Doc's Daily Commentary

Mind Of Mav

Bloody Saturday: What Crypto’s Sell-Off Is Indicative Of

The biggest event of last week is undoubtedly the “Bloody Saturday” crash, led by Bitcoin declining nearly 20% in a matter of hours. Nearly every other crypto followed suit immediately afterward, liquidating billions of dollars worth of crypto assets.

While the name given to this latest market event is somewhat exaggerated and ill-fitting, analysts are rightfully concerned about the market. But where one group of investors sees fear, another sees opportunity.

The strong plunge in crypto values is related to a wider selloff in equities and led by Wall Street, in response to long-awaited changes in the Federal Reserve’s monetary policy. Other factors, like the Omicron variant outbreak and holiday season tax-loss harvesting also play a role. Taken altogether, these individual events created perfect storm conditions for a significant market correction.

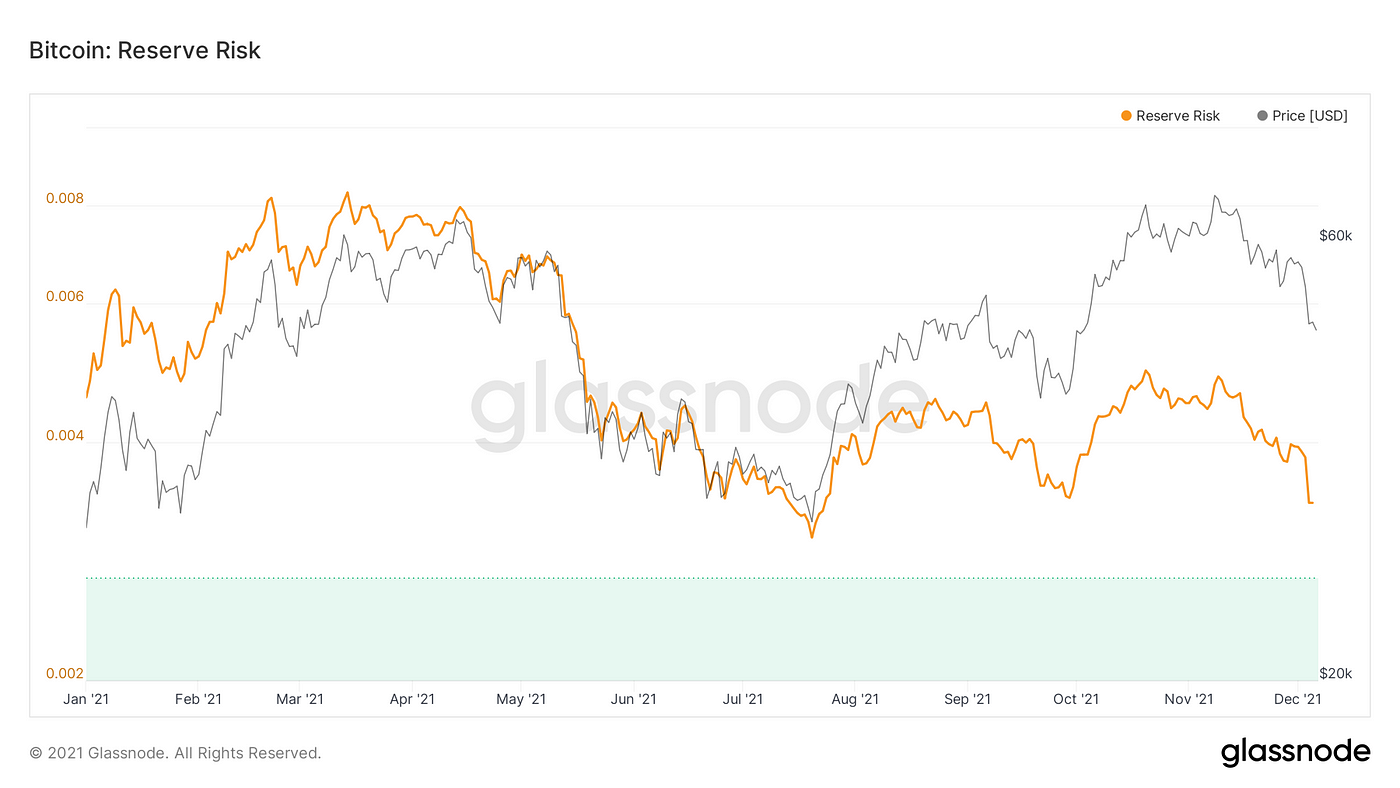

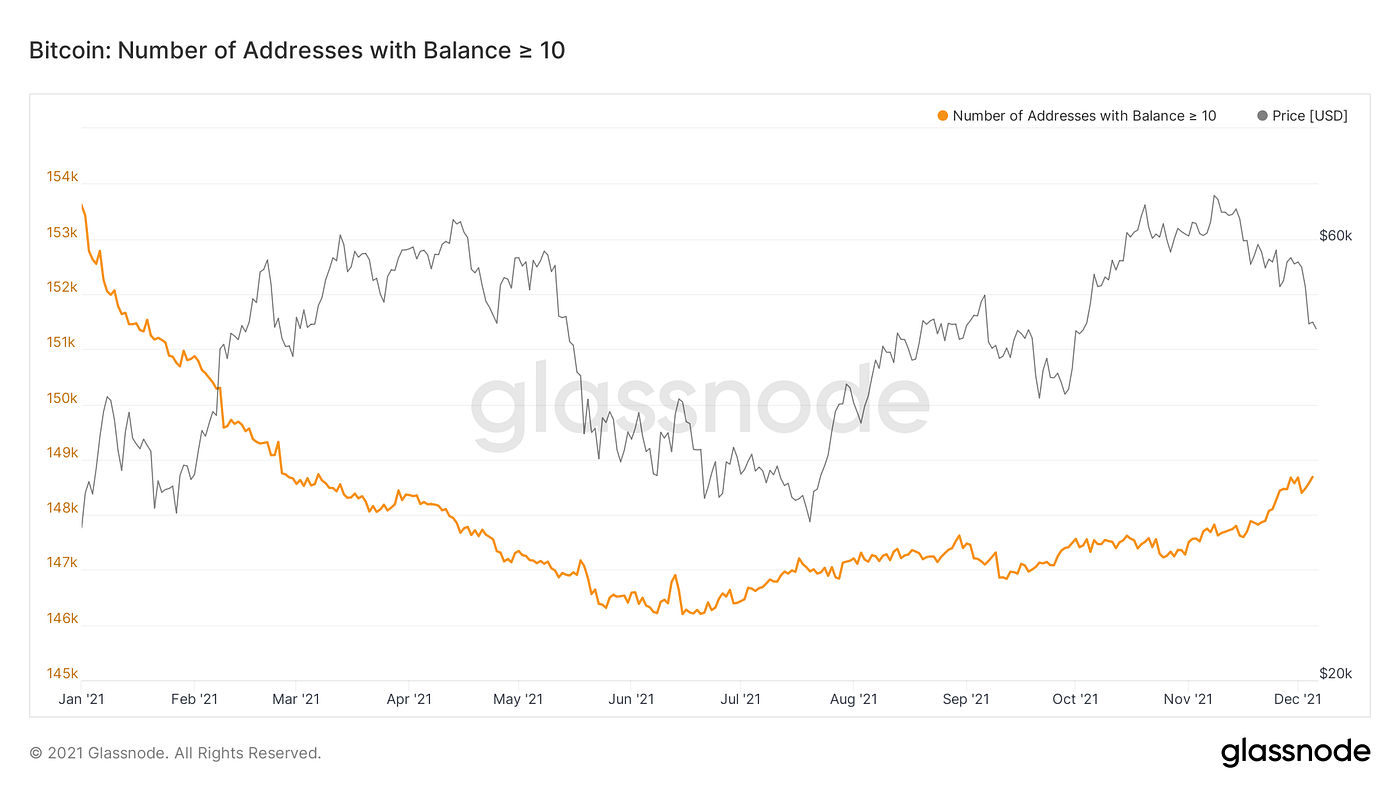

While all these negative factors have contributed to a massive decline in Bitcoin exchange price, on-chain metrics continue to turn stronger. The Reserve Risk ratio saw a sharp decrease this week, indicating a bullish sentiment. Additionally, investors are continuing to accumulate, as addresses with more than 10 Bitcoin continues to grind higher even with this recent stumble.

Federal Reserve Tapering

The Federal Reserve has adopted an extremely loose monetary policy since the beginning of the COVID-19 pandemic, flooding the market with money in order to keep the economy running. This stoked inflation fears, which led to massive investments in crypto, especially Bitcoin, throughout the pandemic era.

Now, the Federal Reserve is planning to rein in its $120 billion-per-month bond purchases and tighten monetary supply, which, according to Jerome Powell, should reduce inflation and promote a healthier economy in the long run. Hedging against inflation, many investors flee to Bitcoin to find a path forward through the chaos that might ensue.

