Premium Daily Crypto Newsletter

August 9, 2018Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

Mav's Daily Commentary

Markets Find Their Footing

Any Port In The Storm

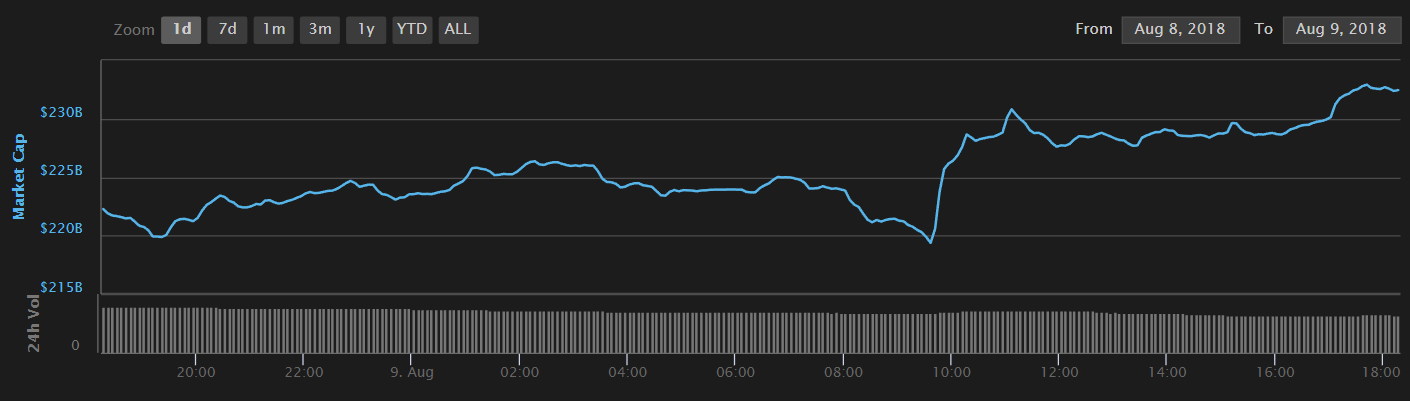

Today the market took a step back from the ledge and recovered 10 Billion.

Despite this, we’re still down 30 Billion for the week.

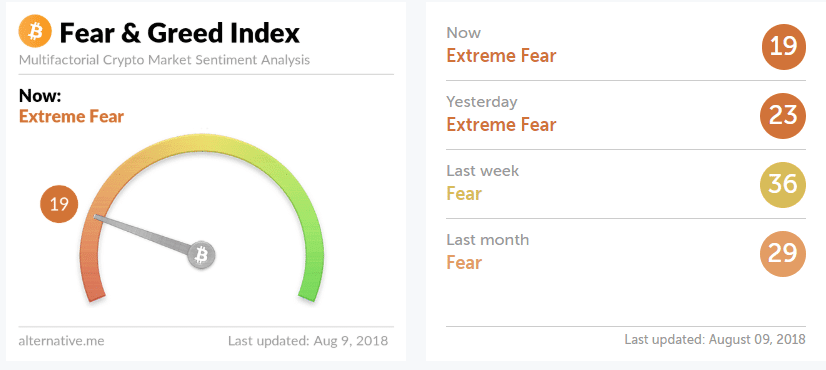

Pantera Capital CEO Dan Morehead today said that crypto markets have recently witnessed something of an overreaction from investors in response to short-term news, such as the SEC’s Bitcoin ETF delay.

Pantera Capital CEO Dan Morehead today said that crypto markets have recently witnessed something of an overreaction from investors in response to short-term news, such as the SEC’s Bitcoin ETF delay.

As we talked about yesterday, we expect more volatility in the later part of August and certainly in September following more news about ETF delays and denials.

In response to further exchanges listing ETC and Bittrex adding USD/ETC and USD/XRP pairs, we’ll be rebalancing our new portfolio in anticipation of some more positive movement.

In an announcement, Bittrex stated:

“We will continue to use a phased approach for USD trading. We are taking our time and ramping up these markets, processes and systems through a measured approach before we open it up to all qualified customers. But, the good news is that you didn’t have to wait a long time for more opportunities. As of August 20, participants will have access to USD markets for BTC, ETH, USDT, TUSD, ETC and XRP.”

