Doc's Daily Commentary

Mind Of Mav

The Many Different Ways To Make Money With DeFi Part 3

Last week, we went through the details of what’s driving the resurgence of interest in DeFi from a technical perspective.

This week, we’ll cover the many exciting ways we can look to make money in the DeFi space — many of which we’ve not yet covered before, so buckle up!

Let’s pick up where we left off yesterday.

First thing: this is purely explanatory and is in no way meant to suggest you do something with your money. Your money, your choices, your risk.

Second, you’ll need some tools:

Tools you need

Required:

A web3 enabled browser (I like Brave) and / or a web3 enabled wallet:

MetaMask (desktop)

Argent (mobile)

Coinbase Wallet (mobile)

Exchange account to onboard fiat to crypto (use https://www.buybitcoinworldwide.com/ to see what works best in your country)

Hardware wallet for cold storage (I like Ledger)

Now, let’s get down to business.

Protocols & Applications

This week we’ll be covering each of these:

Aave

Argent

Augur

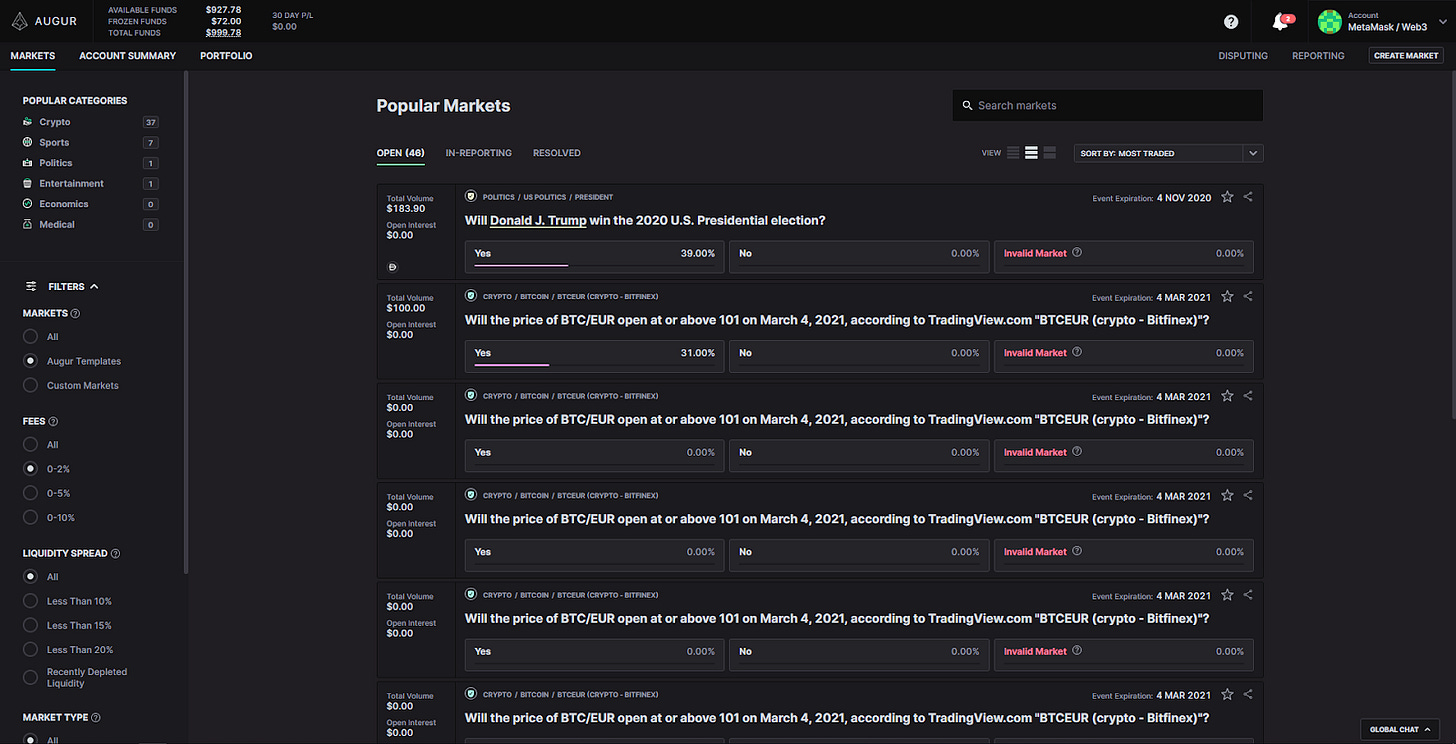

Bet on DeFi with Augur v2

Augur is one of the OG Ethereum money protocols, decentralized to the core.

It allows anyone, anywhere, to bet on anything. No betting limits. No KYC. Pure Bankless. A powerful primitive.

A few weeks ago, Augur launched its highly anticipated v2 upgrade. It provided improvements over the first version and features only possible by incorporating other money legos—Uniswap, Maker, 0x—this is Ethereum’s real vision of the future starting to take shape.

Augur V2 is simply the big upgrade people were waiting for.

You can think of Augur as a global vending machine that pops out “outcome tokens” in exchange for DAI. These tokens confer exposure to or insurance against any future state of reality.

Outcome tokens may be used for anything from betting and trading to bounty creation and risk hedging. The new financial primitive of outcome tokens represent transferable, programmable, and censorship-resistant shares that payout based on real-world events.

Markets that trade these shares are called “prediction markets,” as they may produce forecasts on future events, thanks to crowdsourced information and skin in the game incentives. For example, if YES shares on an Augur market on Trump’s reelection are trading at .40 DAI, the market is signaling 40% odds he will win the election.

Augur v2: The Future of Predicting the Future

Anyone, anywhere, can create or trade markets on anything using Augur.

You can bet on the election, sports, crypto prices, the economy, or how many Twitter followers Kanye will have next month. Any verifiable event in the universe.

Augur v2 delivers a fresh user experience built on an array of beloved “money legos” including Uniswap, 0x, and MakerDAO.

The coolest part of Augur, though, may be its native oracle.

An oracle is a mechanism for transferring real-world information onto a blockchain, in the case of a prediction market, the actual event outcome e.g., did the Lakers win? Augur has what may be the most bulletproof oracle known to date, with game-theoretic guarantees that you can learn about here.

Will DeFi Continue to Defy Gravity?

The Augur market we’ll learn how to trade today is what will Total Value Locked (TVL) in DeFi be at the end of 2020.

As you may know, DeFi has been on a tear lately, rocketing to over 6 billion USD TVL.

Will this trend hold, accelerate, or . . . reverse?

That’s what the Augur market will let you predict and profit off of if you’re correct!

Balancer

Rebalance stablecoins with Balancer

If you have some ETH or ERC20 tokens lying around you’ve probably already asked the question: how should I put these to work? With DeFi there are a multitude for you to earn money with your idle assets: from lending money to Compound, opening a Maker vault, to being a Uniswap liquidity provider.

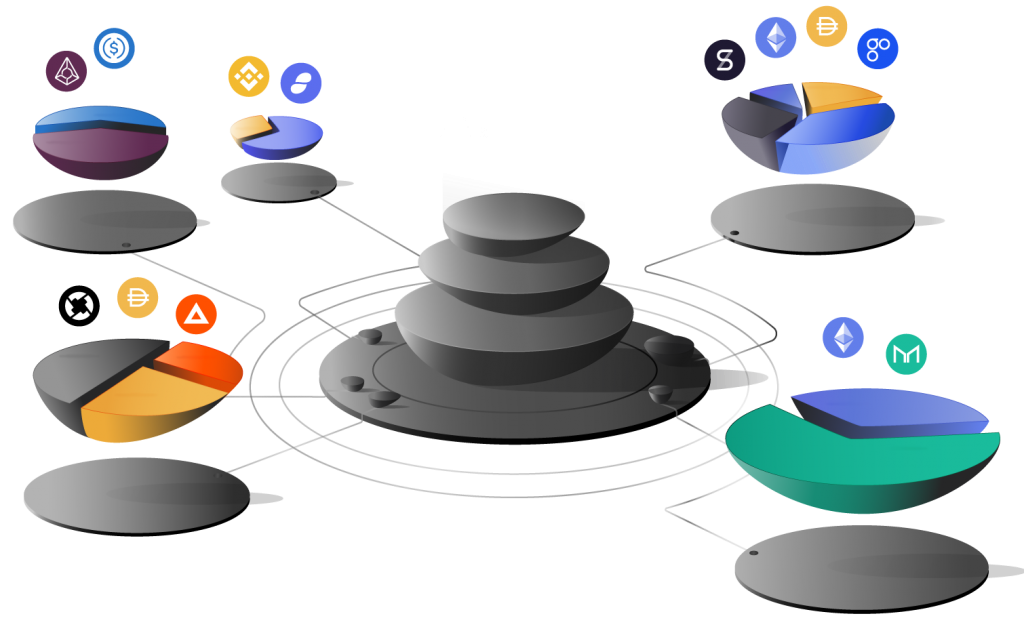

Now there’s Balancer—a new option for providing liquidity. Balancer allows pools with different combinations of tokens (think token ETFs or index funds). With Balancer, any liquidity provider can customize their exposure while earning trading fees from the protocol.

What is Balancer?

Balancer is an AMM protocol that allows anyone to provide liquidity to existing Balancer pools or create one themselves. Each Balancer pool is composed of 2 to 8 tokens. Each of the tokens makes up a percentage of the total pool value: these are the token weights that are chosen at the moment of pool creation. The mathematical properties of Balancer protocol ensure that the value percentage of each token in a pool will stick closely to the weight even as the market prices of the tokens themselves vary.

A Balancer Pool is a self-balancing index fund

This means that each Balancer pool is a self-balancing index fund itself. But it gets better. In a conventional index fund the investor has to pay a fee for the rebalancing service, but in a Balancer pool the liquidity provider is actually rewarded for their service of providing liquidity to the protocol. They earn fees while their index funds are continuously rebalanced for them.

Why Balancer is a magical money lego

Balancer pools can be one of two kinds:

-

-

- shared (i.e. finalized)

- private (i.e. controlled)

-

Shared pools have fixed parameters (they cannot be changed even by the pool creator) so that anyone can add liquidity to them. This is necessary since the pool creator could indirectly steal money from other liquidity providers in their pool if they could, for example by adding a new token they control all the supply of.

Private pools are as flexible as it gets: tokens can be removed/added, weights can be changed and even the swap fee can be adjusted. However, the only address that can provide liquidity to it is the pool creator. This is great for big index funds that manage funds of third parties for example.

But private pools get really interesting with smart pools.

Smart pools are private pools that are owned by smart contracts. These smart contracts can be used as a gateway for external users to add liquidity to pools under known conditions. Some great examples are:

-

- PieDAO BTC++: the BTC++ pool is currently comprised of 4 different types of ERC-20 BTC synthetics. Through governance, PieDAO can change the weights of each of these types of tokenized BTC, add new types in the futures and even pause trading if one of the tokens has problems and loses its peg.

-

- Bootstrapping liquidity pools: projects that are seeking to both make their native token liquid and also distribute tokens in a sale can use the concept of a smart pool that gradually flips the weights of its underlying tokens. This is an effective way of killing two birds with a stone: provide liquidity for your token at the same time as you exchange it for ETH or DAI to fund your project development.

-

- RealT index fund: instead of having fragmented liquidity in many Uniswap Pools, RealT tokenized properties can all live in the same Balancer pool, effectively creating a RealT index fund. By using a smart pool, RealT can keep the possibility of adding new properties in the future, as well as changing the weights of existing ones (say for example one of them is refurbished and doubles in market value).

