Doc's Daily Commentary

Mind Of Mav

The Financial System Changing Before Our Eyes

“Humans used seashells, animal teeth, jewelry, livestock, and iron tools as tokens of barter for tens of thousands of years, but eventually settled on gold and silver in the past few millennia as globally accepted forms of currency.” — Nik Bhatia in “Layered Money”

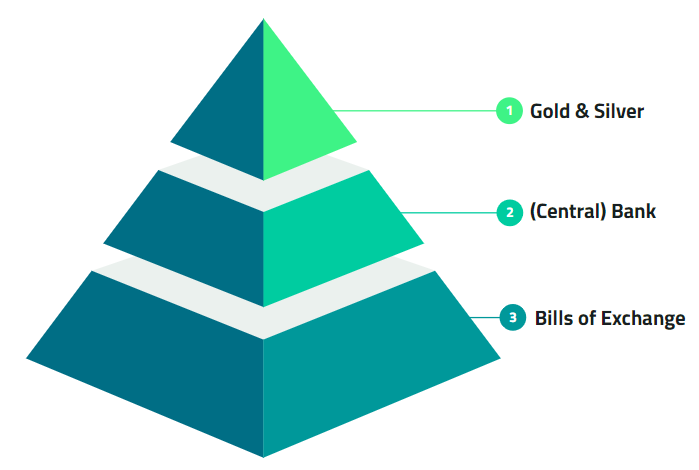

Our current global economy has been backed by gold since the dawn of the ledger based accounting system that would lead to the use of balance sheets and bills that we use today to conduct business. In the old days, humans initially bartered for goods and services. However, this system became impractical and cumbersome. (Imagine having to trade your skills at the grocery store just to get some salt and eggs). As mentioned in my opening quote, humans started to use different tokens like seashells or animal teeth to make trade easier. Eventually, we evolved to using gold & silver to help make trade easier and spurn even more commerce as global trade started to grow.

At some point, paying for things in gold became impractical as well. Gold was cumbersome to use and transport because it was heavy and required a lot of security. (We all have heard of pirate stories looking for gold haven’t we?) Banks (like the Banco dei Medici) sprouted up to further facilities global trade. To make things easier, banks issued bills of exchange that people could use to settle the purchasing of goods and services and they maintained the ledgers and balance sheets. Those bills of exchange came with the promise to convert those bills into gold when redeemed at the bank. (This was actually true in our country-centric Central Bank system until the 1930’s when the British and US dropped the gold standard). The cash or “bills” we used today originated from these ideas of bills of exchange.

Every monetary system has to have a trusted “gold” that can back it. Gold has been valued by humans for as long as we can remember. Why else would the US be trusted as the world’s reserve currency today? The US Central Bank owns by far the most gold reserves of any country (more than 2x the second-place country). You can trust the US Dollar because if it needed to, it could sell its gold to pay off its debts. Gold still retains value even after the governments that own it fail. It has acted as a great store for thousands of years and is an asset that can be passed on from generation to generation, country to country.

Fast forward today and we now have Bitcoin, aka digital gold, looking to completely revamp our current global monetary system. Bitcoin is superior to gold as it is more easily guarded and easier to transport. By the nature of its design, the blockchain that manages Bitcoin’s public ledger can be viewed by anyone, has never had an outage, and is virtually unhackable (until quantum computers become the norm). This type of design helps facilitate the trust needed in order to allow Bitcoin to be the basis of the future global currency market. While the US government is lacking in trust today, it was a very trusted government in its heyday and why it currently is the world’s reserve currency. However, in this day and age, you need an unbiased global currency that is not manipulated or controlled by any central authority. Gold formerly played this role, but now Bitcoin can meet that need much better. Trust takes time to build, and Bitcoin is set up to be the digital asset that is most trusted and can back the future cryptocurrency financial system.

In 2021, Bitcoin has finally reached mass adoption as attitudes towards it have changed as more distrust in the financial system was sown during the Robinhood fiasco this year. Statistics show the majority of millennials and younger generations believe most people will be using Bitcoin in the future. This future is here as we speak. Cities like Miami are exploring paying their employees in Bitcoin. Lots of (smart) financial institutions and companies are buying up Bitcoins to fight inflation (such as Michael Saylor with MicroStrategy) and allowing for transactions in Bitcoin to meet the demands of their consumers (a la Paypal, Square, Visa, Tesla, etc). Multiple Bitcoin ETFs are seeking approval by the SEC and governments and pension funds are even looking to get some Bitcoin too.

