Doc's Daily Commentary and Watchlist

Mind Of Mav

Spot Bitcoin ETF Could Bring $30 Trillion into the Market

Article by Ezra Reguerra

As preparations for spot Bitcoin exchange-traded funds (ETFs) continue, executives from across the crypto community have been sharing their opinions on how the new investment vehicle for crypto could affect the overall markets.

In a CNBC interview, Grayscale CEO Michael Sonnenshein expressed his belief that there’s a lot of optimism in the BTC market again, and many investors are adding Bitcoin to their portfolios. The executive also said that he’s looking forward to the advent of spot Bitcoin ETFs to unlock Bitcoin exposure to a part of the investment community that has not yet had the chance to invest in BTC. Sonnenshein explained:

“We’re really talking about the advise market here in the U.S., which is today about $30 trillion worth of advised wealth.”

Grayscale is one of the frontrunners gunning for spot Bitcoin ETF approval. On Nov. 22, representatives from Grayscale met with the trading and markets division of the United States Securities and Exchange Commission (SEC) to discuss the details of its flagship Bitcoin trust, which the firm wants to convert into an ETF.

Apart from funds flowing into Bitcoin, Jan3 CEO Samson Mow, who predicted that ETFs could propel Bitcoin prices to $1 million, believes that the ETFs could help in the branding and marketing aspect of Bitcoin.

In a thread on X (formerly Twitter), Mow explained how the competition between asset managers for more assets under management (AUM) will spur an advertising battle that will be good for Bitcoin.

On Dec. 19, MicroStrategy co-founder Michael Saylor said that Bitcoin ETFs would be the most significant development in Wall Street in 30 years. Saylor explained that the ETFs will be a catalyst that drives demand into Bitcoin. The executive believes it will open the door for mainstream retail and institutional investors to gain exposure to Bitcoin.

While some may anticipate that the price of Bitcoin will soar, others think the price “won’t double” overnight, even with the ETF approvals. Crypto investor Anthony Pompliano believes the ETF is an “ultra bullish development” but will likely not move a large market.

Meanwhile, Bitcoiner Oliver Velez compared buying Bitcoin ETFs to buying “real Bitcoin.” According to Velez, buying a spot BTC ETF is like “buying paper Bitcoin” with a cost charged yearly, while buying real BTC is a “once in a lifetime cost.” The Bitcoin supporter said that real Bitcoiners will only deal with real BTC with no custody costs.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

