Crypto Market Commentary

21 April 2020

Doc's Daily Commentary

The 15 April ReadySetLive session with Doc and Mav is listed below.

Mind Of Mav

The 3 D’s That Mark An End Of Globalization

With the start of the U.S.-China trade war, the world has started down the path of 3 “D”s: Deglobalization, Decentralization, and Decoupling.

This is no overnight process, but a certain global outbreak has moved the timetable in yet-to-be-determined ways.

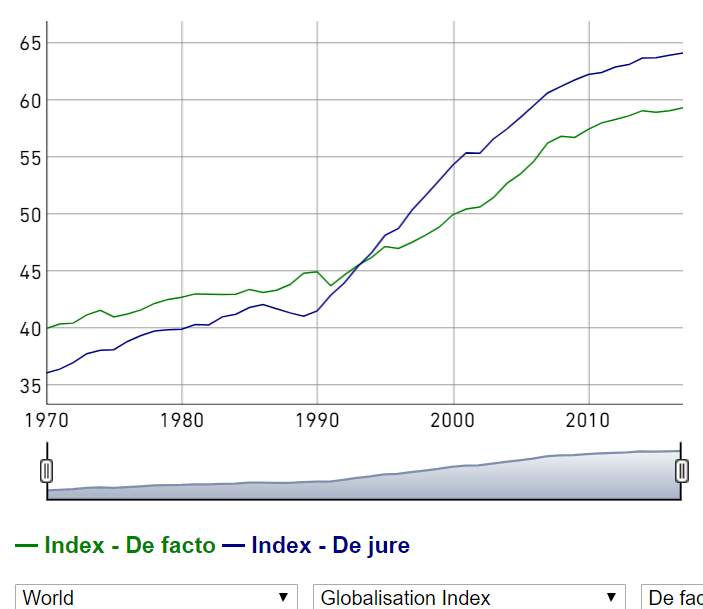

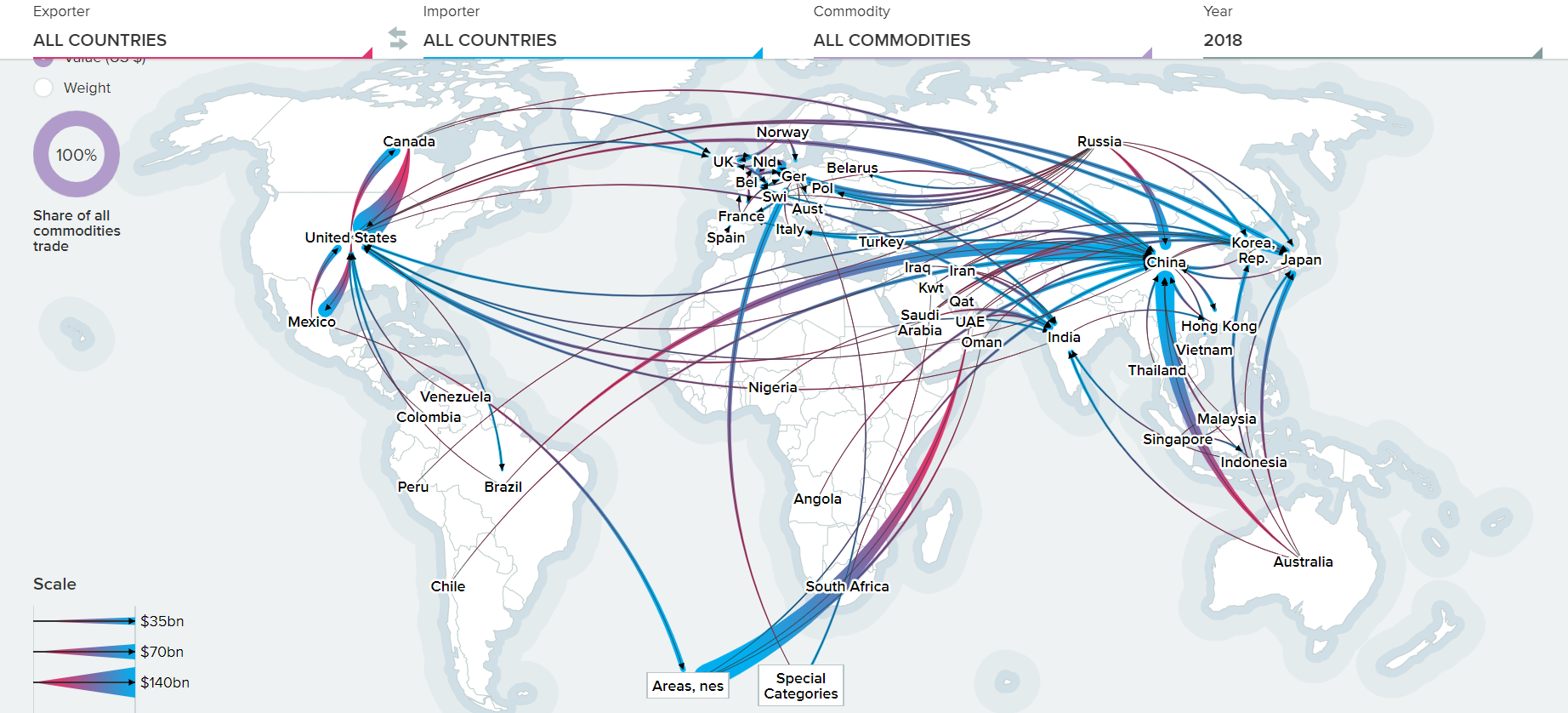

With China’s entry into the WTO in 2000, the speed of globalization has been unprecedented and trade has been highly concentrated in several economies. The cabal of rich countries over poor countries slowly but surely consolidated, and an unprecedented world trading monopoly emerged. Such trade coupling is highly dependent on mutual capital flow, human flow, information and technology flow, as well as goods and services flow. The figure below shows the globalization index for the past 50 years, and notably it had doubled during that period — the modern economic production and supply chain miracle!