Compound

Curve

dYdX

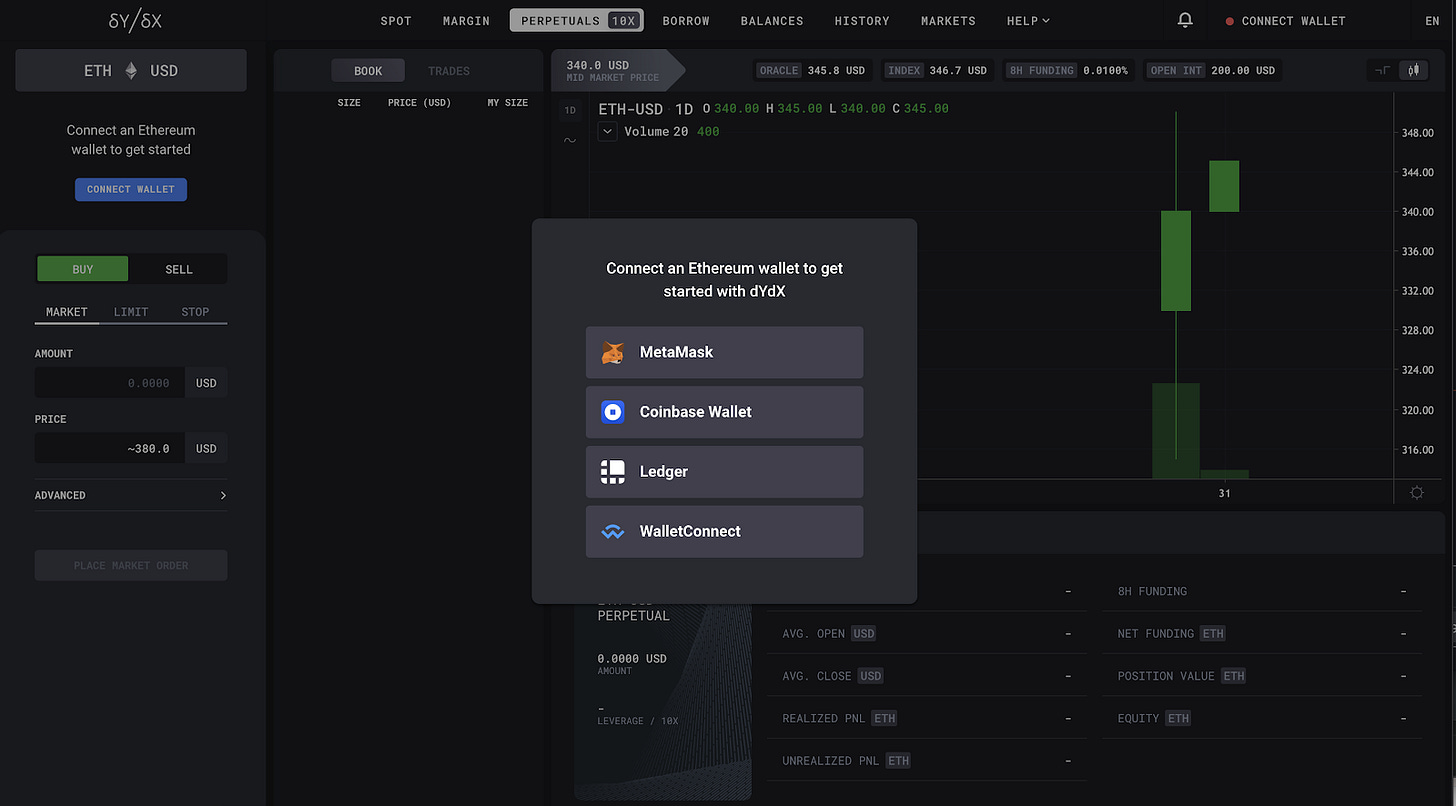

Trade the ETH Perpetual on dYdX

You probably own ETH, and you’ve probably asked yourself what are the easiest ways to access leverage on it.

While there are plenty of ways to do that in DeFi (primarily by using your ETH as collateral to borrow another asset such as a stablecoin), existing solutions are often both cumbersome and severely restrict the amount of leverage you can obtain. On dYdX, a decentralized exchange for spot, margin, and perpetuals, you can now obtain up to 10x leverage on your ETH without ever touching another token.

What is dYdX?

dYdX is an open, permissionless protocol to trade, borrow, and lend crypto-assets. It offers spot and margin markets across ETH, USDC, and DAI pairs as well as perpetual markets for BTC and ETH. Although dYdX is decentralized, the experience of trading on dYdX is very similar to trading on a centralized exchange. It offers professional trading tools and orders, fast trade execution due to its off-chain order books, as well as pays all gas fees for its users once on the platform.

Perpetual Markets

Perpetuals have been popularized by a number of centralized exchanges over the last few years — allowing users to get synthetic exposure to crypto assets without an expiration date. Perpetuals are the most widely traded crypto product with daily trade volume in the billions of dollars, eclipsing spot trading volume in 2019 as the most popular way to gain crypto price exposure.

dYdX’s ETH perpetual functions as an “inverse perpetual,” which means that it is collateralized, margined, and settled in ETH, while all orders are calculated in USD.

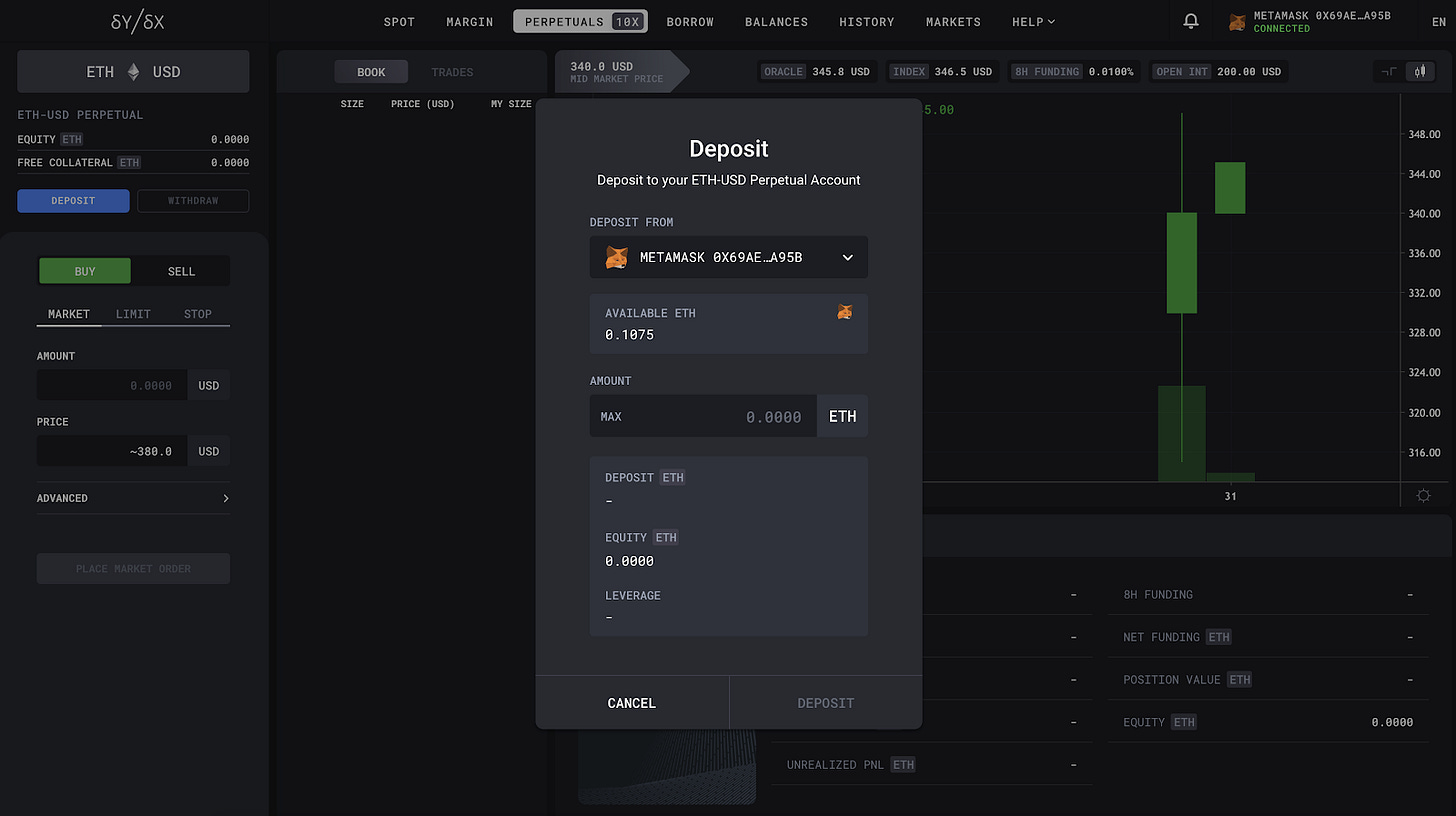

How to open an ETH perpetual

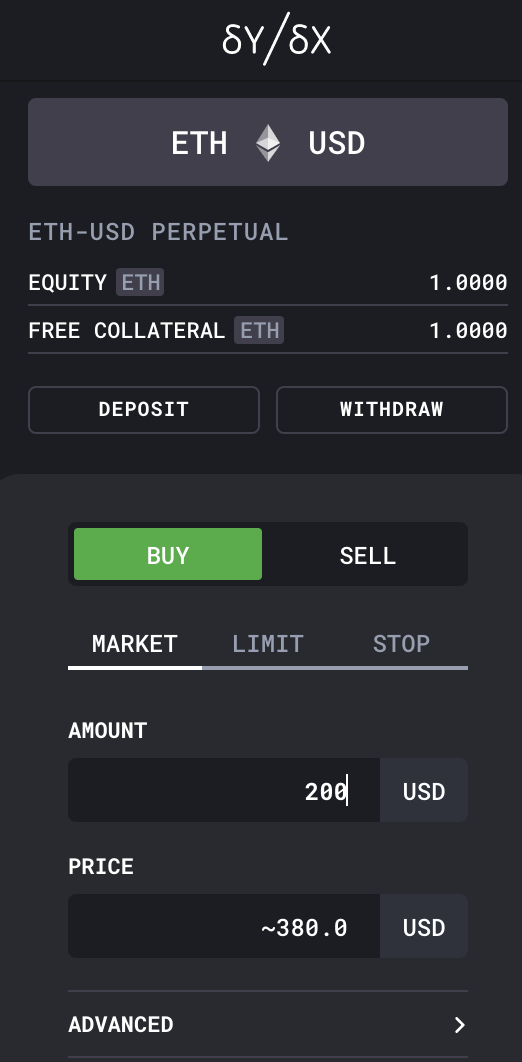

1.Head to dYdX ETH-USD Perpetual Contract Market and connect wallet using MetaMask, Coinbase Wallet, Ledger, or Wallet Connect.

2.Click deposit and determine how much ETH you would like to deposit and trade.

3.Create a buy or sell order. This can be a market or limit order. Leverage is applied automatically and depends on how much collateral you have in your account. For instance, let’s assume you have 1 ETH in your account and the price of ETH is $500, meaning the total value in your account is $500. Let’s also assume you want to buy ETH with 5x leverage. You would simply buy $2,500. Leverage is applied automatically using the ETH in your account.