They added:

“Today’s announcement is another exciting step toward further adoption of blockchain technology, which is truly revolutionary. In addition to broader acceptance, expanding fiat markets to the top digital currencies on our trading platform will help limit the dominance and influence of any one token over other blockchain projects – a necessary evolution if we’re going to unleash blockchain’s potential benefits for consumers and businesses.”

It’s good to see the market diversifying away from BTC and USDT as base pairs and using other major cryptocurrencies to fulfill that role, along with the actual USD.

We also saw a glimpse of the future of exchanges today with Binance teasing their new Decentralized Exchange.

Decentralized exchanges are considered more secure than their centralized counterparts, and are less vulnerable to systemwide hacks. Instead of storing all the crypto on an exchange in a giant “honeypot”, decentralized exchange users retain control of their private keys and thus their crypto in siloed wallets.

Even still, Binance has proven that they’re very much profit motivated. It costs 2.5 Million USD to list a coin on their exchange.

Perhaps this is meant to keep out bad projects, but in practice bad projects have still made their way onto Binance in the past with all their blessings, so clearly the system is fallible.

It’s simply a hard time to start a project right now.

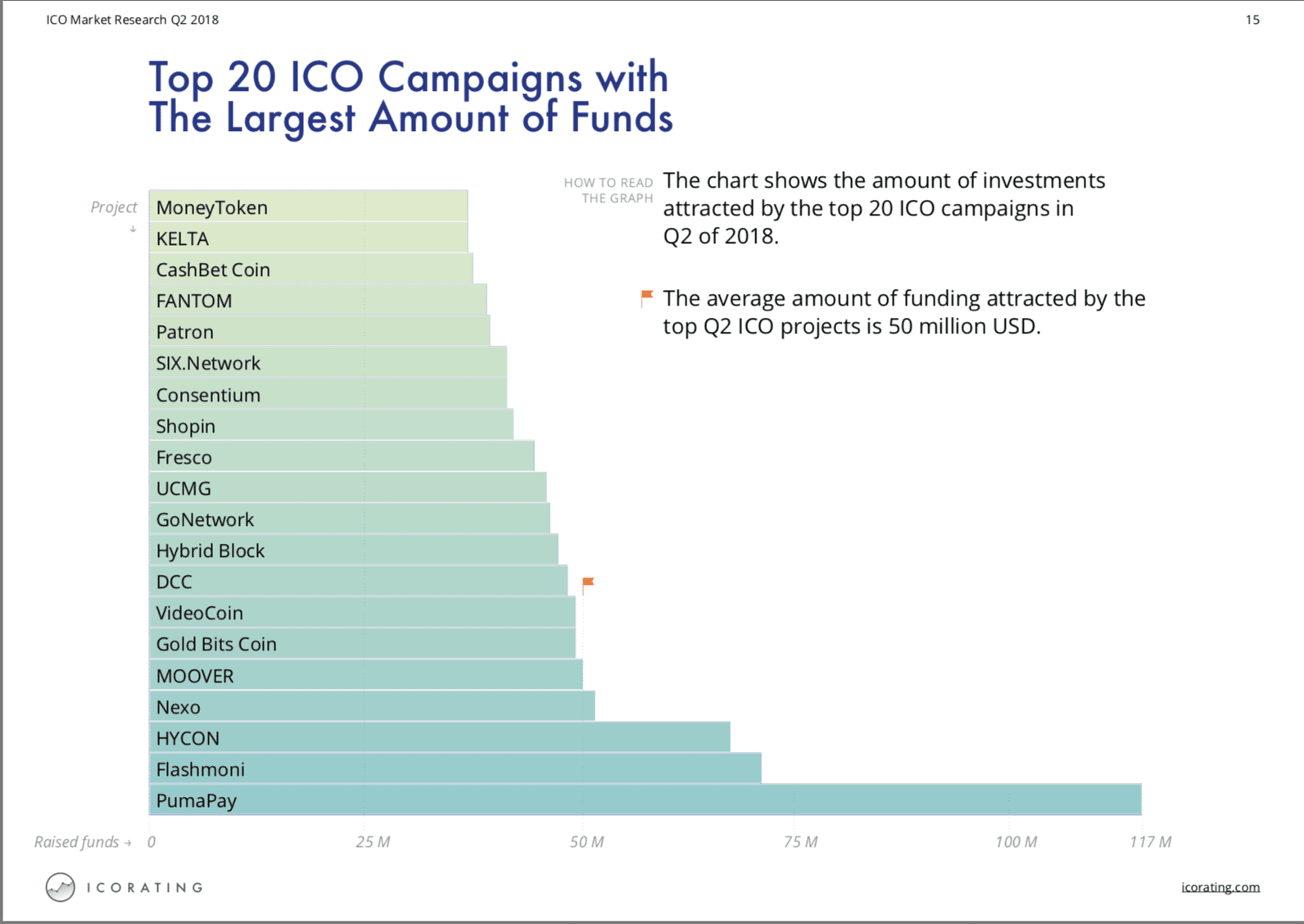

Over half of all initial coin offering (ICO) projects failed to complete their crowdfunding in the second quarter of 2018, revealed cryptocurrency data firm ICORating in its latest report.

ICOs Raised a Record $8.3 Billion in Q2, But Most Missed Their Targets

The independent ICO analysis portal found that 55% of the ICOs failed in Q2 2018. That is 5% more than the number of failed ICO projects recorded in Q1 2018. Nevertheless, money continued to flow in the ICO projects as a whole, raising from $3.3 billion in the first quarter of 2018 to $8.3 billion in the second — amounting to a 60% surge in investments.

What this shows us is that the market is becoming a more sterile environment, but we still have a long way to go before it resembles something like the stock market.

Even still, that shouldn’t be our focus. We need to champion the good projects while ignoring the bad. The projects that can survive this storm will be worth keeping around long term, and as crypto has a very long horizon, this is paramount.

