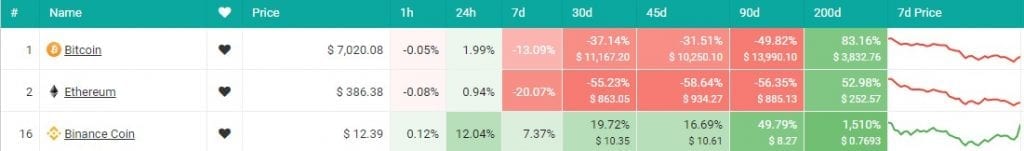

In fact, only two of the top 25 cryptocurrencies survived the last three months with positive gains, VeChain and Bianance Coin. Vechain’s seemingly never ending torrent of announcements and good news, including partnership announcements with BMW and Logsafer, helped to propel it from a relatively unknown status to one of the biggest cryptocurrencies. It just surged in the last 24 hours due to an announced listing on Bitumb, one of the world’s largest exchanges.

Meanwhile BNB is also surging. Binance continues to prove itself as one of the best investments and exchanges in crypto. While their meteoric rise hasn’t been without some pitfalls, they certainly have shown that they have the best interests for crypto at heart.

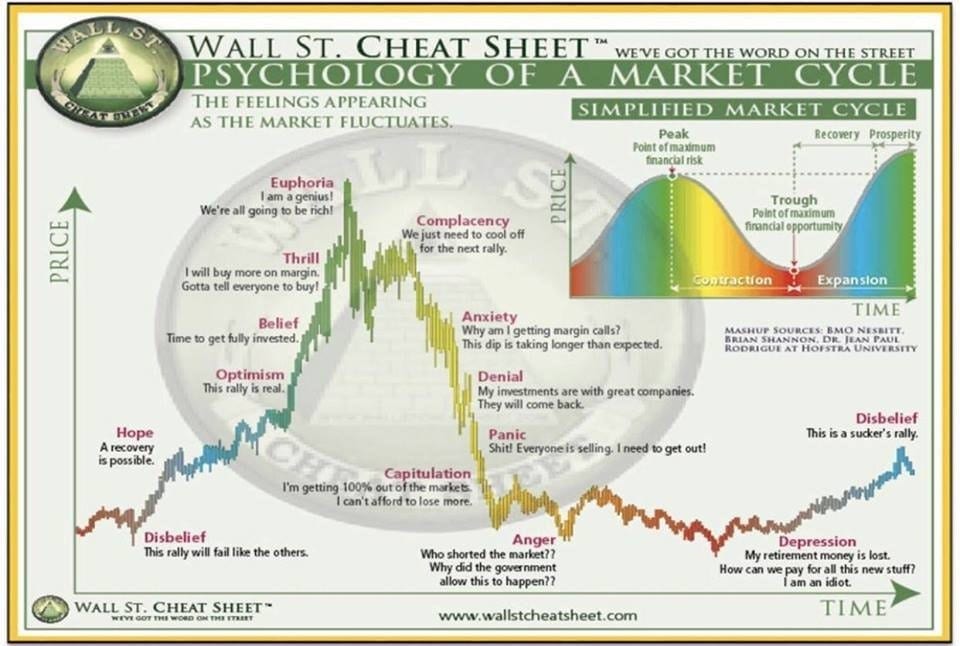

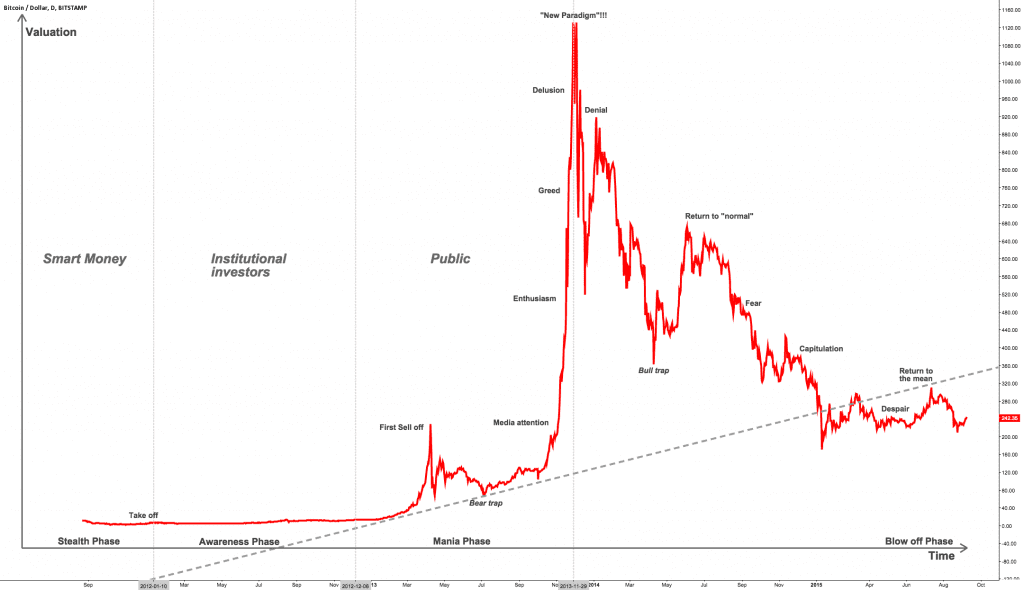

So one of the most important things to understand as a member of the smart money trading and investing in crypto is the psychology of a market cycle.

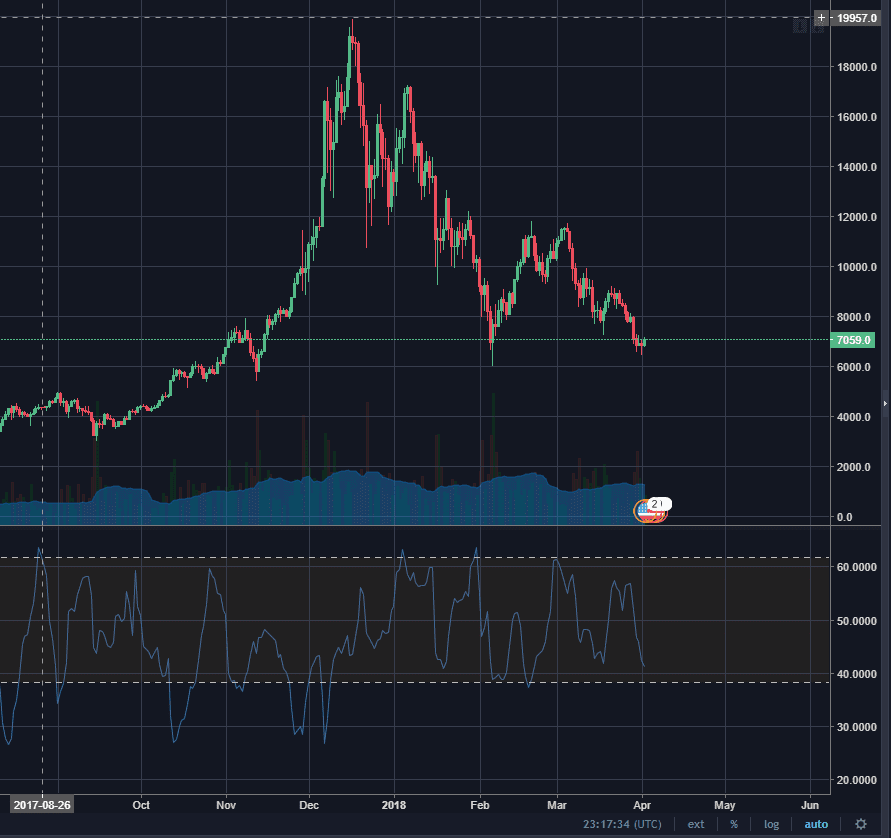

While this year’s bear market is seemingly the end of crypto to some, this is nothing we haven’t seen before. In fact, I want you to take a good look at both of these charts:

2012 – 2016

2018

Notice any similarities?

The one part we can’t say for certain is how long the fear / anger / depression cycle will last, but we are absolutely certain that this is not how crypto dies. Every ending is just another beginning.

Talk to you tomorrow.

New to Cryptocurrencies? Check out our archived classes “Intro to Cryptocurrency Trading”, “How to Find Your Next Big Cryptocurrency: Intro to Fundamental Analysis” and Doc’s new one, “Introduction to Technical Analysis” which are now all available for immediate purchase/viewing in the Premium Member’s Home. View more about them at our online store by CLICKING HERE.

Sign up for our NEW Telegram channel by clicking here!

Watching on Mobile? Click this link to watch in HD

Click here for audio link of today’s video

If you go to buy any of our courses at our online “store” you can receive $10 off the $59 street price with your member’s “coupon code” of member18crypto

Offense – Adding Trades

Offensive Actions for the next trading day:

- Entered HPB position

- Entered ELA position

- Entered QLC position

- Entered KNC position

Defense – Managing Risk

Defensive Actions for the next trading day:

- None.