4.Sign message to open the order

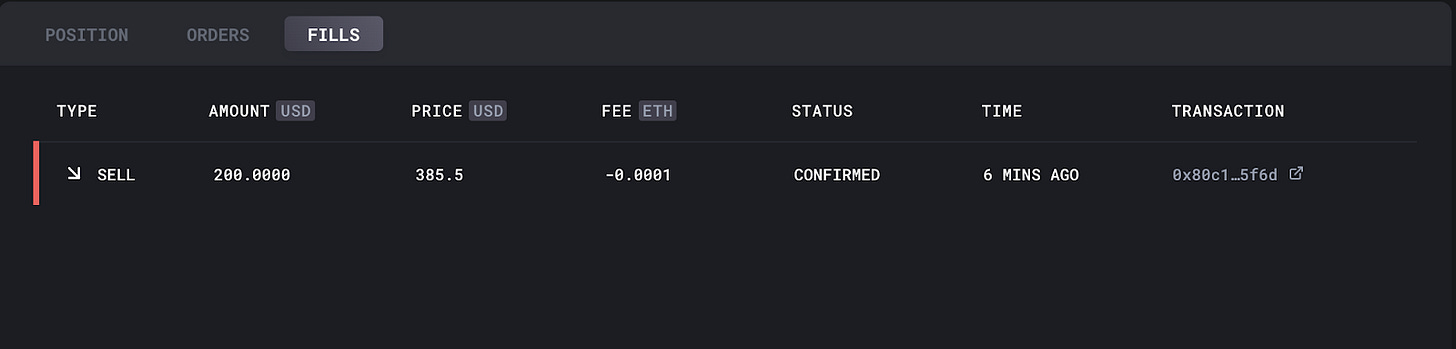

5.To confirm your order was filled, click the “FILLS” tab on the bottom right-hand corner of the screen. Once the status is “confirmed,” the trade is finalized and can be viewed on Etherscan by clicking the “TRANSACTION” link.

Close a position

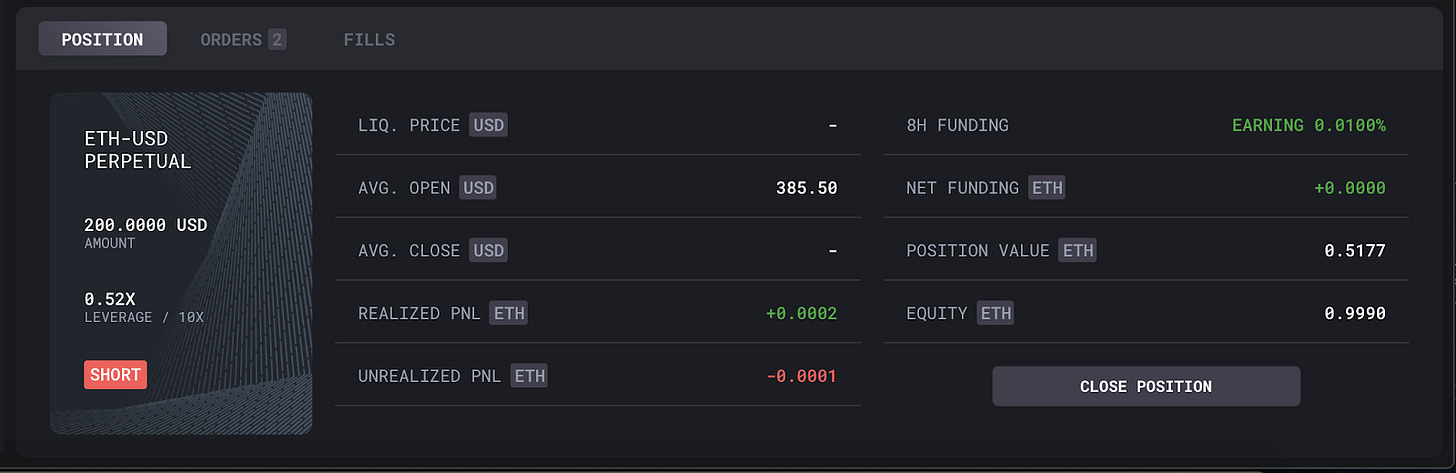

1.Once a long or short position is open, you can view it in the “position” tab in the bottom right-hand corner of the screen

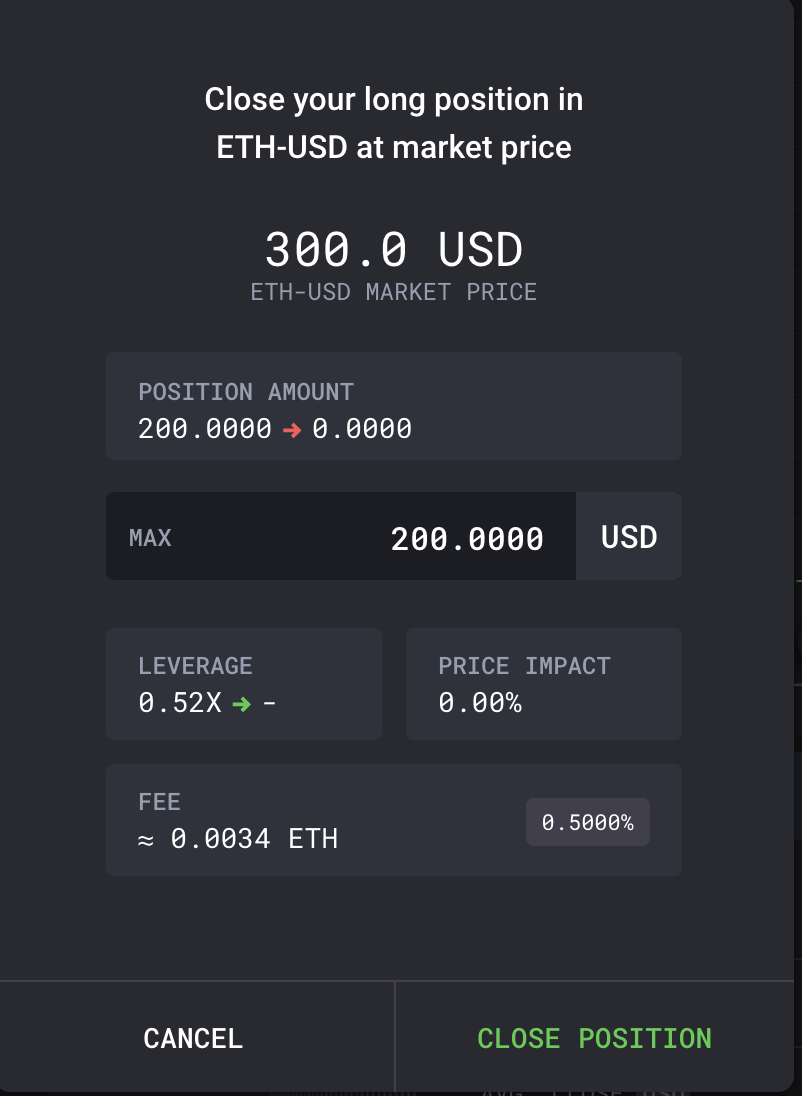

2.To close the position, simply click “Close Position” and confirm the amount of the position you want to close. To close your whole position, click “MAX” after clicking “Close Position.”

3.Sign message to close the order

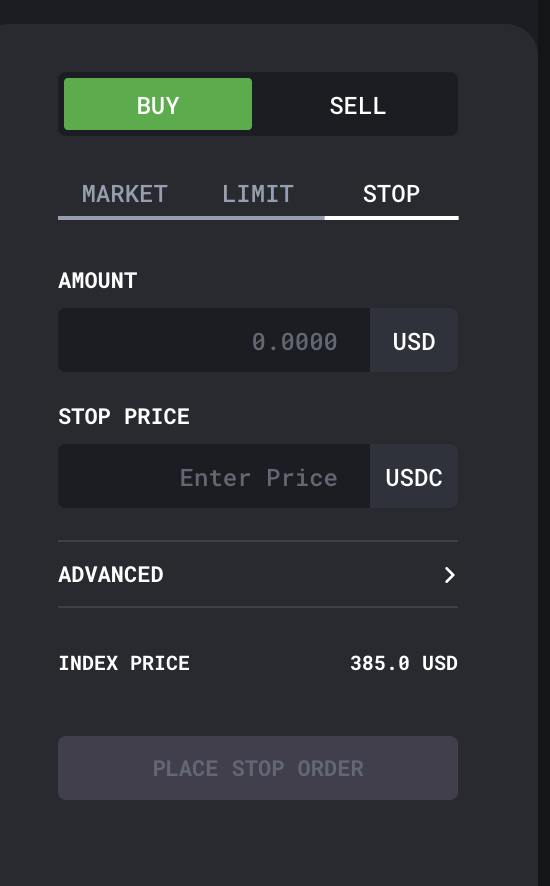

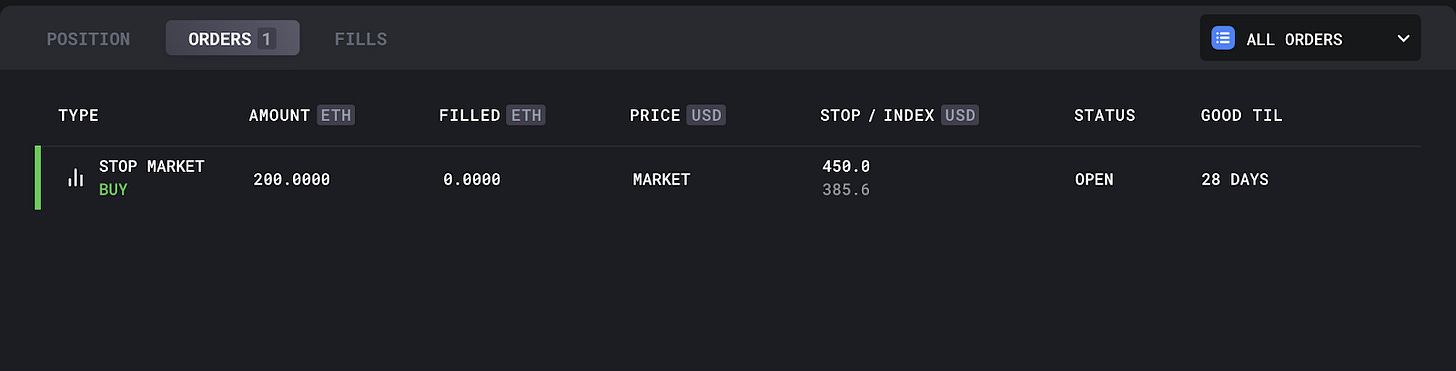

Set a Stop

A Stop order is used to execute a market order once a certain Index Price has been hit (also known as Trigger Price). This is commonly used to automatically lock in a certain amount of profit or loss once a target price has been hit.

1.To set a Stop, click the “STOP” tab on the left side of the screen

2.Determine the amount of ETH you want to buy/sell once the trigger price is hit. Click “Place Stop Order” and sign the message.

3.Your Stop order can be viewed in the “ORDERS” tab on the right side of the screen.

4.To cancel the order, simply hover over the order and click “CANCEL” and sign the message.

That’s it! You can now trade dYdX’s new ETH perpetual product.

