Doc's Daily Commentary

Mind Of Mav

Don’t Fall For The Hype & Fear Cycle

BUY NOW!! Deals like this have never been seen before, and never will again! Double your money tomorrow! Don’t miss out on the greatest investment opportunity of all time. You’ll regret it!

Am I a used car salesman, carnival barker, or crypto pumper? Impossible to tell the difference, it seems. Investing has become a dangerously hype-based gambit recently for many, driven in large part by investors who fear that they’ll “miss out” on “once-in-a-lifetime” opportunities during a volatile market. The plethora of articles and coverage on supposedly self-made overnight millionaires have convinced many investors that they can join their ranks if they just follow along.

This has been disastrous for many. Worst of all, the investors who fall for these gimmicks are often newer to the market and lack the hardened shell that those who’ve been through a few ups and downs possess. Often, they’re investing money that they can’t afford to lose. They learn the hard way that hype doesn’t equal success. Many are probably turned off from investing entirely after taking a loss, which is almost as harmful as the loss itself.

Unfortunately, the only way to combat excessive hype is with cold, clinical reality. Luckily for us, the online personality test I took in fifteen minutes says that I’m the ultimate realist, so I’ve appointed myself to look through the hype and get back to rational investing.

Always do your research

Anyone can cherry-pick statistics. In fact, there’s an entire book on how to do it effectively, aptly titled How To Lie With Statistics. Those who shamelessly pump volatile assets are very adept at this particular skill. The more volatile the asset, the more likely it will have time periods where you can illustrate a large or exponential gain. Trying to time a risky asset within a day or two of peaks and valleys is a fools’ errand, though, so their statistics are worthless.

Crypto has the advantage of having a meteoric run in the early stages of the pandemic, which allows for many “if you had just invested X back in Y year, you’d be a millionaire!” stories. That’s all well and good, but it goes for just about anything successful. If you’d invested in any technology company in the 1980s, or oil a year ago, or anything that’s ever had a run, the same applies.

The past is the past. Investors don’t have time machines. Rather than rue a missed opportunity and chase after risk, stop and give an honest assessment of what a particular asset has done lately. Investing, in general, tends to be beneficial versus doing nothing with your money, so even when a heavily hyped asset does have gains, it doesn’t mean they’re any better than the market as a whole.

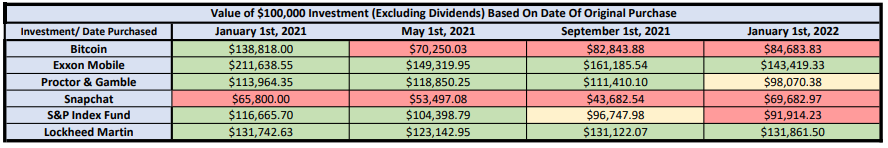

In the interest of playing this game a little more fairly, I decided to pick several investments at random and compare them over various, evenly distributed time periods. To be clear, I am not endorsing any one of these or recommending you do anything other than research any investment before you buy. Further, past performance is no indicator of future performance. I just thought it was worth illustrating our most-discussed investment versus some undiscussed investments.

Depending on your date of purchase, you might have different results in the same investment. As the market is constantly in motion, that makes sense. Crypto, which tends to the NASDAQ more closely than its proponents care to admit, hasn’t done well of late. Based on the articles you see daily, that may be surprising to some.

It’s important to note here as well that volatile assets are…well, volatile. The dot-com bubble resulted in a lot of heavily hyped companies that never recovered. Index funds and the market at large have proven resilient and steady over time. Newcomers don’t come with the same guarantees.

If you’ve looked into the investment yourself and determined you believe in it and can afford the risk, by all means, invest. Risk is an inherent part of any investment, and each individual will have different tolerances for what they can and cannot stand. Just make sure you’re actually verifying the information yourself, and not relying on news articles and social media posts that may not have your best interests in mind.

Invest what you can afford

This seems like common sense, I know, but it’s still worth repeating. Retirement “specialists” and others giving advice will often tell people they’re behind on their savings. Intentionally or not, this can spur some to start investing more aggressively or using money they really can’t afford to part with at the moment. Both can have terrible consequences.

Pressure to keep up with unrealistic savings goals or join in on the latest trend can lead some investors to over-save or use funds they need for other items in their investing. This can result in having issues with day-to-day financial items like bills and credit. If you end up damaging your credit score or acquiring late fees or run into other issues because you’re using that money elsewhere, you’re over-saving or over-investing.

This is doubly true when you’re looking into riskier investments. Investors should ignore feelings that they “have” to invest in something or “need” to buy a risky asset. They should instead only proceed if the underlying purchase makes sense to them and there’s a logical argument for why it will pay off in the long run. Naturally, for riskier investments, only put in the money you are absolutely OK with losing.

An investor in something relatively stable like a blue-chip company or index fund can feel relatively confident that the majority of what they invest on Monday will still be there on Friday, plus or minus a few dollars. The same cannot be said for crypto, options, or leveraged purchases. Losing 20% of your investment (or more) in a given week is certainly on the table with these types of purchases, so plan accordingly.

Unfortunately, the very people who should not be in these investments are the same people suckered in by the hype. Those with difficulty saving and little investing money (either due to a low salary or just poor spending habits) try to “catch up” by chasing 2000% gains that others had several years ago. This is the exact group that cannot afford to have their entire safety net vanish in a period of weeks, but they put it all at risk following advice from writers who are (at best) ambivalent about their readers.

There’s a bit of a gambler’s fallacy at work here, too. If something had a 2000% run, that doesn’t necessarily mean it’s due for another one after some time has elapsed. The odds of another 2000% run are the same as the odds the first time around — minuscule. If you hit a $25,000 jackpot on a $1 slot machine, don’t return to the machine expecting it to happen twice.

Ultimately, investing is a long game that rewards the rational over time. This is boring, I know. But the cold reality is the best way to approach your long-term savings and financial growth goals. Pie-in-the-sky, “I can be a millionaire next Tuesday” thinking, on the other hand, is a good way to go bust. Invest only what you can afford to, and research anything you buy with the most studiousness that you can muster.

Conclusions

There’s an old piece of poker advice I’ve found to be mostly true: “If the table is tight, play loose. If the table is loose, play tight.” In other words, you’ll find more opportunities against the grain, where no one is looking. This is a useful reminder in a market that seems to be driven by hype and pump-and-dump schemes far more than it is rationality.

It can take a lot of mental effort to block out the noise and just do what’s best for you, individually. The effort is well spent, in the long run. Note that I haven’t recommended any particular investments in this newsletter — there’s a reason for that. Investing is much more personal than many make it out to be. A little self-education and research will tell you what investments work best for your needs.

Don’t let anyone else tell you otherwise. Maybe you do have a higher risk tolerance and can afford to float some of the more volatile bets — that’s fine, as long as you’re financially sound enough and mentally comfortable enough to do it. Others may realize they’re not suited for that kind of thing after taking an honest internal inventory. Either way, ignore the hype. Much of it is designed to enrich the author, not their followers.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.