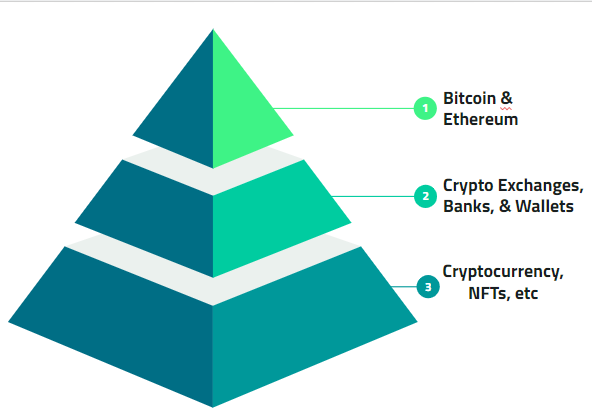

In the current monetary system that is getting built, Bitcoin (and Ethereum) will be at the top of the pyramid in layer 1. The next layer built mostly with Ethereum (and other cryptos) is layer 2 that helps run Crypto Banks (BlockFi, Celsius, etc), Exchanges (Coinbase, Kraken, Paypal, etc), Crypto Wallets (Ledger, Trezor, etc), and Crypto (Payment/Investment) Platforms (HUMBL, Cash App, etc). Layer 3 that is being built now is allowing us to:

* Buy cryptocurrency and digital assets

* Link off-chain data (think Chainlink (LINK)) to help process transactions on-chain (imagine homes being sold and closed via crypto in a week)

* Buy any physical or digital assets via NFTs (non-fungible tokens that can represent anything such as physical/digital art, virtual real estate, and even the NBA digital assets!).

* Provide complete full-scale marketplaces backed by crypto (like HUMBL) to digitize and make processing payments with crypto available for all

* Get paid for watching advertisements when YOU choose to watch them (via the Brave browser and paid in BAT (Basic Attention Tokens).

* Get paid for providing your personal data via the Ocean protocol (think Facebook or google paying you when you choose to let them access your personal data).

The possibilities are endless with crypto and at the end of the day, you will be the one to benefit from it. In this increasingly on-demand digital world, we not only require the ability to resolve transactions instantly but also want more power and control over our own data as well.

If you were like me during the Robinhood fiasco, scrambling to find new brokerages and trying to transfer money, you would’ve found it took several weeks just to setup an account and send funds via ACH transfers to those accounts. In contrast, I tried setting up an account on Coinbase and Kraken this past weekend and was able to get one up and running and funded in under an hour. The account verification process with KYC (know your customer) via your ID took less than 30 minutes and I transferred crypto to these exchanges within 10–15 minutes. Why aren’t ACH payments done in real-time like in cryptocurrency? The velocity of money has screeched to a halt during the COVID-19 pandemic and crypto could solve that problem instantly and save the world’s economy while it’s at it.

If money equals power, then those who have access to money or have the most wealth have the most power. Wealth typically encompasses assets that can be easily passed on generationally and have store of value properties such as real estate, businesses, stocks, and gold/silver. These assets are usually limited to people who already have wealth. For example, have you ever tried buying gold or silver? In California, you pay sales tax on gold or silver if you buy $1500 or less in a single transaction but if you buy more than that, you don’t have to pay taxes on it?!?! If you don’t have 20% down on a home you have to pay insurance against yourself (aka PMI) to purchase your home. In the old days, it was a $200 fee just to buy a stock! To buy Pre-IPO stocks on EquityZen, you have to make at least $200k annually or have $1 million liquid cash. To start a business, you need a lot of capital and the ability to get a loan. How can you if banks have a history of discrimination since the 1930s that continues today? The barriers to entry for these wealth-building and life-changing assets are huge and hard to take down.

However, none of this applies to the new asset class — Bitcoin and cryptocurrency. Anyone can buy as little they want and there are no exorbitant fees like those for gold or loans. With crypto banks like BlockFi, you can get a loan without providing a credit score, as long as you can put up some crypto to back the loan. Inherently these cryptocurrencies are open and available to all by design (unlike the banks in 2008 who got a bailout but did not loan out any of that money). Crypto is the wave of the future and much like the Internet during the dot-com era that helped spread and democratize information, crypto will do the same for the financial world. Those who are involved with crypto can see its potential much like the programmers and creators of the Internet did when they first designed it. Web 3.0 is upon us and we should all try to understand it so we can empower ourselves with it.

The big banks like JP Morgan are noticing the crypto movement and releasing their own blockchains like JPM Coin. The Federal Reserve is working with MIT to make a digital US dollar on their own blockchain. Our financial system is going through major changes today that will change our world forever. Blockchain is bringing power back to the people by making financial assets and loans more accessible to everyone. Crypto is allowing us to benefit more from our own digital assets and data by earning better interest rates and money from our data. It is eliminating the middle man (aka traditional banks) and replacing it with unbiased smart contracts and transactions.

Companies like Celsius pay 80% of their profit back to their customers in interest. Individuals and new companies via ICOs and NFTs can directly raise money and sell to customers any product you can think up without having to go through the IPO and loan hoops. The crypto train is moving and over time, everyone will get on it since it’s designed to benefit its users. Something has to back this new financial system and Bitcoin will likely play that role now as gold had done before. Bitcoin is not only a store of value and a wealth-building asset but a world and life-changing asset too. (Just ask Didi). Our financial system is changing before our eyes and now you know it. What will you do about that?

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.