Doc's Daily Commentary

Mind Of Mav

Everything You Ever Wanted To Know About Bitcoin’s Lightning Network

When Bitcoin creator Satoshi Nakamoto introduced the Bitcoin white paper in the fall of 2008, He wrote quote “I’ve been working on a new electronic cash system that’s fully peer-to-peer with no trusted third party.”

The first reply to Satoshi’s message was quoted “We very, very much need such a system, but the way I understand your proposal, it does not seem to scale to the required size.”

Ever since that reply, developers around the world, Satoshi included, have been working on ways to make the Bitcoin blockchain scalable enough to support the world’s population. Though there have been many attempts to tackle Bitcoin’s scalability issues, only one implementation has stood the test of time. This scaling solution is called the Lightning Network, and over the last year, it’s seen a surge in adoption from individuals, businesses, and even governments for fast and fearless BTC payments.

Today I’m going to tell you everything you need to know about the Lightning Network. Where it came from? What is it? How does it work? And Why the Lightning Network will lead to the mass adoption of Bitcoin.

Bitcoin Basics

To understand what the Lightning Network is, how it works and why it’s important, you need to be familiar with a few Bitcoin basics.

Bitcoin was designed to be a peer-to-peer electronic cash system as per the title of the Bitcoin white paper. Bitcoin is the payment system or network, whereas BTC is the electronic cash itself. As highlighted by the first reply to Bitcoin creator Satoshi Nakamoto, the Bitcoin network is unable to scale enough to make it possible for everyone on the planet to use BTC as a payment method.

Scaling is basically just a technical term for speed. The Bitcoin network can only handle around seven transactions per second, or TPS for short

By contrast, VISA handles around 1,700 TPS on any given day, and it can scale up to 65 000 TPS if need be. VISA’s upper TPS limit has consequently become the benchmark for optimal speed in cryptocurrency.

Bitcoin is obviously nowhere close to this benchmark, and this is because of its block size and block time. The Bitcoin network is actually a blockchain which is just a distributed record of transactions that’s shared by all computers connected to the network. These transactions are batched into blocks hence the word blockchain.

Each Bitcoin block is only 1 megabyte large, and because each BTC transaction has a digital size of two, only 2,700 or so can fit in each Bitcoin block. This limited space is why there are transaction fees to incentivize the computer’s verifying BTC transactions called miners to include a BTC transaction in the next block.

When you divide that number by Bitcoin’s block creation time of roughly 10 minutes, you get about seven transactions per second, easy maths. Given these facts, you might be thinking that the simple solution to Bitcoin’s scalability problem is to increase the block size, increase the block time, or both.

This is actually what many Bitcoin forks have done or tried to do. The only problem there is that doing any of those would compromise the security of the Bitcoin network. This is why Satoshi designed Bitcoin the way he did. If the block size is too large, eventually, only a handful of computers will be able to store the full history of BTC transactions because it would be too large for most of them to handle.

If the block time is too fast, it limits the number of computers that can verify transactions on time, and if there are too many, you’d quickly end up with conflicting BTC transaction histories. This means there is only one solution left, and that’s to somehow process BTC transactions outside of the Bitcoin network or off-chain at a faster speed without compromising security or increasing costs. This is where the Lightning Network comes in.

Lightning Network History

The Lightning Network has its roots in Satoshi Nakamoto’s earliest writings, but its creation is credited to two brilliant developers the Deus Dryer and Joseph Poon.

The Deus is a long-time Bitcoin developer and currently works at MIT’s digital currency initiative, where he focuses on cryptocurrency scaling and interoperability. It’s possible that the Deus is involved in the development of the United States’ upcoming digital dollar. Given that Uncle Sam has partnered with MIT to create it.

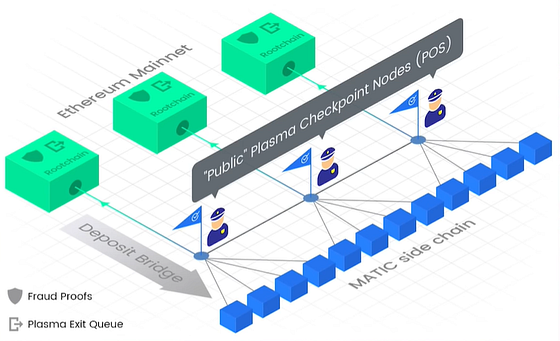

Joseph Poon is also a long-time Bitcoin developer and shifted his focus to Ethereum in 2017 when he co-authored the Plasma white paper with Ethereum founder Vitalik Buterin.