Gnosis

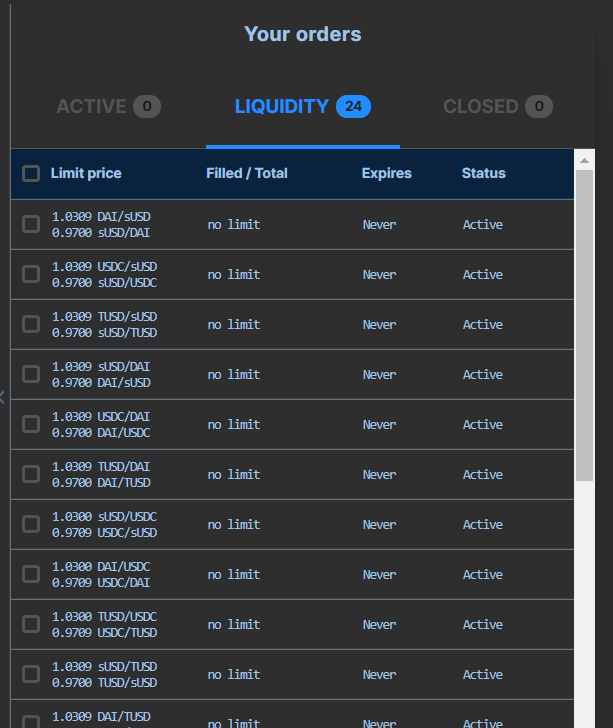

How to use Gnosis to profit on stablecoins

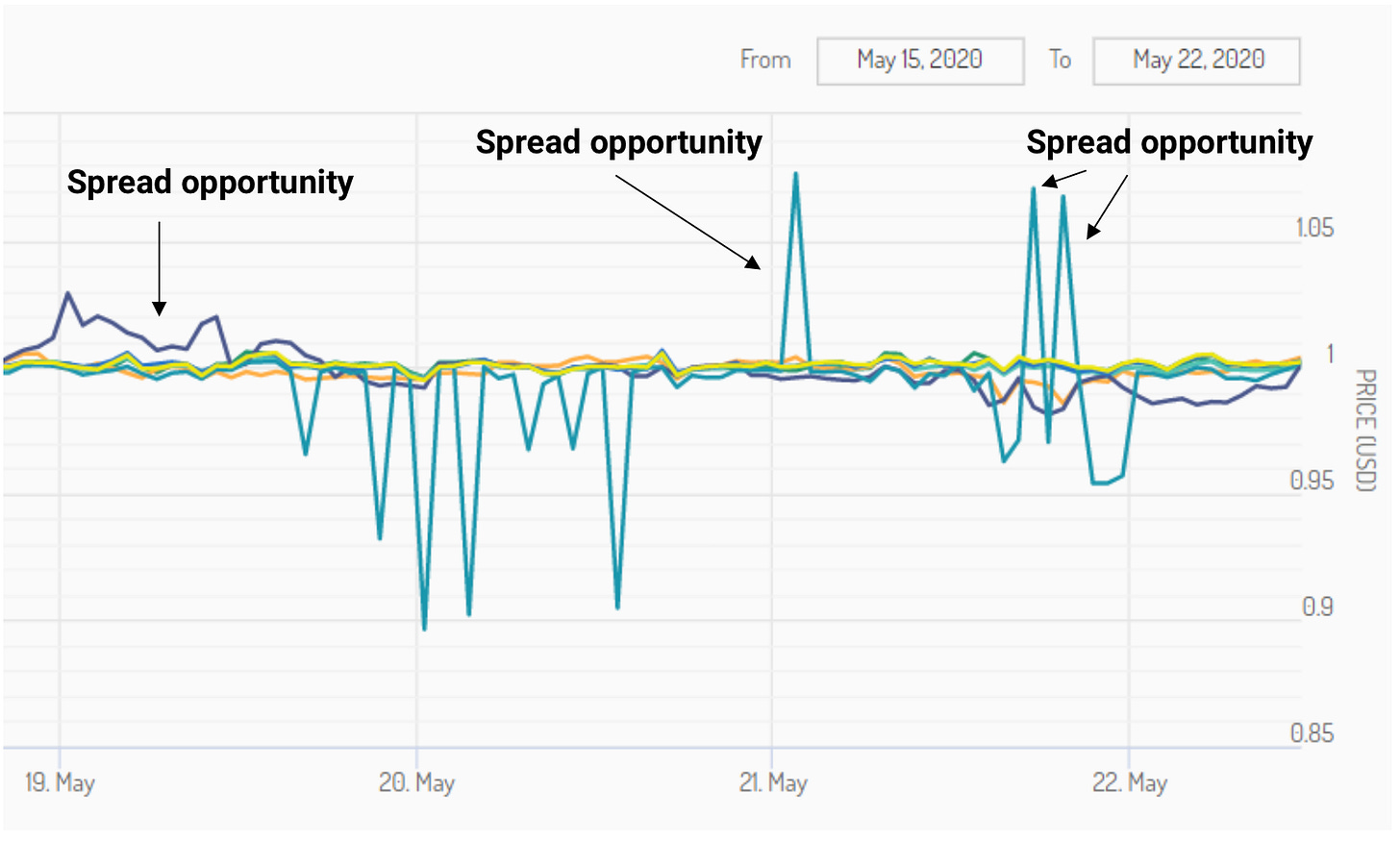

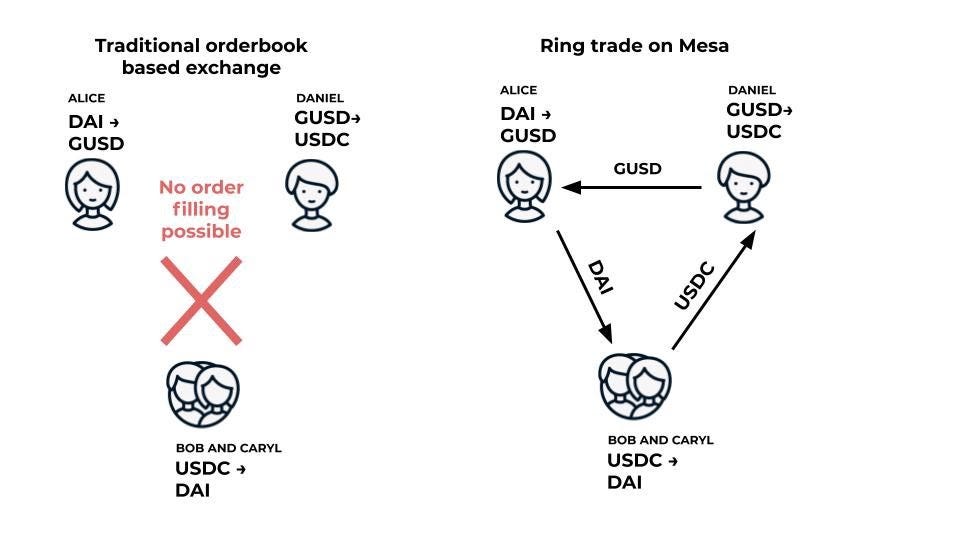

Stablecoins are low-volatility assets that approximately peg the US Dollar. However, in practice, stablecoins tend to deviate from the $1.00 price point. Let’s see how to use the Gnosis protocol through the Mesa exchange front-end to exploit this spread and make a profit. In the the process you’ll learn about the Gnosis protocol—the most trustless Ethereum exchange mechanism since Uniswap.

This is a chart of stablecoins.

Each of the spots where the lines are over $1.00 were opportunities to sell stablecoins at a spread using the Gnosis protocol and earn profits. This tactic will show you how.

But first, what is Gnosis?

Gnosis—the Liquidity Maximization Protocol

The Gnosis Protocol enables trading platforms to execute “ring trades”, which can match three or more people trading multiple assets. Detailed in the image below, this allows their orders to be fulfilled simultaneously when they would not have been able to otherwise.

Here’s the process:

Open orders are all laid out at the beginning of a five-minute batch auction

An open competition for the most optimal settlement solutions is run by solvers to maximize trader welfare and provide single clearing prices

After five minutes, orders are filled and settled on-chain by the time the next five-minute batch auction begins.

That’s it!

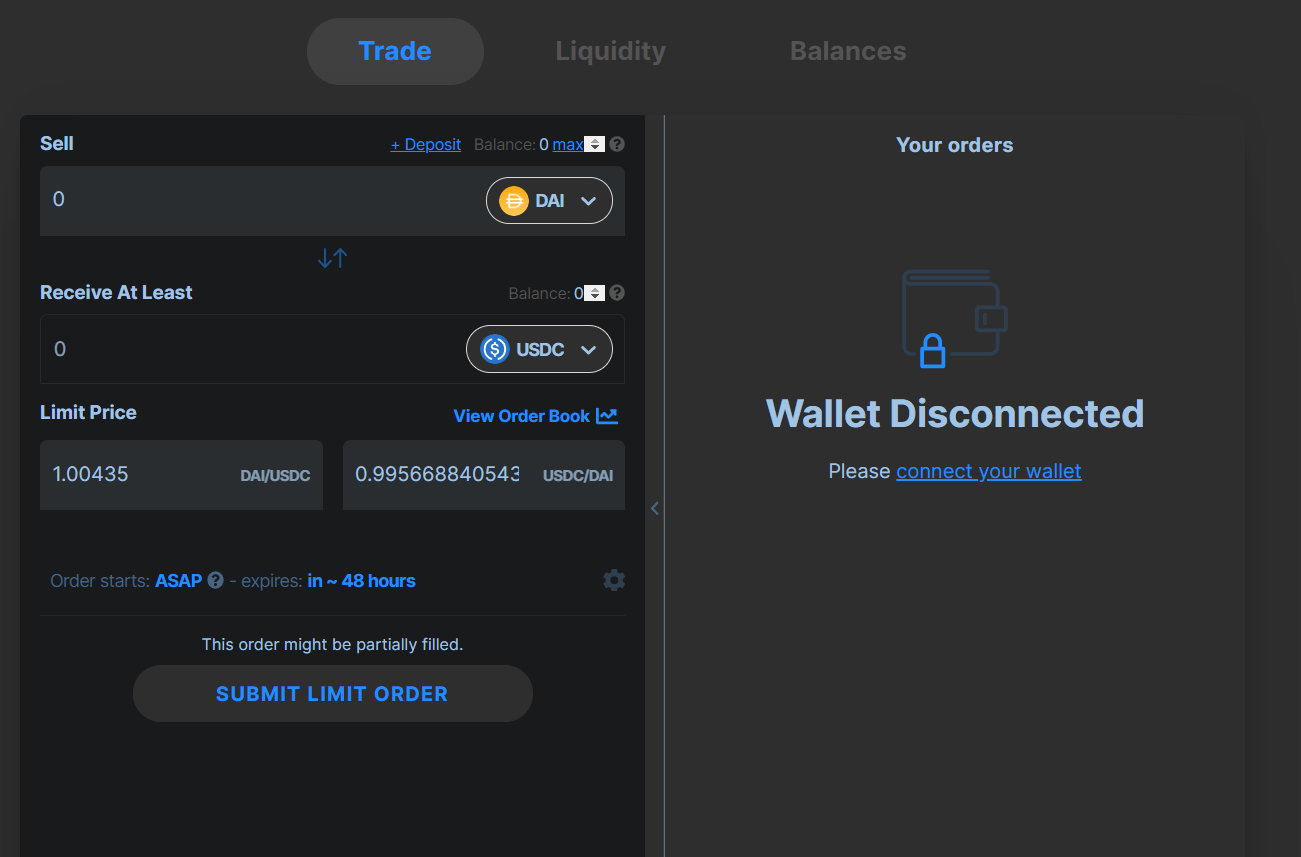

How to submit a liquidity order on Mesa

Let’s submit a liquidity order on Mesa and try this out.