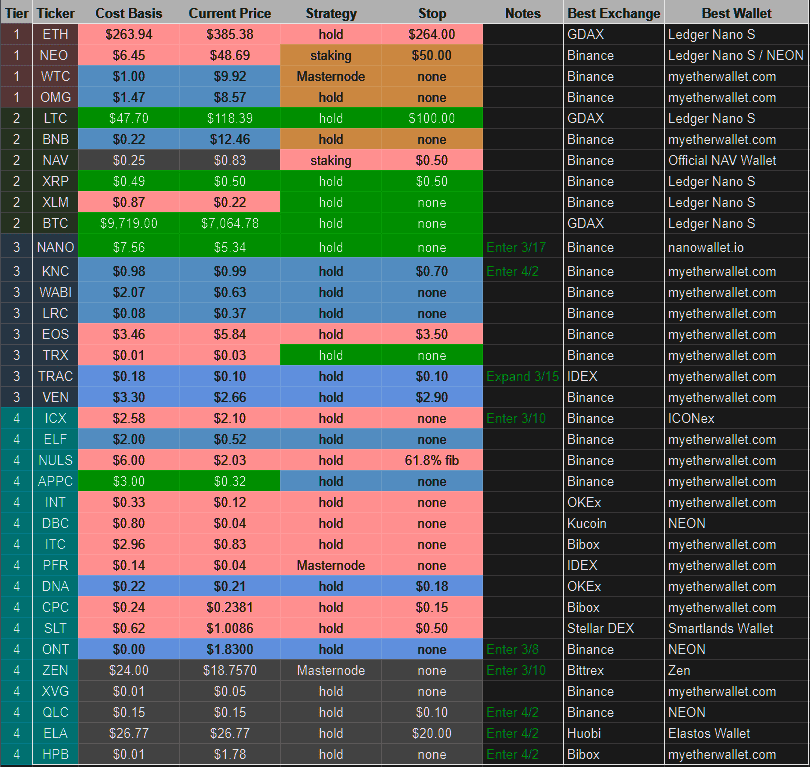

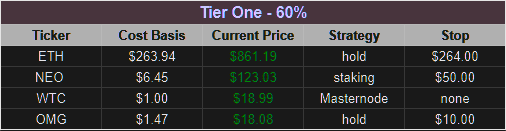

Current Portfolio

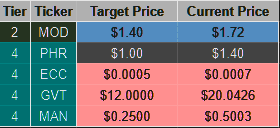

Desired Holdings

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

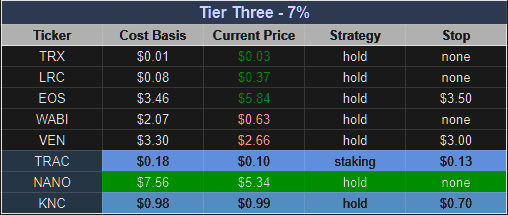

Tier 3

KNC

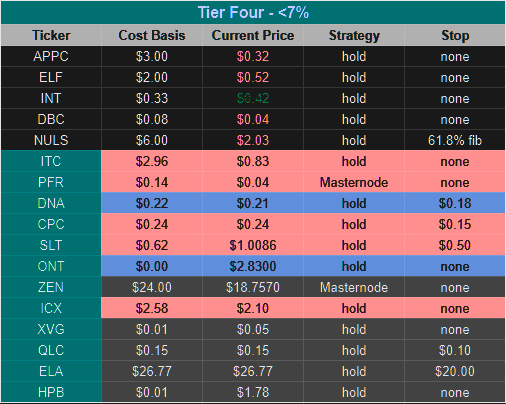

Tier 4

QLC

ELA

HPB

None.

Tier 2

MOD

Tier 3

REQ

SUB

LINK

NANO

KNC

Tier 4

BNTY

TAU

WISH

PHR

LOCI

XBY

ELA

ECC

POE

HPB

BIX

EVE

ReadySetCrypto’s 7 Categories Of CryptoCurrency

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

Tier 3 coins are those coins which we have moderate investments and we believe have a possibility of high performance in the future, but as of yet have not shown enough performance to reduce their risk profile. Tier 3 coins are coins which are moderately risky, but due to our risk analysis of the project and team we believe have minimal chance of failure.

Tier 4 coins are coins which we have minimal stake in, are highly risky, and we are contributing no more than 2% of our portfolio to. These coins represent the outer fringe of our risk analysis, in that we have little information to work with, have little insight into the coin’s performance, and at the very best we are making an educated guess that they will be successful. If a coin performs well and proves that it has a commitment to its compelling feature, it will be moved to the Tier 3 status.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Fundamental Currency Research

One of our biggest plays right now is the NEO ecosystem. We’re very excited to see an Ethereum competitor really starting to get on its feet as a growing number of new projects have launched on it. This ecosystem, of which coins belonging to it are known as NEP-5, might be one of the best investments we could start going after.