For those who don’t know, Plasma is a popular Ethereum scaling solution leveraged by crypto projects such as Polygon, which I’ve covered in detail on this account.

The Deus and Joseph began brainstorming ideas about how to scale Bitcoin in 2014 after seeing how inefficient some of the other scaling solutions were. The pair first penned the Lightning Network white paper in February 2015 and subsequently presented their invention at an annual Bitcoin conference in San Francisco where they’d met the year before.

In January 2016, the duo founded a company called Lightning Labs along with two other Bitcoin enthusiasts to develop the Lightning Network.

After more than two years of hard work and help from Bitcoin developers like Blockstream, the Lightning Network was completed in February 2018.

This occasion was marked by the purchase of two pizzas using BTC on lightning by Laszlo Hagnex. If this scenario sounds familiar, it’s because Laszlo is the man who made the first-ever purchase with Bitcoins in May 2010, when he bought two pizzas for 10,000 BTC. 461,650,000 USD dollars at current prices to save you the maths.

In March 2018, Lightning Labs received over 2.5 million dollars in funding from prolific investors, including Twitter CEO Jack Dorsey. A few days later, the Lightning Network was deemed ready for regular Bitcoin users.

The Lightning Network has seen some serious adoption since then case in point in less than a month’s time. El Salvador will become the first country to use the Lightning Network for BTC payments. I’ll get back to that in a moment, but first, I should probably explain how the Lightning Network works.

How it Works Part 1:

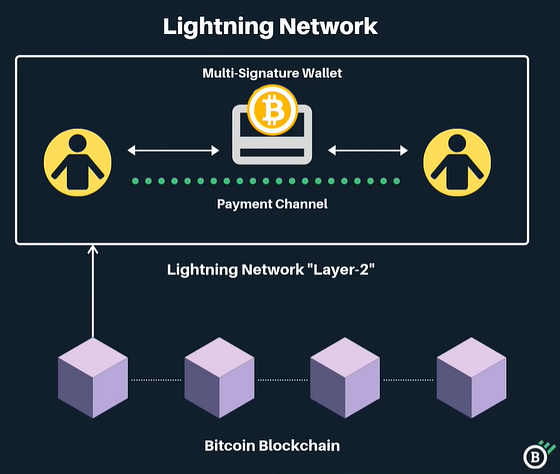

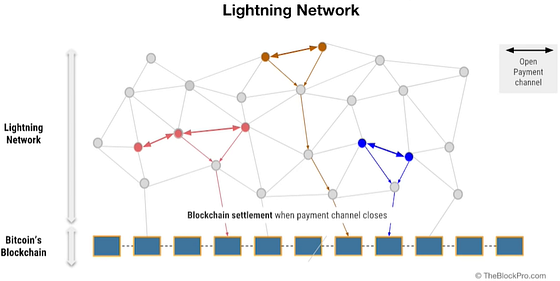

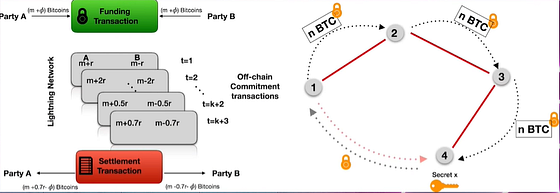

Unlike most Layer 2 networks for cryptocurrency, the Lightning Network is not a blockchain. Instead, it consists of a series of interconnected payment channels created by two parties on the Bitcoin network.

I know that’s a big definition to take in, so let’s break it down bit by bit with a simple example. Imagine there’s a restaurant you go to every day because you’ve become such good friends with the owner of the restaurant he doesn’t always make you pay at the end of every meal. Better yet, he gives you discounts or even free food for helping out around the restaurant, or you know, just being a good and loyal customer. The restaurant owner keeps a record of how much money you owe him for meals minus the ones you got pro bono for helping out and only asks you to pay up at the end of each month when the restaurant’s bills are due.

This payment record you have with the restaurant owner is not all that different from the payment channels you find on the Lightning Network.

