Doc's Daily Commentary

Mind Of Mav

How To Build Crypto Wealth (& Not Get Rekt)

Disclaimer: None of the opinions in this article should be considered financial advice as I’m not your financial advisor.

As the cryptocurrency market capitalization blasts past $ 2 Trillion in April 2021, it’s safe to say that mainstream adoption is slowly but surely being realized.

Over the past few months, several big institutional names have either bought or indicated a strong interest in cryptocurrencies to add to their balance sheets.

As institutional adoption continues to rise, retail investors will also flock to the ecosystem. As a result, there will be a large number of people who are completely new to cryptocurrencies or even investing in general.

As we know, cryptocurrencies have massive volatility. Combine that with new retail money and that’s a recipe for investor wealth erosion.

In this article, I will try to introduce some techniques, tips, and tricks to follow when investing in cryptocurrencies so that manage your risk effectively and avoid losing your money.

For the sake of simplicity, I will be using Bitcoin as the asset of choice in my article but the lessons in this article apply to pretty much any other cryptocurrency out there.

Buy when there is blood on the streets

“Bull markets make you money, bear markets make you rich.” — Unknown

Often, amateur investors FOMO into investing in crypto when prices are near a local top. What follows is a bloodbath where prices pull back by 30–40% and investors are left crying and take out their money in fear.

The above illustration is a nice indicator of the best times to buy Bitcoin in the past. The green patches between 2014 to 2016 and 2018 to 2020 indicate the bottom of the respective bear markets and hence, the best time to get into Bitcoin.

To put it in perspective a $1000 investment in Bitcoin on 15th March 2019 (BTC Price ~ $3091) would be worth approximately $19404 as of 11th April 2021. Portfolio net worth would be 2000% in less than 2 years! ?

This is simply due to the fact that on 15th March 2019 nothing interesting was happening in the crypto space. The fear regarding cryptocurrencies had returned during this time following the run-up in 2018. Hence, prices were at huge discounts.

Conversely, let’s say you FOMO into Bitcoin during the bull mania phase and bought $1000 worth of it on 8th January 2021 (BTC Price ~ $40667). What would follow is almost a 25% drop in BTC price to ~ $30818 and your $1000 investment would have dropped to ~ $757.

Thus, it is extremely important to know approximately when to enter the market. When there is fear, prices are low and thus, assets are cheap to buy.

Don’t FOMO into the top.

HODL and BTFD

I know what some of you are thinking. Why am I suggesting waiting for bear markets in order to buy crypto? Why am I not telling you how to buy during a bull run since we are in one right now?

Don’t worry. This is exactly what I plan to cover in this section.

Do you notice something similar with both of these graphs apart from the monstrous rise in price?

If you look closely, you can see that during both runs, there were multiple parabolic rises followed by dips of 20–40% in price action.

If you are like most people, you did not buy much crypto during the bear markets and want to get in now during the mania. These dips that you see are the best times to get into the market if you don’t have any crypto or have too little.

Why?

Because during these dips, prices cool off, profit-taking occurs, investors with “weak hands” (who trade with emotions) sell their holdings and the price action undergoes a reset to prepare for the next leg up.

HODL is a term derived from a misspelling of “hold” that refers to buy-and-hold strategies in the context of bitcoin and other cryptocurrencies. — Investopedia

But what if you’ve bought when prices are low and you see the price has had a parabolic rise? Should you sell all of your holdings in order to buy the dip?

Well, it depends.

If you are completely invested in crypto and have no liquid cash or stable coins available, then you might want to take only some profit out of your crypto holdings and not all of it.

This will ensure that if prices were to drop, you would be prepared to buy at lower prices because you took profits beforehand.

BTFD or “By the freakin dips” means purchasing an asset after it has dropped in price. The belief here is that the new lower price represents a bargain as the “dip” is only a short-term blip and the asset, with time, is likely to bounce back and increase in value. — Investopedia

Conversely, if prices do not drop and continue upwards, you will still have some amount of money invested and thus, will be able to leverage the trend continuation of the rise in prices.

DCA To Enter The Market

A trend that I have noticed among amateur crypto investors is that when they want to enter the crypto market, they pile in the money and buy all of their desired cryptocurrencies in one big swoop. This type of investing strategy is also called lump-sum investment.

