Doc's Daily Commentary

Mind Of Mav

NFT Flash Loans: The Next Big Thing?

With economic uncertainty being at an almost all-time high and an increasing number of people looking to make money online, it would only make sense that the tails of investors making millions from reselling online art would attract an audience. We have all heard it — from twitter CEO Jack Dorsey selling his first tweet for $2.5 million to a picture of the famous “Nyan Cat” meme being sold for $590,000 — the tails of NFT transactions are undeniably breathtaking.

Although the stories differ in the goods and prices involved, they all share one common characteristic — the ones making money out of NFTs are either selling them or planning to sell them in the future, hoping to profit from a potential price appreciation.

This traditional strategy has undeniably yielded amazing results for a number of investors, but it does not seize to remain primitive in nature and often expensive with the NFT space having become relatively saturated.

With many people not having the required capital and risk-tolerance to invest in NFT collectibles or paintings, this article will provide you with all the basics, as well as the operational pipeline to profit from NFT Flash Loans.

The Basics

Yesterday we discussed the concept of DeFi Flash Loans as well as an A-Z walkthrough on how you can deploy a Flash Swap using UniSwap v2.

Recently though, a team called Very Nifty deployed the first ever NFT Flash Loan showing how this revolutionary new strategy can yield amazing returns. As such, I will walk you through the strategy they implemented and explain the technical details that made such a seemingly impossible feat possible.

The NFT20 Protocol

Many of you may familiar with the concept of NFTs, ERC721 tokens that when minted certify that a digital asset is unique and not interchangeable.

Conceptually, taking an NFT Flash Loan does not make any sense, not before NFT20 is defined. In simple terms, this new protocol allows an ERC721 NFT token to be split into multiple ERC20 tokens, effectively enabling the fractional ownership of Non Fungible Tokens.

Hashmasks

Having understood the capabilities the NFT20 protocol provides us, it is important to analyze one of the most popular NFT collections in the world — Hashmasks.

According to the website,

“Hashmasks is a living digital art collectible created by over 70 artists globally. It is a collection of 16,384 unique digital portraits… By holding the artwork, you accumulate the NCT token on a daily basis, which allows you to choose a name for your portrait on the Ethereum blockchain.”

NCT Tokens

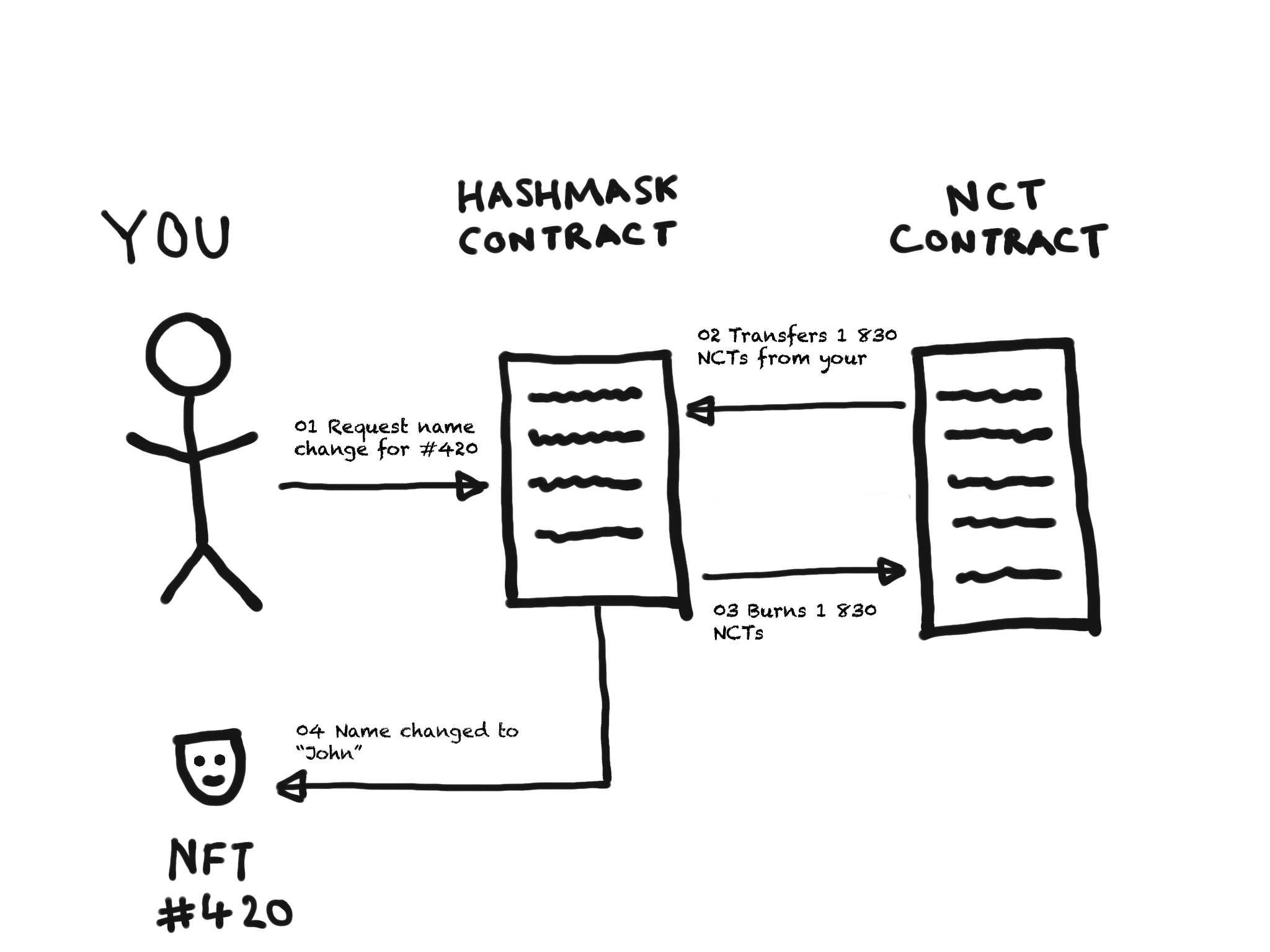

The reason Hashmasks are so important is the NCT (Name Chanking Token) — the native token of the Haskmasks artwork. Once again I am going to quote the official Hashmasks website, with the NCT

allowing its holder to give their Hashmask a unique name that is permanently stored and publicly visible on the Ethereum Blockchain. Thus, commoditizing the name itself and making it the rarest of all attributes within the entire project.

“But why is this important?”, you may ask. The answer lies in the core attribute of these tokens — if you own a Hashmask, you can claim the NCTs that are accumulated by the NFT with each NFT accumulating around 3,660 NCTs per year.

The Strategy

So now you know the basics of the NFT20 protocol and the NCT tokens. The question is how can we leverage this knowledge and profit using Flash Loans.

With these core principles in mind, you can employ the following basic strategy:

1.Borrow a set of Hashmasks from the NFT20pool.

2.Claim the accumulated NCT tokens accumulated while sitting in the pool

3.Sell those NCT tokens for ETH

4.Give back the Hashmasks to the pool.

Sounds simple does it not? The truth is, that it is not only simple but also really profitable as shown by the VeryNifty team.

After reading this article you are now ready to recreate the strategy yourself, becoming an early adopter of this revolutionary new technology. It remains to be seen if this is the “next big thing” or just another fad, but it is inevitable that the combination of DeFi and NFTs will led to some profitable and exciting possibilities.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.