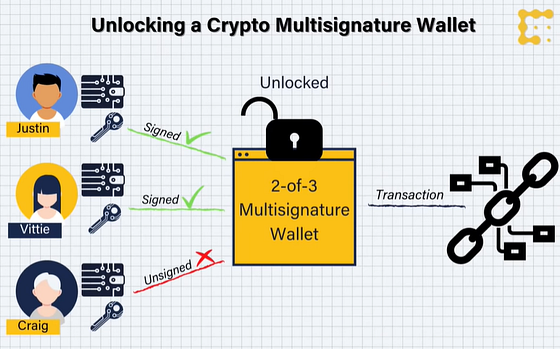

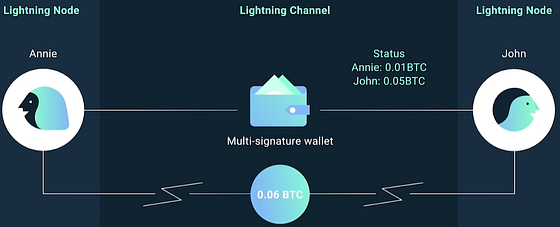

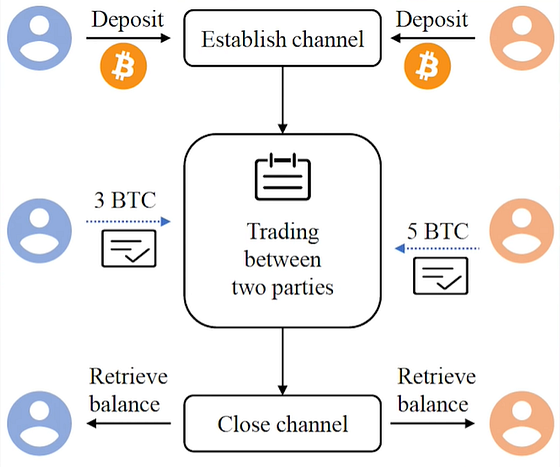

To understand how to let’s imagine you and the restaurant owner agree to settle your monthly tab in BTC, and you’ve decided to use the Lightning Network. This means you’ll have to create a payment channel on the Bitcoin blockchain. This involves something called a multi-signature wallet, and as the name suggests, a multi-signature wallet is a cryptocurrency wallet that will only send out a transaction if the signatories agree. In our example, that’s you and the restaurant owner.

First, you both deposit an amount of BTC into the multi-signature wallet. This amount must be worth the same or more than what you expect to transact next month for security reasons. You’ll see why in a second.

This transaction on the Bitcoin blockchain creates a payment channel that allows you to transact the BTC you deposited between each other instantly as many times as you want for next to nothing. This is because what you’re sending between each other is not actually BTC, but a digital IOU of payments like the physical IOU record you are using for regular money.

Put differently. You’re just adjusting how much of the BTC in the multi-signature wallet address each of you will get when the payment channel is closed. This record is updated every time a BTC transaction is made in your shared payment channel, and this record is kept on both of your computers. It might help to think of it as a sort of receipt. At the same time, regular BTC transactions require at least one block to be generated and can costs upwards of 50 dollars to push through. Because you’re just passing around an updated receipt between two computers, the only limiting factors are computer hardware and internet speed. This makes transactions on the Lightning Network lightning fast, with tens of thousands of transactions per second for every connected computer.

When the month is over, the BTC in the multi-signature wallet is sent back to each of your own BTC wallet addresses based on the balance of the final digital IOU receipts on both of your computers.

This creates a second transaction on the Bitcoin blockchain and closes the payment channel. Note that a payment channel can be kept open indefinitely and can be closed at any time by one or both parties. It turns out that if you didn’t pay what you owed, the BTC you put into that multi-sig wallet would automatically be sent to the restaurant owner. If he overcharges you, the opposite occurs.

Although this probably won’t happen because you and the restaurant owner trust each other, this trust isn’t always there when you’re transacting with strangers, which is why both parties always have to pre-fund the multi-sig wallet with some collateral to incentivize good behavior.

How it Works Part 2:

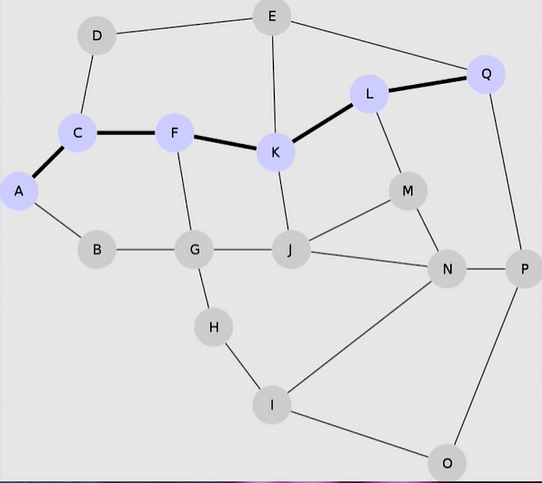

This brings me to the interconnectedness part of the payment channels, which make the Lightning Network a global network and not just a two-way street between two people. Here’s how that works.