1.Visit Mesa

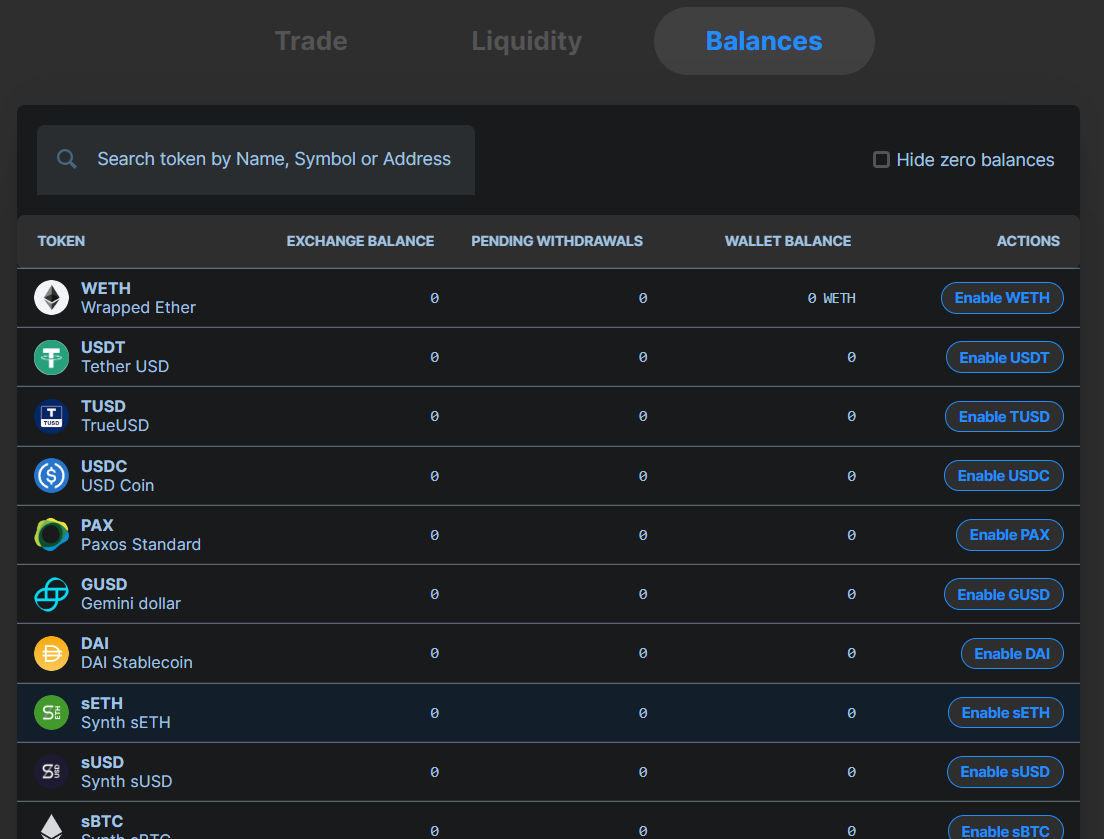

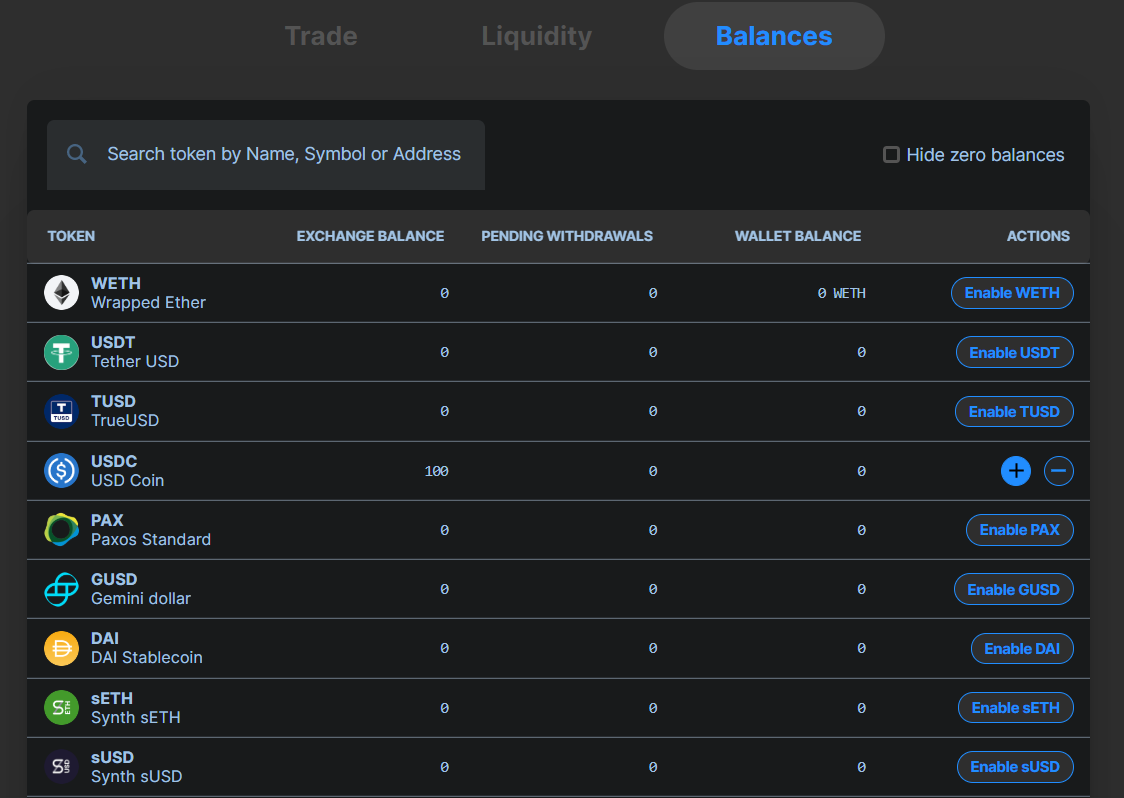

At the Mesa front page (mesadev.eth.link) you will see a place to trade your crypto on the left, as per usual for DEXes. After connecting your Metamask wallet, click “Balance” to see how funds are deposited into the platform.

2.Load funds

To load wallet funds into the exchange platform, click Enable, corresponding with the stablecoins you wish to deposit for your Liquidity Order.

Depositing with Metamask will prompt another signature request, and after your approval, you can move on to the next step by clicking the Liquidity tab.

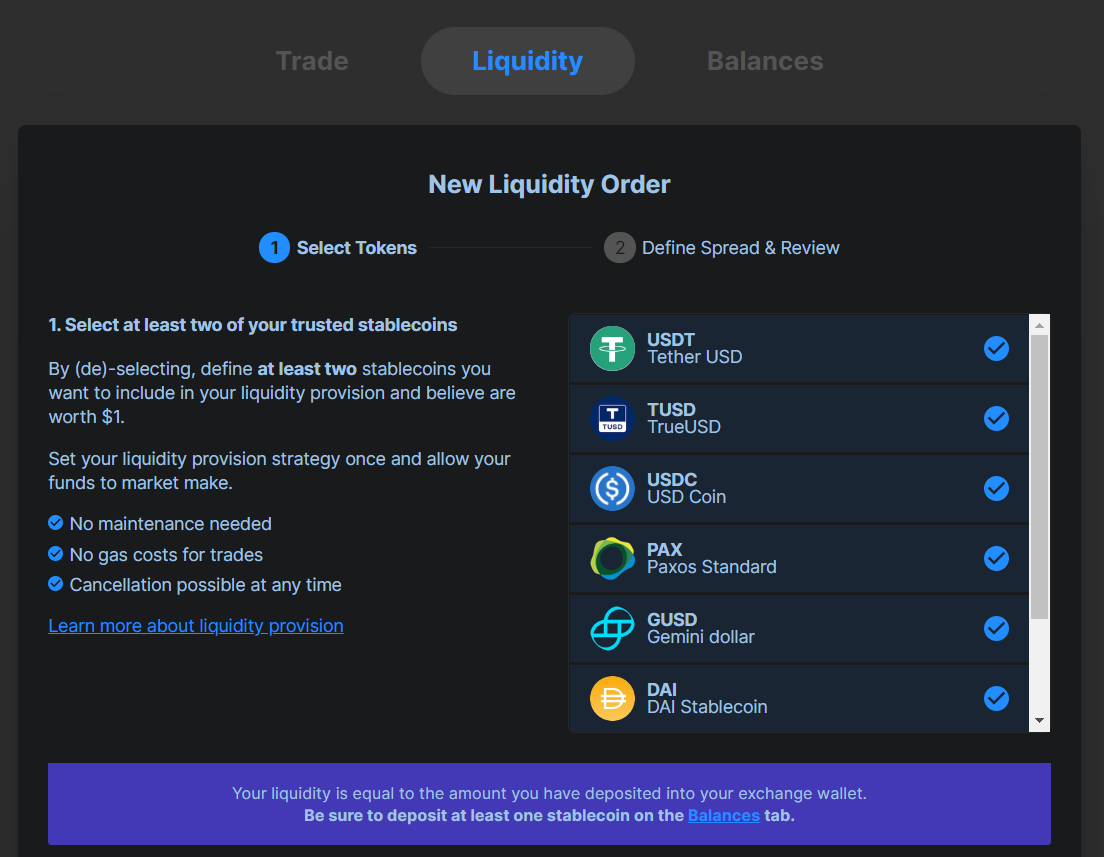

3. Set Liquidity Order

Now you will see the “New Liquidity Order” page, where you can select which stablecoins you wish to include. The more you include, the more opportunities your Liquidity Order will have. Before continuing make sure you select the stablecoins you wish to add to this order.

Some things to be aware of:

When you hit “Submit Transaction,” you may wish to lower gas fees to save on ETH. However, this may jeopardize order fulfillment, as there is only a 15-minute window for these transactions to be mined. It is recommended to either not lower, or raise the one-time gas fee for your Liquidity Order, so that miners can fulfill the transactions in time.

Once your Liquidity Order is submitted, there is no more work to be done. Transactions from here on are gas-free.

4.Sit back & wait

That’s it—your trading work is done.

You can check back periodically to see if profits are gained.