If you were not able to join us for the recent webinar “Ten Steps to Building Your Portfolio” webinar, the replay is available here.

We’ve started to produce episodes for The ReadySetCrypto Podcast; all of our episodes are posted on our blog (and on iTunes) and episode eight is now available. Episode Eight is an interview with Andrei Polgar, the author of the book “Age of Anomaly” which speaks to anticipating negative market events. Look for more episodes shortly as we comb the crypto space for valuable interviews, and create valuable content to keep you in the loop!

See you tomorrow!

Doc's Daily Commentary

Our Weekly Livestream

Our next Premium-Only Livestream is scheduled for 8/8/2018 at 8 PM EDT (UTC/GMT -4 hours)

New to Cryptocurrencies? Check out our archived classes “Intro to Cryptocurrency Trading”, “How to Find Your Next Big Cryptocurrency: Intro to Fundamental Analysis,” Mav’s class on “Security and Wallets” and Doc’s classes, “Introduction to Technical Analysis” and “Short Term Trading Strategies” which are now all available for immediate purchase in our Store, and seconds away from viewing in the Premium Member’s Home. View more about them at our online store by CLICKING HERE.

Didn’t catch our “Building Your Portfolio” Webinar from mid-June? Listen here.

Sign up for our NEW Telegram channel by clicking here!

Watching on Mobile? Click this link to watch in HD

Check out our BLOG for the latest videos, posts, and Podcasts! Click this link and bookmark the page!

If you go to buy any of our courses at our online “store” you can receive $10 off the street price with your member’s “coupon code” of member18crypto

Check out our new merch store! Simply go into the regular store and select “Merchandise” to pick up some RSC merch!

Offense – Adding Trades

Offensive Actions for the next trading day:

- Per Doc’s video today he is adding 2% positions to both ETH/USD and LTC/USD.

Defense – Managing Risk

Defensive Actions for the next trading day:

- None.

RSC Managed Crypto Fund

Technical Analysis Research

Here are the recent swings that we’re tracking in the portfolio below; :

Here are the recent swings that we’re tracking in the portfolio below; :

- DGB/BTC – long @ .00000608 (7/23). My target exit is .000008BTC.

- WTC/BTC – Long @ .00155980BTC (4/23). My target exit is at .002BTC.

- ADA/BTC – Long @ .00003931BTC (5/1) My target exit is at .00005BTC.

- ONT/BTC – long @ .0008905 (5/20) My target is .0013BTC.