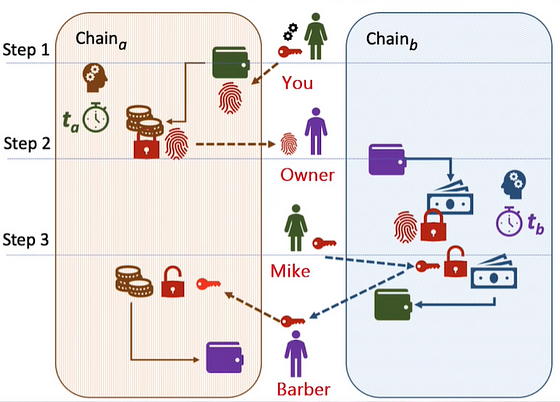

Suppose there’s another regular at the restaurant. Let’s call him Mad Mike. Mad Mike has a BTC payment channel open with the restaurant owner as well. He even has a BTC payment channel open with your barber. When you see Mad Mike’s fresh-cut, you realize you forgot to leave your barber a tip the last time you were. There you’d like to pay this tip with BTC, but you don’t have a payment channel open with the barber. Luckily the Lightning Network has got you covered. Instead of having to ring up your barber and set up a payment channel with him directly, your BTC tip can make it to his wallet via the payment channels that connect you together, you and the restaurant owner, the restaurant owner, and Mad Mike and Mad Mike and the barber.

If you happen to have a payment channel open with Mad Mike, the Lightning Network will automatically route your BTC tip through him to minimize the distance it needs to travel in the same way that real lightning finds its way to the ground-based on the path of least resistance in the atmosphere.

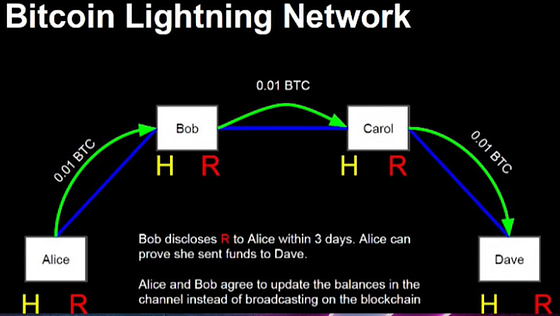

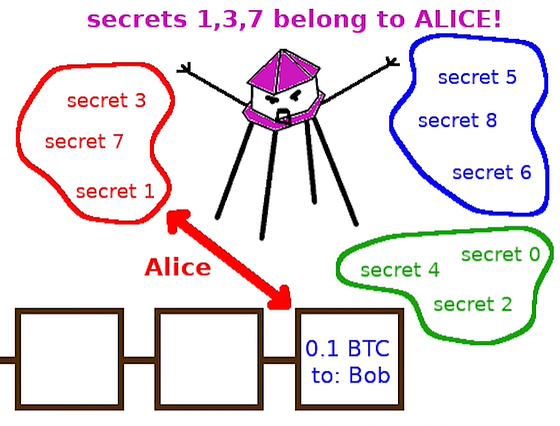

You might be worried, though, that Mad Mike might try and steal that BTC tip in transit since he’s a shady fellow, but the Lightning Network has got you covered there too. BTC payments made through intermediary payment channels are secured by a technology called Hashed Time Locks.

Without getting too technical, this involves exchanging a secret code with the end recipient first before any BTC is sent. Once that secret is successfully exchanged, the corresponding amount of BTC is transferred. If anything goes wrong along the way, such as one of the connected computers going offline, the transaction is automatically canceled, and the appropriate parties are punished if it was a malicious act.

The more payment channels there are, the faster and more far-reaching the Lightning Network is. This connectivity means it’s possible for the whole planet to use BTC as a digital cache like Satoshi envisioned.