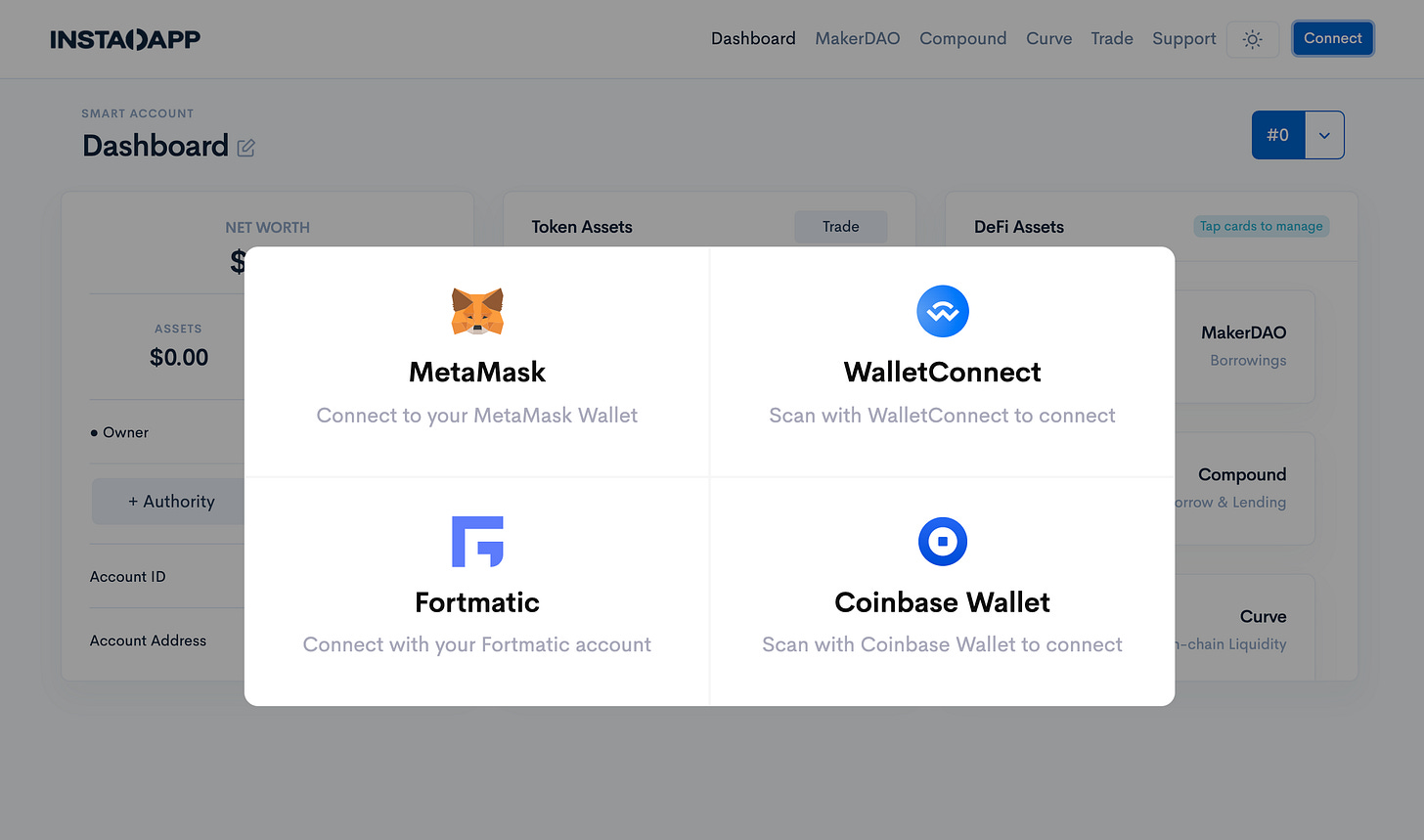

InstaDapp

Maximize Yield Farming Using InstaDapp

1.Get Started

Make sure your web3 wallet is connected successfully on Instadapp’s Dashboard.

Create a DSA if you have not already. Here’s a guide to help you connect your Metamask and create a DSA.

Once you have created a DSA, deposit the funds you’d like to play with from Metamask.

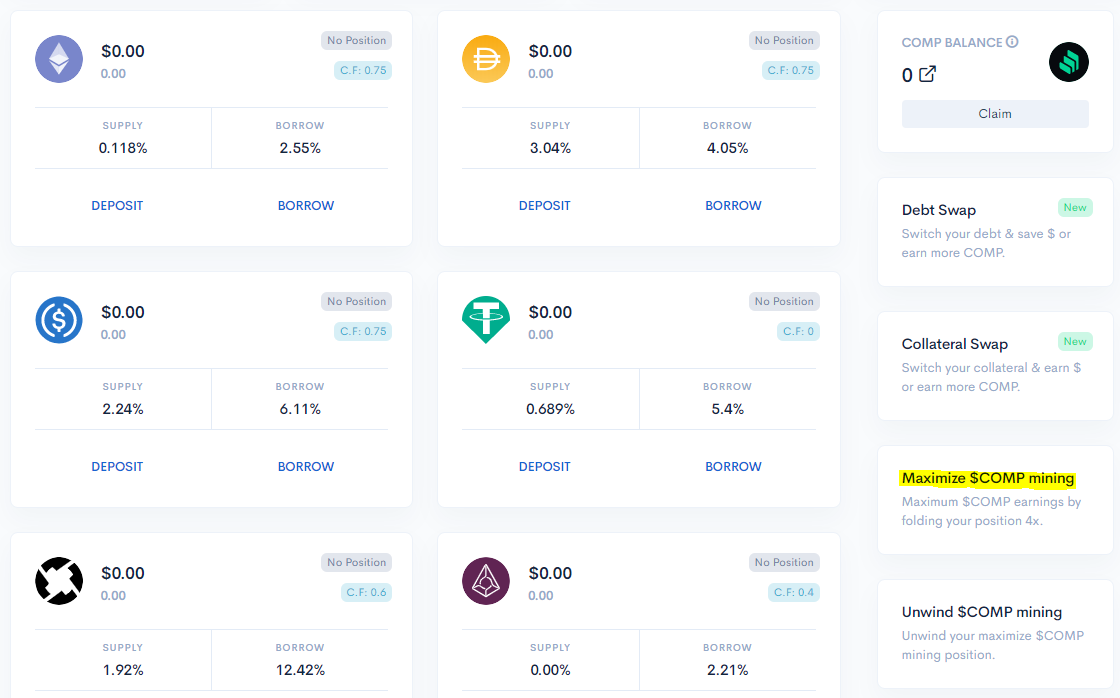

2.Maximize Your COMP Yield Farming

Once you’ve made the deposit, go to the “Compound” tab on the top right and deposit the stablecoins as collateral to begin maximizing your COMP earnings.

Click on the “Maximize COMP Mining” recipe on the Compound dashboard.

The “Maximize COMP Mining” is a recipe that groups three transactions. These transactions usually loop for 3–4 times, depending on your position — but at Instadapp, we use flash loans to abstract it into a single transaction.

Under the hood, you’ll be executing a loop of the following transaction in the similar sequence:

Borrow USDC debt

Swap USDC with DAI

Deposit DAI as collateral

This tool utilizes and maximizes your capital as efficiently as possible to accumulate more and more COMP.

In the current market situation, DAI <> DAI leverage gives you the best COMP return.

YES, you’re lending DAI to borrow DAI. Wild!

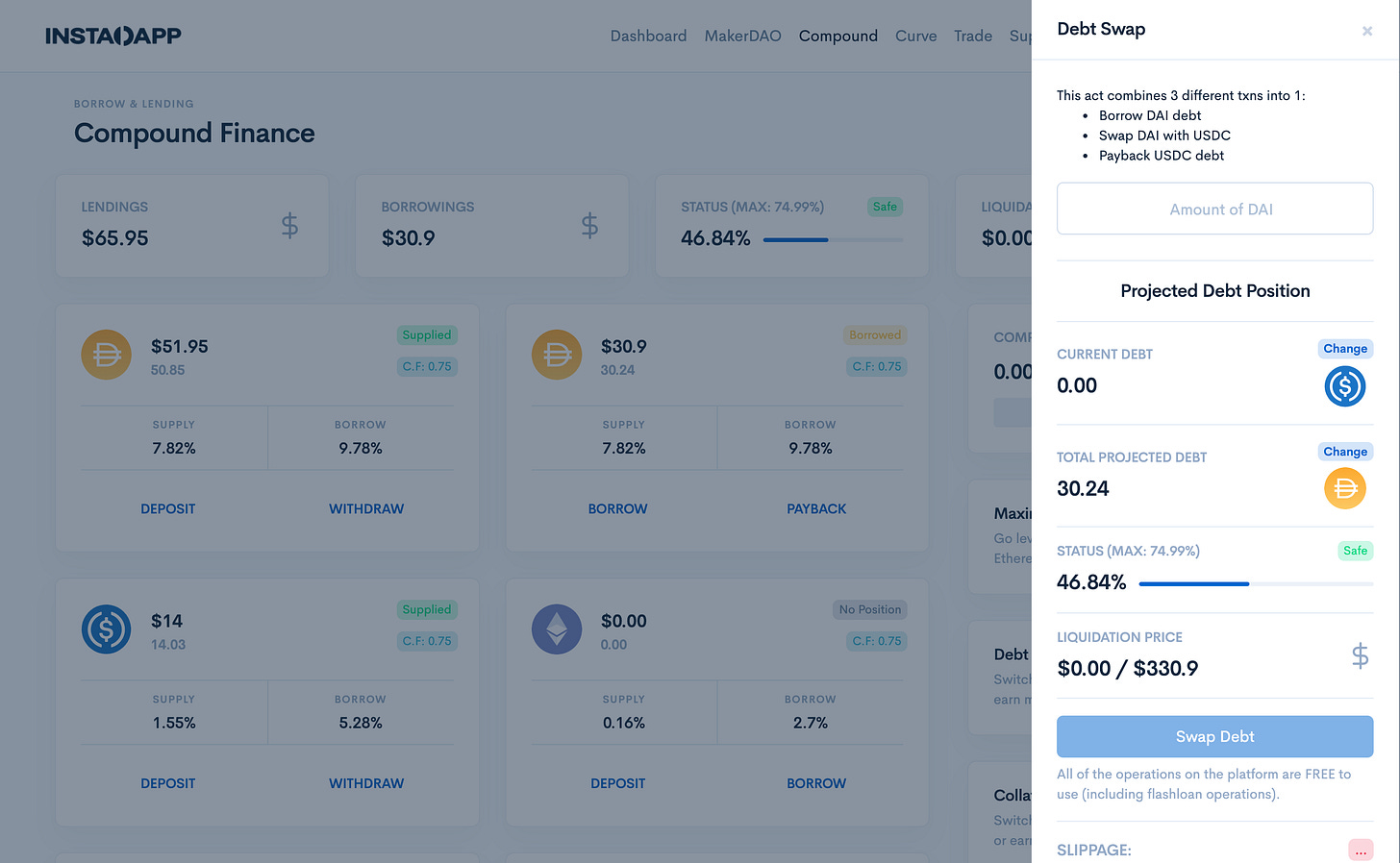

3.Debt and Collateral Swaps, “Crop rotation”

Flash loans are the powerhouse of DSA. They enable unique use cases such as “Debt Swap” and “Collateral Swap” to facilitate complex transactions by grouping them into a single transaction.

These types of swaps can be valuable as it allows you to swap your debt on Compound in a one-step single-click process. For example, you can easily swap debt from USDT to DAI, allowing you to pay less interest, earn more COMP, and save on transaction fees in the process.

You can execute this type of transaction by going to the “Debt Swap” recipe on the Compound dashboard.

MCDEX

Trade ETH perpetual on MCDEX

What is MCDEX?

MCDEX is a decentralized trading platform for perpetual swaps and futures on Ethereum. The mission is to make investing in DeFi more accessible by providing financial services for users with different risk appetites.

Currently, the ETH perpetual contract is live on main net using an on-chain AMM and off-chain order book hybrid model.

With MCDEX, traders can long and short ETH with up to 10x leverage without taking custody of other assets, only ETH.

Liquidity Mining & MCB

In a nutshell, users can get MCB, MCDEX’s native token, by providing liquidity to the AMM pool.

The MCB token will allow key stakeholders of the MCDEX platform, i.e takers, liquidity providers, contributors of trading strategies, DeFi developers, etc, to participate in the governance to achieve sustainable and robust development.

Review of Perpetual Markets

A perpetual contract is a futures-like product but without an expiration date.

Since its inception, perpetuals have become one of the most popular instruments for crypto trading. Its trading price is anchored to the underlying asset price index through a funding payment mechanism (called the funding rate).

The funding payment balances out between long and short positions by charging between them. While CeFi platforms hold customer deposits and control the overall functioning of the platforms, DeFi platforms like MCDEX are non-custodial.

This is the primary reason why trading a perpetual contract on a decentralized exchange is far more beneficial than trading on a centralized exchange such as BitMEX. The fact that decentralized exchanges have no control over your funds, it’s much safer to trade on decentralized exchanges.