I’m not a fan of this style of investments simply because I believe that there is no exact way to time a market entry. When you invest a lump sum you’re indirectly betting on the fact that the current prices are the best time to enter the market which simply might not be true.

The probability of being able to time the market is so little that it’s often better to spread out your investments over a period of time. This style of investment is called DCA or Dollar Cost Averaging. Another term that is synonymous with DCA is SIP or Systematic Investment Plan.

When you DCA, you effectively invest a fixed sum of money over fixed intervals of time.

For example, let’s say that you want to invest $1000 worth of money into Bitcoin over a month. What you could do is pick a day of the week where you would invest $250 dollars for 4 weeks (approximately a month) until you’ve invested $1000.

This way, you nullify the volatility in price during the course of the month. On the chosen day of the week, if Bitcoin prices are low, then you’re able to purchase more Bitcoin for $250. Conversely, if Bitcoin prices are high then you would purchase fewer Bitcoin.

All in all, DCA reduces the impact of volatility and thereby, reduces the risk you take on when entering the market.

DVA For Buying Dips

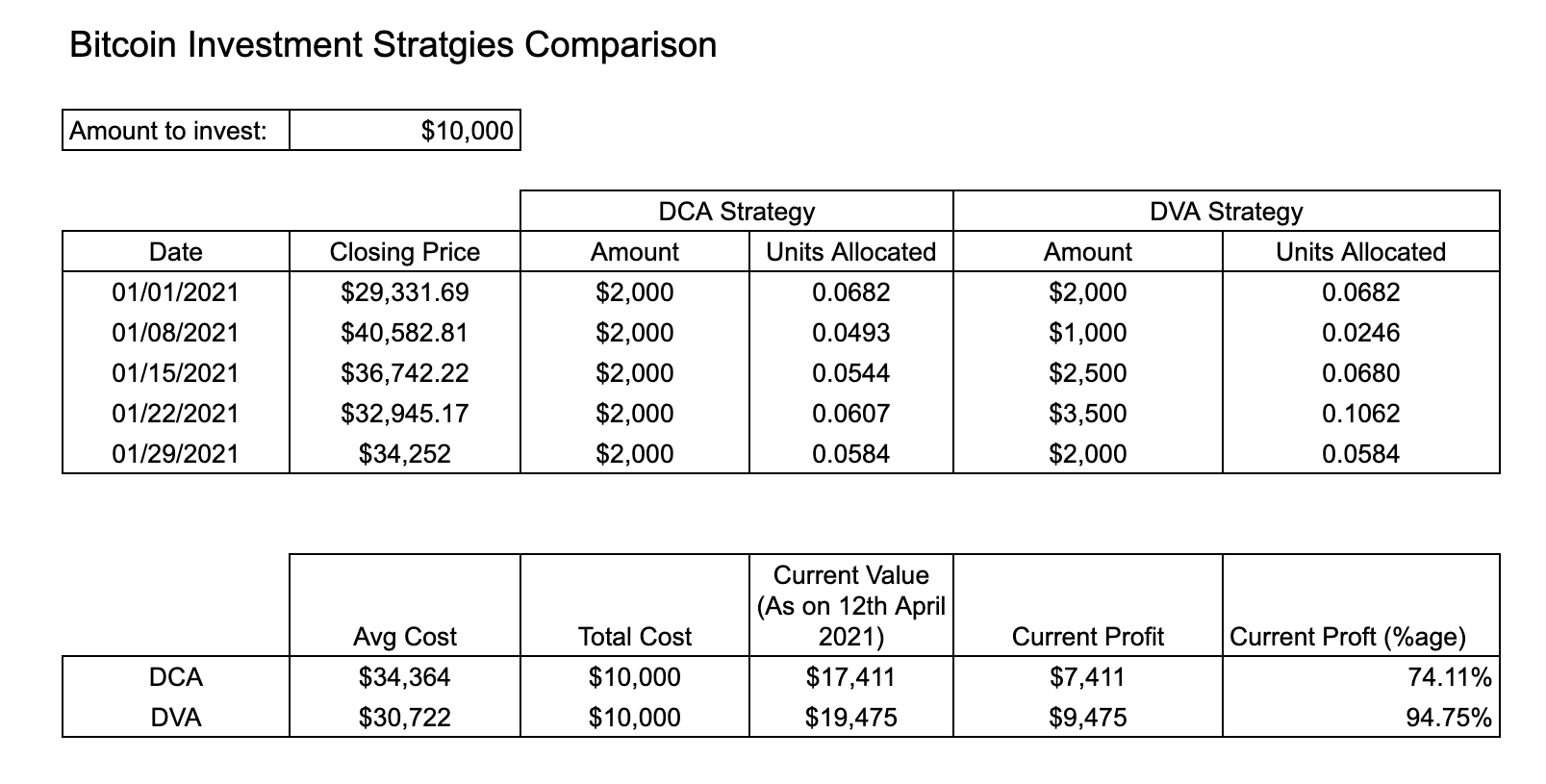

Like Dollar Cost Averaging, Dollar Value Averaging or DVA is an investment strategy that draws from the principles of DCA but ensures that you buy much more units when the prices are down and far fewer units when the prices are up.

This investment strategy is slightly different from DCA because, in the case of DCA, the amount of money you allocate to crypto assets is the same.

The table above shows us the difference between employing a DCA vs a DVA strategy. As you can see, when the Bitcoin price dropped on Jan 15th and Jan 22nd, more money was invested and as a result, more units were allocated.

Furthermore, the aggressive purchase of Bitcoin during the dip ensured that the average cost price of Bitcoin for the DVA strategy was lower than that of the DCA strategy resulting in larger profits in the future.

I usually employ a DVA strategy whenever I buy dips.

Why?

Because just like the notion we established earlier that it’s virtually impossible to exactly know when to enter a market, it’s also virtually impossible to know exactly when the bottom of a dip is formed.

Thus, by employing a DVA strategy during a dip, you ensure that even though you’re buying the dip, your money is spread out strategically so that the most amount of money is invested when prices are near the bottom of the dip.

How To Know When The Market Will Crash?

This will be a relatively short section because just like everything else we have discussed so far, it’s nearly impossible to predict a market cycle top.