To further facilitate the growth of the Lightning Network, it was designed such that it’s possible to create more than one version. This means that anyone can create their own custom version of the Lightning Network, and thanks to something called the Bolt Protocol (BOLT), all versions of the Lightning Network are interoperable.

To top it all off, the Lightning Network can be used with any cryptocurrency which supports multi-signature wallets and hashed time locks which are almost all of them. Because the Lightning Network’s interoperability features are not limited to any one blockchain, this means you can instantly trade supported cryptocurrencies between blockchains at near-zero costs without a cryptocurrency exchange.

Growth & Adoption

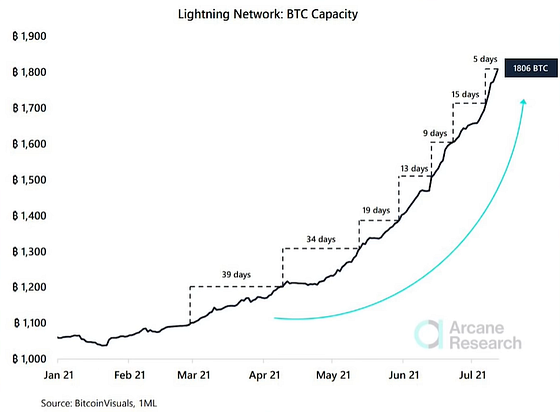

With all these crazy features, it should come as no surprise that the Lightning Network has grown exponentially over the last year. At the time of the shooting, there are over 60,000 Lightning Network payment channels around the world, with over 100 million dollars in BTC locked in its multi-sigs.

While actual user adoption of the Lightning Network had a slow start, the pace picked up at the start of 2020 when Bitcoin lightning wallet developer Zap released the now-famous Strike app.

Zap is the company that helped the government of El Salvador make BTC legal tender. This was after the president took notice of Strike’s popularity in the country, thanks to its fearless remittance payments powered by the Lightning Network.

When El Salvador’s legal tender law goes into effect at the beginning of September, we could see millions of people transacting BTC on the Lightning Network.

Now less than one month after Strike’s 2020 launch, Lightning Labs announced that it had raised another 10 million dollars from a handful of heavyweight investors.

Shortly after that, Lightning Labs released an update to its Lightning Implementation that increased the amount of BTC that could be sent through payment channels.

This paved the way for more adoption of the Lightning Network by larger players in the crypto space, including cryptocurrency exchanges.

Late last year, Kraken announced that it would be adding support for the Lightning Network.

In February this year, OKEx added support for the Lightning Network.

A few days later, peer-to-peer cryptocurrency exchange Paxful announced they had done the same.

In March, a crypto startup called Moon made it possible to pay with BTC using lightning online with any merchant that accepts VISA.

In May, Tesla CEO Elon Musk took a break from bashing Bitcoin to praise the potential of the Lightning Network.

In June, Twitter CEO Jack Dorsey said he plans on adding the Lightning Network to Twitter and its decentralized counterpart BlueSky.

In June, a Canadian company called Liquid Fintech Corp became the first publicly-traded company whose sole purpose is to develop Lightning Network infrastructure.

More recently, a Las Vegas Strip Club announced it had begun accepting Lightning Network BTC payments. How’s that for a use case.

Speaking of use cases, Bitcoin evangelist Andreas Antonopoulos believes that it’s only a matter of time before the Lightning Network is used as a quote “Stream of money.”

For example, instead of getting paid bi-weekly or monthly, you could be paid by the hour or even by the minute thanks to the speed and low cost of the Lightning Network. Instead of paying monthly or yearly for a Netflix or Spotify subscription, you could pay for each minute of content you consume on their platforms instead.

It’s not just payments where the Lightning Network can be used either. Some crypto companies such as Zebedee have combined BTC with video games, making it possible for gamers to earn seats by playing. Play-to-earn gaming is what another crypto project called Axie Infinity is doing.

Lightning Network Issues

If you think that the Lightning Network sounds too good to be true, you are partially correct. The Lightning Network has had its fair share of issues, and not all of these have been resolved.

Dozens of code vulnerabilities have been found since the network launched in 2018, so much so that many still consider it to be in its testing stages, even though it’s technically fully operational. That said, the Lightning Network’s biggest problems are not technical. They’re structural.

For starters depositing BTC into a multi-sig wallet to create a payment the channel makes that BTC much harder to sell since it often needs to be transferred to the Bitcoin blockchain first before it can be exchanged for fiat. This is becoming less of an issue over time as more fiat payment pathways like exchanges integrate the Lightning Network, but it’s still something that’s not readily available to the average BTC holder.