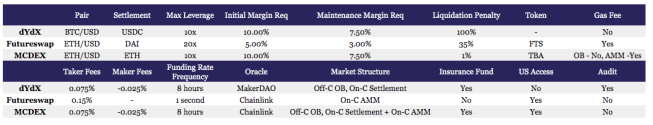

While MCDEX, dYdX, and FutureSwap offer similar products, each DEX has taken a different design approach with both their contract specifications and infrastructure.

Here’s a concise overview of each exchange and their respective perpetual swap products:

mStable

Opyn

Make money selling ETH options with Opyn

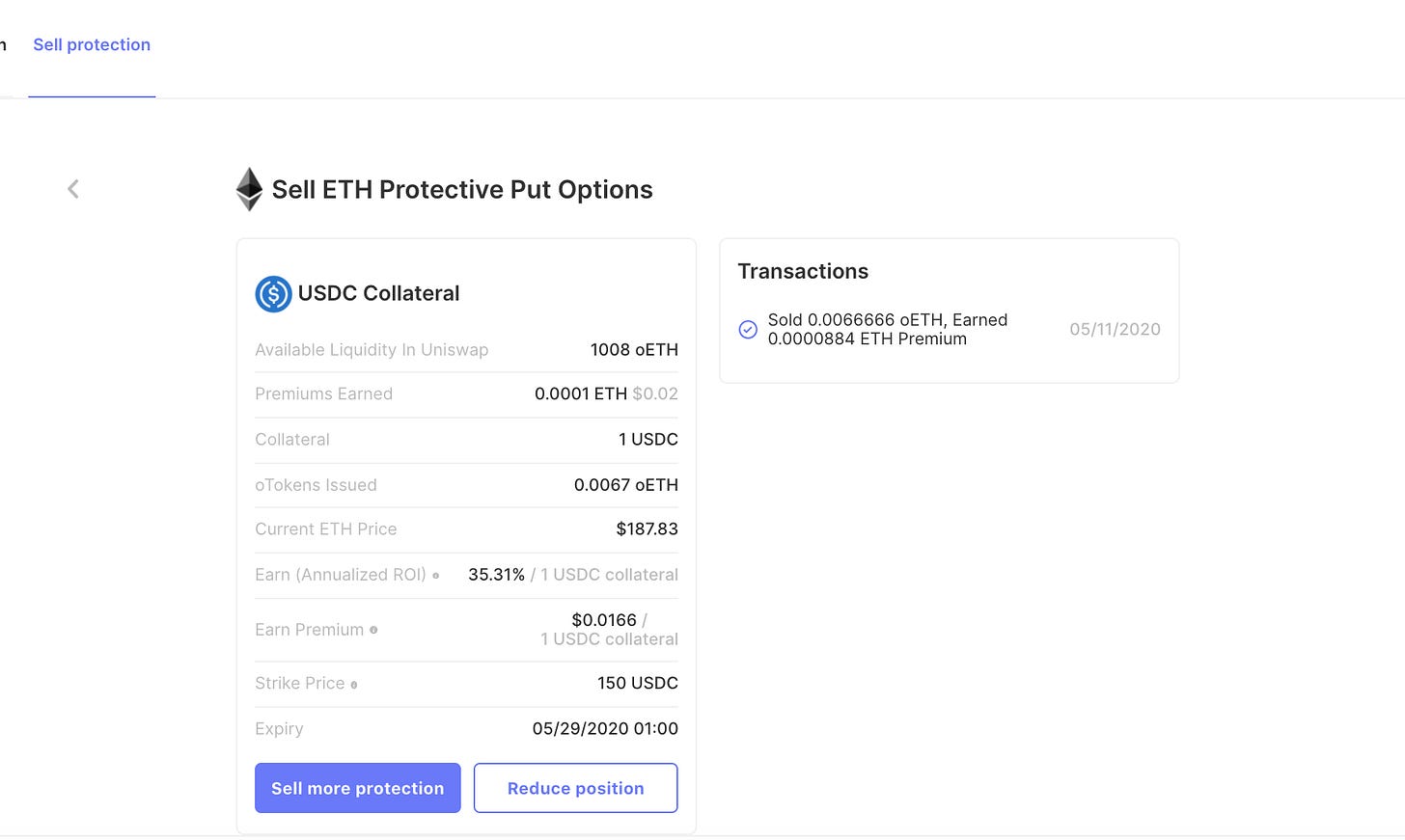

Selling Put Options

By selling a put option on ETH, you are selling someone the “right but not the obligation to sell you ETH at a pre-specified price”.

If the price of ETH remains above the strike price, then the seller of the option keeps the premium they earned for selling the option and is able to withdraw their USDC upon the option expiring.

If the price of ETH falls below the strike price, then the seller of the option may be obligated to buy ETH at the strike price (which could be higher than the market price of ETH). The image below demonstrates the payoff for a seller of a $200 Strike Put option on ETH.

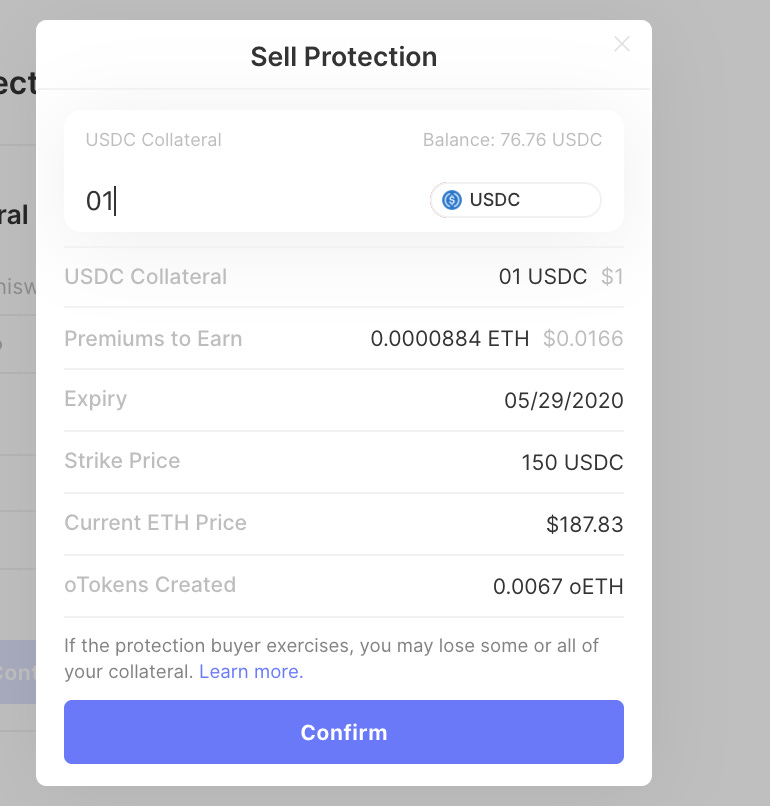

How to use Opyn to provide ETH protection to other users

Requirements: The following section only works on a desktop browser. You will need your computer and MetaMask for the following to work.

You will also need some USDC and ETH (for gas) in your wallet.

Note: Gas is very expensive these days. In order to make a positive ROI by selling ETH options on Opyn, you’ll need a fair amount of capital to get started. I’m recommending at least $500+.

1.Go to https://opyn.co/#/sell

2.Connect your wallet by clicking the “Connect Wallet Button” on the top right corner.

3.Scroll down to the “Sell Protective Put Options on ETH Section”.

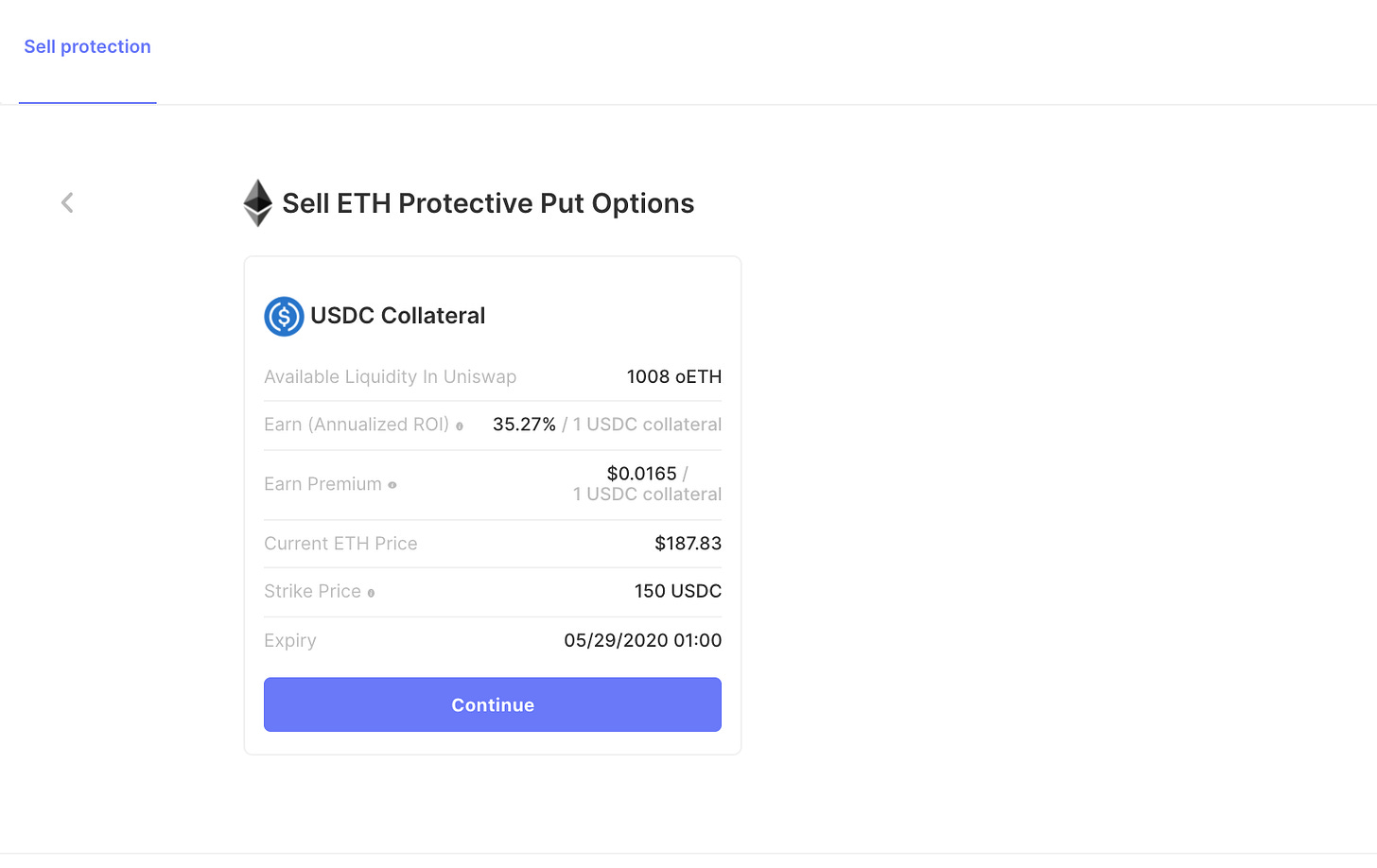

The expiry is the date that your protection will expire on. You are providing protection until that date.

Strike Price is the pre-specified price that you are agreeing to buy ETH at if ETH falls in price. You are effectively selling someone “the right but not the obligation to sell you their ETH at that price (the strike price)”.

The earned premium is how much you could make upfront per 1 USDC that you lock up as collateral.