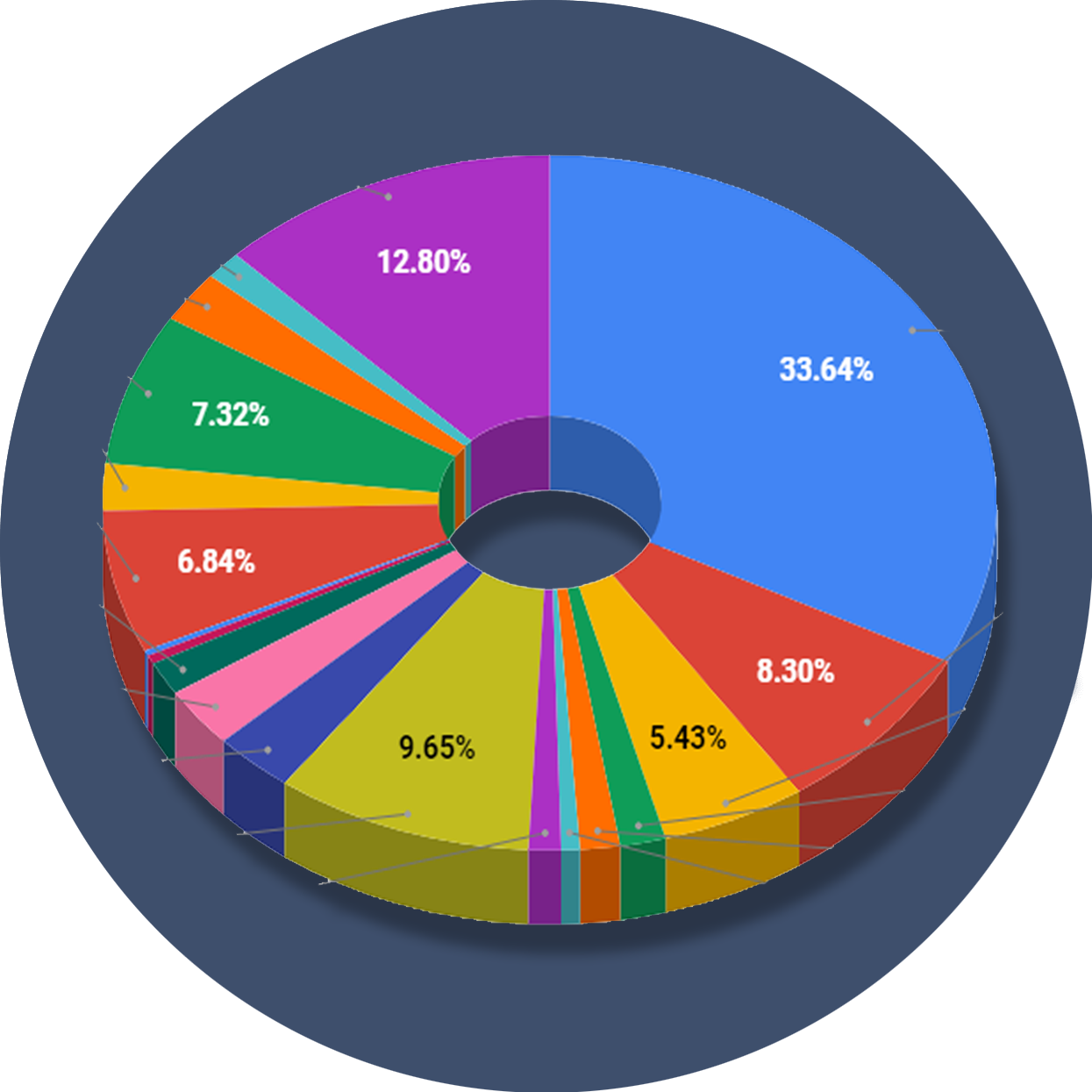

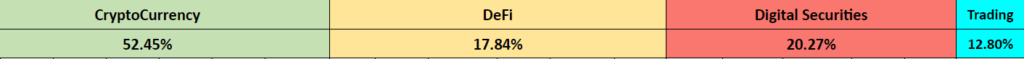

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

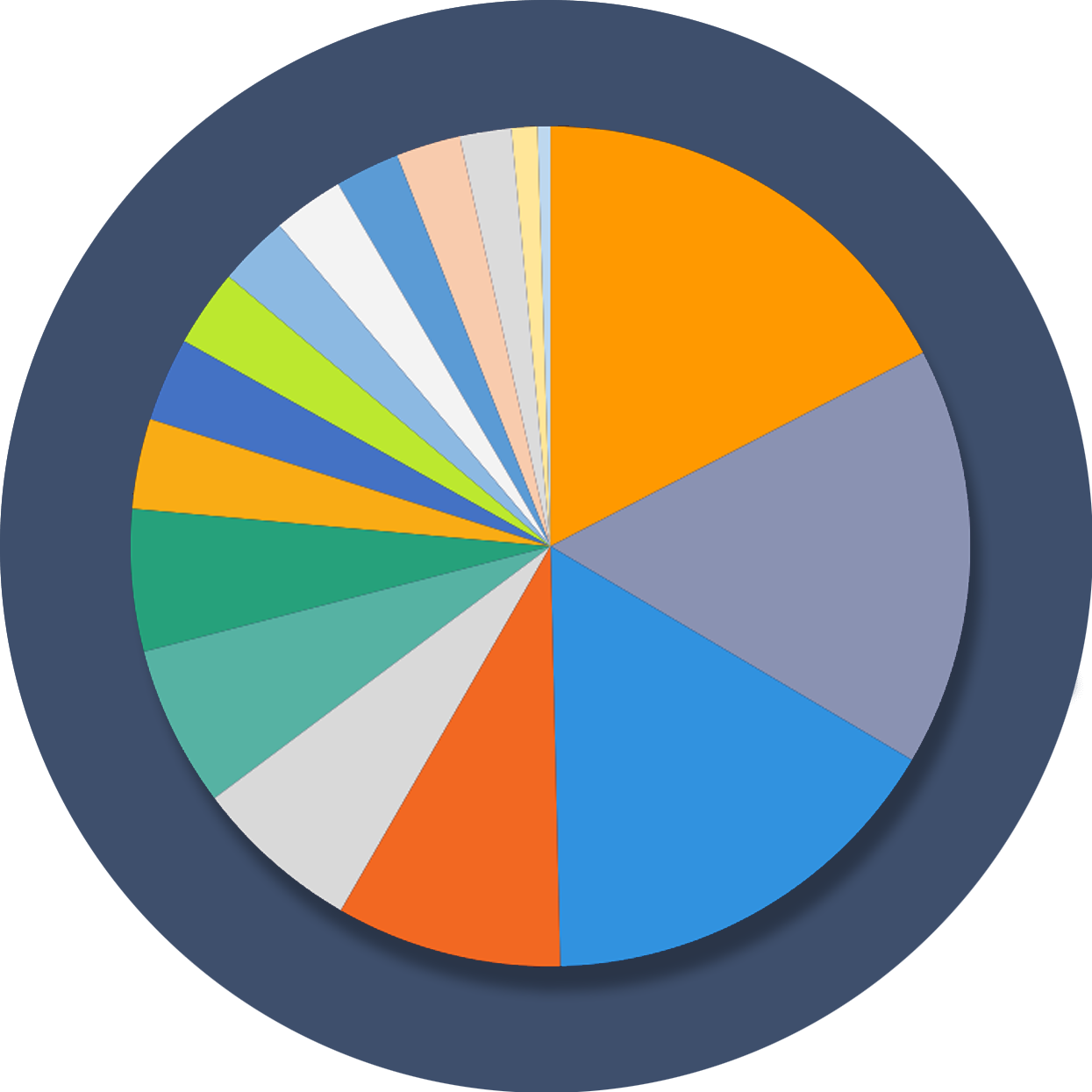

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.