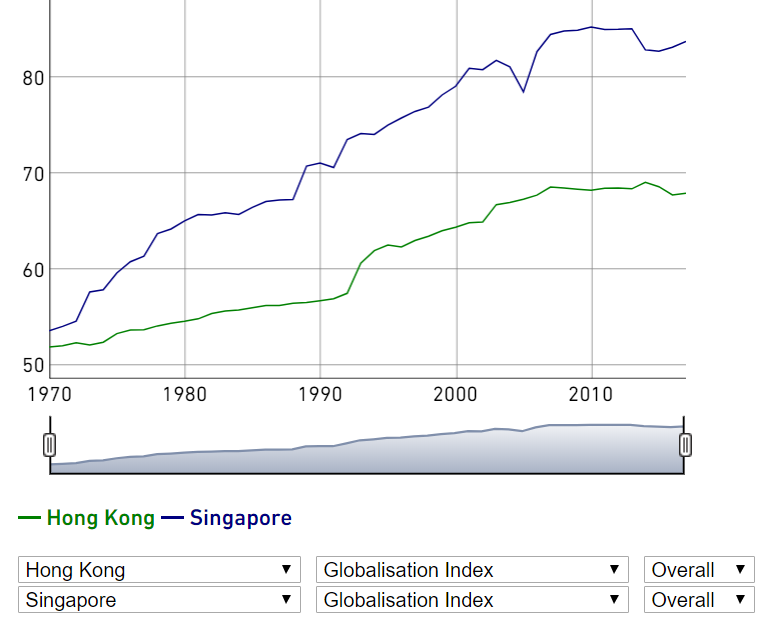

We can also see the effects by focusing on a few countries that serve as focal points for the forces of globalization.

Namely, we can observer Singapore and Hong Kong as highly internationalized economies. During this 50 year period, Singapore’s globalization index rose higher than the global average, and it also rose faster than Hong Kong. Therefore, it achieved higher economic growth from globalization. Hong Kong has always participated in global matters in the capacity of an international city, but in recent years it has seen intrinsic and extrinsic setbacks and regionalized, which can be reflected with a drop in the globalization index.

Before the pandemic, globalization brought a long period of economic growth to the world. We know through research that globalization brings economic growth to middle and high-income economies — but it also brings new risks and injustices to the world, including the risk of over-concentration, which has been exposed in the current efforts in fighting against the pandemic.