You can see a list of NEP-5 tokens here: https://neoguide.io/nep-5-tokens-2/

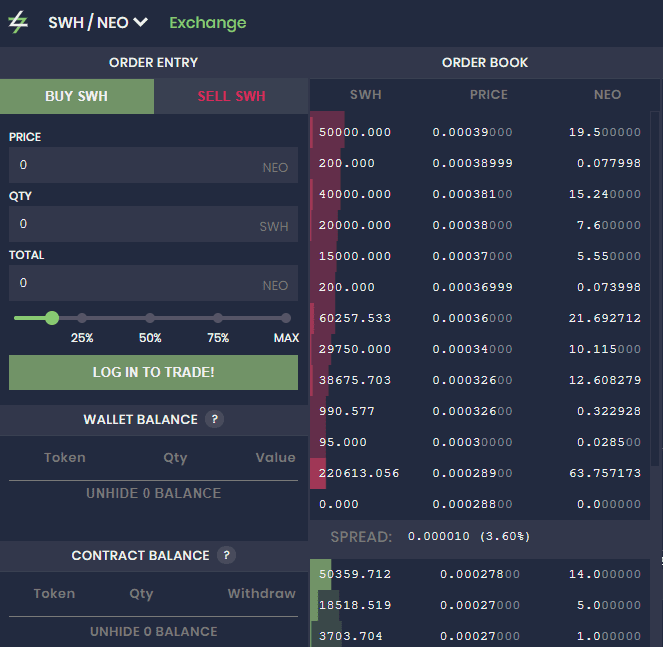

Just today, Switcheo launched it’s mainnet. It will faciliate a NEP-5 token exchange, which is now live at https://switcheo.exchange/. This is important as it’s a real testament to the NEO ecosystem. Among the pairs currently trading on it are NEO, GAS, Switcheo Token (SWH), Red Pulse (RPX), TheKey (TKY), Bridge Protocol (IAM), Trinity (TNC) and DeepBrainChain (DBC).

Future plans for Switcheo will include launching on QTUM and Ethereum. In the meantime, the team says it will continue to “strive and achieve the milestones that are set out in its white paper,” some of which include:

- Q2 2018 — Launch of QRC20 trading

- Q3 2018 — Launch of ERC20 trading

- Q4 2018 — Cross-swap feature using SWH and Wanchain

- 2019 — Launch of trading for top 5 chains

We think a healthy competitor to Ethereum is extremely good for the long term prospects of crypto, and we’re not just saying that because we’re invested in NEO. We think it’s inevitable for Ethereum to overtake Bitcoin as the top crypto, and when that happens people will look for alternative smart contract and dApp platforms to invest in. We think NEO is the stand-out winner.

We’ve seen a comical reference to the “NEP-5 booster pack” which is N.E.O., or NEO, Elastos ($ELA), and Ontology ($ONT), as these are the three most promising projects in the NEP-5 ecosystem right now. That being said, we like the potential of Qlink ($QLC) and Trinity ($TNC) as well.

We’ve entered a position in QLINK ($QLC) based on an announced partnership with Binance.

“Qlink debuted its first dApp featuring mobile network sharing such as WiFi and Wallet functionalities on Github in January. The dApp has gone through 11th upgrades and will be available on Google play in April. Qlink team announced to support BNB token as utility token in Qlink dApp. BNB is issued by Binance as a means of payment in the Binance platform and is currently among top 20 crypto currencies in market capitalization.”

We’ve reacquired KNC, ELA, and HPB after previously hitting our stops on them.

KNC – KyberNetwork is an on-chain protocol which allows instant exchange and conversion of digital assets (e.g. crypto tokens) and cryptocurrencies (e.g. Ether, Bitcoin, ZCash) with high liquidity. KyberNetwork will be the first system that implements several ideal operating properties of an exchange including trustless, decentralized execution, instant trade and high liquidity. Besides serving as an exchange, KyberNetwork also provides payment APIs that will allow Ethereum accounts to easily receive payments from any crypto tokens. As an example, any merchant can now use KyberNetwork APIs to allow users to pay in any crypto tokens, but the merchant will receive payments in Ether (ETH) or other preferred tokens. Although running on the Ethereum network, KyberNetwork’s roadmap includes supporting cross-chain trades between different cryptocurrencies using relays and future protocols like Polkadot and Cosmos. Ethereum accounts will be able to safely receive payment from Bitcoin, ZCash and other cryptocurrencies via our payment APIs, through this trustless payment service. Derivatives will be introduced to mitigate the exposure to the risk of volatilities for the users of KyberNetwork Crystals (KNC) and selected cryptocurrencies. This will allow users to participate in the price movements synthetically.