Please keep in mind that if you want to follow these trades, I am using FIXED RISK POSITION SIZING. This means that I am using a fixed amount of risk capital that is based on my account size, like 2%. I am assuming that the trade will burn to the ground and that I will lose that entire capital position! Only in this manner can one effectively manage a position the way that you have to. If you’ve every checked your blockfolio nervously every 5 minutes when you’re underwater, this will prevent that. I will track these positions in this area and not in the main portfolio section. I will use a public portfolio tool to do so, which you can access by clicking below:

Public Swing Portfolio Link

I hope you all got a chance to catch my webinar class from earlier this year; if not, the replay is available here. If you missed my earlier webinar, “More Profits in 2018; Ten Ways to Chart Like a Pro.” then you can catch the replay here. My new class “Introduction to Technical Analysis” is now available via our online store.

If you go to buy any of our courses at our online “store” you can receive $10 off the street price with your member’s “coupon code” of member18crypto..

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio and/or Delta to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

I am also trialing the Profit Trailer and CryptoHopper trading apps which are working well in this choppy market.

Fundamental Currency Research

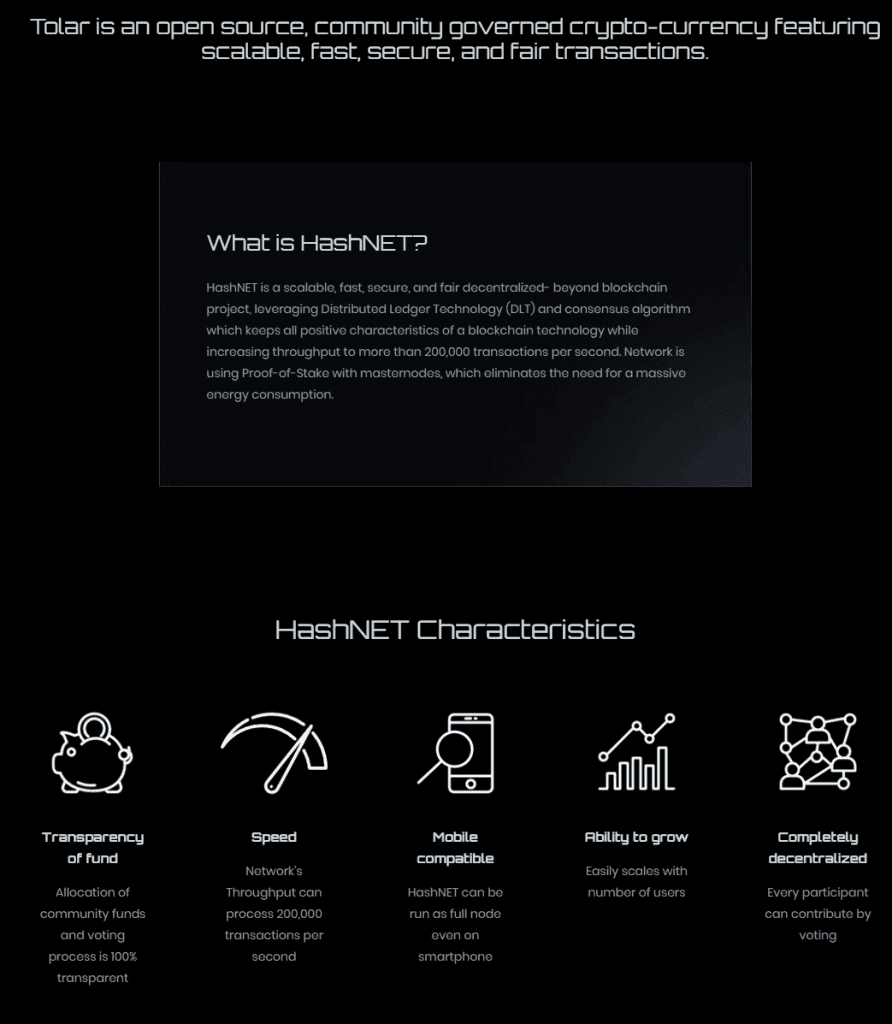

Tolar

For flipping Good.

For long-term holding Neutral.

What is it?

What is our verdict?

What we like: The prototype has an insane 130,000 TPS

What we don’t like: TPS expected to drop as more nodes join the network. Team’s business strategy relies on collaboration with other companies.

