Doc's Daily Commentary

Mind Of Mav

The Rise Of MachineFi: Why It Matters

Blockchains are financialization-to-everything protocols: endowing objects (like jPegs of memes) with scarcity. And scarcity attracts markets (aka financialization) like a magnet does iron shavings. Thanks to blockchain we have: DeFi (Decentralized Finance) and GameFi (Game Finance) headlining the explosion in [X] + Fis. Helium protocol even has a decentralized market for device connectivity and 5g (which they call “FreedomFi”).

So MachineFi, put simply, is the financialization of machines, or, more precisely: internet-connected devices. One obvious question is why? Why do devices need financialization or decentralized markets?

When Amazon’s internal cash register rings in the sale of internet-connected devices like Alexas or Apple Watches, it marks the beginning—not the end—of the financial contract between buyer and seller. This is why tech companies are willing to sell devices at, or even below, cost. In other words, the financialization of internet-connected devices already exists in a rudimentary way. It’s just that all the spoils go to big tech firms. Whose predatory data collection is now the stuff of legend—thanks to Netflix’s “The Social Dilemma,” high profile depositions, and a barrage of media coverage generally.

What is MachineFi?

So MachineFi takes the riches generated by device-financialization from big-tech and decentralizes it to actual users, which is what web 3.0 is all about: changing the financial model of the internet (and now devices) from platform advertising to user ownership (often through the broad distribution of a token). Here’s a nifty web 3.0 koan that a16z’s Andrew Chen shared on LinkedIn the other day:

Web 1.0: Read.

Web 2.0: Read/Write.

Web 3: Read/Write/Own.

Blockchain is how we get to “own.” So you can think of MachineFi as shorthand for “web 3.0 for devices.” So where Ethereum is the foundational web 3.0 protocol for internet applications (roughly speaking), MachineFi projects will provide the web 3.0 protocol for devices. And web 3.0 is no fringe pipe-dream, it’s barreling down the tracks of innovation like a Japanese bullet-train: Drawing the likes of ex-Twitter CEO Jack Dorsey to abandon the helm of one web 2.0’s most prominent companies in favor of web 3.0.

Now let’s dive into how MachineFi works, by analogy, with the U.S. mortgage market. I know facts about mortgages are no NBA finals in terms of excitement, but hang with me here.

The value generated by the “internet of things” from now until 2030, according to McKinsey, will be $12.6 trillion. And while this isn’t a one-to-one comparison, the primary US mortgage market was just under $17 trillion as of early 2021. Which gives a sense of the opportunity. In other words: Machines could become as important to household wealth as homeownership. This is a radical claim. But one that seems plausible given the rate of automation. The problem is, without MachineFi, this wealth will accrue to the balance sheets of a few powerful tech giants. The average person risks being shunted outside the economic arena in the face of automation. MachineFi is about addressing this inequality—giving everyone the financial tools to participate in our economic future.

MachineFi and US Mortgages

Everyone knows homeownership is one of the pillars of wealth for the average American household. Case in point, primary residences make up 26 percent of US household wealth.

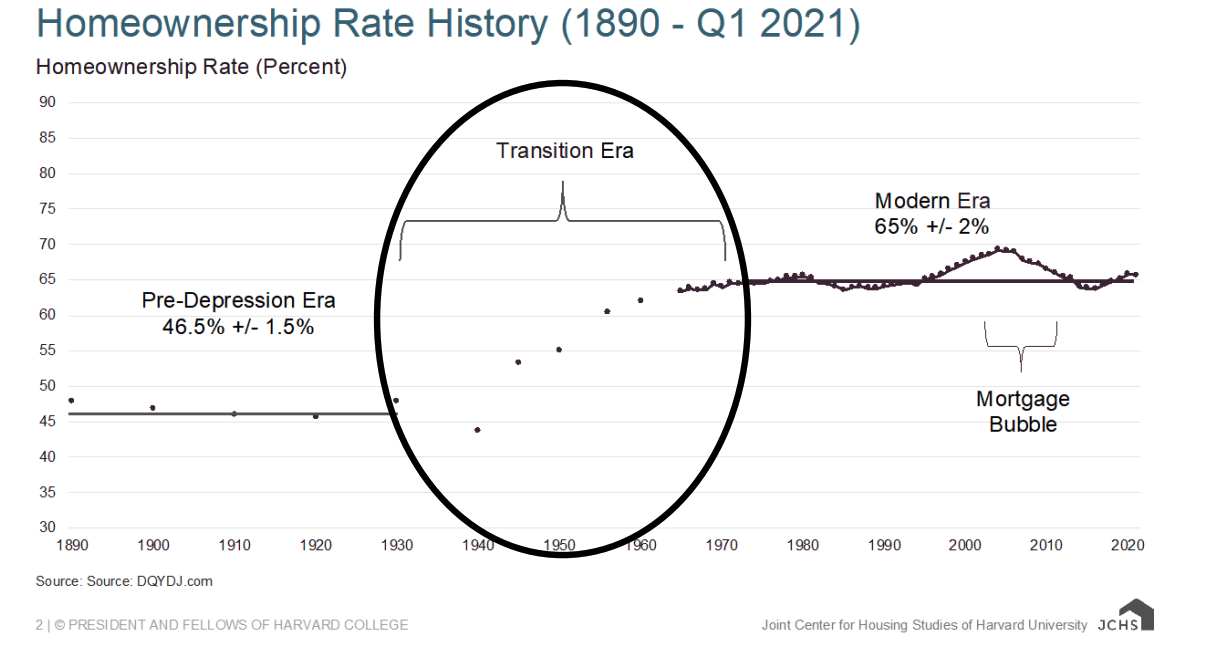

The modern mortgage was introduced in the United States in the early 1930s when less than half of Americans owned a home.

After the introduction of the mortgage, the rate jumped to 65 percent and has stayed roughly steady ever since. As the rate of ownership rose, the value of the average home rose with it (in 2000 dollars) from $30,600 in 1940 to $119,600 in 2000. The point here is that financial innovation was a cause not an effect of this boon to household wealth. But not all financial innovation is created equal (not all financial innovation results in equitable distributions, obviously). We all remember the 2007/8 financial crisis that resulted from the over-centralization of mortgage assets thanks to financialization run amok. Collateralized Debt Obligations(CDOs) and Mortgage-Backed Securities spun out of control as mortgages were chopped up and tranched into piles of financial abstraction dynamite that blew once housing prices started to fall. We cannot let Google become the Lehman Brothers of the machine economy.

In this analogy, MachineFi is to the mortgage what big tech is to the CDO. MachineFi, done right, will cause the proliferation of device innovation and distribution of wealth to households. This is why it needs to be introduced now, right before (and during) the economy engages in this seismic shift to automation, and not after.

Why MachineFi Matters

The devil is, as always, in the details. Facebook, with its recent rebrand to Meta, has plunged into the device space—intending to wrap its users in “embodied” content (read: deliver targeted ads in 3D space), which Russell Brand has termed “the colonization of consciousness.” The above image, which appears self-evidently dystopian, shows a single smiling tech overlord marching through a sea of disembodied metavers-ians. I pray, for all of our sakes, that we can keep Zuck from implementing his dystopia. MachineFi is a big step in the right direction.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.