Omicron Fears

The last week has been volatile across the board when it comes to the impact of the highly mutated Omicron coronavirus variant. New cases are being reported across the globe, and very little data is available on the variant itself. It is still not clear whether it is deadlier than other variants, or whether vaccines are equally effective against it.

This creates an uncertain environment for investors, who are stuck deciding between two potential playbooks — the “restrictions and lockdowns” playbook and the “pandemic recovery” alternative that was just starting to take shape. Under the former, we can expect market dynamics similar to those that played out after the first restrictions were announced in March 2020. Vaccine and work-at-home stocks like Moderna, Pfizer, and Zoom rose first, and Bitcoin followed the upward trend towards the end of the year.

The latter scenario is also bullish for Bitcoin, but with less of a delay. Bitcoin’s relatively constant growth since its July 2021 lows is distinctly linked to pandemic re-opening. If that re-opening continues, we can expect business-as-usual for Bitcoin, despite the corrective action of the past week.

Tax Harvesting

As 2021 winds down to a close, crypto investors are looking for ways to lock in the year’s gains or cut down their taxable income. This might explain why such a large number of Bitcoin holders are selling their positions even now, at rates lower than the cryptocurrency’s all-time high from last month.

While BTC is trading significantly lower than it was earlier, it’s still up more than 60% from the beginning of the year. Some investors expect more volatility to come in January, just like it did then, and might be hedging their bets in order to swing back into Bitcoin at an even lower price.

Investors who already posted significant gains from Bitcoin’s price movements throughout the year may be looking for reportable losses that will ease their tax burden. Anyone who bought high and sold low might end up owing less in taxes for the year — even if they buy back in right after.

Liquidation Cascade

One of the lesser-known factors playing into Bitcoin’s dip is the liquidation of Bitcoin futures, which occurred at the same time as the other factors impacting the cryptocurrency’s valuation. Derivatives traders added a great deal of downside pressure over the weekend, but futures may now form some positive momentum from Bitcoin’s current valuation.

Bitcoin still faces a giant futures gap in the upcoming week. CME futures closed at $53,545 on Friday, which is significantly higher than post-correction spot price levels. The price of Bitcoin should rise to meet that gap, which would allow it to reclaim its $50,000 support position and retain its $1 trillion market capitalization.

The number of leveraged traders and their influence on the market is much higher now than it ever was in the past. This might mean that Bitcoin’s price correction was driven more by technical factors than by actual market sentiment — which remains bullish overall.

El Salvador Buys the Dip

One person who is bullish on Bitcoin despite the correction is the Salvadoran president Nayib Bukele, who bought 150 BTC at $48,670 on Friday. The president announced on Twitter that he missed the market bottom by only seven minutes. The Central American country now has a reserve of almost 1500 BTC.

El Salvador has already formed a pattern out of its progressive dip-buying. These interventions have turned the tiny nation into an informal central bank propping up the cryptocurrency. Given enough time and leverage, it may gain the ability to intervene in exchange markets to keep the currency stable the way typical central banks do.

President Bukele offered a unique glimpse into that ambition earlier this week when he urged Federal Reserve Chairman Jerome Powell to “stop printing money” for fear of “making things worse.” This is particularly interesting since inflation fears have been one of the primary drivers of Bitcoin’s price growth in the last couple of years. Time will tell how this policy plays out for Bitcoin holders and the Salvadoran people.

Hash Rates

One of the factors indicating bullish market sentiment towards Bitcoin is the volume of network activity using the Bitcoin protocol. Depending on how you calculate the network’s hash rate, this figure is either approaching or surpassing its all-time high.

Bitcoin’s seven-day average currently figures around 162 exahashes per second, which is just below the record set in May before China cracked down on its mining market. According to MiningPoolStats, the hash rate is at its highest-ever sustained levels. This means that the difficulty of the Bitcoin hash algorithm is likely to increase by nearly 1% within the next week, which will impact supply and drive prices upwards.

It has been a difficult week for Bitcoin holders, miners, and other industry stakeholders, but there are plenty of good reasons to remain bullish on the cryptocurrency market. While some investors are undoubtedly experiencing short-term pains, the market as a whole is far from a true panic selling situation. It may be best to look at this period of time as a test of cryptocurrency investors’ resolve, and hold onto your portfolios — or add to them while the timing is right.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.