- Project name: Tolar

- Token symbol: TOL

- Website: https://www.tolar.io

- White paper: https://www.tolar.io/wp-content/uploads/2018/07/Tolar-whitepaper-1.pdf

- Hard cap: 45,000 ETH (token sale contributors will own 35% of the total token supply)

- Conversion rate: ICO price and presale price for 1-9 ETH = 0,000145055 ETH per TOL

- Maximum market cap at ICO on a fully diluted basis: $54 million based on current ether price of $420

- Bonus structure: For presale, contributions of > 50 ETH = 20% bonus; between 10-49 ETH = 10% bonus. 3-month lock up for bonus tokens.

- Private sale / white list: Presale in progress until the end of August 2018. Presale and whitelist registrations are currently open at https://tolar.io/presale.

- ERC20 token: Yes (will be switched to native tokens when the mainnet is launched)

- Countries excluded: USA, China

- Timeline: Currently planned for September 15-20, 2018 (14:00 GMT). The ICO may end earlier if hard cap is reached (please visit Tolar’s official website and join their Telegram channel for the most up-to-date information on their upcoming token sale)

- Token distribution date: Q3 2018

Website: https://www.tolar.io

Whitepaper: https://www.tolar.io/wp-content/uploads/2018/07/Tolar-whitepaper-1.pdf

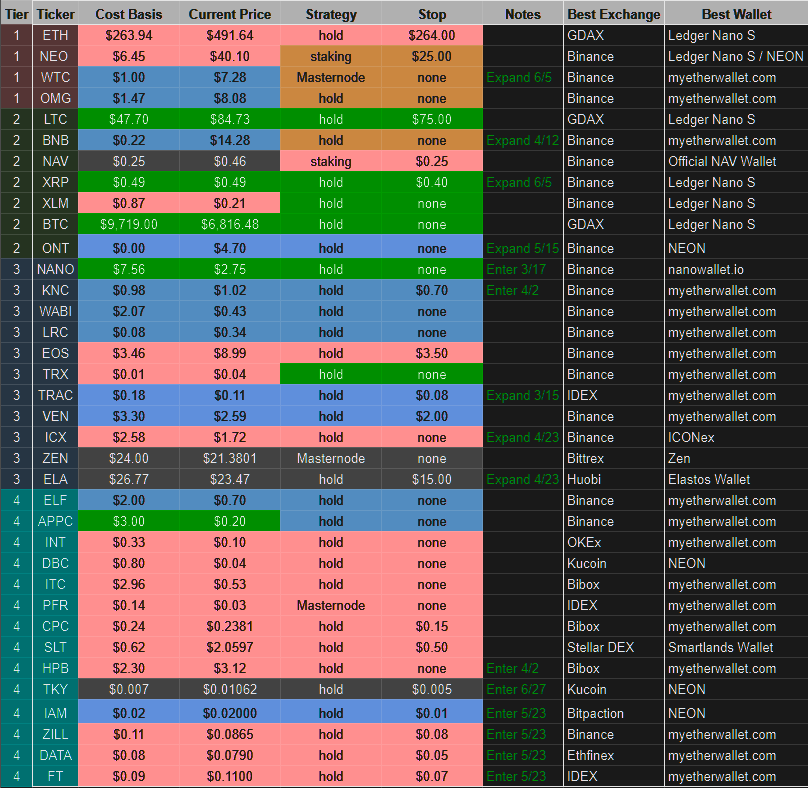

2017- 2018Q2 Portfolio (Discontinued)

Desired Holdings

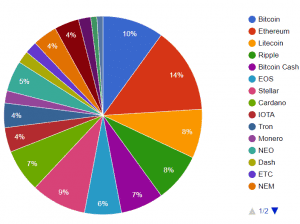

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

Tier 4

ZIL

IAM

FT

DATA

ELEC

None.

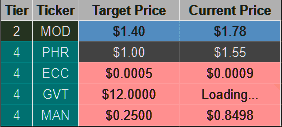

Tier 2

MOD

Tier 3

REQ

SUB

LINK

NANO

KNC

Tier 4

BNTY

TAU

WISH

PHR

LOCI

XBY

ELA

ECC

POE

HPB

BIX

EVE

XVG

NULS

DNA

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.