Doc's Daily Commentary

Mind Of Mav

Bitcoin As A Hedge Against Inflation

For most of their existence, institutions have stayed away from investing in bitcoin, often citing it as a risky, speculative asset.

Over the course of 2020, however, many institutions have started to endorse bitcoin.

So, let’s ask the question: what’s changed?

One of the most commonly cited reasons for this change of tune is the growing narrative that bitcoin could serve as a good hedge against inflation.

For example, in early May billionaire hedge fund manager Paul Tudor Jones announced that he had over 1% of his assets in bitcoin. He explained that he viewed it as a hedge against inflation, saying “we are witnessing the Great Monetary Inflation — an unprecedented expansion of every form of money unlike anything the developed world has ever seen.”

In their recent report “Why Corporate Treasuries May Consider Bitcoin,” Fidelity Digital Assets cites potential inflation as one of the primary reasons that companies are starting to consider holding bitcoin in their corporate treasuries. MicroStrategy, Square, and others, have recently bought bitcoin and stated that they see it as a protection against inflation.

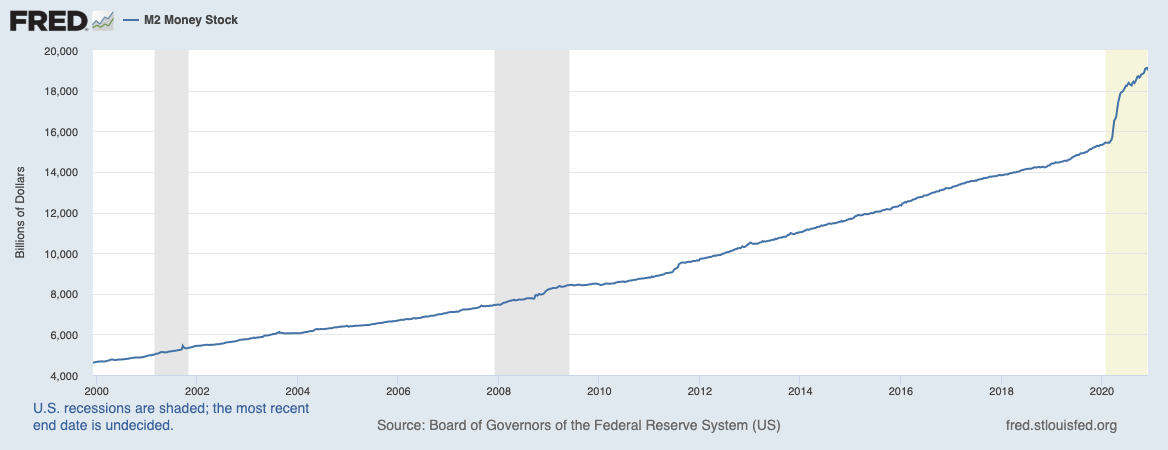

The rapid onset of COVID in early 2020 changed macro conditions seemingly overnight. Following the market crash of March 2020, central banks around the world began printing money and introducing quantitative easing measures coupled with aggressive fiscal stimulus at an unprecedented rate. In late March the US passed the CARES act, which provided about $2 trillion worth of stimulus money. As a result, the US M2 money stock, as seen below, grew more from about $15 trillion to about $19 trillion over the course of 2020.

For context, the M2 money stock grew by less than $1 trillion from January 2008 to January 2010, following the 2007-2008 financial crisis.

Quantitative easing and growth of the M2 money stock does not necessarily directly lead to increased inflation — as newly printed money typically stays in bank reserves. But combined with mounting fiscal deficits due to lagging global economies, rampant quantitative easing has pushed federal banks to their limits and created conditions that could lead to a significant inflation rate rise.

Source: Federal Reserve Bank of New York, Center for Microeconomic Data

To put this in perspective, 35% of all US dollars in existence have been printed in 10 months:

Although inflation rate is still around 2%, the uncertainty around potential future inflation has increased. In other words, while the current median estimate of expected inflation is still anchored around 2%, the variance in expectations has widened. This is reflected in the below chart from the New York Federal Reserve, which shows inflation uncertainty increasing to over 3% following March 2020.

Source: Federal Reserve Bank of New York, Center for Microeconomic Data

This increased uncertainty was also reflected in the Federal Reserve’s updated monetary policy statement released in August 2020. While the Fed has historically targeted a 2% inflation, the updated statement says it “will likely aim to achieve inflation moderately above 2 percent for some time.”

Make sure you understand everything we just covered. In effect, it is the super bull catalyst we’ve been waiting patiently for, and knowing it is an inevitable level of Bitcoin’s price does a lot for investing confidently in it.

You see, Bitcoin, in contrast, does not suffer from an uncertain monetary policy.