ELA – Elastos is a blockchain based operating system which is the world’s first open source Internet Operating System. The Elastos Foundation was founded by Rong Chen and Sunny Feng Han, aiming to create a new Internet system powered by blockchain technology. On this new Internet, people will be able to own digital assets and generate wealth from them. Elastos will be used as the base-layer infrastructure rather than an application and has received sponsorship of over 200 million RMB from the Foxconn Group and other industry giants for its research and development. Elastos has open-sourced tens of millions of lines of source code, including more than four million lines of original source code. DApps are forced to never connect directly with the internet and only interact with the Elastos runtime (which in turn acts as a middle layer, then connecting to the internet) and you’ve essentially got a system that’s 90% more secure than the way IoT or smart devices currently work. Today if I have 50 smart devices in my home, they all interact with the internet, I need to worry about 50 security threats. With Elastos, all I need to worry about is 1 threat, an attack on the Elastos runtime itself, this is a 10x better set-up and applies to IoT or frankly any device, with the beauty being its code written in C++ so any device can run it, even your fridge, and it’s open source, so any developer can make whatever DApps they want.

HPB – Seen by some as the Chinese version of EOS, High Performance Blockchain (HPB) aims at solving the scaling issues that many current blockchain platforms face. These scaling issues range from low TPS (Transactions Per Second) to long confirmation times (or latency) – impeding crypto adoption from businesses which process millions of active users per day and large amounts of data. Being able to quickly handle this amount of data is critical for BaaS (Blockchain-as-a-Service) systems to avoid issues, as in the future, data will come from a vast number of sources (IoT trackers and sensors from smart-fridges, smart-cars, and other objects).

In this section we’ll feature a daily ICO or new coin we think you should check out. Based on your country, you may not be able to participate in the ICO, but you will be able to trade the coin once it is listed on an exchange following its ICO (usually only a couple of weeks). ICOs are where a lot of money in crypto is made. Here’s proof. That said, we should warn you: ICOs are highly risky endeavours and you need to mitigate any potential losses. Treat it as money you’ve lost the moment you contribute to the ICO. We are not responsible for the ICO’s performance. Today’s featured ICO / New Coin is:

DEEP AERO

For flipping Neutral.

For long-term holding Neutral.

What is it?

Decentralized, intelligent, self-aware, autonomous drone traffic management platform Vertical Take-off and Landing (VTOL) aircrafts transporting people and goods running on DEEP AERO UTM. Decentralized market place for Drone related products and services Flight plans meet all regulatory requirements with AI driven, rules-based airspace intelligence for enterprise friendly drone operations.

What is our verdict?

What we like: Actual product, good vision

What we don’t like: High Cap ICO, Team needs better focus

Website: https://www.deepaero.com/

Whitepaper: https://www.deepaero.com/docs/DEEP-AERO-White-paper.pdf

Technical Analysis Research

Did you feel it? On Sunday the “Death Cross” hit BTC, with the 50 day simple moving average crossing under the 200 day. In the past, all that has created is more high-vol sideways price action. On the 60 minute chart, we’ve seen some fairly large volume spikes, with some hours trading over 12k coins just on Bitfinex. Volume at a low indicates huge disagreement in price and is what we need to see to exhaust the selling. Today’s candle was green with a modest gain across the board but is not the kind of face-ripping action off of the bottom that I’d prefer to see.

My focus in the short term is going to be building a short-term swing trade solution. Unfortunately, too many family obligations this weekend so I made little progress, but I know the basics of what I want to build, after which the intent would be to broadcast any entries/exits into the Telegram group.

I might begin trialing a second bot-trader in the near future; the current vendor that I’m using appears to be working well, it’s just….hard to use and to understand and is not for the faint of heart. If you have trouble navigating our member’s area, you’d find it impossible to use. Eventually I will do a full bake-off between these vendors.

If you missed Wednesday evening’s webinar, “More Profits in 2018; Ten Ways to Chart Like a Pro.” then you can catch the replay here.

My new class “Introduction to Technical Analysis” is now available via our online store.

If you go to buy any of our courses at our online “store” you can receive $10 off the $59 street price with your member’s “coupon code” of member18crypto..

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

I will also be experimenting with the Profit Trailer app which might be useful in this choppy market. I hope to share results and tips/tricks with you in here once I get this bot up and running.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.