On that note, if the price of BTC were to pump or dump too much, you could see a lot of payment channels close as multi-sig participants sell their BTC because of profit or panic. This could shrink the size of the Lightning Network and possibly even cut off some BTC holders on lightning from off-ramps that accept BTC via lightning.

Not only that, but there are not many incentives to keep a payment channel open to begin with. Fees on the Lightning Network rarely exceed a handful of Satoshi’s worth fractions of a penny. These are paid to any intermediaries when BTC moves between payment channels. The average user is unlikely to keep their BTC locked up on the Lightning Network for pennies in profit. For the average user, the value of the Lightning Network comes from its utility.

Moreover, when you send a BTC transaction across multiple payment channels on the Lightning Network, every single one of the multi-sig wallets on the way must have a BTC balance that is larger than or equal to the amount being sent. This makes larger transactions harder to do.

When you combine these pain points with the cost of opening and closing payment channels on the Bitcoin blockchain, you end up with a Lightning Network that is remarkably centralized, with most traffic taking place through custodial intermediaries that are not that much different from banks.

This has historically been one of the biggest criticisms of the Lightning Network, but this has also been improving as time goes on. So, this begs the question, if operating a payment channel on the Lightning Network is not very profitable, then where does the incentive come from for the individuals and institutions providing this service.

When a product is for free, you are the product. In the case of the Lightning Network, it’s likely that most of the company’s operating custodial lightning wallets and services are closely tracking their user’s transactions. It’s even possible that this tracking is happening on the Lightning Network itself through so-called watchtower nodes, which analyze payment channels for any fraudulent transactions and notify any affected users so they can close their payment channel and claim their BTC.

Though this sort of surveillance may not be very profitable today, it will become more profitable as the adoption of the Lightning Network continues. Big businesses will want to see where all the little people are spending their money in real-time and will gladly spend some of their own to get this information. Interestingly enough, this concern runs contrary to the Lightning Network’s supposedly superior privacy.

Lightning Network Privacy

Some of you may remember the Cointelegraph headline from September last year, which read the quote, “The IRS offers a 625,000 USD bounty to anyone who can break Monero.”

What you may not remember is the end of the headline, which includes the Lightning Network under the same bounty. This is a small but significant detail because it implies that the Lightning Network has a similar degree of privacy to Monero, which offers the best privacy of any cryptocurrency.

The Lightning Network has been on the radar of U.S. regulators since last summer when the IRS published a document that cited the rapid growth of the network as a cause for concern.

Although the document notes that Lightning Labs has developed a tool to track transactions on the Lightning Network, this tool can only be used by someone operating a payment channel and only for their own payment channel. In other words, the only transactions they can track are the ones they are making with the other party in their payment channel. They can’t track the transactions they are rooting on behalf of someone else. This has to do with the hashed timelock technology I mentioned earlier.

Recall that this involves exchanging a secret code between the sender and the recipient before a transaction is made. When this transaction hops through all the payment channels, the participants in between have no idea where that payment came from, where it’s going, nor what their position is in the transaction’s path. So, to use our restaurant example, if I send the BTC tip to my barber through the restaurant owner and Mad Mike, neither of the two knows which position they’re in when that payment goes through. Nor do they know whom it came from or whom it’s going to.

This is, of course, easy to figure out when you’re dealing with a small group of people, but as the Lightning Network grows, it gets harder and harder to trace transactions.

Besides stuff like watchtowers, the biggest vulnerability of the Lightning Network’s privacy has to do with the transactions made on the Bitcoin blockchain, when payment channels are opened and closed with multi-sig wallets. These transactions look different than regular transactions, which makes them that much easier for government-friendly blockchain tracking firms such as Chainalysis to trace.

As it so happens, Bitcoin’s upcoming Taproot Upgrade will make multi-sig wallet transactions look identical to regular transactions.

After November, there will be no telling when someone is moving their BTC on or off the Lightning Network. So, what that means is that Bitcoin could offer Monero like privacy with VISA level speed at near-zero fees thanks to the Lightning Network.

If the Lightning Network sees a similar degree of adoption on other popular cryptocurrency blockchains, this could usher in the cypherpunk future that Satoshi and so many others envisioned. It might just save cryptocurrency from the incoming regulatory crackdown too.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.