One of Bitcoin’s core properties is its predictable supply schedule. New bitcoins are issued every time a new block is mined as a reward for the miner who successfully mined the block. This is the only way that new bitcoins can be created and is a key part of the Bitcoin protocol.

Bitcoin’s current block reward is 6.25, which means 6.25 new bitcoins are issued every time a block is mined. On average, blocks are mined every ten minutes, which typically means about 800-1000 new bitcoins are issued every day. There’s a slight variance from day to day due to the unpredictable nature of exactly how often new blocks are mined (Bitcoin’s difficulty adjusts every two weeks to keep the average block time around ten minutes), but over the long term, this supply issuance is deterministic and predictable.

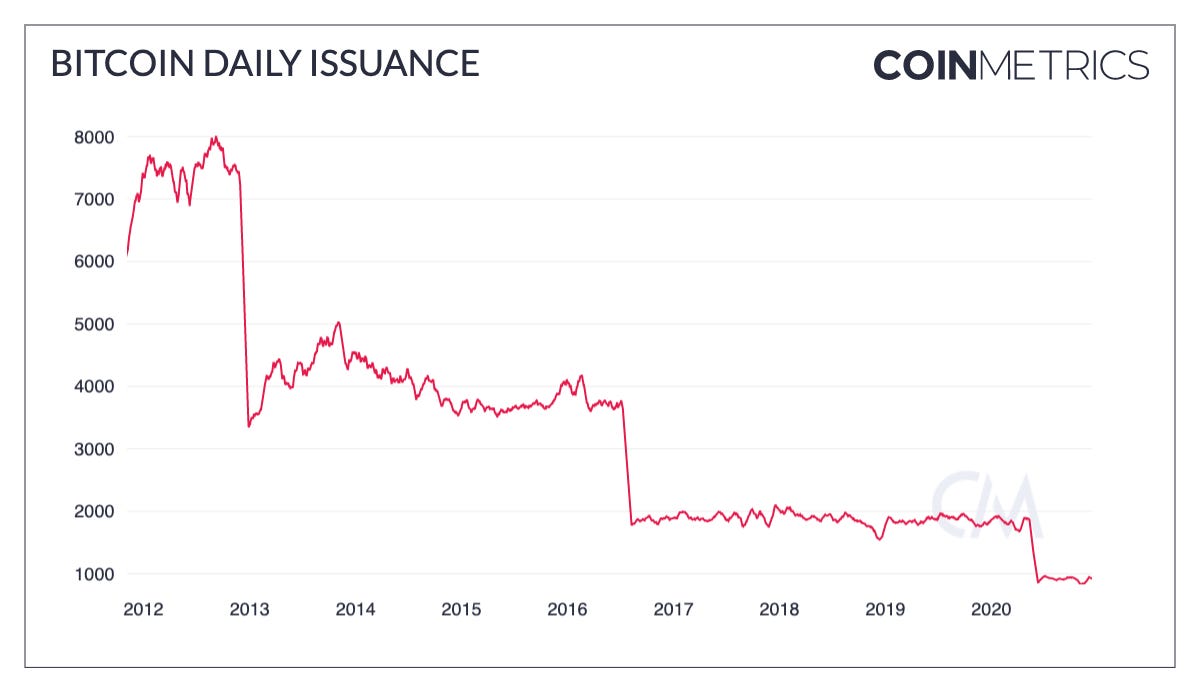

Importantly, Bitcoin’s supply issuance is also transparent and auditable. Anyone can run a Bitcoin node and independently verify Bitcoin’s issuance throughout its history. The below chart shows Bitcoin’s daily issuance going back to 2012, smoothed using a 30-day rolling average.

Source: Coin Metrics Network Data Charts

Bitcoin issuance is decreased by 50% every four years. These halvings are also a core part of the Bitcoin protocol, and are predictable well into the future. The most recent halving occurred in May 2020, which dropped Bitcoin’s average annual inflation rate to below 2%.

Source: Coin Metrics Network Data Charts

Unlike fiat currencies, there’s a hard cap on the total number of bitcoin that will ever exist. Halvings will keep occurring every four years until the supply cap of 21M bitcoin has been reached. This means we can project well into the future, and have clarity about what Bitcoin’s inflation rate will look like 1, 5, or 10 years from now.

Source: Bitcoin – A Novel Economic Institution

Bitcoin’s predictable and transparent monetary policy is ultimately what makes it a good potential hedge against inflation. While the US dollar, and many other fiat currencies, face increased uncertainty about inflation expectations over the upcoming years, Bitcoin’s inflation expectations are predefined. Due to its regular halvings and maximum supply cap, Bitcoin’s inflation rate will decrease in the future, while fiat inflation rates may increase.

To better understand how this translates to Bitcoin’s price, viewing our recently released CheckOnChain Onchain Analysis portal will give you that crucial insight you need.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.