Doc's Daily Commentary

Mind Of Mav

Hello From Bitcoin 2022 In Miami – The Layer 1 War

Hello from Miami!

In the next five to 10 years I think we will see Ethereum’s utility trends more in the direction of store of value, rather than just an L1.

From my perspective I am seeing the ETH community repeat this protocol maximalizm, the same that Bitcoin maximalists did to the ETH community. The Bitcoin Maxi’s immediately discredited Ethereum. Bitcoin was the clear dominant crypto they said. Look what happened.

The ETH community is repeating that same ingroup bias, except it is directed towards any L1. Before alt L1 narrative started to take off, Ethereum was the clear number one. Innovation happened on Ethereum. The best builders built on Ethereum. If you wanted to be a pioneer of the new internet it happened on Ethereum.

The narrative that “Innovation only exists on Ethereum” is just untrue these days. I think it’s fair to argue that there is more innovation on alt L1’s, then Ethereum.

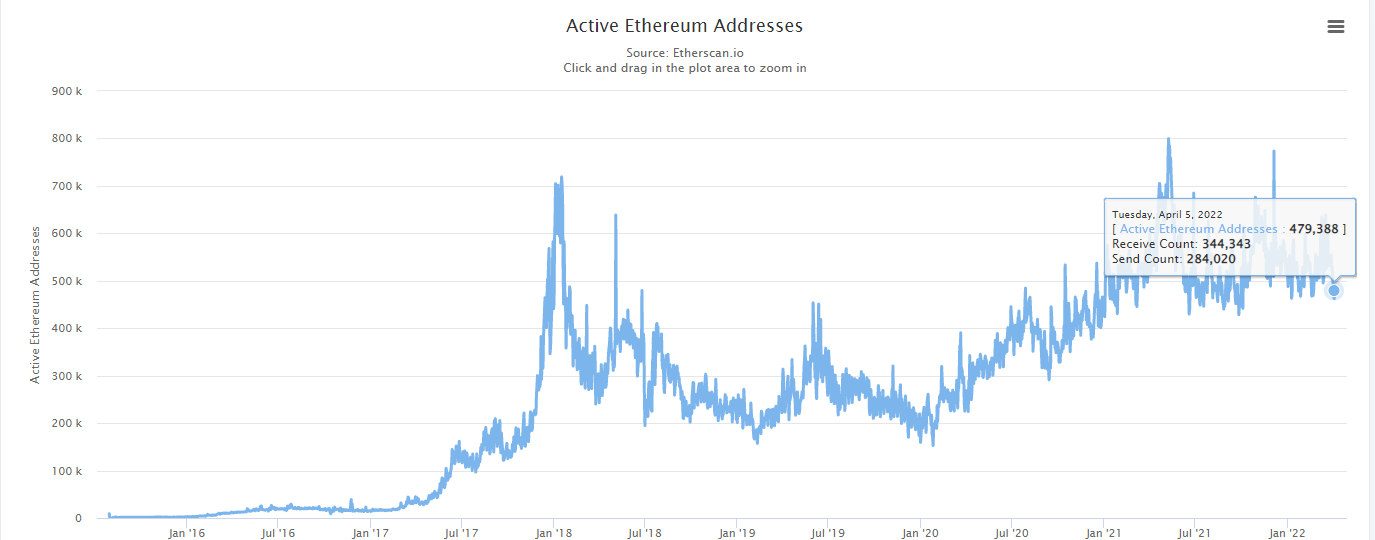

New Users aren’t Choosing Ethereum

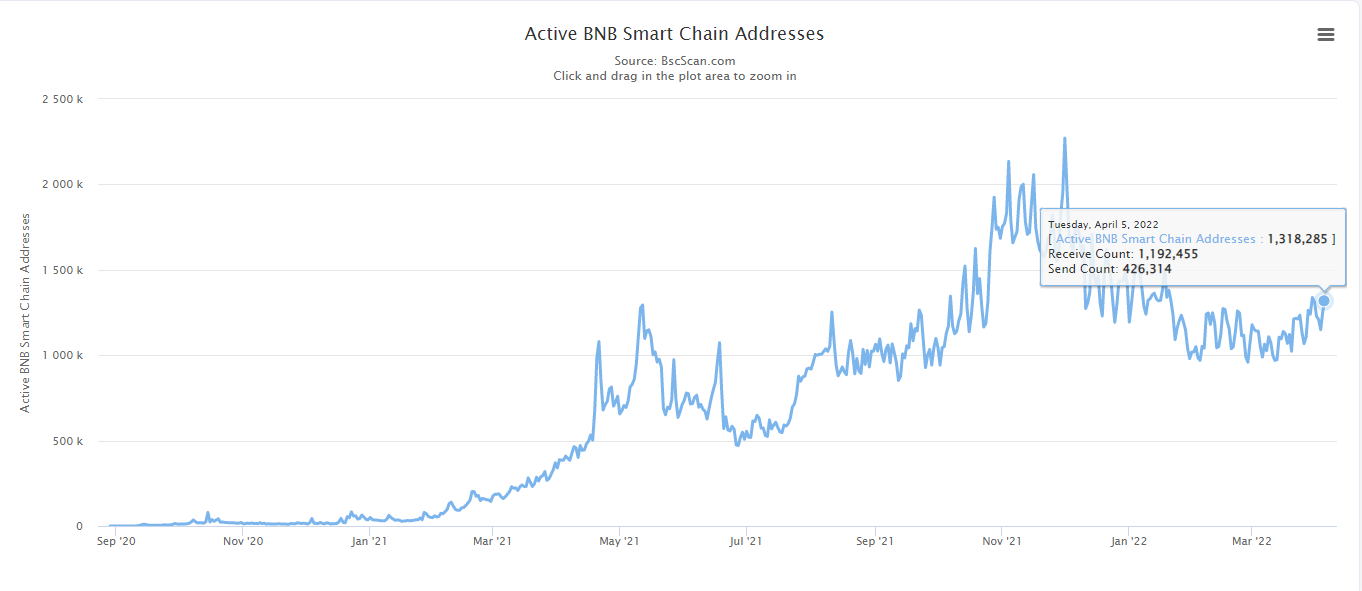

Ethereum is losing the war of adding new crypto users. Just because you dominated the past doesn’t mean you own the future. Innovation always wins. New users are choosing alt L1’s like the Binance Smart Chain, Luna, Avalanche, Solana, Fantom, etc. Why is that? High barriers to entry and low Dapp innovation.

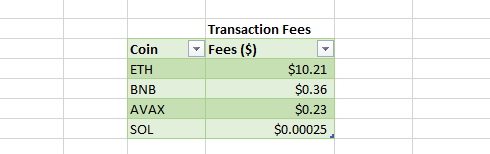

Let’s take the perspective of a new crypto user who has $1000. If they are looking to participate in an ecosystem, which one will they choose? The smaller market cap blockchain with faster transactions and cheaper fees? Or are they going to choose the OG blockchain with expensive fees and slow transactions? Lets look at the average transactions fees per blockchain:

That new user with $1000 isn’t going to be using Ethereum. Besides the transaction fees, a common narrative in crypto is “be early”. In the eyes of the new user, Ethereum has already made significant gains. They want that too. They are attracted to the smaller, cheaper, more innovative blockchains.

Human tendency tends to go one of two directions: forwards or backwards. Backwards thinking tends to choose the “old” way because it is proven, safe or because “everyone already uses it”. Forward thinking tends to choose the innovative, unknown future that is perceived riskier than the old way. The forward thinkers, the innovators, the risk takers are rewarded.

Developers Follow the Users

In late 2019–2020, Ethereum was the hub for Dapp innovation. If you weren’t building on Ethereum you weren’t going to make it. All Dapp innovation took place on Ethereum. All of the best builders built on Ethereum. Most importantly, all the users flocked to Ethereum. In 2021 we saw a trend shift.

2021 was the year of SolLunVax, aka layer 1 season. These coins pumped astronomically, bringing in tremendous gains for these users. At this time Ethereum is extremely congested. Average transaction prices are around $40-$80. For the small, new user this was not sustainable. They started flocking to alt L1’s. Developers need users to use their product. They left too.

Hungry developers flocked to other chains with something to prove. All they need are users to use their product. For the first time ever, innovation is happening on alternative L1’s rather than Ethereum.

Luna is rewriting the playbooks to DeFi. The BSC is dominating the gaming sector. Avalanche and Solana are doing their thing too.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.