However, there are a number of great resources in the form of websites, YouTubers, technical analysis charts, and social media groups that you can follow for getting a decent idea as to where the market cycle top might be. I’ll provide links at the end of this article to the resources mentioned above. ?

I will not delve into any form of fundamental or technical analysis in this article to discuss price movements.

However, in the next section, I will provide a strategy to exit the market.

Hint: We’ve already spoken about this strategy before!

DCA To Exit The Market

You knew this was coming didn’t you? ?

Just like we have spoken about using DCA to enter the market, we can also employ it to exit the market.

As mentioned in the previous section it’s not possible to exactly predict where the market cycle top is. Therefore, if you feel things are getting too heated and prices are for a huge drop, then DCA your way to exit the market.

For example, let’s say by using the resources I’ve mentioned in the previous section you hypothesize that the market is ready to enter the bear market in the next month. You decide that you’re 80% sure that this hypothesis of yours will be true.

What should you do?

It’s simple really. You look at the total value of your portfolio.

You then proceed to calculate the value of 80% of your portfolio.

You then decide that every week you will remove 25% of 80% of your portfolio for 4 weeks (approximately a month).

Thus, by next month you will have approximately 80% of your total portfolio in cash and/or stable coins and only 20% of your total holdings in crypto.

Why keep the 20%?

Notice that we assumed that there is an 80% chance that the market will crash. This means that although there is a strong chance of a crash, there is still a 20% chance that the market continues going up.

Thus, having 20% of your portfolio in the market ensures that you do not miss out on potential profits.

Even if the market dips by let’s say 50% before you decide to remove the remaining 20%, your total loss will only be 10% of your portfolio.

The amount that you decide to keep in your portfolio in this scenario will depend on your risk tolerance. If you are a risk-taker, you’ll probably keep a higher percentage of your portfolio invested and vice-versa if you’re risk-averse.

Congratulations! You are now a crypto millionaire!

Well, not really. The truth is it takes a lot of discipline to be able to enter and exit the market at the correct times. Your emotions often get the best of you when there is euphoria or fear.

However, the strategies and tips mentioned in this article should help lower your risk and maximize your risk-adjusted return in the crypto market.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.