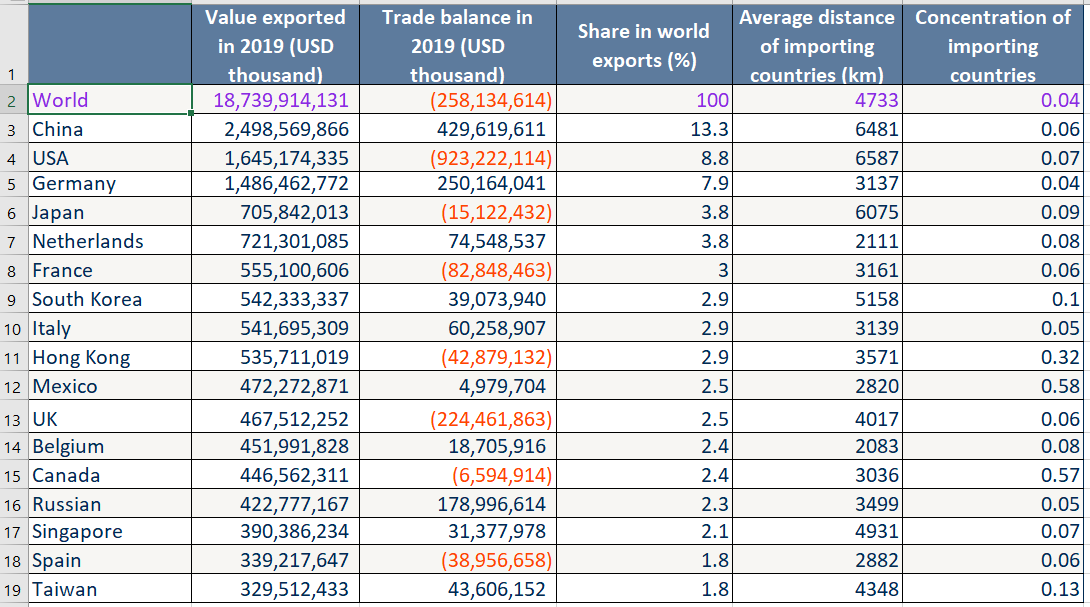

The top four economies of the world are China, the United States, Germany, and Japan. The sum of those alone account for 1/3 of the global exports, with their export values valued at US$ 2,498.6 billion, 1,645.2 billion, 1,486.5 billion and 705.8 billion, respectively.

While impressive, it also shows us that a high concentration of world trade is centered on a few economies. Hong Kong and Singapore, by comparison, ranked the 10th and 16th, with exports of US$ 535.7 billion and 390.4 billion in 2019. Singapore and Hong Kong also rank among the world ’s 2nd and the 3rd highest export-to-GDP ratio economies in 2017 (188%, 173%, see Wikipedia Trade-to-GDP Ratio List). They reflect a high dependence on the globalized economy, and will face a more difficult economic transformation with a slowdown in globalization.

As the pandemic has spread, it has caused many countries to restrict the inflow of visitors. The tourist industry has been frozen, the logistics and information flows have begun to change, many countries start restricting the export of certain types of products. Although these measures may only be short-term, the over-reliance on the globalization has been exposed by this pandemic, and it has shown how a fragile global supply chain poses a huge risk to the pandemic-prevention tasks, such as the production and distribution of medical products and food.

We’ve seen countries like the United States and Japan provide national finance to assist their manufacturers in an effort to move certain production bases back to their home countries, or at least to ensure more than one supply base in the procurement policies.

We can see the pieces coming together. Further automation in the face of biological threat, further disruption of the globalized supply chain with a consumption halt, and a further reliance on domestic manufacturing does long-term damage to the goals of globalization — the first wave of a decentralization and deglobalization trend.

It seems that the world is moving towards a new Cold War, with the lines being drawn in relation to China. This is the essence of the decoupling process, and signals the rise of China as a power broker for its region.

Ultimately this signals the end of 30-year trends in globalization and the reversal of established coupling relationships.

By the basic tenants of what we can conclude through conjecture, this becomes increasingly likely and will inevitably reshuffle the world economy. Essentially, China has been waiting for an opportunity like this with aims to challenge the USD Reserve Currency status, and to move away from its position of the world’s factory.

They’d rather see the wealth that is generated from the IP and sale of products, rather then the manufacturing revenue which is inevitably less. This is observable in the “smile curve”, where manufacturing creates the least amount of value.

With the global economy and world order going through massive changes, we’d do well to see these macro developments and plan for their upcoming roll in an unfamiliar world.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)