The Annualized ROI is what your returns over the course of a year could look like if you continued to earn the current rate of premiums.

Choose the parameters that work best for you and click on that specific row.

4.You should see the page below. Click on the continue button if the strike price, expiry, earn premium all look good to you.

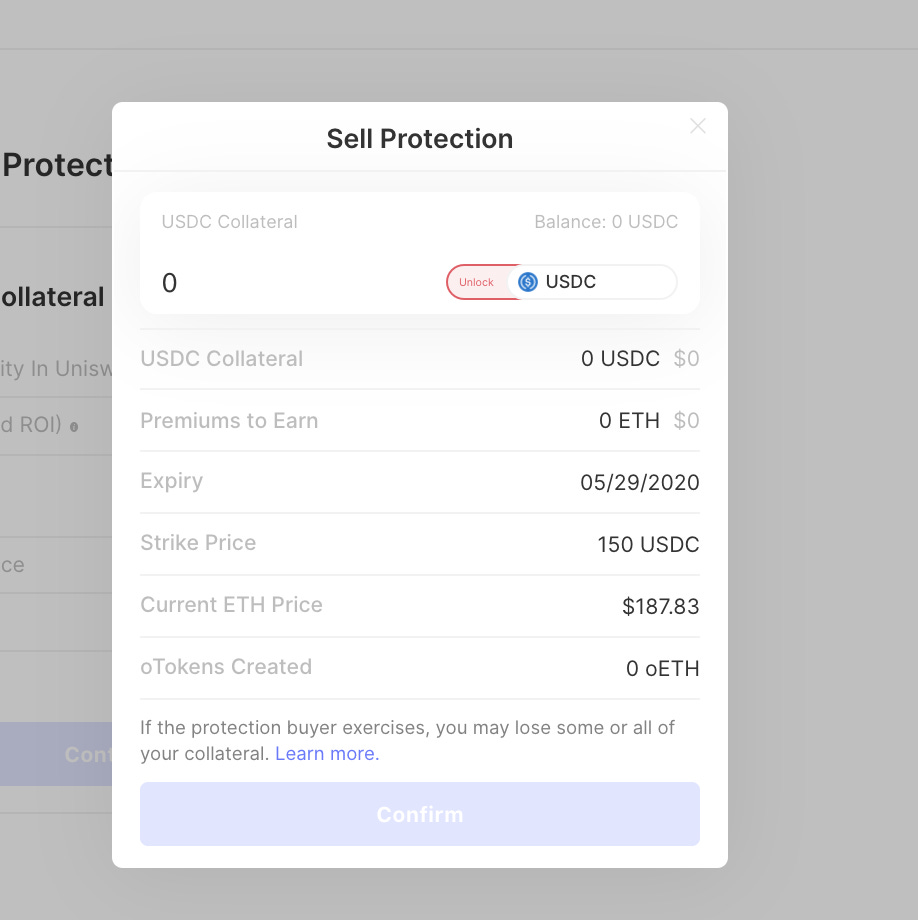

5.Unlock the modal that you see below to allow the contract to spend your USDC.

6.Enter the amount of USDC that you want to put down as collateral

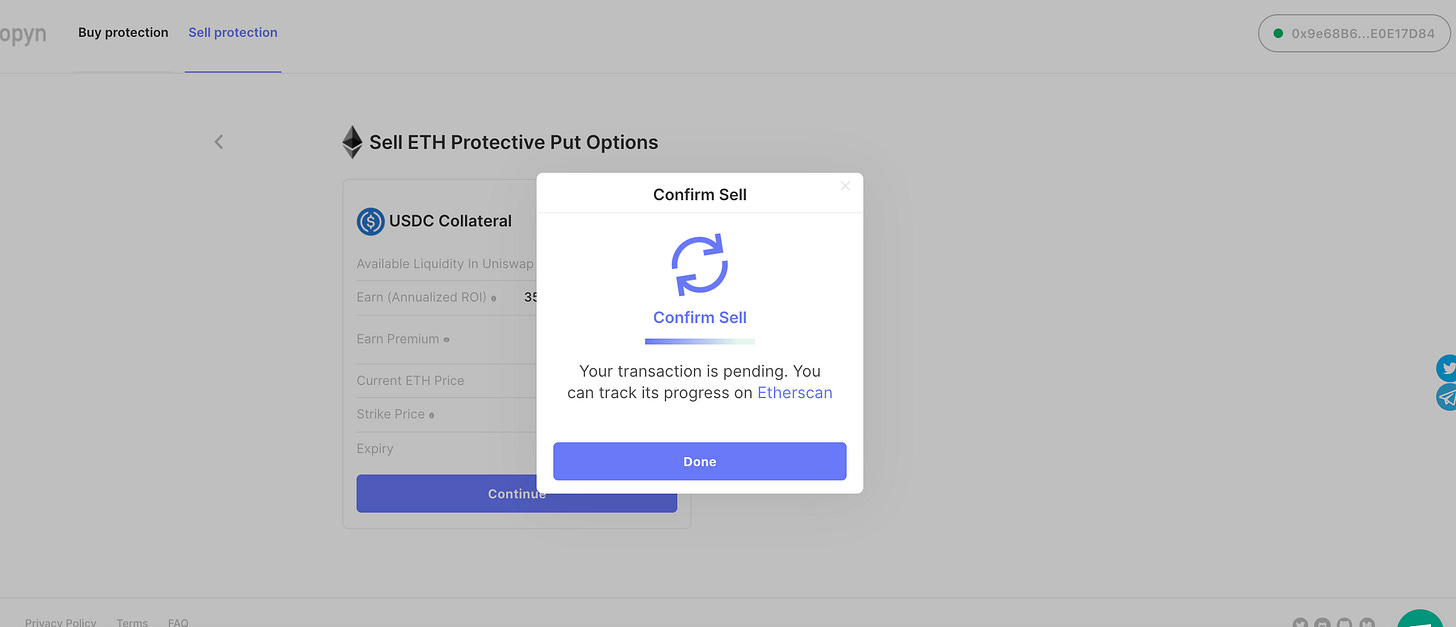

Click “confirm” and approve the transaction through MetaMask. Once that is done, you should see a screen like this

Once the transaction has been confirmed on Ethereum, you should be able to see your position on this page. Refresh the page to see the new view.

And that is it! You have earned a premium by selling a put option. You should see the ETH in your wallet.

What happens now?

If ETH falls below the strike price, you might get exercised on. In other words, someone might sell you their ETH for the USDC that you have locked in the vault.

Polymarket

Set Protocol

Synthetix

Speculate on DeFi tokens with binary options

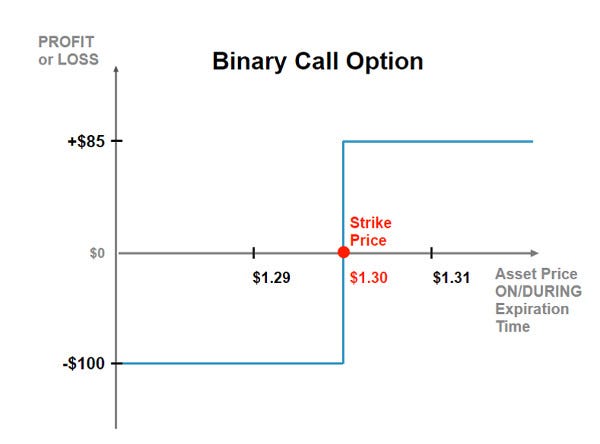

How do binary options work?

Let’s consider two implementations of binary options in DeFi: Synthetix and Opium.

The Synthetix implementation of binary options is based on so-called “Pari-mutuel markets” (yes that’s the correct spelling), which means that the payout of winners to losers is determined by the relative capital pool size of longs and shorts.

Pari-Mutuel = Bet Together. This means all bets go into one pool so the price of any given contract reflects the opinions of market participants. In other words, you are competing against other participants, not the house.

Every binary options market on Synthetix has a “bidding phase” in which traders can place bids for long and short positions.

After a fixed time period, the bidding phase is closed and the payouts are fixed based on the spread between long and short bids. Traders can then either trade their positions on secondary markets or wait until maturity. At maturity, the winning traders can exercise their options for the previously determined payout. Traders can specify how much margin they want to lock upfront, however, their potential payoff is unknown until a later stage.

On Opium, binary options are implemented based on a fixed initial margin which means that the maximum payoff of losers to winners is known upfront and therefore risk is mitigated. Professional traders who use options to hedge their trading risks generally prefer this implementation of decentralized derivatives. Traders can get the desired price exposure through buying a certain volume of long or short contracts for the right price (eg. a trader buys 3 binary options contracts on Opium with $50 margin each to have a total of $150 invested).

In comparison, Synthetix currently offers more markets and guaranteed execution. Binary options on Opium are more predictable and therefore more suitable for traders that want to hedge risks, however, execution of trades is depending on liquidity.

Zerion

Use Zerion to build a crypto portfolio

Zerion lets you build a crypto money portfolio of any size for $1. No management fees, no middlemen, and no bank. Here are three portfolio templates you can use:

1.Stable portfolio

Possible annual returns: 3-8%

As the name suggests, this is the portfolio with the lowest risk, mainly consisting of stablecoin bets locked on Compound to produce fixed income yields (3-8% annually). The second component of this portfolio provides liquidity to Uniswap to produce income. This is a stable, relatively low risk, fixed income style portfolio.

60% stablecoin bets (50% DAI on Compound, 50% USDC on Compound)

40% Uniswap Pools (60% ETH-DAI, 40% ETH-USDC)

ENS: stable.zerion.eth

Possible these swap-outs:

Swap DAI on Compound for DAI in the DAI Savings Rate–a way to remove risks inherent in Compound will keeping similar returns (trackable in future versions of Zerion)

2.Bankless portfolio

Possible annual returns: -60% to +300%

Balanced portfolio with heavy weighting on crypto money bets. The rest is put into bank bets to have exposure to money protocols (DeFi) with some liquidity remaining in Stablecoin bets for fixed income yields.

70% money bets (75% ETH / 25% BTC auto-balanced using ETHBTC7525 Set)

20% bank bets (MKR—50%, SNX—15%, KNC—15%, REN— 5%, LEND— 5%)

10% stablecoin bets (50% DAI & 20% USDC Compound, 30% ETH-DAI Uniswap)

ENS: bankless.zerion.eth

Consider these swap-outs:

Swap the ETHBTC7525 Set for 75% ETH and 25% BTC to reduce smart-contract and wBTC custody risk (but lose auto-rebalancing)

Swap out half of the DeFi bank bets for CeFi bank bets by adding sCEX which is a synthetic that tracks the top centralized exchange tokens—I’d wait until Snythetix is more tested and sCEX is more widely tested

Swap DAI on Compound for DAI in the DAI Savings Rate

3.DeFi Maximalist portfolio

Possible annual returns: -60% to +300%

Portfolio that bets on the growth of the DeFi money protocols primarily. It mainly consists of ETH, money protocol tokens, and highly used Uniswap liquidity pools.

50% bank bets (25% MKR, 25% SNX, 25% KNC, 25% LEND)

30% money bets (100% ETH)

20% Pools (50% Uniswap ETH-MKR, 50% Uniswap ETH-DAI)

ENS: defimax.zerion.eth

Consider these swap-outs:

Swap out some of the bank bet tokens for other money protocols such as REN, ZRX, LINK, LRC, MLN or others

Swap out the ETH bet for a Set like ETH 20 Day MA Crossover which tends to perform better than pure ETH in bear, neutral, or moderate bull markets

Check back tomorrow to see more of this list completed!

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.